Gold is trying to hold support in the $1,620’s…as of 4:30 am Pacific, the yellow metal is down $6 an ounce at $1,628…Silver is off 23 cents at $30.17…Copper is flat at $3.72…Crude Oil is 42 cents lower at $96.89 while the U.S. Dollar Index is up over one-tenth of a point at 80.56…Gold’s next major support below the $1,620’s is $1,600…

Today’s Markets

Asian markets were mixed overnight…Japan’s Nikkei average suffered its second straight weekly loss after its longest weekly winning streak in 54 years…European shares are flat while stock index futures in New York as of 4:30 am Pacific are pointing toward a flat to slightly lower open on Wall Street…the two-day G-20 meeting begins in Moscow today…the Wall Street Journal reports this morning that in a fresh effort to calm talk of currency wars, the Group of 20 industrial and developing nations will pledge to ensure that their monetary policy is focused on price stability and growth, rather than weakening their currencies, according to the draft of a statement they intend to release tomorrow… economic data due today includes the University of Michigan Consumer Sentiment survey for February at 9.55 a.m. New York time…analysts polled by Briefing.com expect the index to fall to 73.5 from 73.8 in January…

Paulson Maintains Stake In SPDR, Soros Cuts Back

Billionaire investors George Soros and Louis Moore Bacon cut their stakes in exchange-traded products backed by Gold last quarter while John Paulson maintained his holdings…Soros Fund Management LLC reduced its investment in the SPDR Gold Trust, the biggest fund backed by the metal, by 55% to 600,000 shares as of Dec. 31 from three months earlier, a U.S. Securities and Exchange Commission filing showed yesterday…Bacon’s Moore Capital Management LP sold its entire stake in the SPDR fund and lowered holdings in the Sprott Physical Gold Trust…Paulson & Co., the largest investor in SPDR, kept its stake at 21.8 million shares…

Venture Exchange Chart Update

The Venture Exchange fell 8 points yesterday to 1197 after two straight days of slight gains…John’s 3-month daily chart shows RSI(14) approaching support as is the Index…investor patience is critical as this basing pattern continues…

Rainbow’s Growing Jewelry Box At Jewel Ridge

Less than two weeks after reporting a high-grade Silver discovery at its Jewel Ridge Project in Nevada, Rainbow Resources (RBW, TSX-V) has delivered more surprising high-grade results from this intriguing property – and on claims it now owns 100%…Rainbow negotiated a deal with private landholders to secure the “Croesus” claims, about 40 hectares of strategically important ground within the Jewel Ridge package…the company announced the closing of this transaction after market hours yesterday, and also released stellar historical drill results from Croesus including hole N85-36 (drilled by Homestake 20 or 30 years ago) that returned 4 g/t Au over 18.2 metres from surface…other results from Croesus included 6.1 metres grading 4.9 g/t Au (4.5 m to 10.6 m in PL7-15) and 7.5 metres grading 3.7 g/t Au (15.2 to 22.7 m in N85-31)…in this business, those are terrific numbers…in addition, grab samples collected by Rainbow at Croesus confirmed the presence of impressive mineralization with Gold values ranging from 1.4 g/t to 3.2 g/t while Silver values ranged from 8.9 g/t to 24.7 g/t…immediately to the west of Croesus, on Rainbow’s shared ground, grab samples returned 1.5 g/t Au and 190 g/t Ag, and 4.4 g/t Au and 85.3 g/t Ag…

Widespread Mineralization At Jewel Ridge

Rainbow is quickly putting the Jewel Ridge puzzle together no small accomplishment given the fact that no other company has properly assembled all of the historical data…the property map that was released yesterday provides a bigger picture view of what’s unfolding with locations of some historical drill results as well as Rainbow’s sampling…mineralization literally extends from one end of the property to the other – a distance of at least three kilometres, so this indeed could be a very substantial system…RBW has already reported that “mineralization appears to be continuous along the Hamburg-Dunderberg contact”…importantly, Rainbow has also discovered high-grade silver mineralization at Jewel Ridge as evidenced by the argillic zone encountered in JR-12-04 (one of six RC holes drilled in November)…most previous operators, interestingly, didn’t even bother assaying for Silver – including Greencastle back in 2004…near the northern boundary with Barrick, Rainbow collected a grab sample that graded nearly 400 g/t Ag – 2.5 kilometres to the north of JR-12-04…meanwhile, approximately 750 metres northeast of JR-12-04, historical drill results include 18.1 metres grading 3.4 g/t Au, 12.2 metres grading 4.0 g/t Au, 10.6 metres grading 4.4 g/t Au, and 21.8 metres grading 1.0 g/t Au…all historical drill results, as well as historical soil sampling data and of course Rainbow’s Phase 1 drill results, are being incorporated into a conceptual Jewel Ridge geological model that could become a “game-changer” for Rainbow – possibly in the coming weeks…we’ve said all along, this is a fabulous property – and now it’s starting to show its true potential…mining exploration history in North America is full of examples of companies that have gone back to properties like Jewel Ridge and have turned them into huge success stories thanks to a fresh set of eyes, geological re-interpretation and higher metal prices…what also excites us, of course, about Rainbow is the company’s recent Gold-Silver discovery at Gold Viking in the Kootenays – a property never previously drilled – and news is likely imminent regarding that…in addition, Rainbow’s substantial land position in the flake graphite region of the Slocan Valley is of significant importance – especially considering the market’s appetite for graphite at the moment…what seems likely, based on the company’s January 18 news release, is a spin-out of this asset or a JV…Rainbow’s 100-square-kilometre land package includes strategic claims within shouting distance of privately-held Eagle Graphite’s processing facility…Eagle is the only producer of natural flake graphite in western North America….

