5:30 pm Pacific

(Exclusive to BMR Subscribers – Not for Distribution or Posting on any Board!)

Venture Bull Run To Intensify

It’s safe to say that the Venture, which has been leading the broader averages higher in recent weeks, will test its 200-day moving average (SMA) in the mid-520’s as early as tomorrow following today’s bullishness on Wall Street. Canadian markets were closed for the Victoria Day holiday while the Dow and S&P 500 kicked off the new week with powerful advances. Stocks that would benefit from a reopening of the economy led American markets sharply higher, while investors also cheered news that an experimental coronavirus vaccine from Moderna (MRNA, NASDAQ) showed promising early signs.

The last Venture breakout above its 200-day SMA occurred in late 2017, and that was followed by an immediate major push to the upside. The Index was on the verge of busting out above its 200-day in late February this year, only to be thwarted by a virus from China. This time around, there appears to be no stopping the Venture which has posted 6 consecutive weekly gains during a period of rising Gold and Silver prices and a very strong recent rebound in Crude Oil.

The significance of a breakout above a 200-day SMA cannot be overstated. As we pointed out in last night’s Sunday Sizzler, Canada Silver Cobalt’s (CCW, TSX-V) average share price percentage gain has been 154% (over a period of less than 3 months) on its previous 3 breakouts (2017, 2018, late 2019/early 2020) above its 200-day SMA. The 4th and latest such breakout since the beginning of 2017 occurred just over a week ago when the stock pushed through the mid-40’s (a 154% gain from 43.5 cents = $1.11).

Clean Air Metals (AIR, TSX-V)

And Northern Ontario’s Emerging PGM District

Exploration excitement is ramping up in Northern Ontario. We’re all familiar with CCW’s high-grade Silver discovery at Castle East (plus Gold potential) which is about to move into a new phase, and just recently GFG Resources (GFG, TSX-V) cut 71.3 g/t Au over an 8.5-m core length at a vertical depth of approximately 50 m below surface for a new grassroots discovery (drawing in Alamos Gold as a major investor) at its Pen Project immediately west of Timmins and approximately 100 km northwest of Castle. Near GFG’s Project, Melikor Resources (MKR, TSX-V) has been drilling into high-grade Gold at its Carscellan Project (CAR-20–05 intersected 25.7 g/t Au over 6 m). MKR has quadrupled in value over the last 10 sessions, trading at 90 cents Thursday morning before it was halted with more news pending.

