Gold has traded between $1,206 and $1,216 so far today…as of 8:00 am Pacific, bullion is relatively unchanged at $1,206 in lighter activity ahead of Monday’s U.S. Memorial Day holiday…the yellow metal is headed for its biggest decline in 4 weeks but importantly has held support at $1,200…Silver is flat at $17.11…Copper is off 4 cents at $2.80…Crude Oil is 70 cents lower at $60.02 while the U.S. Dollar Index has reversed higher to 95.99 after dipping just below 95 early this morning (prior to the release of CPI data)…

Gold has not moved more than 3% on either side of $1,200 since mid-March…holdings in SPDR Gold Trust, the world’s largest Gold-backed ETF, have slid to their lowest level in 4 months this week which is interesting considering that the metal also hit a 3-month high…support has been coming from somewhere…reports say that Gold buying was slow in Asia this week – money in China continues to chase equities with the Shanghai Composite powering nearly 3% higher today…

Gold has not moved more than 3% on either side of $1,200 since mid-March…holdings in SPDR Gold Trust, the world’s largest Gold-backed ETF, have slid to their lowest level in 4 months this week which is interesting considering that the metal also hit a 3-month high…support has been coming from somewhere…reports say that Gold buying was slow in Asia this week – money in China continues to chase equities with the Shanghai Composite powering nearly 3% higher today…

In their latest research report published Wednesday, commodity analysts from Macquire gave an upbeat assessment for Gold over the final several months of this year. “Lower-for-longer global interest rates and still-robust emerging market demand should allow the Gold price to make steady gains in the second half of 2015 and 2016,” they stated…

Data from Thomson Reuters’ Lipper service showed yesterday that investors in U.S.-based funds pulled $597 million out of funds that specialize in commodities and precious metals in the week ended May 20, the biggest outflow since December 2013…what immediately followed that, of course, were significant upside moves in the commodity sector with prices trending higher until the U.S. dollar started its parabolic move over the summer…

QE Love-Fest

In Portugal today, approximately 150 central bank governors, academics and financial market representatives were invited to an economics event which was probably more like a QE love-fest…ECB President Mario Draghi, speaking this morning, said the economic outlook for the euro zone is looking “brighter today than it has done for 7 long years.”

The Fed’s Janet Yellen, meanwhile, is making a speech on the U.S. economy to the Providence Chamber of Commerce beginning at 10 am Pacific – investors will obviously be paying close attention to what she has to say…there is consensus among analysts that a Fed rate hike is now being pushed back to September, but there’s also a growing risk that the Fed will postpone a move until even 2016 – they are clearly in a difficult spot given the weakness in the economy that has continued into Q2…

Today’s Equity Markets

Asia

Financials, insurers and brokerage houses led the charge on the Shanghai overnight as the index hit a fresh 7-year high, closing up 128 points at 4658…meanwhile, Japan’s Nikkei turned positive late in the session to finish at its highest level since April 2000, extending gains into a 6th consecutive day…

Europe

European markets are mixed in late trading…Germany’s final figure for Q1 GDP came in at 0.3%, confirming an earlier flash estimate…

North America

The Dow is off 21 points as of 8:00 am Pacific…U.S. consumer prices moderated in April on weak gasoline prices, but rising shelter and medical care costs boosted underlying inflation pressures with the so-called core CPI, which strips out food and energy costs, making its biggest jump (0.3%) since January 2013…this is the number the markets focused on when it was released at 5:30 am Pacific, reversing the greenback higher which in turn erased Gold’s mild gains…

In the 12 months through April, the CPI fell 0.2%, the largest decline since October 2009, after dipping 0.1% in March…

In Toronto, the TSX has lost 13 points after the first 90 minutes of trading while the Venture is 2 points higher at 702 as it once again threatens to challenge critical resistance at 707…

