Gold fell to a 5-week low overnight on continued speculation the Federal Reserve will begin to scale back QE3 beginning next week, and as Syrian tensions ease amid talks on a plan for that country to surrender its chemical weapons (or as bullion manipulation continues as suggested below)…as of 7:00 am Pacific, the yellow metal is off $2 an ounce at $1,319…it touched a low of $1,304 overnight…Silver, which was technically overbought and needed to correct somewhat, is headed for its biggest weekly drop since April…it fell below $21.50 overnight but is now up 15 cents at $21.89….on a weekly basis, we’ll see today if it can hold support at $22…Copper is off 2 cents at $3.17…Crude Oil is off 91 cents a barrel to $107.69 while the U.S. Dollar Index is up slightly at 81.59…

Check out the interesting article by Lawrence Williams at www.Mineweb.com this morning (“Gold Knocked Down…Again and Again”)…his main argument is that Gold is being manipulated at the moment in a similar fashion as it was in the spring…here’s an interesting excerpt from his piece this morning: “Some even reckon China may be behind the manipulations which seem to be taking place after close of Asian markets and just ahead of opening of European ones. With the kind of Gold purchasing activity seen in that nation when the Gold price dropped so sharply back in April, perhaps this could be seen as yet another way of moving physical Gold from West to East as part of an ongoing pattern to corner the global supply of Gold. Certainly Western Gold inventories seem to be declining rapidly and no one is really sure how much physical metal actually remains in central bank coffers given their rather opaque accounting mechanisms. Who knows?”…do you think Williams is right or he is just engaging in “conspiracy theory” thinking…provide us with your thoughts in our comments section…if he’s right about manipulation, we have little doubt the Chinese have their fingerprints all over it…

Check out the interesting article by Lawrence Williams at www.Mineweb.com this morning (“Gold Knocked Down…Again and Again”)…his main argument is that Gold is being manipulated at the moment in a similar fashion as it was in the spring…here’s an interesting excerpt from his piece this morning: “Some even reckon China may be behind the manipulations which seem to be taking place after close of Asian markets and just ahead of opening of European ones. With the kind of Gold purchasing activity seen in that nation when the Gold price dropped so sharply back in April, perhaps this could be seen as yet another way of moving physical Gold from West to East as part of an ongoing pattern to corner the global supply of Gold. Certainly Western Gold inventories seem to be declining rapidly and no one is really sure how much physical metal actually remains in central bank coffers given their rather opaque accounting mechanisms. Who knows?”…do you think Williams is right or he is just engaging in “conspiracy theory” thinking…provide us with your thoughts in our comments section…if he’s right about manipulation, we have little doubt the Chinese have their fingerprints all over it…

Updated Gold Chart

So where do things stand technically with Gold given this week’s drop?…today indeed could be turnaround time, as John’s 3-month daily chart shows RSI(14) has hit previous support…don’t forget, there’s an important support band between $1,320 and $1,350 which held yesterday ($1,321) and could hold today as well on a closing basis…Gold landed on Fib. support at $1,307 overnight…

What’s just as unusual about the Gold price drop since post-Labor Day is how the Venture Exchange has managed to hold up so well, which we believe is a very encouraging sign for both the junior market and bullion itself…we’ve seen 3 major 1-day drops in Gold since last week, totaling more than $80 an ounce including yesterday’s $45 plunge…yet the Venture was actually up slightly on 2 of those days and declined just 4 points yesterday…that’s a pattern – the Venture shrugging off a more than 5% drop in Gold – that we just haven’t seen over the last 2+ years…there’s no manipulation behind that…so John went to work on a couple of very interesting charts…

