Gold has traded between $1,255 and $1,274 so far today…as of 8:30 am Pacific, bullion is down $11 an ounce at $1,258…Silver is off 34 cents at $16.99…Copper is down 2 pennies at $2.59…Crude Oil has jumped $2.43 a barrel to $50.88 while the U.S. Dollar Index has retreated two-thirds of a point to 93.83…Warren Buffett, the billionaire chairman of Berkshire Hathaway Inc., said in an interview on the Fox Business network yesterday that it would be “very tough” for the Federal Reserve to lift interest rates this year because of the stronger greenback. “That would exacerbate the problem,” he said. “I don’t think it’ll be very feasible to do. I think it would have a lot of international repercussions.”

January’s U.S. non-farm payrolls report from the Labor Department is due tomorrow and could certainly impact both Gold and the dollar, though keep in mind that both have been moving together recently…the current positive correlation between Gold and the dollar has lasted since November…the last time they moved upward in tandem for a prolonged period was after Greece, in 2009, disclosed its budget deficit would likely soar…between Jan. 11 and June 10, 2010, the U.S. Dollar Index rose almost 16%, while Gold climbed nearly 12%…since the turn of the century, Gold and the Dollar Index have both finished higher year-over-year 5 times – in 2001, 2005, 2008, 2010 and 2011…

January’s U.S. non-farm payrolls report from the Labor Department is due tomorrow and could certainly impact both Gold and the dollar, though keep in mind that both have been moving together recently…the current positive correlation between Gold and the dollar has lasted since November…the last time they moved upward in tandem for a prolonged period was after Greece, in 2009, disclosed its budget deficit would likely soar…between Jan. 11 and June 10, 2010, the U.S. Dollar Index rose almost 16%, while Gold climbed nearly 12%…since the turn of the century, Gold and the Dollar Index have both finished higher year-over-year 5 times – in 2001, 2005, 2008, 2010 and 2011…

Bloomberg reports that holdings in ETPs backed by Silver fell 0.3% last month, after declining 3% in December, while Gold holdings jumped 4.1% January…retail investors account for 80% of U.S. purchases, according to estimates by ETF Securities LLC…

A report issued by UK-based research firm Capital Economics is bullish on Gold’s prospects in a deflationary environment. “Overall, our view is that the wider implications of a lengthy period of deflation, even one triggered by a favorable shock such as cheaper Oil, should strengthen rather than undermine the price of Gold. Indeed, it is not difficult to think of circumstances in which deflation could be positive for Gold, many of which apply now. For a start, interest rates are more likely to be held close to zero or even cut into negative territory, minimizing the opportunity cost of holding Gold.”

WTIC 2-Year Weekly Chart

WTIC continues to try to conquer resistance at $50 in what has been a normal unwinding of temporarily extreme oversold conditions (a “dead cat” bounce), as opposed to a change in the primary trend which remains bearish in our view…Crude will need time to heal its wounds from the last several months and overcome the supply problem in the market, meaning a fresh low is still very possible this quarter…if support can’t hold around $45, then $35 to $40 becomes the new target area…

RSI(2) on this 3-year weekly has moved up to 62% and may reach into overbought territory shortly…

Sell-Off In Greece

Greek stocks and bonds took a beating today after the European Central Bank fueled an increasingly tense standoff between the Greek government and its international creditors by declaring that it would stop accepting Greek bonds as collateral for central bank loans…Athens’ main stock index plummeted 9% in early trade before recouping marginally, while the country’s 2-year debt yield soared by more than 3 percentage points to around 19.3%. “It is currently not possible to assume a successful conclusion” of Greece’s current bailout, the ECB said late yesterday, just hours after its president, Mario Draghi, met with Greece’s new finance minister, Yanis Varoufakis in Frankfurt…

Today’s Equity Markets

Asia

Asian stocks were mostly lower overnight with Greece in focus…China’s Shanghai Composite fell 37 points to close at 3137, while Japan’s Nikkei average slipped 174 points…