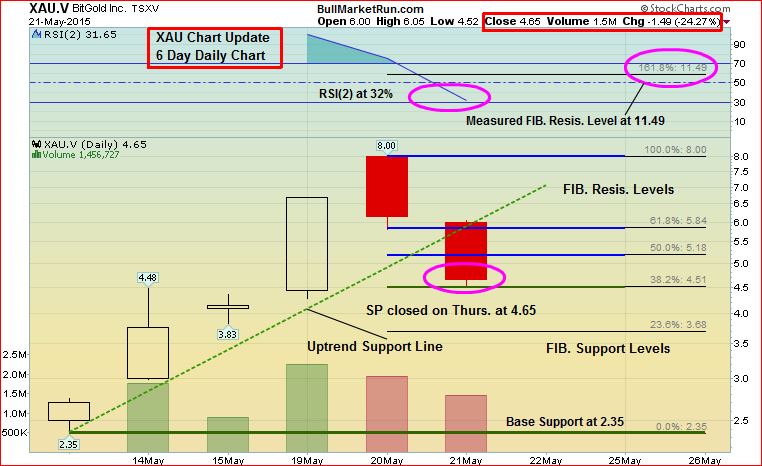

BitGold Inc. (XAU, TSX-V) Update

Plenty of investor appetite for BitGold Inc. (XAU, TSX-V) since it made its Venture debut just over a week ago on May 13…it closed at $2.70 that first day, and climbed as high as $8 intra-day Wednesday before closing at $4.63 yesterday on a retracement…continued volatility is likely…

XAU was halted just prior to the open this morning, pending news…below is a look at XAU’s first 6 days of trading with Fib. support and resistance levels…

Doubleview Capital Corp. (DBV, TSX-V) Update

As things get ready to heat up in northwest B.C.’s Sheslay district, what’s significant about this Doubleview Capital (DBV, TSX-V) chart is the breakout above the downsloping flag and the very strong new support at the top of that flag which coincides with a Fib. level and the 200-day moving average (SMA)…the 200-day is also now beginning to reverse to the upside after being in decline since the 4th quarter of last year…in addition, while it’s not shown on this chart, DBV also sports a rising 500-day SMA at 14 cents, underscoring the primary bullish trend that started in 2013…

These highly encouraging technicals jive with the consistently improving fundamentals at the Hat Property where it has become increasingly apparent in recent months that DBV has a world class Gold-Cu alkalic porphyry deposit in the making…

DBV is up 1.5 cents at 17 cents as of 8:00 am Pacific…

Claude Resources Inc. (CRJ, TSX)

Despite challenging market conditions, there have been several outstanding success stories among producers including smaller-scale ones…we’ve pointed out how Richmont Mines (RIC, TSX) turned the corner financially last year, with that stock tripling in value since July, while Claude Resources (CRJ, TSX) has also experienced a similar turnaround with superb results in the market…

Claude recently reported 1st quarter net profit of $5.1-million, or 3 cents per share, a $10.2-million difference from the 1st quarter of 2014…this is related to improvements in Gold production, sales volumes, ore grades and operational efficiencies at its flagship Seabee mine in Saskatchewan…a declining all-in sustaining cost per ounce profile for the remainder of the year bodes well for the company (fortunately, their operations are in mining and business-friendly Saskatchewan, not neighboring Albertastan)…

CRJ is certainly worthy of our readers’ due diligence and should be watched closely, especially in the event of a potential corrective pullback to the uptrend support line…nearest Fib. resistance is 80 cents on this 3-year weekly chart…

Houston Lake Mining Inc. (HLM, TSX-V)

We’ll have more on this situation next week – look at this 10-year monthly chart for Houston Lake Mining (HLM, TSX-V) which has a very interesting Lithium Project in Ontario…we’re bullish on Lithium, and what’s fascinating here is how HLM broke above a 7-year downtrend line last year and continues to significantly out-perform the market…

HLM is unchanged at 18 cents as of 8:00 am Pacific…

Tribute Pharmaceuticals Canada Inc. (TRX, TSX-V)

Our non-resource chart of the day is Tribute Pharmaceuticals (TRX, TSX-V) which is looking very strong after breaking out above a pennant formation…it’s up another 12 cents at $1.25 as of 8:00 am Pacific…

Note: John and Jon both hold share positions in DBV.

