Gold Bullion Development’s (GBB, TSX-V) latest results from the LONG Bars Zone of the Granada Gold Property near Rouyn-Noranda in northwestern Quebec continue to demonstrate a fascinating and growing mineralized system. About 15 months ago, Gold Bullion started drilling at Granada and soon after made an important discovery northeast of Pit #2 where much of the historical production took place at the property. Since that initial 2,500-metre Phase 1 program, more than 40,000 additional metres of drilling has occurred at Granada and continues around-the-clock. Results from over 80 holes clearly show the undeniable potential of this property to develop into a major open-pit operation in one of the best jurisdictions in the world for mining and exploration. Less than an hour’s drive from Granada down the “Golden Highway” is Osisko’s (OSK, TSX) massive Canadian Malartic discovery, the largest Gold deposit in Canada which is on the fast track to production. The “Cadillac Trend”, as it’s called, is one of the hottest addresses in the entire world for Gold exploration and there’s every indication things are going to heat up in this area even more in the year ahead, especially with the yellow metal at record high prices. Granada is in the heart of the action.

Mineralization, often very close to surface, is open in all directions at Granada with six kilometres of highly prospective ground yet to cover going east. BMR’s faith in this property remains as firm as ever since we first uncovered this story when Gold Bullion was trading at just 7 cents. We have made three separate site visits to the LONG Bars Zone over the past year and each time we have found the vastness and potential of this project to be breathtaking. The point of this article is not to rehash Gold Bullion’s February 15 news release but instead highlight a few results that may have been overlooked by investors and make some general observations about this large project.

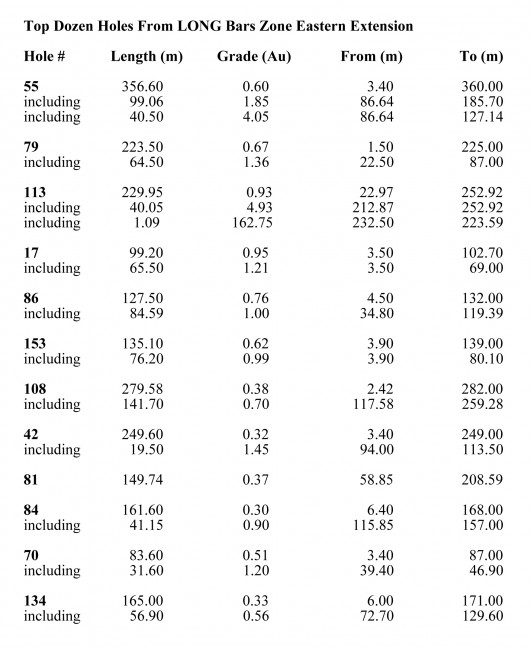

Eastern Extension

Much more drilling is required in the Eastern Extension but results are definitely beginning to show important continuity between this area and the Preliminary Block Model immediately to the west where a non-43-101 compliant 2.4 to 2.6 million potential ounces was outlined in April of last year.

One hole that was not specifically highlighted February 15 that we find very interesting is #79 which was collared just a few metres inside the Preliminary Block Model and was drilled toward the east-southeast, across the “boundary” into the newly-named “Trail Sector” which is really the beginning of the Eastern Extension. No narrow high-grade intervals were reported for #79, so our assumption is that this hole featured really nice Gold distribution. Overall, the hole returned 223.50 metres grading 0.67 g/t Au which included a 64.50 metre interval of 1.36 g/t Au. That’s an impressive result showing thickness and very mineable grade.

Our expectation is that the Eastern Extension will continue to expand northward and southward and of course to the east where so much blue sky potential remains. In the north, assay results by our calculation are still pending on seven additional holes (106, 165, 168, 171, 173, 178 and 179) over several sections north and east of #55 which delivered a whopping 356.60 metres grading 0.60 g/t Au as reported November 9, 2010. Only one hole (#60) was from this general area in the latest release and it returned a respectable 52.04 metres grading 0.57 g/t Au. Gold Bullion’s claims extend for at least 1.5 kilometres to the north.

