1. Spot Gold has traded between $1,723 and $1,744 so far today…as of 7:00 am Pacific the yellow metal is off $16 an ounce at $1,733 in a healthy corrective pullback…similarly, red-hot Silver has retreated 46 cents to $17.12…Nickel has rallied 10 cents to $5.74 while Copper and Zinc are steady at $2.44 and 90 cents, respectively…Crude Oil has added another 89 cents to $34.38 while the U.S. Dollar Index is up slightly at 99.16…first-time filings for unemployment insurance totalled 2.44 million last week (in line with expectations) as the tail effects of the Wuhan COVID-19 shutdown continued to impact the American jobs market…the seasonally adjusted total, while still well above anything the nation had seen pre-COVID-19, represents the 7th straight week of a declining pace following the record peak of 6.9 million in late March…the downturn in activity across the eurozone has started to ease as lockdowns introduced in some of its largest economies to help stem the spread of the virus are relaxed, although the bloc is still set for an historic economic contraction in this 2nd quarter…a widely watched survey of services and manufacturing business activity showed an uptick in May, from record lows the previous month, according to data published this morning…President Trump has escalated his verbal attacks on China, accusing Beijing of “a massive disinformation campaign” around the origins of the pandemic…“They could have easily stopped the plague, but they didn’t!”, the President wrote on Twitter last night…the global tally of reported coronavirus infections passed 5 million today, according to data compiled by Johns Hopkins University (Brazil has become the new hotspot), but more green shoots of normalcy emerged in parts of the world as governments continued lifting pandemic lockdown orders…all 50 U.S. states have begun reopening in some form this week…a thoughtful common sense piece in this morning’s Financial Post from former Canadian Finance Minister and Natural Resources Minister Jim Oliver…“Canada has the dubious distinction of being the only country rich in energy resources whose government’s policy is to keep most of its wealth buried forever in order to address a global problem that it cannot solve but which countries that could solve it won’t. This is self-harm on a massive scale for no reason other than virtue-signalling in what is now increasingly an echo chamber. Could there be a less appropriate time for indulgent vanity than during the devastation of a global pandemic?”…Trudeau has not budged on his radical “climate change”/ social engineering agenda over the past 2 months, putting Canada at a competitive disadvantage to its largest trading partner and others…unfortunately, The True North Strong And Free has become The True North Weak And Over-Governed…

2. TD Securities says Silver could be headed for an “explosive” move as demand for the metal picks up for commodity and investment purposes…TDS has recently argued that Silver was increasingly trading as an industrial metal…“While deteriorating industrial demand has provided a strong headwind against Silver prices (causing Silver’s performance to lag Gold’s), our firming real-time commodity demand indicator suggests it may now become a tailwind. Indeed, a simple analysis extracting the (rolling) regression coefficient of Silver’s returns as a function of Gold’s and our commodity demand indicator suggested that Silver has increasingly been driven by commodity demand”...meanwhile, Silver inflows into ETFs have been robust, along with Gold…interest from Commodity Trading Advisers has been low, but this means potential for fresh buying power…“That being said, inasmuch as commodity demand continues to firm, the context of rising investment flows in precious metals, combined with rising commodity demand, creates the set-up for explosive performance – particularly considering the constrained supply-side and low speculative interest,” TDS concluded…

3. More than 600 doctors have signed onto a letter sent to President Trump pushing him to end the “national shutdown” aimed at slowing the spread of Wuhan COVID-19, calling the widespread state orders handcuffing many businesses and keeping kids from school a “mass casualty incident” with “exponentially growing health consequences”…the letter outlines a variety of consequences that the doctors have observed resulting from the coronavirus shutdowns, including patients missing routine checkups that could detect things like heart problems or cancer, increases in substance and alcohol abuse, and increases in financial instability that could lead to “poverty and financial uncertainty” which “is closely linked to poor health. We are alarmed at what appears to be the lack of consideration for the future health of our patients,” the doctors say in their letter…“The downstream health effects…are being massively under-estimated and under-reported. This is an order of magnitude error”…the letter continues, “The millions of casualties of a continued shutdown will be hiding in plain sight, but they will be called alcoholism, homelessness, suicide, heart attack, stroke, or kidney failure. In youths it will be called financial instability, unemployment, despair, drug addiction, unplanned pregnancies, poverty, and abuse. Because the harm is diffuse, there are those who hold that it does not exist. We, the undersigned, know otherwise”…British Columbia is an excellent example of how poor government strategy (a non-targeted approach to COVID-19) has very negatively impacted vast portions of the province outside of metro Vancouver…COVID-19 barely exists from the southern Interior of B.C. to the far north but B.C.’s lockdown measures – just now beginning to ease – were implemented across the entire province in a disastrous “one size fits all” solution by the socialist NDP government which garners most of its support from metro Vancouver/metro Victoria…far from being “protected” by Big Government, many residents of B.C. have become victims of Big Government…