30 Comments

WRR-Any word when we can expect drilling to start??

Thanks

From what I understand, Jeff, they’re almost ready to start—they’ve been active on the property…I’m hoping they’ll deliver news on the exploration/drilling next week…

Any news from GBB?

Ted, have a look on the forum page of GBB. Mixed and unclear messages coming from Frank. IMO very unprofessional and could lose support of shareholders. I can’t tell whether the current plan of a rolling start has been abandoned or not. Frank is talking about doing a bigger project which could start producing gold in 3 years time.

Bitgold buys out GoldMoney.com now theirs a game changer .wonder how the Fed will deal with that . People will be able to use a currency backed by gold other than a currency backed by nothing.

GBB is now in the rim of 2 cents stock…. Not a good sign …. dump before you lose all!

Now is not the time to sell GB. An updated RE is due and there is also the possibility of a 1% NSR being given to shareholders.

Keep in mind that there are always reasons why certain stocks discussed here on BMR are at 52 week lows. If the market was optimistic on these plays which are at 52 week lows you would see bargain buying and people snapping up the shares……their prices wouldn’t stay very long at their lows. Sometimes very short lived buying opportunities happen because of unusual increased selling but increased buying shows up to take advantage of it. I have seen a lot of picks mentioned here that I wouldn’t touch and there wasn’t much DD involved to see the red flags. I think many will soon have regrets for having chosen the wrong stocks at the wrong time. The Sheslay Valley will soon see some action……the question is …..are people well positioned to capitalize on it or will they be praying that their area plays will ride the coat tails of someone else’s success???????? DD is key! Got DBV?

D4, you’ve stated here you’re “all-in” on DBV and I’m rooting for DBV as much as you. I have enormous respect for Farshad and how he has been able to take the Hat from a grassroots level a couple of years ago to where it is now, on the cusp of becoming a major new deposit in NW B.C. with the potential to be even bigger and better than Red Chris. Time will tell. But Farshad has shown the kind of grit, perseverance, and skill that’s necessary to take the Hat to the world class stage. I believe it’s there (in the ground) and he has the team to do it. Farshad has done a lot of things right over the last 2 years (a few honest strategic slip-ups, but no one is perfect) and it’s unbelievable how he has been able to overcome various challenges including of course a difficult market environment. He’ll face more obstacles I’m sure – this industry is full of them – and when you start to develop something big and have success, that’s sometimes when the real challenges begin. On a personal level, I can tell you that my prayers are with him every day, and for the entire district to be successful.

Therein lies my next point. D4, this is not a “competition” between DBV and others in the district, and you have a tendency to frame it that way and dismiss other players in the area. I made the mistake of underestimating Farshad at the beginning, in 2013. But I corrected that mistake in early 2014, and have been telling others ever since never to underestimate him. The whole Sheslay story from 2013 has taken some incredible, unpredictable twists and turns. And I can guarantee this – there will be more incredible, unpredictable twists and turns. Do not underestimate anyone or any company. For all we know, for example, and unlikely as it may seem, Mike England could come out of nowhere with a unique discovery at the Hackett Property – this entire district is “pregnant”, anything is possible. Here are a few realities:

1. Farshad is the first to admit this, and all the evidence backs it up: We can be 99% certain there are multiple deposits throughout the district – certainly on the Hat, the Star, and (I emphasize) on the Grizzly (about to be drilled) which is the biggest property by far of the three. No one knows for sure at this point who could be sitting on the biggest and best deposit.

2. The “area plays” you refer to are ABR and AIX at this point. ABR (with the Hackett) has the best target of those 2 at this point;

3. DBV’s major advantage right now is how the Hat is coming together, Farshad’s incredible passion, and the team he has assembled that includes the key recent addition of Dr. Razique. I have tremendous respect for Dr. Razique and the rest of the DBV team.