The southern half of the Eastern Extension continues to deliver promising results. Hole #145, 190 metres southwest of #17 and along the same section it appears as #17, #14 and #18 north to south, intersected 45.86 metres grading 0.82 g/t Au. Some 50 metres to the northwest, hole #153 hit high-grade right near the surface (54.98 g/t Au from 3.90 to 4.90 metres) and averaged 0.62 g/t Au over 135.10 metres.

Another hole we like deeper to the south is #70 which was collared about 30 metres outside the Preliminary Block Model (100 metres southwest of #153) in order to test a possible extension of Vein #2. From 39.40 to 71 metres, #70 returned 1.20 g/t Au with mineralization appearing to be quite consistent throughout the length of the hole.

A series of Phase 2 and Phase 3 holes (14 in total according to the latest map on the GBB web site) have so far been drilled below the boundary of the Preliminary Block Model in the far south of the Eastern Extension in the vicinity of Hole #86 where significant near-surface mineralization was discovered last fall. Assay results are pending for 10 of these holes – three new ones (87, 131 and 134) were reported February 15 while #64 was released previously. Hole #87, drilled 120 metres northeast of #86, encountered high-grade mineralization near-surface (23.49 g/t Au from 18 to 18.75 metres). Holes #131 and #134 intersected a new structure, according to GENIVAR, with #134 returning an interval of 56.90 metres grading 0.56 g/t Au. Intense alteration has been observed in this area (the far south) of the Eastern Extension, as reported by Gold Bullion last fall, and it’s important to note that the Timiskaming sediments (most favorable for Gold mineralization) continue for about another 200 metres to the south of #86.

We are extremely encouraged that Gold Bullion is moving a drill sometime this month to test the promising Aukeko target which is nearly two kilometres east of Phase 1 discovery hole #17. A discovery at Aukeko, followed by a proven link between the current LONG Bars Zone and LONG Bars Zone #2 (the Aukeko area) as Gold Bullion has called it, would be a huge development for this project.

The discovery of high-grade mineralization at depth in Hole #113 (162.75 g/t Au from 232.50 to 233.59 metres) is very interesting and warrants follow-up drilling to test that new structure encountered between 212.87 and 252.92 metres depth (40.05 metres grading 4.93 g/t Au).

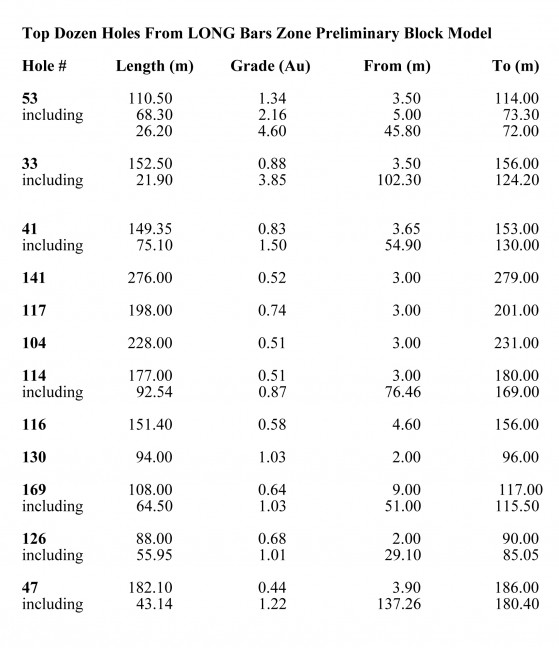

Preliminary Block Model

Infill, definition and exploratory drilling continue throughout the Preliminary Block Model where multiple new vein structures and near-surface mineralization have been outlined over the past year. Historical mining (underground) and previous exploration at Granada were mostly focused on the extreme southern portion of this area (Pits #2 East #2 West). Gold Bullion’s drilling over the past year along with historical results and recent prospecting by Adventure Gold (AGE, TSX-V) have confirmed to us that mineralization extends beyond the Preliminary Block Model not just to the east but in every other direction as well – north, south, west and at depth.

