Gold has traded in a range between $1,571 and $1.587 so far today…as of 5:55 am Pacific, the yellow metal is up $1 an ounce at $1,578…Silver is off a dime at $26.96…Copper is off a penny at $3.36…Crude Oil is down 57 cents at $87.57 while the U.S. Dollar Index is up one-fifth of a point at 83.88…

Below is John’s updated long-term Silver chart, initially posted last night, that paints a remarkable picture of the potential of this market…RSI(2) has nearly touched the extremes of the 2008 Crash with superb support at $26 an ounce…the COT structure is also exceptionally bullish with commercial traders’ short positions at near-record lows…one theory to keep in mind is that “Big Money” may wish to trigger stop-loss orders and flush all the nervous nellies out of the market completely with a brief plunge below $26, but this would be followed by a violent reversal to the upside…there’s no question the opportunity in Silver is huge based on this chart…

Improvement in China Manufacturing Activity

China’s manufacturing sector clawed its way back toward growth in July, according to a survey that suggests that government policies to support the economy are starting to work…HSBC said its purchasing managers’ index for July was on track to rise from 48.2 last month to 49.5, which would mark a five-month high..but, in remaining below the 50 threshold, the flash PMI figure – the earliest piece of monthly economic data for China – indicates that factory activity is still contracting at a mild pace…although shifting its policy footing to a pro-growth stance, which has included two recent interest rate cuts within a month and some fiscal stimulus measures, the government has so far been reluctant to deploy a large-scale stimulus as it did in late 2008…the critical factor in restraining its response has been relative stability in the labor market…

Euro Zone Private Sector Continues To Struggle

Business surveys showed today that the euro zone’s private sector shrank for a sixth month in July as manufacturing output remains weak, adding to the likelihood that the bloc will slip back into recession…in a further blow to policymakers battling a raging debt crisis, the downturn that began in the euro zone’s smaller economies has become entrenched in the core countries of Germany and France…Markit’s euro zone Composite Purchasing Managers’ Index (PMI), a combination of the services and manufacturing sectors and seen as a guide to growth, held steady at 46.4 this month, slightly under expectations for an uptick to 46.5…the index has been below the 50 mark that separates growth from contraction for six months, and Markit said it suggests a quarterly GDP fall of 0.6%…a Reuters poll predicted last week that the bloc’s economy would shrink a more modest 0.1% in the current quarter…coupled with an expected 0.3% contraction in the second quarter, that would put the euro zone in its second recession since 2009…

Data from Germany, Europe’s largest economy, showed its manufacturing sector contracted at its fastest pace in over three years and that its service sector, which was expected to stagnate, also shrank…in France, factory activity fell at its fastest pace since May, 2009, although its service sector confounded expectations by eking out a small amount of growth…to try and aid the euro zone economy, the European Central Bank cut its main refinancing rate to a record low 0.75% and the deposit rate to zero earlier this month…more measures are expected from the ECB…

Other Euro Zone Developments

Germany’s finance minister is meeting with his Spanish counterpart in Berlin today, amid fears that Madrid will be forced to seek a bailout from its euro zone partners of the sort used to rescue debt-laden governments in Greece, Ireland and Portugal…meanwhile, inspectors from the international lenders keeping Greece afloat returned to Athens today to relaunch its stalled economic plan and decide whether to keep the nation hooked up to a 130 billion euro ($158 billion U.S.) lifeline or let it go bust…

Today’s Markets

Stock index futures in New York as of 5:55 am Pacific are pointing toward a slightly weaker open on Wall Street after triple-digit losses on the Dow Friday and yesterday…Asian markets were mixed overnight while European shares are flat today…the Venture Exchange slipped 22 points yesterday on low volume, closing at 1172, but remained above the June 28 intra-day low of 1154…