4. GGI has some unique advantages. They have the most money right now, a massive land package, about 8 years studying the property, and a huge advantage in the fact they’ve been able to compare DBV and PGX drill holes to various signatures which has greatly enhanced their chance of a discovery of their own very quickly (the first few holes) this summer. They have the same consulting group (C.J. Greig and Associates) as Pretium. I’ve met Charlie Greig. He’s phenomenal. Also, our due diligence shows that the most favorable location of a Sheslay district processing plant and tailings storage is likely somewhere in the big space of Grizzly Central (flat, away from any rivers and lakes) which also shows similar signatures as the Hat and the Star. So along with also hosting a potential major deposit, Grizzly Central is hugely valuable for its infrastructure possibilities. Garibaldi could get bought out just for that alone. Yes, DD is key, D4. Keep in mind, also, GGI has a discovery in progress in Mexico – they hit on the first hole at Rodadero. They’ve walked the walk in Mexico (diversification), they will do it at the Grizzly. Flow-thru selling, which is now drying up, is the only reason GGI has slid to where it is now. That scenario will change quickly.

5. DBV, GGI and PGX all need each other. Success by any of them will help the others, and failures or miss-steps by one could also hurt the others. Given potential capital costs, economies of scale here are going to be critical – in other words, the more deposits there are, including a high-grade starter area which is critical, the better the chances that will the capital will be poured in here by a major to turn this district into a prosperous mining camp.

There are risks in this industry. As a result, it’s never wise to put all your eggs in one basket, in a district play or in this market in general. Diversification is important.

DBV, GGI, PGX, ABR, AIX, Teck – they all share in the brand of the Sheslay district. The chances of this area becoming a new mining camp are extremely good – I’m rooting for everyone. Yes, DBV is leading the charge at the moment and I love how the Hat is shaping up – but there are many more chapters to be written in this story which we predicted 2 years ago, when hardly anyone was paying attention, that this would become a major Canadian exploration district and rise to national attention.

GGI could ride on Roradero alone plus they will hit the red rock at grizzly central somewhere. you have a winning situation on all front. This is a long term play regardless went the drill will start turning on the sheslay

Well said Jon The sooner everyone can get those drill bits turning the better. This could be one of the largest deposits in the world.. IMHO

Jon

very well said

thanks for pointing all of the above out, I have been losing confidence lately in GGI, but I know patience is the key… thanks for a well thought out post…

Jon- there are many players in the district. Some will not physically do much this year and just staked a claim because of the potential of the area. It’s all about timing and being in the right play at the right time. Being in the wrong one(s) may have a negative effect on one’s portfolio by lost potential profits. Does someone want to be in a few area plays that will not do much in the near/medium term and watch the leaders of the district move up? I doubt it. There is a losing strategy and a winning strategy in this game unless one has infinite time to wait to reap potential rewards. For me, I’m strategically playing this region to meet my goals quicker.

We both agree that the district has the potential for multiple deposits. District wide potential doesn’t occur often and this may be our only shot at it. When it does one needs to capitalize on it in order to reap the most rewards. Being in the right stock at the right time based on short term potential is the winning strategy (unless like I said one has infinite time to wait). When the right stock has attracted the market’s attention one then diversifies into the next one that is gearing up to attract some attention before the big price appreciation and so on and so on BUT ONLY after extensive DD. I have said it before and I am sure there will be a Sheslay Millionaire Club (aka SMC) created but unfortunately only the ones that played it well will become a part of it. Many posters here are not currently playing the district to their advantage by having exposure to DBV which we both agree has the most near term potential.

I see the following comments here by other posters:

DBV is too expensive and they prefer one of the cheaper plays.

