1. Spot Gold has traded between $1,697 and $1,677 so far today…as of 7:00 am Pacific, the yellow metal is up $4 an ounce at $1,691…prices remain strong despite the fact that physical demand in China continues to be in the doldrums with dealers in the top consumer offering massive discounts…Silver, with strong new support at $15, has added 14 cents to $15.33…Nickel, the top-performing base metal last week, has added another 12 cents to $5.54…Copper and Zinc are relatively unchanged at $2.33 and 88 cents, respectively…Crude Oil for May delivery is getting hammered, down $6.31 a barrel this morning to $11.96 (see below), while the U.S. Dollar Index is up slightly at 99.87…in a televised address over the weekend, Russian leader Vladimir Putin said the pandemic in Russia is “completely under control”...so we know, then, that the situation there is exactly the opposite…Russia, Turkey, India, Indonesia, Brazil and Ecuador are just some of the global “hot spots” where management of the pandemic has been very weak and cases are accelerating…Britain is not considering lifting its lockdown imposed almost 4 weeks ago given the “deeply worrying” increases in the death toll, a senior minister said yesterday…certain countries in Europe, however, have already started to slowly ramp up their economies…Italy, the epicenter of Europe’s crisis, reopened some bookshops and children’s clothing stores last week…Spain allowed workers to return to factories and construction sites, while also allowing children outside for the first time in 5 weeks…Austria allowed thousands of hardware and home improvement stores to reopen, on the condition that workers and customers wear masks…in Denmark, elementary school teachers readied classrooms for young children to return to school in the coming days…the Czech Republic announced reopening of sports centers and some shops…Poland is preparing to open some shopping malls…in Germany, smaller shops will be reopened this week…are the COVID-19 health experts in the United States (and Canada) looking at this? – according to the National Bureau of Economic Research and the medical journal Lancet, every 1% hike in the U.S. unemployment rate will likely produce a 3.3% increase in drug-overdose deaths and a 0.99% increase in suicides…with 22 million Americans losing their jobs so far, and unemployment approaching Great Depression-era levels of near 20%, those projections suggest thousands could be at risk…policymakers in the U.S. and Canada must weigh the potential impact of strict lockdown measures on citizens’ health (physical and mental)…it is so important, where possible and with the right approach beginning in the lowest risk areas, to begin reopening the U.S. and Canadian economies as quickly as possible…accurate testing and contact tracing will be critical in terms of making that happen…

2. U.S. Vice President Mike Pence is set to visit the GE Healthcare manufacturing facility in Wisconsin tomorrow…ventilators are being produced there while GE is also involved with Sona Nanotech (SONA, CSE) in producing an important rapid response lateral flow test for COVID-19…GE’s powerful new membrane, interacting with SONA’s proprietary Gold nanorods plus the right biologics, are expected to give SONA a highly trusted versatile test (3rd party validation is imminent) that delivers results in 5 to 15 minutes…click on the arrow to learn more from the latest interview over the weekend with SONA director Jim Megann:

3. U.S. Crude prices are getting hammered today as traders continue to fret over a slump in demand due to the Wuhan COVID-19 pandemic…the price of the nearest Oil futures contract, which expires tomorrow, was the hardest hit, detaching from later month futures contracts with a drop of more than 30%…Spot prices are particularly weak at the moment due to a combination of a collapse in demand and a subsequent lack of storage…in addition, recently announced OPEC+ cuts don’t take effect until May 1…the front part of the Oil futures ‘curve’, which is the May contract, applies to fuel that’s set to be delivered while most of the country remains on lockdown…there’s little demand for gasoline from refineries, and storage tanks in the U.S. are nearing their limits, exacerbating the problem…Oil storage is filling rapidly across the globe, approaching operating max…this has led to a dash by traders to lease floating or onshore storage in a bid to sell the fuel for a profit when prices rebound, creating the “contango” structure in the futures market where contracts for later delivery trade at a significant premium…traders believe Crude prices will rally in the future, encouraging them to store Oil now and to sell at a later date…if demand doesn’t pick up during this 2nd quarter, however, the problem will just get worse…