4. The Job Creators Network ran a full-page ad in today’s Wall Street Journal to post an open letter to Dr. Anthony Fauci, calling for a “second opinion” on the coronavirus shutdown…Fauci, the director of the National Institute of Allergy and Infectious Diseases, is a member of the White House’s coronavirus response task force…“You are the nation’s leading voice on how and when society reopens from the pandemic-induced shutdown,” the letter begins…“And while Americans appreciate your service, voice represents one of many important perspectives in the medical field”…the missive, signed by Job Creators Network President and CEO Alfredo Ortiz, goes on to declare that just as patients would “routinely seek a second opinion regarding any serious medical procedure, we ask respectfully for a second opinion on this urgent issue before us”…while Fauci is one of the federal government’s most prominent faces amid the pandemic, President Trump has left it largely up to the states and their governors to decide how to move forward with reopening under federal guidelines that recommend a series of gradual steps…

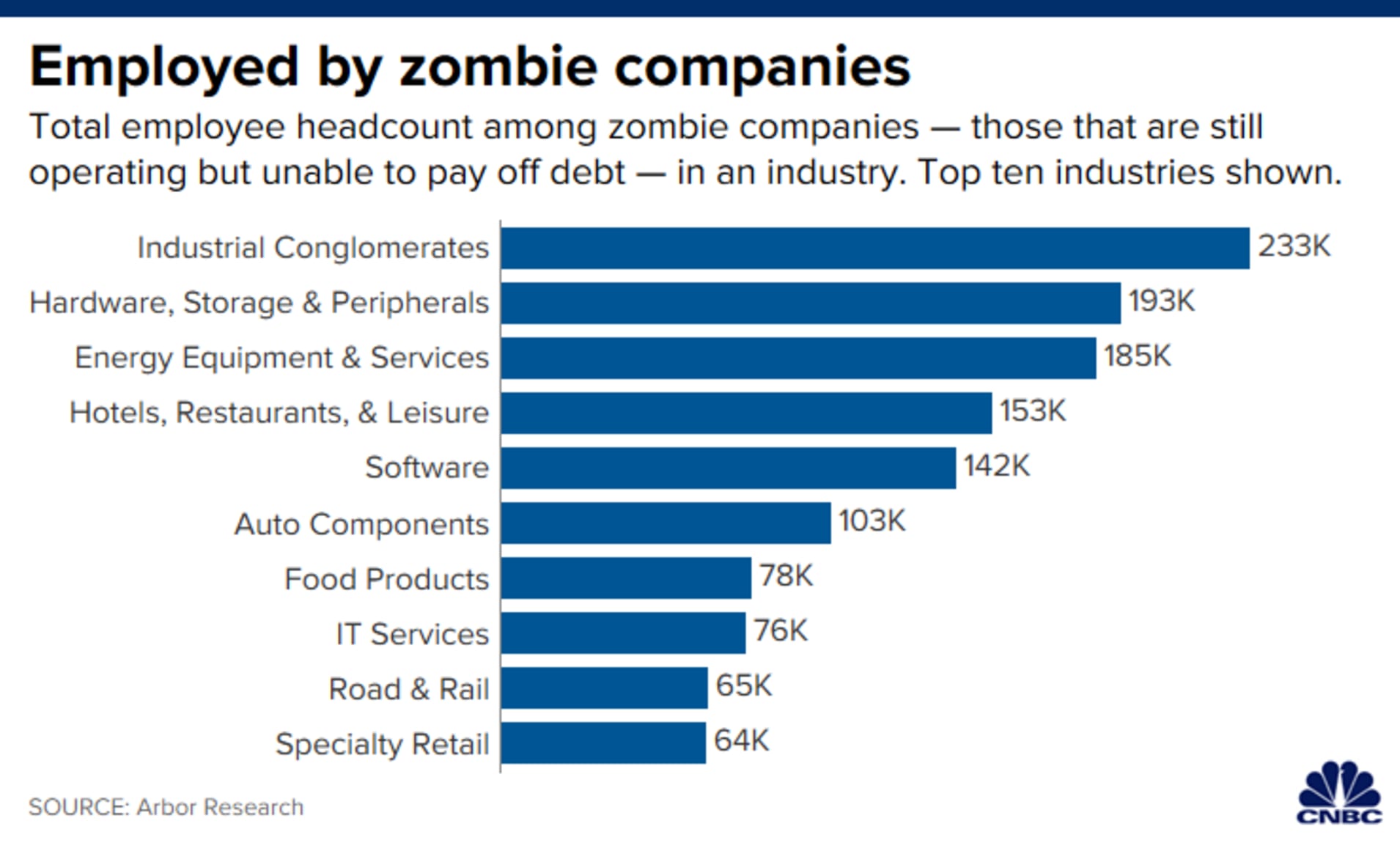

5. Heavily indebted “zombie” companies happen to control nearly 2.2 million jobs at a time when the U.S. is in a deep employment crisis…the companies occupy a large swath of American industry, from big conglomerates to the restaurants and bars that have suffered so much during the coronavirus pandemic and the associated social distancing measures that have torn a hole through the U.S. economy…they’re generally designated as companies that continue to operate even without the revenue stream to pay off their debts…at the sector level, they range from the 233,000 jobs in industrial to conglomerates to a low of 738 in the insurance business, according to data compiled by Arbor Data Science…some of the biggest names have actually found it easier to raise more debt during the present crisis, as a Federal Reserve intervention has breathed new life into the corporate bond market…their stock prices have also rebounded aggressively…the unemployment rate has surged to 14.7% during the pandemic as more than 23 million Americans were out of work as of the end of April…