People not understanding why DBV stock price/mkt cap is worth more than GGI

People continuously waiting for things to materialize

People seeking your guidance and reason behind lack of news, low prices at 52 week low, etc

People taking hearsay for granted

As I indicated in my earlier post, there are reasons for stocks being the price there are at. Never go against the market as one will lose. DD is key and it’s a never ending process. One needs to continuously do DD and reassess every new item. I was in PGX and GGI but my DD told me at some point to move on and add more DBV. I have nothing against the other area plays other than they are not at a stage where I feel I can capitalize on them soon so they will not get any of my money (after DD some may not get ever get my money if I feel there are issues even if they are about to drill a promising property). Matter of fact, at some point in the future during an SMC gathering at an exotic destination I may say that I was once a shareholder of all of the Sheslay plays and played them strategically to become a member. Time is limited and one must choice wisely.

Yes some diversification is important and everyone has different risk tolerance, experience and knowledge. Some do extensive DD , some mediocre DD and some just take the advice of others. Diversification mainly hedges against risk but at the expense of potential profit. If one invests in 10 juniors (for simplicity $1000 in each for $10,000), what are the odds that one’s portfolio ends up being $100,000? If one invests in 1 junior ($10,000), what are the odds that it the portfolio ends up being $100,000? The more diversification (assuming the same sector) the more one dilutes potential profits if the stock runs. Many years ago I held over 20 juniors and it almost cost me my marriage as it consumed too much of my time. The beauty about less diversification is that one can fully dedicate 100% of their time to DD and monitoring their portfolio or stock! The opposite of diversification is all eggs in one basket. I don’t recommend this strategy to people unless one has extensive experience, one can afford to lose it all, and one actually know what thorough DD is!

Time will tell if my 4th attempt will be as successful as my other 3 attempts. If it is the SMC will be established in 2016 and I will let everyone know where and when the first meeting place…..I just hope that I won’t be the only member of the SMC as it will be boring by myself!

We are all here for one common goal- to make money! Some will find my comments as pumping but believe me DBV will not need any pumping to get to new heights as the drill bit will do the talking. Some don’t like my comments because it indirectly bashes their area stock plays. Some will find me very cocky thinking DBV is the one and having high expectations for it but if one has done extensive DD on it like I have they probably would be too (my DD includes porphyry geos opinions some of which have extensive experience and worked on some of the world’s biggest deposits).

You said that GGI has the most money. They closed a PP for $1.25 million 5 months ago but how much of that will they actually have left for drilling by the time they start? Both of them almost have the same amount. I said a long time ago when I sold GGI for DBV that I would one day buy back into GGI when its time. When I do buy any of the other area plays I will let everyone know.

The Sheslay Valley is about to get some attention soon. I would like to thank BMR again for being the first and only group that covers the region but unfortunately they will soon be joined by others trying to capitalize on the region.

“Time will tell if my 4th attempt will be as successful as my other 3 attempts” – by this I mean all eggs in one basket!

Well done Jon, it’s warming up here in the central interior and it’s about to get even warmer.

Jon, D4, …great comments. thanks!!

D4 you won’t be the only member of the SMC as I also only hold DBV . At times things can be very frustrating due to the pit falls a JR endures in their struggle to prove up a resource , Farshad has done a truly remarkable job in getting DBV to this point ahead of the others in the area. With the team on site now it won’t be long before the next series of holes that were chosen by the best group of geologists are completed. Eventually , as this massive find will be proven it will attract many interested groups of people including a few majors .Long DBV. Good luck to all.

Nice to hear Jon talk about ABR/AIX as it’s been a long time!

The Hackett is a smaller property than the Hat (contiguous to it) but an exceptional target, Steven – all the geologists we’ve spoken to agree on that. There is enough historical information, and new information, to suggest the Hackett is either an extension of the Hat system or a potential separate deposit. It is fully permitted for drilling. Just a few weeks of additional work, including some IP, would nail down the precise drill targets. The frustrating thing is that like many companies, ABR has had difficulty raising money, and unlike DBV and GGI they just don’t have the funds yet to drill. But I suspect that will change as things heat up in the district on continued success by DBV and a possible drilling discovery by GGI. Don’t underestimate the Hackett – there’s no question there’s potential for a big surprise there. Yes, it is about 1/4 the size of the Hat, but keep in mind that the richest part of Red Chris is only about 600 m by 300 m. What’s also curious about the Hackett is the extent of high-grade historical gold showings up along the western side.