2013 and 2010 Venture Comparative Charts

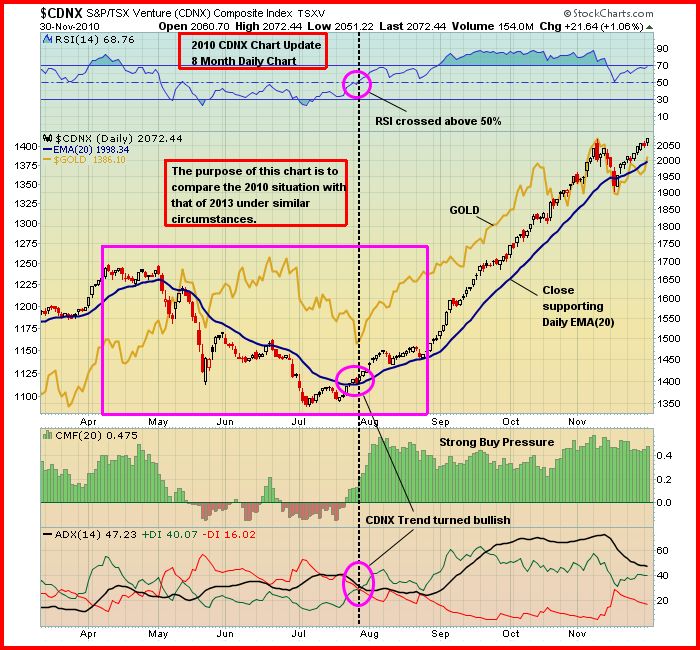

The similarities between the 2 charts below is quite remarkable, though we’re not suggesting the Venture is about to enter a 2010-type surge over the coming several months…what we are theorizing is that the current pattern is powerful additional evidence that the Venture hit an important bottom in late June and is slowly gearing up for a possible sustained recovery during the upcoming 4th quarter…

Notice the turnaround in July of this year when RSI(14) broke above 50 (now support), a bullish +DI/-DI crossover occurred, and sell pressure turned into buy pressure…importantly, the EMA-20 has provided consistent support during this move up…these technical patterns, interestingly, are virtually the same as they were during the summer of 2010 when the Index emerged out of a correction and started a massive run…it also shrugged off a temporary slide in Gold…again, we’re not anticipating a 2010-style move now – overall conditions, fundamentally and technically, are quite different, but the argument can certainly be made that both the Venture and Gold could finish the year on a much more positive note vs. what we’ve endured most of this year…

2013 Venture 9-Month Daily Chart

2010 Venture 8-Month Daily Chart

Media Reports: Obama To Nominate Summers As Fed Chief

Markets would have preferred to see continuity on this matter with Vice-Chair Janet Yellen selected to replace Ben Bernanke, but it appears almost certain now that President Obama, in his infinite wisdom, will nominate Larry Summers, his former economic adviser, as the new Fed Chairman to take over from Ben Bernanke who is expected to step down at the end of January when his term expires…Japan’s Nikkei newspaper (the English language version) reported this morning (quoting unnamed sources) that Obama “is set to” name Summers as early as late next week, though the White House this morning denies those reports and says Obama has yet to make a final decision…Summers is regarded in Washington as a confrontational figure and his nomination may not get an easy ride through the Senate…he has said little regarding monetary policy in recent years…

Today’s Markets

Asian markets were mostly weaker overnight with China’s Shanghai Composite retreating from a 3-month high, falling 19 points to close at 2236…Japan’s Nikkei average bucked the trend and gained 17 points to finish at 14405…Japanese media reported that Prime Minister Shinzo Abe will raise the 5% sales tax to 8% next April, and that Abe has ordered an economic stimulus package that could total as much as $50 billion to cushion the tax hike’s impact…governments never cease to amaze us…Japan has a spending program and hauling in more tax revenue just keeps feeding the monster…

European shares are flat today to finish the week…

North America

The Dow is up 63 points through the first 30 minutes of trading…U.S. consumer sentiment fell to 76.8 in September…economists polled by Reuters were expecting the index to fall to 81.8, compared to 82.1 the month before…the TSX is up 37 points while the Venture is off 4 points at 936…

Probe Mines Ltd. (PRB, TSX-V) Update

We’ve focused very much on high-quality discovery situations in recent months, companies with the working capital, the expertise, the properties and the drive to succeed both on the ground and in the market – companies that have the ability to make discoveries that majors will buy…that’s how great wealth will be built by many investors over the next couple of years, especially considering some current valuations…in northwest British Columbia, of course, we’ve targeted the Sheslay River Valley as the next major discovery area which could take the market by storm in the coming weeks…both Prosper Gold (PGX, TSX-V) and Garibaldi Resources (GGI, TSX-V), who control a combined 240 sq. km in the Sheslay River Valley, unquestionably fall into the category of the 10% of Venture companies who meet our criteria as described above…in northern Ontario, a situation we continue to find extremely appealing is Probe Mines’ (PRB, TSX-V) Borden Lake Gold deposit which has evolved enormously in recent months with the company drilling into a high-grade system to the southeast of the main deposit…this is a fabulous geological and market story…if you haven’t looked into Probe, we highly suggest you do as we see a strong possibility of a takeover of this company by Agnico Eagle Mines Ltd. (AEM, TSX-V) within the next year…