6. The Dow is up 67 points as of 7:00 am Pacific…optimism knows no bounds for shares of Facebook (FB, NASDAQ) and Amazon (AMZN, NASDAQ) which both hit new highs yesterday…it’s as if those 2 companies were built for a pandemic, offering touch-free interactions and e-commerce for a stay-at-home nation…Facebook rose more than 6% after the social network launched a new e-commerce feature for small business, Facebook Shop…Deutsche Bank analysts called it a $30 billion revenue opportunity, but Facebook positioned it more altruistically…“We hope these tools can relieve some of the pressure small businesses are facing right now and help businesses of all sizes prepare for the future,” a Facebook statement read…in Toronto, the TSX is off 18 points in early trading while the Venture, aiming for its 7th straight weekly gain, has retreated 3 points to 531…the Venture is locked in a powerful uptrend channel (next Fib. resistance in the 580’s followed by 740) and any minor pullbacks toward the supporting EMA-8 (currently 515, just below the 200-day) should be embraced…Sona Nanotech (SONA, CSE) is on the rebound, up 4 cents at $1.42 in early trading as a very bullish technical pattern following a healthy correction gains traction…Northern Ontario’s emerging PGM district is about to garner a lot more attention as Clean Air Metals (AIR, TSX-V) begins trading tomorrow as confirmed this morning in a Venture bulletin…Clean Air, which has completed a successful RTO of Regency Gold, will have a war chest of approximately $15 million, some of which came from Eric Sprott, to tackle the highly prospective Escape Lake and Thunder Bay North Projects southeast of the Lac des Iles Palladium mine now owned by Impala Platinum (IMP, JSE)…with Palladium trading near $2,000 an ounce, and Sprott involved, investor interest in Clean Air is expected to be high…direct beneficiaries should be Benton Resources (BEX, TSX-V), which holds 25 million shares (19.7%) of Clean Air, and Transition Metals (XTM, TSX-V) which owns 100% of the Saturday Night Project and 25% of the more advanced Sunday Lake Project, both right on trend with Clean Air’s properties…GoldON Resources (GLD, TSX-V) has commenced diamond drilling at the West Madsen Gold Property, optioned from Great Bear Resources (GBR, TSX-V)…Chris Taylor, President and CEO of Great Bear, stated: “We originally staked the West Madsen properties because of their strong potential to host Gold mineralization. As GoldON shareholders, we view the identification of 6 new drill targets, 4 of which will be tested in this inaugural program, as a demonstration of significant exploration progress. We are looking forward to these drill results as they will provide critical data to drive ongoing exploration and could potentially lead to a transformative discovery”…