4. If a major industry in Quebec or Ontario is under imminent threat, the Trudeau government jumps in immediately to do all that it can…the Feds are actually racking up a deficit that could easily touch a previously inconceivable $200 billion…when it comes to the West, however, Team Trudeau only has a few crumbs to hand out to the Oil and gas sector which the Liberals ideologically don’t favor…they are still clinging to their ridiculous “climate change” narrative to secure left-wing votes (mostly out east) and remain in power…now is actually the perfect time, with such low interest rates and the need to create jobs, for the federal government to invest heavily in the Oil and gas sector, greatly expanding pipeline capacity and strategically positioning the country economically for the next wave up in Oil prices…none of that will happen under the Trudeau regime, however, which is more content to simply see Oil and gas companies go bankrupt…last Friday the government gave yet another slap in the face to the industry, announcing a series of measures that they knew would appeal to their political base while at the same time allowing Trudeau to say he has actually taken steps to “help” the industry…Ottawa says it will spend $1.7 billion to help clean up Oil and gas wells in producing provinces (for the last few years the Feds had been encouraged to do this but it took a national crisis for them to finally act)…in addition, Trudeau also announced a $750 million fund aimed at reducing methane emissions…he said the fund would allow Canada to “continue to fight climate change and reduce emissions while keeping people at work”…the reality is that Friday’s announcements from the government had more to do with Liberal environmental messaging than any serious desire to directly help the Oil and gas sector…“This is not going to do anything,” declared Grant Fagerheim, CEO of Calgary-based Whitecap Resources (WCP, TSX)…“If this is as good as it gets, it will do very little or nothing to assist with operations for companies. I don’t think there’s a full appreciation and understanding of the severity of what we’re dealing with”…a coalition of 84 environmental advocacy groups lobbied the Trudeau government late last month NOT to provide any direct help to the Oil and gas sector…“Giving billions of dollars to failing Oil and gas companies will not help workers and only prolongs our reliance on fossil fuels,” the coalition wrote in an open letter March 23…has there ever been a country in the history of the planet that has deliberately undermined/sabotaged its most important industry as the Trudeau Liberals have over the past several years?…it is beyond comprehension…what Canadians have to realize is that through this process, wealth is being transferred from Canada to the United States…that in turn means Canadians will have to accept a lower standard of living…

5. The U.S. economy could experience a double-digit percentage contraction in 2020 due to the Wuhan virus pandemic, Mohamed El-Erian told CNBC this morning, suggesting a much steeper decline than most economists…“I think we may be at minus 10% to minus 14% growth for the U.S.,” the Allianz chief economist said on “Squawk Box”…“This is a big hit”…El-Erian said the distinct nature of this economic hit – stemming from a health crisis – means traditional frameworks may not be applicable, acting as a further obstacle for a rebound…“The benefits you would expect normally, lower Oil price means more dollars in consumers’ pockets, even that doesn’t work in this economy. So I’m a little bit more worried than what the consensus of economists out there is right now”…the comments from El-Erian, formerly CEO of investment powerhouse Pimco, were in response to data from CNBC’s Rapid Update Survey which includes various GDP forecasts from across Wall Street…the average of the estimate late last week showed about a 4% decline in U.S. GDP this year…

6. The Dow has fallen 395 points as of 7:00 am Pacific after posting back-to-back weekly gains for the first time since early February…energy stocks are taking a hit on Wall Street and in Toronto where the TSX is off 155 points through the first 30 minutes of trading…the Venture is steady at 445…the Index is up 34.4% since its March 19 intra-day low of 331, making it the top North American equity market since that time…Sona Nanotech (SONA, CSE) has gained a nickel to $2.03…technically, the stock has commenced what appears to be a “Wave 5” move that should take it powerfully through Fib. resistance in the $2.20’s…in another example of the growing humanitarian/economic disaster in Ecuador, Salazar Resources (SRL, TSX-V) announced this morning that it has created a new registered non-profit organization called the Salazar Foundation…this entity, supported by Salazar Resources and private donors including Fredy Salazar, will build on the initiatives that Salazar Resources has introduced during the course of its Community and Social Relations programmes in the 13 years since its creation…Ecuador has been hit particularly hard by the Wuhan COVID-19 pandemic combined with the plunge in Oil prices…