Below is an updated Probe chart from John…notice how the stock has significantly out-performed Gold since April, and there’s a good reason for that…John’s updated 2-year weekly PRB chart shows strong support around the $2 level…PRB closed yesterday at $2.05…it’s unchanged as of 7:00 am Pacific…

Canada Carbon Inc. (CCB, TSX-V) Update

Canada Carbon (CCB, TSX-V) gained fresh momentum after pushing through resistance at 25 cents Tuesday, and closed up 3 cents yesterday at 27 cents…it has doubled over just the last dozen trading sessions…this morning, the company released preliminary VTEM airborne survey results which have identified multiple anomalies over the 20.7 sq. km Miller hydrothermal lump/vein graphite property in Quebec…of greatest significance, CCB stated, is a large anomaly that extends from the previously announced (VN1) graphite vein discovery for 285 metres to the southeast and 15 m to the northwest…the company has been carrying out trenching on 40 m of the anomaly’s 300 m length…

Below is an updated CCB chart from John…new support now exists at 25 cents while Fib. resistance sits at 30 cents…cautionary note – RSI(14) is solidly in the overbought zone at 75%…it could remain there for a little while longer but at some point in the near future there will have to be an unwinding of that…CCB is unchanged at 27 cents through the first 30 minutes of trading…

Note: John, Jon and Terry do not hold share positions in PRB or CCB. John and Jon both hold share positions in GGI while Jon also holds a share position in PGX.

29 Comments

MIKE SWANSON OF WALL STREET WINDOW BELIEVES IT COULD BE THE BOTTOM TODAY: Will Gold and Mining Stocks Bottom Here? – Mike Swanson (09/13/2013)

By Mike Swanson on Fri, 09/13/2013 – 08:17

Topics:

Gold and Gold Stocks

Yesterday we saw a sharp drop in gold prices and mining stocks as gold fell down towards 1300 an ounce after having been over 1400 an ounce just the other week. In my view gold and mining stocks are still in the process of forming a stage one consolidation base after making a bear market bottom in June, which should come to an end soon, probably this month after next Thursday’s FOMC meeting.

The current key level of resistance on the HUI is at the 280 level. A close above that for the HUI will be a key breakout that will complete the stage one base and mark the start of a full blown stage two bull market.

The HUI fell 5.69% yesterday. I’m looking for it to make a bottom at this level much like it did in August when it had a quick drop at the start of that month.

We seem to be in a sell the rumor of Fed “tapering” next week. But with such a quick drop we saw yesterday the drop will probably end much sooner than next Thursday – it wouldn’t surprise me if metals and mining stocks bottom today.

Jon

here is what Hong Kong hedge fund manager William Kaye has to say about the smack down in the gold price

Kaye: “My thoughts are that some markets are manipulated and others aren’t. Crude oil is a more complicated market. It isn’t controlled and can’t be controlled by the central banks. So as you say, it’s trading $1.30 higher, while the gold market is being manipulated today by the usual suspects. This manipulation by the central banks will continue until they lose control. The bottom line is people that understand the gold market, they know that gold has been manipulated for more than two decades.

But I think we are now very close to the central banks losing control of the gold market. It could happen later this year because the evidence, which is very powerful, is that they just don’t have the gold to deliver into the system. And when we reach that point where the physical gold can’t be delivered to make good on the promises that the fake paper gold market has made, you wind up with potentially a bifurcated market.

By that I mean you wind up with a market in which the physical market migrates well north of the paper market. At that stage you have no paper market. In other words, the rigged casino ends and the players leave the casino because they know it’s a rigged game and it’s not an honest market. Then, the CME just shuts down trading precious metals altogether because they lose credibility.

So we are very close to the point where the entire paper market facade ends, and the physical market takes reign over the paper market. The paper products have been created by all of these bullion banks, some of whom have already defaulted on those paper promises and have demanded settlement in cash because they just don’t have the physical metal to deliver.

But as the physical market takes over, that will shut down the paper market altogether. This is what I’m in it for, and this is what our partners are in it for. For what it’s worth, I’ve been managing money for over 35 years, and this is the worst year I’ve ever had because we are down more than 10%.

That’s never happened to us. We’ve never been down more than 10%, not ever. That includes the 1987 stock market crash, when I was on the Board of Paine Webber in New York. It also includes the 1997 crash in Asia in the emerging markets where we actually made money. So I have a pretty good record, particularly in bad times.