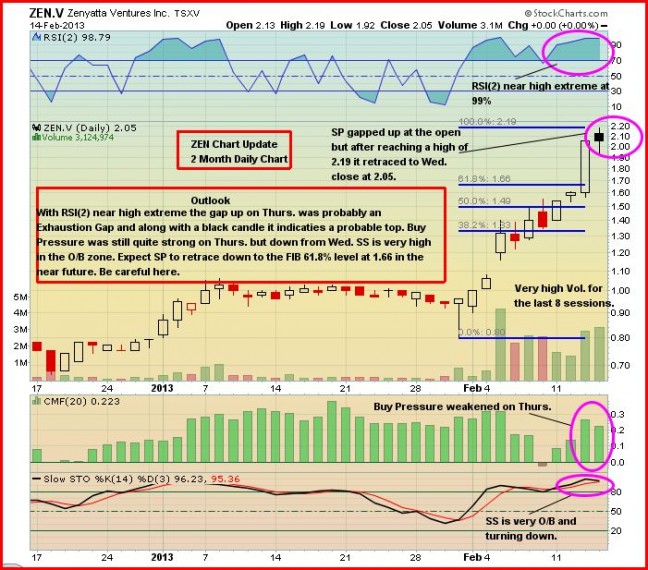

Zenyatta Ventures (ZEN, TSX-V)

One of the hottest graphite stories has been Zenyatta Ventures (ZEN, TSX-V) which has soared to the $2 level after trading at 15 cents in August…Zenyatta is targeting the $13 billion synthetic graphite market as it develops a rare vein-type deposit it discovered two years ago in northwestern Ontario…who knows how much higher this could ultimately go (that’s pure speculation) but John’s 2-month daily chart shows there’s an increasing likelihood that ZEN may have to pause and take a breather over the near-term given the extreme overbought condition of the RSI(2)…the RSI(2) was also in an extreme position in late December/early January which was followed by about a month of sideways action in a narrow trading range…ZEN has gotten way ahead of its supporting 50-day moving average (SMA) this month which it has touched, or nearly touched, on three occasions since its big move started late last summer…

GoldQuest Mining (GQC, TSX-V)

GoldQuest Mining (GQC, TSX-V) is drilling aggressively in the Dominican Republic and we can’t help but think there’s a good chance that this will result in a new discovery at some point this year, especially with GQC much more confident with its targeting given what it has learned from the Romero discovery…below is an updated 2.5-year weekly chart from John…GQC is starting to look more bullish and gained 6 cents yesterday to close at 60 cents…

Critical Elements Corp. (CRE, TSX-V) Updated Chart

Critical Elements Corp. (CRE, TSX-V) is a situation for patient investors that continues to look interesting with very strong support at the rising 200-day SMA at 18 cents…CRE closed up half a penny yesterday on total volume (all exchanges) of 1.3 million shares…as always, perform your own due diligence…

Note: John and Jon hold share positions in RBW. Jon also holds a share position in GQC.

12 Comments

RBw results are certainly far from terrific, plus they are 20 years old so the market doesn’t care. As far as grab samples go again nobody cares. Jon I understand you have painted yourself into a corner here with RBw but you are making it worse with your constant stellar praise of mediocrity at best.

My eyes burn everytime I look at my penny portfolio – fugly is the only way to decribe the gold miners right now

DYG is about to move up! Alert guys!

GQC chart is interesting. Dr Richard Sillitoe report available and of note he recommends no infill drilling nor deep drilling at this time. GQC should seek to delineate Romero deposits with step out holes of 100 meters in the mineralization zone are sufficient. New targets should be drilled now. My words not his. Read the report. IMO this should mean faster completion of holes and the opportunity to make another or even other discoveries of similar magnitude to Romero.

Please advise if you still plan on releasing the Everton interview.

Theodore, why do you say this regarding DYG do you have any concrete evidence?

Thanks

The worst has yet to come. One last cleanse.

can someone please tell me again why we wont see 700 on the venture??????? regardless of the priuce of tea in china… all peeps need money… so where ever they can find it they will take it… fund outflows??? obviously any rise in stock prices on the cdnx is met with sellling, minimal buying on good news…

help in understanding?????? all comments welcome….

The opposite argument was made in late 2010 and early 2011 when everyone was so bullish. Same type of question: “Can someone please tell me why we won’t see 3000 on the Venture?”. Well, of course, the Venture didn’t go to 3000 and topped out at 2465 because too many were bullish and there were few new buyers left. Now, too many are bearish and there are too few sellers left. Sentiment is at historical lows. That’s why it won’t hit 700. Also, around current levels is where we’ve been seeing takeovers over the last 9 months – two examples just last week including a competing bid for Orko. Some of the valuations right now are just ridiculous.

The RBW is looking very good, it is setting up very nicely to get more awarness of its many charms. This is what is needed to increase client base. Down the road drilling results could send this stock to the moon. good luck to all longs. richard l

You hear that? that’s the sound of the venture going down the toilet. This market is brutal!!

Someone is trying to bump up the price DYG, bought 1,000 shares at 4 cents in the last minute. Althoug I hold a portfolio of this stock but I will not do this … continue to collect more at 3 cents. Let this one go up by itself. You do not have create a high price as current turnover is too low. You may be questioned by Security Commission in your trading habit. Stop doing this.

I GUESS JOHN/JON WAS RIGHT, IT TESTED THE 1600 LEVEL….AND REBOUNDED AT THE END TO 1610……WHAT ABOUT VENTURE? SOME BOUNCE AT THE END TOO?