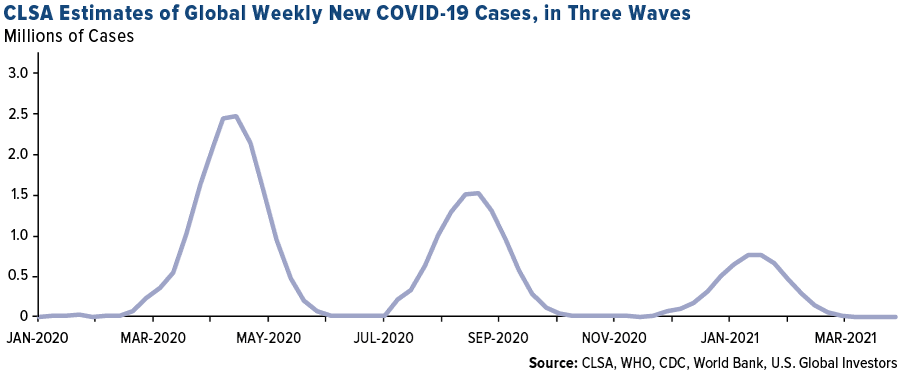

7. It’s still too early to celebrate the possible near-term end to The Great Lockdown…even if we somehow managed to get the number of new cases down to zero (won’t happen), the reality is that the virus could return in additional waves…2 additional waves, to be more exact…that’s the projection, at least, of quantitative analysts at CLSA, working in conjunction with professors at the University of Toronto…in a research report dated April 17, the group, led by Head of Quantitative Research Jon Barden, states that until a vaccine is developed, the coronavirus could continue to reseed itself in human populations, with the 2nd wave to peak in late August and the 3rd in early 2021…procurement departments at health agencies around the world are preparing now for that worse-case scenario, and that’s why a company like Sona Nanotech – with a highly versatile and accurate test – is in such a favorable position…the most shocking part of CLSA’s forecast is that more than 30 million people could contract the virus over the next 12 to 18 months. CLSA believes this could be the case since “current reported new cases do not yet include nearly 80% of the world’s population”…as of today, the total cumulative number of confirmed cases tops 2.4 million, but the actual number is undoubtedly much higher…

Most Popular Recent BMR Posts

How This Pandemic Will Ultimately Help Copper

The Cost Of Doing Business With China (The CCP)

“Silver Lining”: Innovative Vancouver Company Provides Help During Crisis

Smithers Shakes Off Turmoil For A Major 3-Day Event Connecting Hockey And The Resource Sector

9 Comments

Jon, although I disagree with your thoughts regarding Trump sometimes, I definitely agree with your thoughts regarding Trudeau’s attitude toward the oil patch. Alberta has contributed massively to equalization payments that have helped other provinces over many years. Now the oil patch needs a little help. It should work both ways.

Pretty amazing, a barrel of oil at this minute is less than a litre of gas, gezz!!

They’ll pay us just to take it off their hands and store it somewhere, Laddy…we get the Oil for free…maybe that’s a new biz opportunity…

June futures are holding up with Oil in contango, but the market is looking at severe demand destruction as a result of these economies being shut down…

Yes Jon, I’m still licensed, find a truck and tankers and I’ll run to Edmonton and pick up a load and park it in my driveway, I’m sure my wife would love that!! Not lol…

wow, barrel (NYC) at -35$ USD…

Cant be sustainable… bought HOU at 357 .. promptly dipped to under 3bucks.. my reputation is still in tact:) LOL…

HOU – 1 and 3 yr charts – if only you knew in advance

JON—I am wondering if you would comment on the relative percentage dollar share you currently would suggest be allocated between SONA, SIXW, AND GGG, and further if you could comment on the SIXW price action today. Thanks in advance.

Horizons ETFs Announces Temporary Suspension of New Subscriptions for Shares of HOU and HOD

Canada NewsWire

TORONTO, April 21, 2020

TORONTO, April 21, 2020 /CNW/ – In response to the extreme volatility in crude oil markets, Horizons ETFs Management (Canada) Inc. (the “Manager”) has announced today, that it will not be accepting new subscriptions for shares of the BetaPro Crude Oil 2x Daily Bull ETF (“HOU”) and the BetaPro Crude Oil -2x Daily Bear ETF (“HOD”, and together with HOU, the “ETFs”), which trade on the Toronto Stock Exchange under the ticker symbols HOU and HOD respectively.

The Manager accepted all subscriptions received this morning before the 9:30am deadline and has now suspended new subscriptions for shares of the ETFs until further notice. Redemptions will continue to be accepted in the normal course.

The Manager anticipates that purchases of new shares of the ETFs at the available offer prices on the secondary market are not expected to be reflective of the underlying net asset values per share. The Manager anticipates that the secondary market will continue to provide holders of shares with a forum to sell shares at a price reflective of the applicable net asset value per share.

It is imperative to note that shares of the ETFs could be expected to trade at a substantial premium to their net asset value while subscriptions of shares are suspended. As a result, the Manager strongly discourages investors from purchasing shares of the ETFs at this time.

The Manager will advise as soon as there are any further developments with respect to the ETFs.

SOURCE Horizons ETFs Management (Canada) Inc.