And these aren’t bad times for most investors. So the idiots are making money, and the people who actually know what they are doing are seeing mark-to-market losses. But I say all of this because after 35 years you learn some things. I don’t have a problem losing money because of a miscalculation on my part, but that’s not what we are dealing with here. What we are dealing with right now is an intentional and calculated smash on gold and silver that is meant to damage the asset class and anyone who is invested in it.

So, we have lost money, market-to-market, but I’m quite certain that money will be made back in spades, and perhaps exponentially. The bottom line is the price of gold and silver will be much higher 1, 2, 3, and 5 years from now. I’ve never been more confident of any forecast in my life.”

Jon

Ted Butler follows the gold and silver markets like no one else and he puts it in print all of the time about the manipulation of both gold and silver by JPMorgan, he says right now they have an illegal long position in gold and an illegal short position in silver, he actually calls them crooks in print all of the time and the amazing thing is, JPMorgan never does anything to deny his claims or sue him for slander..

JPM’s 57,000 contract net long position still represents 17.3% of the total net open interest in COMEX gold (minus spreads). Before JPMorgan succeeded in sponsoring legal action to throw out position limits, the CFTC formula for markets the size of COMEX gold called for no entity to hold more than 3%of a market share. Even after a 28,000 contract reduction in JPMorgan’s gold market corner (and approximately a $350 million profit), the bank still holds a position almost six times greater than the position limit formula approved by the CFTC. – Silver analyst Ted Butler, 07 September 2013

My argument that charts are a thing of the past is bearing

through today, gold not only broke through the narrow band

of support but the wide band. This is not whining my friends,

because i have been buying away, during the last few days, as

if everything around me is normal. I will either do well with

this game or i go broke, then you can stand by for the whining.

More from Ted Butler….

I am screaming, with all the force I can muster, the equivalent of “FIRE” in a crowed theater. If there is no fire and I have no proof that there is a fire, I should not be allowed to do so and, further, I should be reprimanded for doing so. Let me be the first to say that I should be stopped immediately from making allegations against JPMorgan (and the CME) for manipulating and cornering the COMEX gold and silver markets, if it can be shown I am acting in bad faith in any way or that sufficient proof doesn’t back my allegations. – Silver analyst Ted Butler, 07 September 2013

Jon- do you think Williams is right or he is just engaging in “conspiracy theory” thinking… provide us with your thoughts in our comments section…if he’s right about manipulation, we have little doubt the Chinese have their fingerprints all over it…

Greg- would not surprise me at all, the Chinese know that it is just a matter of time before the physical market over runs the paper market, so why not keep the prices down so they can buy more at these low prices before it all blows up?

Jon- re: CCB, cautionary note – RSI(14) is solidly in the overbought zone at 75%…it could remain there for a little while longer but at some point in the near future there will have to be an unwinding of that…

Greg- Jon what does the chart show it unwinding back to?

Greg…interesting interview today at KWN with Andrew Maguire, regarding JPM. May be of interest to you.

Jon,

Did you get a chance to check out azc Augusta Resource?

GOLD REBOUNDED NICELY AT THE END! CCB, CKR!

Hi Jon CKR has broken out of its earlier resistance at .03 last month and doubled last week, great volume the last 6 days for this little graphite play with 4 or 5 key properties. Today it hit another 52 week high at .09 and closed at .085 of volume just under 5 million. Tuesday it came out with some very good news that there are 4 conductors on the Mulloy property, rumour has it that they have better results than CCB, I guess we will find out soon enough.

Steven – GOLD REBOUNDED NICELY AT THE END!

Bert – I agree, but the futures is down $22.00. R !

Thanks Greg J I will check it out

Jon – do you know how many drills PGX has on the Sheslay property? You would think with so much many historical hole(85%)bottoming in mineralization they would want as many drills on the property as possible, given the relatively short season up there. Yes, I know they can possibly drill year round but it is much easier with no snow on the ground. Also have you heard anything on how drilling is going – how many holes drilled so far?

Also have you heard from GGI? They are still quiet and I am anxious to hear something regarding their property. I took the plunged and purchased over 50,000 shares this week.