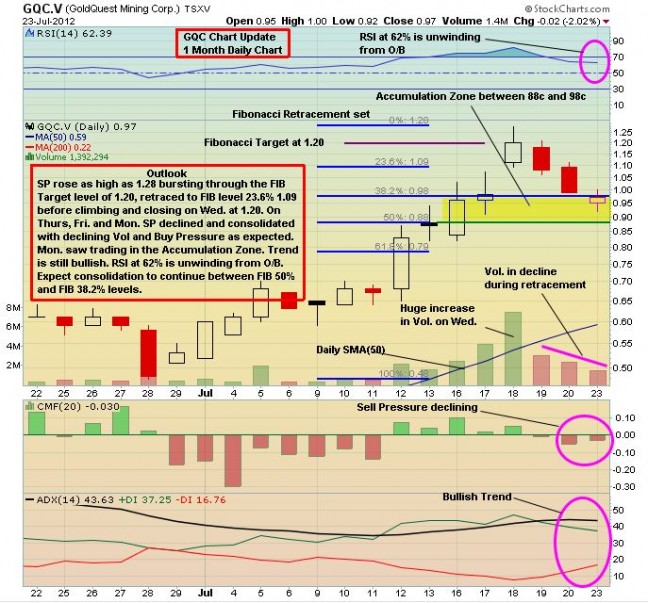

GoldQuest Mining (GQC, TSX-V)

After climbing to an intra-day high of $1.28 last week on more stellar drill results from its Romero discovery in the Dominican Republic, GoldQuest Mining (GQC, TSX-V) has backed off into an “accumulation zone” in a textbook technical pullback over the last three trading sessions as shown in an updated chart from John…GQC, which hit John’s latest Fibonacci level of $1.20, closed at 97 cents yesterday…the accumulation zone is between the Fibonacci 50% and 38.2% levels – 88 cents and 98 cents…while we caution that it’s still very early in the drilling stage, the possibility of a “monster” Gold-copper porphyry deposit at Romero is very real based on what is known so far…

Note: Jon holds a share position in GQC (John and Terry do not).

Rainbow Resources (RBW, TSX-V) Chart Update

Like GoldQuest, Rainbow Resources‘ (RBW, TSX-V) pullback yesterday to its rising 20-day moving average (SMA) was very normal from a technical perspective…on the daily chart, the RSI(14) is back at support at 50…RBW has clearly broken out of a down trendline and this bodes well for the coming days and weeks with a drill program slated to begin shortly at the company’s flagship International Silver Property in southeast British Columbia…discoveries are still rewarded handsomely in this market, as we’ve seen with GoldQuest and some others recently, and that’s why Rainbow is in such a favorable position…they’re about to drill shallow holes into a known high-grade structure with the exploration target being a high-grade, near-surface Silver and polymetallic deposit…the risk-reward ratio at current levels and leading into the speculative drilling stage is highly favorable – hence, an initial Fibonacci level from John that makes perfect sense…all of John’s Fibonacci levels with GoldQuest have been bang-on…

Note: John and Jon both hold share positions in RBW with Jon adding to his position yesterday (Terry does not hold a position).

Great Atlantic Resources (GR, TSX-V)

One of the emerging Venture Exchange CEO stars, in our view, is Great Atlantic Resources‘ (GR, TSX-V) Chris Anderson, and we’ll be conducting a series of short interviews with Chris in the near future to get his take on a range of issues including the current markets and the strong potential of mining and exploration in Atlantic Canada…

22 Comments

I’d rather buy ADE than GR.

What is this life if full of care,

We have no time to stand & stare,

No time to stand beneath the boughs,

And stare as long as sheet & cows.

The above lines states it all my buddies, we are always in a rush

& that includes me. life is so precious, yet we are always rushing,

longing for tomorrow, next week, next month, next year & even RBW

permits. We can complain all we like, but whatever will be will be,

sang Doris Day, so we invest & we wait & we have a 50/50 % chance

of doing well on our investment & that is good odds. I still feel

positive about RBW because it actually hasn’t had a run yet & all

stocks are due at least one run, so i wait & i wait & unlike the

sheep & cows, who have nothing else to do but stand & stare, i am

keeping abreast of what is going on with Rainbow. R !

Andrew M – I don’t know ADE too well, but they are focused in Charlotte County, GR are also there (Digedeguash) and Victoria County, further north near Woodstock as well as other locations in Atlantic Canada, including Cape Breton. They are more diversified (other PMs including Graphite and Gold), have far fewer Sh OS and lower market cap. Their news flow and presentation is excellent as is their business model. I’m really impressed with GR and for these reasons I would rather buy GR 🙂

I have shown i am positive on RBW, but if i were to argue for the other side, say Andrew,

although he doesn’t need anyone to argue on his behalf, i would shout loud & clear, what

the heck is going on here Mr. Johnston, are your going to let the so called bureaucrats’

spoil your dream ? They are only bureaucrats & they do have a supervisor, who may also

have a supervisor, then there’s the MHA, pick up the phone & give them a blast, tell them

you are shutting down operations & moving to Newfoundland. I accused RBW of being tardy

sometime ago, now i have to include the Government of BC bureaucrats’. Although i will

admit that bureaucrats’ may be slow, there’s no way they can be this slow. Surely they

care for their jobs’ & not only that, some of the pressure had to be taken off them,

when they farmed out the chore of issuing permits to an independent firm. Even if the

permits come this week, there was something just not right up to this date & we may never

know, because we don’t have the privilege of getting to talk to the bureaucrats’. R !