Europe

European markets are mixed in late trading overseas…

Wishful thinking or a legitimate emerging turnaround?…the EU’s official economists say the sharp drop in global Oil prices and a weaker euro should boost growth in the euro zone this year, so they’ve raised their forecasts for the currency area’s largest economies…the economists at the European Commission, the EU’s executive arm, say the euro zone should grow 1.3% this year and 1.9% in 2016…in November, they expected growth of 1.1% this year and 1.7% next…the commission raised its growth estimates for most of Europe’s largest economies, including Germany, France and Spain…

North America

The Dow has climbed 156 points through the first 2 hours of trading ahead of tomorrow’s all-important jobs number…the U.S. trade deficit in December jumped to the highest level in more than 2 years as American exports fell and imports climbed to a record level..

In Toronto, the TSX is up 143 points while the Venture has added 7 points to 694…

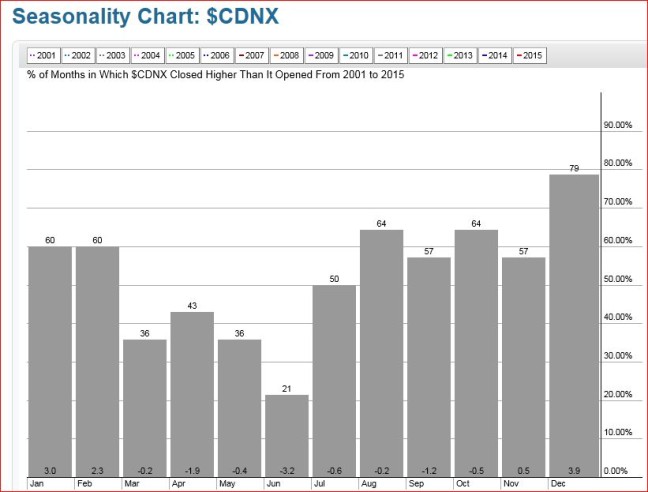

February – One Of The Venture’s Strongest Months

The Venture is off to a good start in February which is consistent with historical patterns as over the last 14 years this has been the 4th best performing month of the year (the PDAC curse usually then strikes in March)…

NioCorp Developments Ltd. (NB, TSX-V) Update

NioCorp Developments (NB, TSX-V) continues to make progress with its high-grade, large tonnage Niobium Project in Elk Creek, Nebraska, and the final results of the company’s 3-phase 2014 drilling were released January 19…the infill drilling that was carried out should allow the company to elevate the resource to the measured and indicated category (Niobium has physical and chemical properties similar to those of Tantalum, it’s a rare and a soft transition metal primarily used in the production of high-grade steel such as that used in gas pipelines)…

Technically, NB in the fourth quarter of last year unwound an overbought condition that emerged in May…since then, the stock consolidated in a horizontal channel between the low 50’s and the high 70’s until a confirmed breakout this week…

NB is up 3 cents at 84 cents as of 8:30 am Pacific…

Doubleview Capital Corp. (DBV, TSX-V) Update

Through sheer grit and determination, and some good luck as well, Doubleview Capital (DBV, TSX-V) President and CEO Farshad Shirvani has put his company in a position to define British Columbia’s newest world-class porphyry deposit in the emerging Sheslay District in 2015, a highly notable achievement considering 2 major factors in particular: 1) The exceptionally challenging market environment the junior resource industry has had to deal with; and (2) the fact that the Hat Property was merely at the grassroots stage only a year-and-a-half ago with no previous drill holes…the latter point speaks to the immense opportunities the Sheslay District offers…

Any property that advances to the deposit stage (not many do) will produce several “game-changing” holes along the way…H-23 completes the “hat trick” for Shirvani…the first 2 of course were H-8 and H-11 in January 2014, the latter delivering 451 m grading 0.33% CuEq…each round of drilling has returned better results at the Hat, a trend one looks for in the successful evolution of a deposit (by contrast, Colorado Resources – CXO, TSX-V – could never match the success of its first hole at the North ROK Project in the spring of 2013…ironically, that first hole was a catalyst that ignited fresh interest in the Sheslay District)…