Hi Dan, our research over the last few months has shown that what PGX and GGI are looking at is something on a very large scale. I truly believe this has unusually good odds of rapidly developing into an important new discovery in northwest B.C., given the geology that covers these 2 land packages and the quality of the people who are involved. You can be sure that with PGX, they have very carefully targeted these initial holes as Bernier knows how important it is to get this project off on the right foot. Where they’re at with the drilling, I have no idea – they are being very tight-lipped and we just have to wait for news. They’ve already stated the Sheslay has not been tested at depth (that’s a fact), so we can certainly expect them to drill deeper than Firesteel ever did. I have extreme confidence in this group given their amazing success at Blackwater, and knowing the quality of the targets they’re drilling. As for GGI, they have an incredible opportunity here and keep in mind they’ve been bullish on this whole area since they first acquired the Grizzly in 2006. They’re not just going to sit back and watch Prosper Gold do its thing. These properties are intimately connected, geologically, based on everything I’ve seen, and to me this adds up to one very large potential discovery that’s right on trend with other major discoveries, deposits and mines to the southeast along the prolific Stikine Arch. Teck didn’t acquire all that ground right up to the southern border of the Grizzly for nothing. They’re expecting something to happen in this area as well. The next several weeks I think are going to get very exciting for GGI and PGX.

Just to add to the above comment, it will be interesting what the deep IP survey reveals since I believe that was completed sometime in August? So, this team GGI is probably drilling into the heart of what could be a massive ore body.

Jon,

Did you get a chance to check out azc Augusta Resource?

We are close to news on the permit.

Hi Frank, I’m looking at that this weekend. Bear with me. Should have something to say by tomorrow sometime.

Thanks

Frank, haven’t forgotten about this….still working on it…

Looking briefly over the GGI website I truly hoping to ride PGX hopeful drilling campaign. GGI doesnt really seem like a company that overly busy. They’ve been sitting on the Grizzly for a good portion of this bull market with very limited work completed on the property. This play completely depends on PGX

Makes sense to me you’ll see some major changes in that regard very quickly as GGI rolls out its activities and plans imminently as they have indicated they will be doing. Be patient because I really do believe we’re about to see a lot of excitement from both GGI and PGX as this discovery opportunity starts to unfold. Personally, I wouldn’t invest in a play that can’t tell its story properly and effectively. And we want our readers to have the best chance of success if they’re involved because their interest was tweaked due to our extensive DD of this over the last few months. Based on our DD, we have 100% confidence both GGI and PGX have the understanding, the ability and the means to get the message out on the Sheslay River Valley in powerful, resonating fashion across the investment markets imminently. We’re going for a home run on this because of the geology, the expertise and proven track records of all the people involved, and the financial strength of both of these companies. There are many, many considerations when you’re looking at the best exploration opportunities. This is in the top 1% (the top 1%, not the top 10%) of those opportunities in our opinion, a very unique situation.

Jon – A poster on Stockhouse posted that PGX started drilling 6 weeks ago. It is certainly interesting that Bernier said they should have assays back in early October and would probably release 3 to 4 holes at once. IMO, for them to have drilled that many holes and have results back that quickly it is possible they may have started drilling before trading resumed in PGX. Your thoughts?

Dan, what we know is what Prosper Gold announced Sept. 3 – that drilling has commenced and initial results are expected in the first part of October. Anything else, of course, is speculation. Given how this team executed at Blackwater, if they put in NR form that results can be expected at a certain time, they will deliver. They always delivered on time with Richfield.

Just heard on CKNW this morning that analysts say they expect gold to get a run past 1430 by early October over the next few weeks….also, that Gold’s reversal on Friday will lead Gold to a pretty good open on Monday. Hopefully, BMR can cover some of their thoughts this weekend too..

Jon,what do you think about what North American Nickel has going on in Greenland?Do you think they’re looking at another Voisey Bay type of play there?

I think it looks very interesting, Jim…looking fwd to assay results as there should be some high grades given the sulphide percentages. The grades certainly appear to be there – the question is, can they develop the tonnage, as that’s what could really drive the share price. We continue to keep a close eye on it.

Another day & as for the stock market, another worry. Time really flies

& again we are faced with turmoil between the 2 governing parties in the

U.S. The question remains, will the U.S. Government default on it’s debt ?

Will the R………. find a way to defund & repeal Obamacare ? All this

will have a negative bearing on the markets & that includes the Venture,

so stay tuned, it ain’t over yet. For 2 years now, i have been thinking,

just wait until next month, but next month has been a never ending

wait. Good luck for what it’s worth ! R !

Jon,

Regarding azc …

http://stream1.newswire.ca/media/2013/09/16/20130916_C7315_DOC_EN_30847.pdf