The current bull market in Gold began at the beginning of 2016, and the correction late last year was merely a “head fake” but it fooled many analysts and investors.

Powerful moves usually occur when few are expecting them which is one reason we’ve been calling for a BIG move in Gold before 2017 is over. The set-up for the 2nd half of the year is particularly intriguing given the continued technical deterioration of the U.S. dollar – a bear market in the greenback does appear to be underway, yet most market participants either haven’t recognized this yet or simply don’t want to admit it.

Meanwhile, a quick scan of events around our chaotic world certainly leads one to the conclusion that owning Gold and Gold stocks right now is a wise choice.

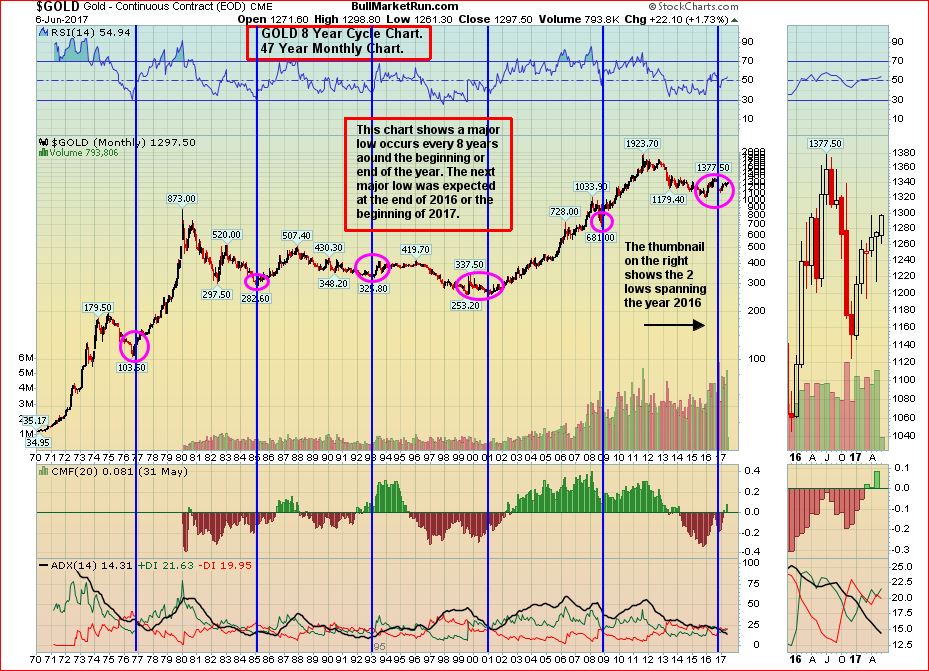

John, who is clearly one of the top Gold chartists in the business given his amazingly accurate calls over the last number of years including the recent $1,215 low, gives us a unique perspective on the “Big Picture” in bullion with a 47-year monthly chart.

For some strange reason, as you can see below, Gold has a habit of forming major lows approximately every 8 years – so the metal is now working its way higher again and who knows where it will stop.

From the 5 previous major lows to highs beginning in the late 1970’s, the percentage moves have been as follows:

739%, 79%, 29%, 309% and 182%. The average for just the last 4 of those moves (taking away the 743% surge) is 150%, which means it’s reasonable to argue that Gold could double from current levels to about $2,600 an ounce during this cycle over the next several years.

Significantly, in terms of what’s happening NOW, the RSI(14), CMF and ADX indicators on this monthly chart are consistent with the thesis that Gold’s uptrend is gaining strength and any surprises during the 2nd half of 2017 will be to the upside.

In Monday’s Morning Musings, we looked at 3 attractive producers and 1 speculative junior under 30 cents and they were all strong performers today as Gold pulled within shouting distance of $1,300.

We’ll follow-up with more on Gold and Gold stocks tomorrow in 7 @ 7:00 and Morning Musings.

4 Comments

By the end of June cxo will double, great buying opportunity right now that no one is talking about Jon

End of June is a little aggressive, Greg…the technicals won’t really be properly aligned on CXO until sometime in July and that’s when drilling will start…nonetheless, a double is certainly in the cards IMHO as a minimum move in the July-August period…

What is with the big offers on GGI and CSR. Scratching my head.

Dave – Re: GGI. holding in price in range until PP closes. I think same for CSR – the final tranche of their PP has yet to close.