As revealed this week, H-23 has hit at least 3 important mineralized zones with more assays on the way…it has extended the Lisle Zone by over 100 m to the north, and has also confirmed that strong mineralization is present about 220 m below the zone encountered in drill hole H-22, the nearest drill hole…

The market has plenty to speculate about as assay results are pending for the final 250 m of core (so far) from H-23. “A third, wider chalcopyrite-pyrite zone was visually observed to extend for at least 120 m beginning at a depth of 402 m,” as DBV reported yesterday…we take that to mean that the final 130 m has not yet been viewed by a QP, raising the possibility that this 3rd zone may continue beyond 522 m…

H-23 may not even be complete as there’s still a chance DBV may extend it beyond 650 m where it was halted just prior to the Christmas break…the grades in H-23 (a 278-m interval returned 0.53% CuEq) are substantially better than those found in the first 2 discovery holes as DBV appears to be edging closer to the “juiciest” part of the system at the Hat which potentially could even be another anomaly, such as “E”, which hasn’t even been drilled yet…

Something very special appears to have been cooked up at the Hat, so it’s difficult to imagine there isn’t a high-grade Gold-Copper core somewhere in this system…the Lisle Zone currently measures 1 km long and half a km wide, and mineralization is extending several hundred km to depth…this is already a very significant deposit, though DBV must cut into some higher grades to make the Hat economic…they are clearly making progress in that regard…

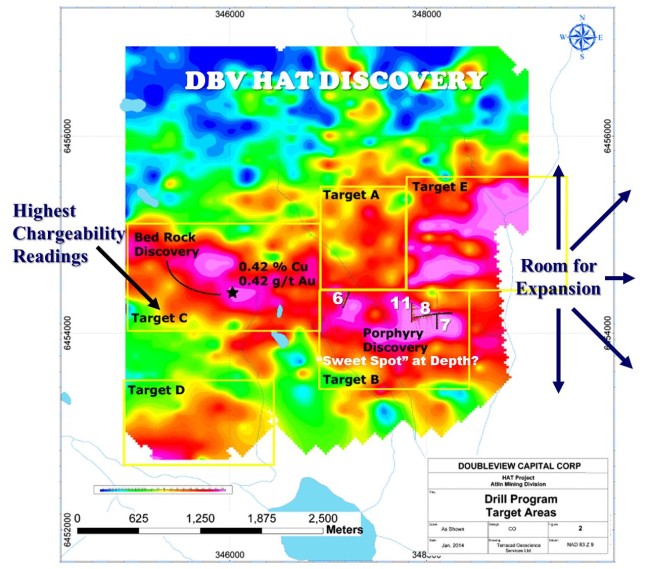

The Big Picture

Below is a map we first posted last year, adapted from the DBV web site, that shows how the Lisle Zone (in target “B”) is quite possibly just 1 part of a much bigger system…we’ll have an updated map Monday in conjunction with the first part of an interview…the various targets cover an area 4 km x 3.5 km…there is so much to still learn and discover at the Hat, and that process will be fascinating to watch unfold over the coming months…

Updated DBV Chart

Below is another check-up on DBV’s technical health, and it’s getting stronger despite the minor pullback this morning…what’s encouraging is the bullish “W” in the RSI(14) which is now above 50% and gathering momentum…the 50-day moving average (SMA) is also just beginning to reverse to the upside – this has happened on 2 other occasions since the start of 2014, and the results were very bullish…

DBV is off 2 pennies at 14.5 cents on light volume as of 8:30 am Pacific…

Garibaldi Resources Corp. (GGI, TSX-V) Update

Next up to bat in the Sheslay District is Garibaldi Resources (GGI, TSX-V), which strategically armed itself with over $1 million in a financing just before Christmas to target primarily the Grizzly as its flagship property in British Columbia…GGI’s sense of timing in that regard couldn’t have been better, given developments at the Hat, plus the fact that GGI is set to become the first company in the district to come out with a NI-43–101 technical report since the staking rush of early last year…speculatively, that document could contain powerful new information supporting both the district and of course the Grizzly where Garibaldi has outlined multiple targets spanning at least 15 km…drill permits are in hand as GGI gears up for first-ever drilling at the Grizzly…