Let everyone not forget the DBV team of geologists that include Patrick McAndless is well connected to Imperial Metals and Dr. Abdul Razeque with Antofagasta. There is great interest in the Hat and area and the majors know a lot more as to what’s going on than most people believe. IMHO

For me ABR it’s a joke, when you finance 150,000$ at 0,01 cent and you dilute for 15 millions shares ????? miss lots serious I’m a shareholder !!!!!

They wouldn’t be the first company to do that, and then hit on a drill hole, Guy. The important thing is, they do have a valuable asset in the Hackett. What a boost of confidence it would be for the market in general if ABR were to make something happen. Again, we’re sure to see some more strange twists in the Sheslay story and that could be one of them. Who knows.

Let me better explain my good friend Guy’s comment as the language barrier didn’t allow him to fully express his thoughts ….it shows how DD is important.

He says ABR is a joke because:

CEO diluted with a PP for $150k at .01 (15 million shares)

CEO did a reverse split on AIX

So does anyone think that the CEO will not do the same with ABR?

My comments- there is a reason why its trading where its at. There is a reason why they are having problems finding money to drill. A good property with potential is a good start but one must also look a lot more than this…..management and technical team are crucial…..also ability to raise money as well! DD is important.

D4, you’re right that techncial expertise is crucial, and ABR obviously doesn’t have the technical team strengths that DBV and GGI have. But here’s something you’re missing (again, DD). ABR will get all the technical help it needs from DBV and GGI, if it can raise some money. The technical part right now isn’t the issue for ABR. Both DBV and GGI want ABR to drill and hit. There’s huge leverage in ABR at current prices – if they raise some dollars. And they will raise dollars if DBV and GGI evolve as we anticipate. Again, you keep framing the Sheslay story as a “competition” among the various participants. That’s perhaps the way it was in the early going. That has changed, evolved. Think of it this way: In a sense they’re all like independently-run operations but part of the same league or franchise, the Sheslay district brand. They’re all part of what’s developing as a much bigger picture – the gradual emergence of what will likely become an important new mining camp in NW B.C. that is sure to draw plenty of attention from many different quarters and stakeholders – and they all need each other’s cooperation and help.

Jon- I highly doubt that DBV will provide direct technical help as they will be very busy between now and snow falls but if you are referring to using their data to help better understand the geology then yes but one still requires its own competent technical team to ensure success.

I highly doubt DBV wants ABR to hit and I’m sure they don’t care what happens outside their claims. The only real synergy between these companies needing help from each other is if their properties are not big enough to entice a major they can pair up with an adjacent property to improve the economies of scale and make it worth it for a major to mine it. If one of these companies has a Red Chris deposit then it really doesn’t matter what the others do.

Everyone here is biased towards the stocks they own. It seems as though you only have only have good things to say on the stocks with properties in the region and always reply to negative comments with a positive one. This also happens with non-Sheslay Valley stocks. Some on this board look to you for opinions and guidance but we must keep it real and look at both the bad and good. It’s hard to publically criticize a stock one owns for fear of temporarily affecting investor sentiment and consequently the stock price if its thinly traded. Lets face it, although the region has huge potential it’s not all positive with the companies that have claims there. They all have their strengths and their weaknesses. If you are being compensated by these companies then I understand that you can’t honestly speak negatively about them.

I have no issues criticizing DBV even though I’m a major shareholder and have all my eggs in one basket. You mentioned that Farshad has done a great job so far but I disagree to an extent. I mentioned in the past that he did a good job based on the fact that he was a one man team.

