TSX Venture Exchange and Gold

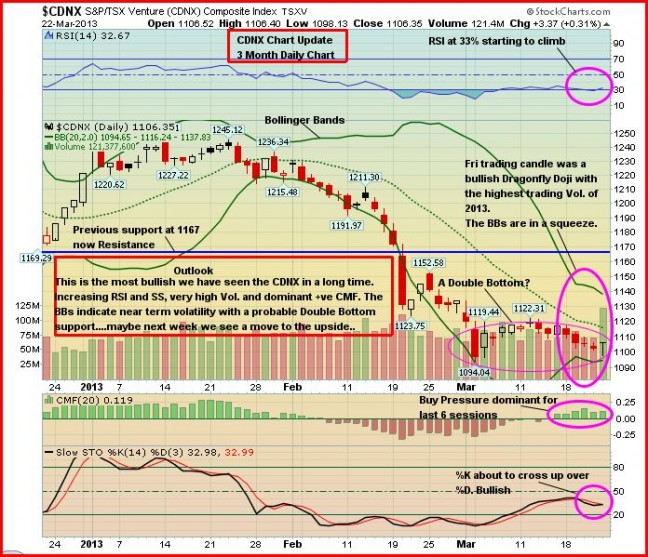

Gold’s move about $1,600 an ounce helped the producers but not the juniors last week as the Venture fell 11 points or 1% to close at 1106 while the TSX Gold Index climbed 2.4% to finish at 258. Friday’s volume was the highest of the year for the Venture, but a good chunk of it (42 million shares) was generated by the takeover offer for Eacom Timber Corporation (ETR, TSX-V). The coming shortened trading week (markets are closed on Good Friday) will be important and potentially volatile as the first quarter of 2013 comes to a close. Indeed, a Bollinger Band (BB) “squeeze” is very evident on John’s 3-month Venture chart below. A BB squeeze typically precedes volatility. Will there be a break to the upside or the downside? The BB squeeze in late January was followed by the worst February ever for the Venture Exchange. This time around, RSI(14) is increasing, not decreasing, while the Slow Stochastics indicator is more favorable.

Events in Cyprus in the coming days will likely be critical in determining the direction of Gold and the markets. As of late Sunday afternoon Pacific time, reports are circulating that Cyprus and its international creditors have hammered out details of a potential deal that would preserve the country’s place in the euro zone.

Venture 3-Month Daily Chart

In a sign of the times, over the first two months of the year, not a single company went through the laborious process of listing on the Venture Exchange. The last record of two consecutive months without any IPO’s dates back to 2009 when financing was not widely available for juniors. From a contrarian standpoint, perhaps that’s bullish – negative sentiment toward Gold stocks (and even bullion itself) are at extreme lows. Precise timing of a reversal, however, is very difficult to predict.

Gold

Gold broke above resistance at $1,600 last week and nearly touched another resistance area – $1,620/$1,625 – before backing off slightly. It gained $16 for the week to close at $1,609. Events in Cyprus gave Gold a boost, as the potential collapse of the Cypriot financial system underscored why governments can’t be trusted and why it makes sense to avoid holding cash as savings or investment. Meanwhile, the Federal Reserve Bank stated last week that it intends to maintain its asset purchase program in order to further stimulate job growth and boost the economy.

John’s 2-year weekly Gold chart provides strong evidence that bullion may soon test $1,650.

Silver bounced around last week and closed essentially unchanged at $28.77. Copper held above key support around $3.40, closing 6 cents higher at $3.52. Crude Oil gained 26 cents to finish at $93.45 while the U.S. Dollar Index jumped one-quarter of a point to $82.38.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, Gold is being driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, is having a huge impact on Gold.

The fundamental case for Gold remains incredibly strong – currency instability and an overall lack of confidence in fiat currencies, governments and world leaders in general, an environment of historically low interest rates and negative real interest rates that won’t end anytime soon (inflation is greater than the nominal interest rate even in parts of the world where rates are increasing), a Fed balance sheet now in excess of $3 trillion and expanding at $85 billion a month, money supply growth, massive government debt from the United States to Europe, central bank buying, flat mine supply, physical demand, investment demand, emerging market growth, geopolitical unrest and conflicts, and inflation concerns…the list goes on. In the current environment, it’s hard to imagine Gold dropping below key support around $1,500.