7. The “psychedelic space” has come to the Venture, which may also help to explain this company’s market cap: Numinus Wellness (NUMI, TSX-V) made its Venture debut yesterday, climbing as high as $1.55 for a market cap in excess of $150 million…Numinus is off a penny at $1.02 through the first 30 minutes of trading this morning…the company describes itself as “one of the first in-market, fully integrated companies in the psychedelic space in North America”…CEO Payton Nyquvest stated, “We are on a mission to help address the universal desire to heal and be well. We are looking for like-minded investors who share our belief that new approaches and new ways of thinking are needed to supplement existing options”…Numinus says it has put a value chain in place comprising 3 pillars that will be key to the company’s growth – 1) Numinus Wellness; 2) Numinus R&D; and 3) Numinus Bioscience…Numinus Wellness plans to offer physical locations where psychedelic-assisted therapies can take place once approved by regulators…the company’s near-term goal is to identify a suitable location and build a purpose-built, flagship wellness centre to conduct psychedelics-assisted therapies in a safe, controlled therapeutic environment when approved by regulators and governing bodies – a process we are helping to support…Numinus Wellness provides a full suite of therapeutic services through a wellness centre in Vancouver; however, psychedelic-assisted therapies are not currently provided…Numinus R&D is creating partnerships with leading research groups to advance practice and understanding in the space…Numinus Bioscience is licensed by Health Canada to test, sell, distribute, and eventually conduct research on psychedelic substances…“We are excited about the future of psychedelics and our focus will solely be on its therapeutic use,” says Nyquvest…“Psychedelics will move forward in a therapeutic and research context, where the application of these substances will only happen in safe, controlled treatment environments. Numinus has these pieces in place today”…the efficacy of psychedelic therapies are gaining attention…Johns Hopkins University recently announced the Center for Psychedelic and Consciousness Research, a first-of-its-kind $17 million research centre designed to study compounds like LSD and psilocybin for a range of mental health problems, including anorexia, addiction and depression…

How This Pandemic Will Ultimately Help Copper

The Cost Of Doing Business With China (The CCP)

“Silver Lining”: Innovative Vancouver Company Provides Help During Crisis

Smithers Shakes Off Turmoil For A Major 3-Day Event Connecting Hockey And The Resource Sector

9 Comments

Hey Jon, wake up – lol. Thoughts on SONA’s news this morning?

Yes, excellent news, Dan1, and from this the odds of the news we’ve all been waiting for have heightened considerably for next week/month-end…expressions of interest for tens of millions of units shows the incredible market potential this has…

Good morning Jon, thinking of dipping into AIR. Any idea of a fair price right now. Seems to be sitting around .40 cent right now. Has about 100 millions shares OS? Looks like acummulation in this range? Thanks

We’ve liked that situation even before it started trading as of this morning, Roger…and of course they’re drilling right off the bat…great potential for that whole area to heat up, which includes Benton and Transition…

Any insight on XTM down 8% this morning?

Down a penny-and-half on just 50,000 shares, schiffwasright…rising 300-day SMA at 16.5 cents…Transition announced a 15-cent hard dollar and 18-cent FT PP this morning for $1.2 million…very good sign, actually…wouldn’t be surprised if that gets upsized…this shows that XTM (a prospect generator) is going to get much more active with its own work including drilling…they will also benefit from having 2 exceptional properties (one of them very advanced) on trend with AIR’s Escape Lake/Thunder Bay North properties…that whole region is going to light up…I hold a very healthy position in XTM and I’m sure it’s going to have a great year with a major breakout to multi-year highs given several strong potential catalysts…

Ya I’m in at an average price of $0.19. It’s been hard to watch XTM drift lower while F and others go up. But you’re very right that the PP is a good sign. (That news didn’t show up in my bank Direct Investing but I see it on XTM’s official site now…trying to switch to another brokerage but it’s hard because any trade I make will derail the transfer…) I’m waiting for Eric Sprott’s weekly podcast. It seems like every week he announces a new PP and the stock explodes. This group of AIR, BEX, and XTM can’t have escaped his attention.

RMI has been pretty silent, lately, especially after a very intriguing NR stating they did hit on 170 meters when the aim was only 100. Sulfide all around, which should mean that gold is well preserved. How do you see RMI unfolding, Jon, and when do you think we could see assays?

There has been silence from RMI, recently, Ragnorak because of the lockdown measures in Sonora State (officially they haven’t been able to say anything, though work has continued)…we will hear from them in terms of assays sometime in June…looks like they have some very good holes…I’m expecting an update from the company this coming week…