A hole like #141, collared about 220 metres from the northern edge of Pit #2 and just a few metres inside the northern boundary of the Preliminary Block Model, undoubtedly showed the kind of structure that GENIVAR and Gold Bullion are excited to see. The hole hit some high-grade near-surface (39.9 g/t Au from 40 to 41.5 metres) but must have included numerous other sections of mineralization in order to produce such a long intersection (276 metres) grading 0.52 g/t Au.

Gold Bullion’s drill map shows that a series of holes have been completed over a wide area north of #141 in order, we assume, to test the north-dipping Preliminary Block Model structure at depth and follow the potential east-west continuity of feldspar porphyry and quartz veining discovered in the far north of the adjacent Eastern Extension. Assay results are still pending for all of these holes with the exception of two that were also reported February 15. Hole #118, collared 140 metres east-northeast of #141, returned a 165-metre interval grading 0.41 g/t Au while Hole #142 intersected 85 metres of 0.44 g/t Au. Holes #141, #118, and #142 aren’t eye-popping numbers for the market and were likely glossed over by most investors but these holes demonstrate thickness and structure – exactly what the geologists want to see at this stage of the game. This is what helps lead to a mine.

Hole #117, collared 120 metres southeast of #141, cut several high-grade sections including 2.4 metres of 22.5 g/t Au starting just 4.6 metres down hole. These intervals, combined with lower grade sections, averaged 0.74 g/t Au over 198 metres – another impressive result.

A total of 16 new holes were drilled into the Vein #2 sector with results extending the vein down dip between 100 and 200 metres. It’s very encouraging, as Gold Bullion’s news release reported, that numerous smaller parallel veins have been intersected in the hanging wall of Vein #2 and that all of these veins appear to be related to an altered feldspar porphyry.

There are very interesting developments over the western portion of the Preliminary Block Model.

Results from several Phase 2 and 3 holes (#169, #172, #175 and #176) drilled up to 40 metres northwest of the waste pile provide additional evidence of an eastern extension of historical Pit #1 West. Hole #169, for example, returned a 64.50 metre interval grading 1.03 g/t Au.

Gold Bullion’s property boundary extends nearly 600 metres west of Pit #1. Follow-up drilling west of Pit #1 was recommended in a 2006 Technical Report on Granada given several encouraging historical drill intercepts. In addition, prospecting by Adventure Gold has resulted in the discovery of numerous Gold-bearing zones associated with porphyritic intrusions and/or quartz veins with disseminated sulphides in strongly altered and locally well-deformed sediments up to one kilometre west and southwest of Pit #1 as reported by Adventure Gold November 10, 2010. The LONG Bars Zone really begins west of Pit #1 in our view.

Southwest Activity

The latest drill map clearly shows that GENIVAR has recently been busy drilling holes in the southwestern portion of the Preliminary Block Model (Vein 2A on the map). Some 20 holes have been drilled south of Pit #1 and west of Pit #2 West, all within about 100 metres or less of Phase 1 Hole #13 which returned a 27.75-metre section grading 1.27 g/t Au.

Three holes (#225, #227 and #228) have also been drilled east-southeast of Hole #167 which appears to have hit a new mineralized structure south of Vein #1 as it cut an interval of 35.60 metres grading 0.92 g/t Au. This may partially explain GENIVAR’s apparent growing interest in this part of the Block Model.

It’s important to keep in mind as well that Phase 1 Hole #21, collared 50 metres outside the western boundary of the Block Model, intersected 65.5 metres grading 0.72 g/t Au (from 3.5 to 69 metres) including 20 metres of 2.20 g/t Au.

Another result released February 15 from the western portion of the Block Model that we find interesting and important is Hole #126 , about 40 metres northwest of Pit #2 West. It returned an interval of 55.95 metres grading 1.01 g/t Au within a total core length of 88 metres grading 0.68 g/t Au. It appears to show continuity of Vein #2.