Todays smile If at first you dont succeed dont try your luck at skydiving

BMR and fellow investors what are our collective thoughts on bgm Do you think the 10 million ounces in the ground is for real.. IF it is bgm is selling at a real discount of about 8 dollars a ounce.What will happen when the dust clears Iam very interested in your reply

your 1166 support you claimed was the bottom was just blown through like a fart in the wind

Joey, what we’ve been claiming is that this market is crawling along a bottom, and if you read our weekend report, we also stated what we need to see before the expected new uptrend sets in is a move above the EMA-20. Until that happens, more basing. In technical terms what we could be looking at now is a double bottom, or just continued back-and-forth action within the resistance and support zones. But that remains to be seen. It’s also wiser to focus on support zones rather than a specific, absolute number. No reason to panic just because the Index drops a couple points intra-day below the late June low.

Joey

No wonder i didn’t notice it move down, guess it was the wind. Anyway, see if

it closes at or above the support. R !

Joey

Support held, a strong close considering it had to fight off that f–t. !!! R !

RBW will be on the rise soon! We are testing our patience everyday. Today’s 2 cents up is nothing to talk about as the volume is low low low. GBB appears to be dead now … pending to be Certified! GQC is still a star today… up 13%.

I must be on ignore no one responds to my queston. feeling a little rejected

Theodore – why single out GBB.

What about Yorbeau, Threegold, Vantex, Newstrike, or one of hundreds of others doing very little in the summer doldrums?

Gil – feeling a little rejected

Bert – I know what it’s like, very seldom do i get a response, unless it’s someone

wanting to tear me apart. Anyway, i don’t know anything about BGM, but it

appears to be a good deal, but like many other deals, it has suffered because

of the European mess. To get this deal going, the market may be looking for

some financial returns & in particular profit from the mining venture. Good

luck ! R !

gil – I’m interested in BGM too, but with BCSC scrutinising them it makes it impossible to know which way its going to go. The Company says that Peter George is confident that his completed technical report will satisfy BCSC but, I guess, at this point they couldn’t say anything else? I wonder if there is a P. Geo. on this board who could comment on the methods used to estimate the mineral resource?

Thanx Bert and Andrew for your input

Gil

There you go, DD at it’s best, thanks Andrew.

Gil – The phone call I received last week was to get into one particular stock and to stay away from bgm. I was told the strip ratios were off and not reported right among other things. Now, you and I both don’t know if this is true, but my contact on this is uncanny right about 100% of the time. I am not in it nor will I buy it. I don’t know if this helps you or not. Every investor must do thier own DD and make thier own decisions.

Last week I mentioned a pick from a contact (not the guy above). It is time. I will put it on the board after the market opens.

Theo – why do you think GBB is dead in the water? The stock is reaching a bottom I think, and should recover later in the year.

Gil … the only thing I heard was that the economics of the deposit were poor… getting outta the ground will be tough… that was on BNN the day of or the day after the announcement..

sorry for the delay.. unlike Bert, I golf alot!:)

Looks as if we are going to have a very positive day, my fingers are crossed.

Over the Rainbow…. Although it’s not over yet, but they do need to take steps to

rectify the situation they find themselves in.. There are many disgruntled shareholders

out there & counting. I have written that i am positive, but isn’t it up to company

RBW to ensure that i remain positive. I won’t repeat the latest excuse that i have heard,

it’s laughable. Anyway, i have no further information re permits, but i am expecting them

today. Further delays will surely drain any positive feelings we have left & no doubt,

play on our emotions.

It has been said that using capital letters indicates shouting,

RBW– YOU ARE LOSING YOUR CORE (no pun intended) FOLLOWERS. SHOULD WE EXPECT A COMPANY,

WHO CAN’T SEEM TO ARRANGE TO HAVE A MINING PERMIT IN A TIMELY MANNER, TO FIND A DEPOSIT.

Anyone still reading this site I pity.. BMR will take all your money, totally unqualified to give any investment advice