In the meantime, Mexico should be taking center stage for GGI in the very near future as investors anxiously await updates on both the Rodadero high-grade discovery in Sonora State and the La Patilla Property in Sinaloa State…core photos proved to be a reliable guide for investors with regard to drilling at DBV’s Hat Property…we believe the same will hold true for GGI’s Rodadero…

Technically, John is excited by what he sees in this 3-year weekly chart which hints at a pending reversal to the upside following a consolidation on declining volume and a triple bottom formation…note how the RSI(14) held just above support and is now turning higher…

GGI is off half a penny at 16.5 cents in light trading as of 8:30 am Pacific…

Reservoir Minerals Inc. (RMC, TSX-V) Update

A company investors should definitely keep on their radar screens for 2015 is Reservoir Minerals (RMC, TSX-V)…

Reservoir, which had just over $40 million in working capital at the end of August, reported at the end of October that diamond drilling had resumed with 5 rigs operating on its Cukaru Peki deposit and other Copper-Gold targets as part of the exceptional Timok Project in eastern Serbia…Freeport-McMorRan (FCX, NYSE) is the operator of the JV and picking up the tab on all exploration expenses (RMC also has 100%-owned permits it’s exploring in the area)…

Reservoir climbed as high as $7.43 last year before falling by more than half as the overall market tanked in Q4…recent very oversold conditions (September to early November) mirrored the overbought conditions that emerged in February/March when it was a good time to take profits…

Over the last few months, RMC has found its footing and appears to be gearing up for a solid 2015 that could include a test of last year’s high or, potentially, even a breakout to a new all-time high…

Sell pressure has been declining steadily, and the stock is now approaching its still-declining 200-day SMA…note the breakout in December above the RSI(14) downtrend line – such an event is usually quite significant from a TA perspective…

RMC is down slightly at $4.61 as of 8:30 am Pacific…

Note: John and Jon both hold share positions in DBV and GGI.

11 Comments

The next 120 meters with Pyrite and calchopyrite is probably another 0.75%eq minimum with this 120 meters the next release we will have a minimum of 452.4 meters at 0.55%eq and this is I think the minimum….imagine if we find this ore on the 250 meters !

The venture’s weekly RSI has finally poked its head out of oversold conditions (currently sitting at 31). MacD has also crossed over to the positive side.

BLO is continuing the climb today. 24.5 cents and market cap just over 10 mil.Still very cheap imo

Roger

LOT-Iamgold, Now that is a hit. WOW

Just got home and noticed 50k on the bid now at .55 on NAR – guess its safe to guess it may be time to buckle up.

BLO: doing great. approaching next fib resistance level (0.25 canadian/ 0.20 US). Jon, are we approaching overbought levels? Or do we throw that out the window considering current company developments/speculation (e.g., prototype to be released soon, etc.)

Yes, great action in BLO…it’s not approaching overbought territory, it’s in OB territory if you look at the RSI(14) and RSI(2) on the daily, way up there…however, as we’ve seen in other stocks and markets, an overbought state can continue for a while…hoping we’ll see the prototype by the end. of Feb…exciting project…

Thanks Jon! Would be nice if they had the prototype for their special meeting. I see that BLO has filed details of the “arrangement” on SEDAR.

Hey guys make sure you put

BHS Bayhorse Silver on your radar as this horse is just about ready to gallop to much higher levels. GiddyUP!! Only 23 million shares out with management holding 60%.

Company will be in a cash flow position soon.Do your own DueDilly!!

Jon/John- thanks for taking the time to do an interview and the work both of you put into profiling DBV and all other companies. I do feel that DBV is still very undiscovered and I believe that this will change this year. They have an aggressive drill program planned and they are all very looking forward to starting! Look forward to the interview. I hope you spoke to Patrick McAndless and you asked him the good questions seeing that he is the expert for the region/geology, etc.

Hi d4, you’re welcome and I agree with you. The market will discover soon enough just how big the Hat is shaping up to be.