General Observations

The process of trying to prove up a multi-million ounce Gold deposit, as Gold Bullion is attempting to do, is never easy. It takes time, patience, hard work and some good luck along the way. What Gold Bullion has accomplished since it started drilling just 15 months ago is impressive to say the least – the company has clearly demonstrated that Granada could develop into the next major open-pit deposit along the Cadillac Trend. The LONG Bars Zone discovery would not have been possible without the vision and tenacity of Frank Basa and the technical expertise of GENIVAR’s Nicole Rioux, the project’s senior geologist, and members of her team who are working tirelessly to pull this all together. Nicole is known for her ability to uncover an ore body – she is a very capable General but she could probably use more soldiers on the ground.

What we hope to see moving forward, besides continued good results which we’re confident Granada will deliver, is a ratcheting up of the exploration program. That is absolutely critical in our view in order to give Gold Bullion fresh momentum, new discoveries and a significantly higher market valuation. The model investors are looking at here is a low-grade, massive tonnage system (even at a grade of 0.50 g/t Au, as we’ve stated before, the economics could be very robust as other mines in North America have shown). Massive tonnage in this case is going to require massive drilling. Gold Bullion has a HUGE amount of highly prospective ground it has yet to explore, in addition to more infill and definition drilling that’s required throughout the Block Model and the adjacent Eastern Extension. This is probably stating the obvious but at some point a major beefing up of personnel and infrastructure are required at Granada in order for this project to realize its full potential which could very well be many millions of ounces. The addition of one or two more drill rigs in the near future would be immensely beneficial.

We are greatly encouraged by the results to date. Geologists we have spoken to, independent from this project, like how it’s coming together. The Eastern Extension covers a greater area now than the Preliminary Block Model (and we all know the ounce potential of the Block Model). So it’s not hard to do the math here. Granada is big and getting bigger. Many long intersections of mineable grade have already been reported. “The thickness is there,” as one geologist told us the other day. Keep in mind also that Granada, not unlike some other deposits in the Abitibi, has particle gold that in many cases won’t show up in drill results but will be processed in the mining procedure – the so-called “upgrading” effect. That’s why Gold Bullion’s large 2007 bulk sample (grading 1.62 g/t Au) was so important. NQ drilling alone, which is all we’ve seen so far, won’t be sufficient to quantify the grade at Granada.

The intense faulting and alteration throughout Granada, extending out to LONG Bars Zone 2, are very positive indicators of Gold mineralization. Many secondary faults have developed from the Cadillac Fault which traverses through the northern portion of the property (north of the Cadillac Fault, where one sees much more VMS-style mineralization, are volcanic rocks. Sedimentary rocks are found south of the Fault where there tends to be considerably more faulting, increasing the chances of Gold mineralization). One of the keys for GENIVAR is to identify the location and orientation of these faults, and it seems they’re having success in doing that.

Initial metallurgical testing completed by Gold Bullion last year showed very high recovery rates (in excess of 90%) which is consistent with historical information we’ve seen on the property.

Gold Bullion has significantly added to its overall land position around Granada. With approximately 11,000 hectares, it’s now the dominant landholder in an exciting new area of the Cadillac Trend. We expect Adventure Gold to start drilling shortly and that can only be positive for this play.

Later today at BMR, we’ll be highlighting what we consider to be the top two dozen holes drilled to date at Granada. They are undeniably good.

Granada’s future is as golden as ever. We look forward to continued results and following the development of this property as closely as possible. No matter what, the market will always get the hiccups from time to time but we encourage investors to keep focused on the fundamentals because Gold Bullion Development keeps showing that Granada has the goods. LONG Bars Zone + Gold Bull Market Of A Lifetime is a powerful combination.

Note: The writer holds a position in Gold Bullion Development.

13 Comments

i bailed for a small loss today. I fear a correction is upon us and the technicals on GBB are not good to say the least. Regroup and watch from the sidleines is where i’m at these days….energy looks more enticing than gold for the short term.

Any new updates on MTU, the SP has dropped significantly for a company coming out with string results on their drilling. They had a high grade past producing mine on their site and seems like the potential is high here.

I really like the geological potential of Manitou’s land package. The stock has pulled back, not unexpectedly. Difficult to be a trader with this one but if you take a long-term view you could possibly do extremely well.