(The following is my opinion) Many of the holes were not effective enough to hit what they were looking for. Due to the angles drilled, they should have drilled deeper to properly test where the good stuff usually resides based on the Red Chris model. I believe that as a result a lot of time and money was wasted. If they would have drilled an extra 150 to 200m I think the results would have been very different and they would have showed much more mineralization! To be honest, I and a few loyal shareholders of DBV probably wouldn’t still be in it (or wouldn’t have as many shares) if it wasn’t for the technical team that is running the show now. With the team he now has, a new winning strategy is in place. Farshad is now able to concentrate on performing his CEO duties without also having to plan the drilling which is now in the hands of Dr Razique…..no need to discuss his back ground and successes!

If it wasn’t for the new technical team, I would have never gone all eggs in one basket (assuming I remained a shareholder) even if the property was very promising as it takes much more than just this. DBV has all the pieces of the puzzle to deliver and succeed. Now it’s time to let the team do their thing and also time to let the drill bit do the talking! I have upmost faith in Farshad and his team and look forward to further drilling in hopes of getting the SMC off to a good start!

We’ll agree to disagree, D4, on some of your points.

First, a correction to your comment that, “It seems as though you only have good things to say on the stocks with properties in the region.”

That’s simply NOT the case – perhaps you didn’t read our harsh critique about how Prosper handled things last year, and back in 2013 we were being criticized for NOT saying good things about DBV (we consistently brought up the issue of not enough technical strength – of course that has changed now). AIX has been a disappointment, we went after the incompetently run lifestyle company Victory Ventures, and ABR needs to get its act together on raising money. We’ve never received any form of compensation from any of these Sheslay district companies, other than a 2013 Christmas gift of a cap and a jacket from Prosper that I received personally, so we’ll call a spade a spade at all times. That’s why I’m not on Prosper’s Christmas card/gift list anymore, and Bernier hasn’t called me in 8 months. If DBV or GGI mess up on something big, they’ll wish too that we did not exist. Having said that, we’re huge supporters of the district because this is a great Canadian discovery area with tremendous wealth creation potential, near-term and long-term. The geology speaks to that. And there are some tremendous people involved in this. I have respect for them all, even when they make mistakes because we’re all human.

Your suggestion that you highly doubt DBV wants ABR to hit simply isn’t true and doesn’t make sense. It would be equivalent to saying GGI and Prosper and ABR and others didn’t want DBV to hit in 2013. The fact DBV hit created a staking rush and allowed Prosper to raise $4 million at 50 cents. If ABR hit, you don’t think Farshad, Razique, Regoci and everyone else, including the entire market, would be doing cartwheels? Of course they would. Get real here.

Thanks Jon for your excellent analysis of the sheslay play.A stock to put on watch list is strike, SRK.V an area play with great potential. (diamonds surrounding NAR.V) Richard l

Jon- I forgot about the PGX saga. My point was that most of the time comments are mostly always good in spite of issues.

Thanks for the confirmation on compensation. Someone on SH was spreading info that BMR is or has been compensated by GGI and this was why BMR is very defensive on negative posts on them.

As for you wants who to strike. I do agree that $.01 ABR that is having problems finding money wants DBV and others to hit but again with DBV I honestly believe this isn’t the case. DBV has a very good idea of what lies there following Dr Raziques’ thorough 3 month analysis and at this point I think they don’t care if ABR, GGI, etc strike. In the past I am sure they cared to ensure survival (AKA financing).

Its unfortunate that you’re no longer on the PGX Christmas card/gift list. I’m sure that the jacket and the cap are at the bottom of a closet and not getting much use……..that’s if you haven’t thrown them out. I’m ensure that BMR is on the SMC’s 2016 Christmas card list once it gets stood up (if you and John are not already members). I hope that BMR and many of the loyal readers/contributors here become members of SMC. If people play their cards right I think in 2016 we will be starting the SMC.

Back to waiting for the long over due H23 result and drilling to start…..

D4 – Its one thing to voice your opinion about a particular stock, but its another to start a war over it. If you think DBV is the only stock with merit that is fine, hold your shares and be happy. Take a break and chill out.

Dave I have a Canadian Chat room that you may be interested in

let me know at [email protected]