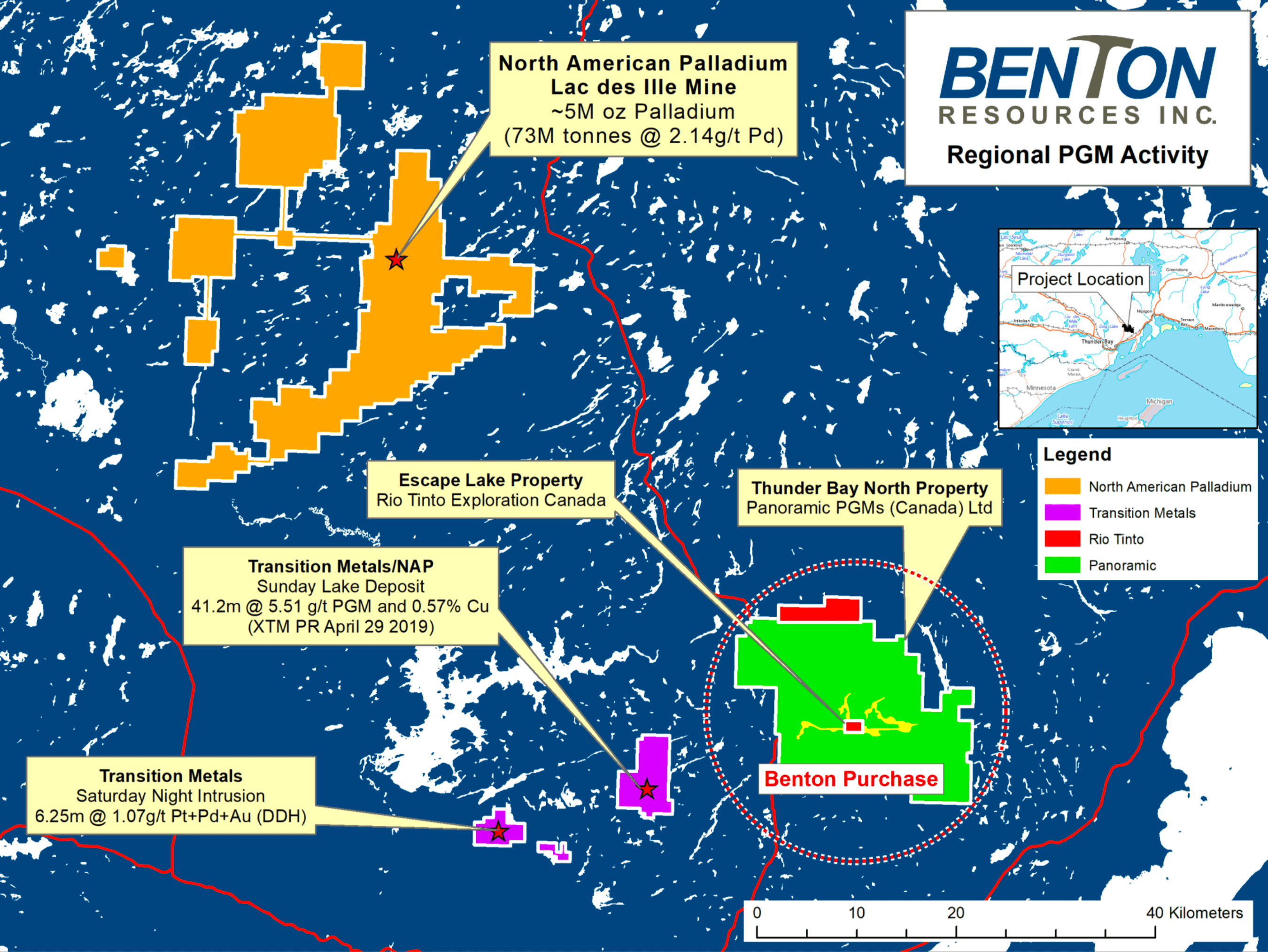

Meanwhile, near Thunder Bay, Northern Ontario’s emerging PGM district is about to garner a lot more attention as Clean Air Metals (AIR, TSX-V) gets set to commence trading “on or about” this coming Friday, May 22, according to the Venture Exchange.

Clean Air will have a war chest of approximately $15 million, some of which came from Eric Sprott, to tackle the highly prospective Escape Lake and Thunder Bay North Projects southeast of the Lac des Iles Palladium mine now owned by Impala Platinum (IMP, JSE).

Jim Gallagher, former CEO of North American Palladium (bought out by Impala) and executive chairman-designate of Clean Air, stated, “The recent acquisition of the Lac des Iles mine by Impala Platinum underscores the globally recognized significance of the PGE-rich Thunder Bay North region. Clean Air Metals has consolidated 2 prospective PGE properties with a significant amount of historical exploration drilling with some impressive PGE-Ni-Cu intercepts in North America and is focused on expanding these results.”

Benton Resources (BEX, TSX-V)

And Transition Metals (XTM, TSX-V)

With Palladium trading near $2,000 an ounce, and Sprott involved, investor interest in Clean Air is expected to be high. Direct beneficiaries should be Benton Resources (BEX, TSX-V), which holds 25 million shares (19.7%) of Clean Air, and Transition Metals (XTM, TSX-V) which owns 100% of the Saturday Night Project and 25% of the more advanced Sunday Lake Project, both right on trend with Clean Air’s properties. Keep in mind, all 4 drill holes into XTM’s Big Red Anomaly at Sunday Lake have hit high-grade PGM mineralization including 41.2 m @ 5.5 g/t PGM and 0.57% Cu.

Benton’s market cap is only $10 million while Transition’s is only $8 million (XTM has just 47 million shares outstanding). Both are undervalued. Transition just released more solid results from Sunday Lake and also has a lot of other irons in the fire (high-grade Gold, Copper and Nickel, plus ground immediately next to CCW), in addition to its highly attractive share structure.

XTM Long-Term Chart

What we’re looking at here is a long-term chart pattern with very explosive potential, suggesting XTM could easily surge into the 38 to 57-cent range on a breakout through the low-to-mid-20’s which has provided resistance for the past several years:

- RSI(14) has been holding support his year at 50%;

- Rising 300-day EMA (EMA-15 on this monthly chart), currently 16.3 cents, underpins the stock price;

- SS is nicely positioned with %K moving higher;

- ADX indicator confirms a bullish trend.

XTM is a low-risk, undervalued play with a great chance to turn into a double or triple or better for patient investors over the coming months.

BEX Long-Term Chart

Note how BEX has been following its uptrend line this year.

Momentum is strong with RSI(14) at 74%, SS is still climbing while the ADX indicator has room to strengthen.

Key resistance is 14 cents – once that’s conquered, the next obvious target is measured Fib. resistance at 21 cents.

BEX closed Friday at 11.5 cents.

Sona Nanotech (SONA, CSE)

Sona Nanotech (SONA, CSE) is beginning to emerge out of deeply oversold conditions that formed last week when the stock lost one-third of its value from Monday to Tuesday. A bullish Morning Star reversal pattern formed Wednesday after 6 consecutive losing sessions, and the stock firmed up modestly to close the week at $1.28.

Over the past 2+ months SONA has experienced 3 major corrections (52% over 9 sessions in early March, 41% over 3 sessions in early April and 45% over 6 sessions culminating last Wednesday). Notably, this latest strong pullback ended near the still-rising 60-day moving average (SMA) and the bottom of the channel as shown in John’s updated 3.5-month daily chart.

With this “cleansing”, SONA could now be ready to launch into a much-anticipated “Wave 5” explosion to new highs in conjunction with its Rapid Response Lateral Flow validation test with a major U.S. laboratory. Validation and approval in the U.S., vs. the same in Canada, is going to result in a much higher profile for the company.

G6 Materials (GGG, TSX-V)

G6 Materials (GGG, TSX-V) continues to perform well, closing Friday at 13 cents. The stock’s technical posture remains bullish with a series of higher highs and higher lows and a path to 20 cents if when it busts through key resistance at 14 cents on this 8-year monthly chart.

The company recently raised $1 million, allowing it to scale up its graphene manufacturing capacity and complete plans involving a graphene coated air purification system designed to mitigate the threat of virus infection in confined spaces such as offices and industrial warehouses.

Note: John, Jon and Daniel hold share positions in CCW. John and Jon also hold share positions in SONA and XTM. Jon also holds a reduced share position in GGG. Jon and Daniel also hold share positions in GFG. Daniel also holds a share position in BEX.