MTU has been down to .62 so far today and obviously looks attractive. However, as with yesterday there are not many stocks that have not had a significant slide. World events are, perhaps, causing this market nervousness and maybe it’s not the time to increase holdings until there is more stability?

Andrew, at this point the CDNX’s decline has been consistent with previous pullbacks. The pattern is quite familiar. And during each of these pullbacks, a lot of investors have gotten nervous only to see this market ultimately move higher. The uptrend is still very much intact and Gold is looking strong as well. Some people are jittery about what’s happening in the Middle East and that’s understandable, but markets also often climb a wall of worry. No one knows exactly what will unfold in the Middle East. So for now, I’d have to say any CDNX weakness is an opportunity as has been the case for many months now.

Thanks for the update guys – much appreciated. I agree that this is an exciting story with a great future. I think the sell-off over the last while is coming to an end now and I also think gold is heading towards a breakout soon. Juniors are always are slow to pick up the lag. I think Frank has admitted that he made a mistake by issuing a complicated NR and he wont make the same mistake again. Complicated as it was, lets not detract from the fact it was excellent and a great story in the making. In couple of years people will look back and kick themselves for not buying at these levels! GTLA

Herb – . I think Frank has admitted that he made a mistake by issuing a complicated NR and he wont make the same mistake again

how did you come to that conclusion??? just asking.. really.. just asking.. just havent seen anything.. thx mate

I can tell you exactly where I heard it – it was in the interview he had with Dominic Frisby the very next day

Have a listen yourself – its a good interview.

http://commoditywatch.podbean.com/2011/02/16/frank-basa-interprets-the-drill-results/

Hi Jon, thanks for that comprehensive update on the situation at Granada. Everyone is disappointed with the current share price and I think we have gone over the errors that were made enough times without rehashing them. From a “big picture” point of view it would seem to me that we are heading for 4 plus ml oz resource between the preliminary block model and the long bar zone. I am no geologist but with extensions being found in every direction and at depth this seems to be a conservative and realistic figure for these two zones. If they could prove up a resource that size in a jurisdiction as good as Quebec, close to surface and with perfect grades for large open pit mining, each proven ounce in the ground would be worth $300 in the current $1400 gold market. Making both those assumptions, which I admit are just assumptions but very realistic ones, would give GBB a market cap of $1.2 billion as opposed to its present one of $60 million. This last month has been tough on everyone involved with GBB but I am confident that long term this can be a big winner for all of us.

Jon, thanks for your comments on the current CDNX decline.

Thanks Jon,

I only wished you would have posted this earlier. Seems some investors are jumping the band wagon, might take GBB a little bit longer to get there, but with a few tweeks and corrections it will probably be back on its way to recovering stock prices. I agree with what Patrick wrote, long term GBB will be a winner.

Thx Herb – appreciated:)

Doug Casey: Get ready for the junior gold mania

Tuesday, March 08, 2011

Text Size:

From Mineweb:

Junior resource stocks, while no longer cheap, still present speculators with big opportunities as an unprecedented rally fuels precious metals and the companies that find them, said veteran investor Doug Casey.

Casey, a legendary investment guru who founded and chairs his own research firm, said he would not be surprised if gold hits $5,000 an ounce in the next couple of years, as paper currencies in the United States, Europe, and Japan drop in value.

“Central banks all over the world are creating trillions of currency units and that in turn is creating lots of bubbles,” he said in an interview on the sidelines of the PDAC prospectors and developers convention in Toronto.

“It’s very probable that they’re going to ignite a bubble in gold and they’re going to ignite a really wild bubble in small resource stocks.”

Gold hit a record high of $1,444.40 an ounce on Monday as oil prices spiked on political instability in the Middle East and North Africa, and on worries that a downgrade of Greek debt could undermine confidence in the euro.

Casey said he believes gold is not even close to overvalued. In his opinion…

Read full article…

Crux Note: To learn more about profiting from junior resource stocks – and get access to Casey Research’s top recommendations in the sector – click here.

More from Doug Casey: