Throughout the week, we’ll be focusing even more intensely on the prolific Iskut River region of northwest British Columbia where a significant Copper-Gold discovery by Colorado Resources (CXO, TSX-V) has sent geologists scurrying to the area. Investors have seen just one drill result so far from Colorado – the entire length of the hole returned a whopping 333 metres grading 0.51% Cu and 0.67 g/t Au. These grades compare very favorably to Imperial Metals‘ (III, TSX) Red Chris porphyry deposit immediately to the southeast which is expected to commence production next year upon completion of the Northwest Transmission Line. Red Chris has robust economic viability over a projected 28.3-year mine life – even with metal prices of $2.20 Copper, $900 Gold, $12 Silver and a 90-cent Canadian dollar, Red Chris shows a 15.7% after-tax IRR with a 4.6-year payback. Reserves are in excess of 300 million tonnes and the planned open-pit is expected to be 1.8-km long and up to 1,000 metres wide. It’s a monster.

As reported last Thursday, Colorado’s third hole at North ROK was collared nearly vertically from the same location as the first hole and was drilled to a depth of 594 metres. It’s interesting to note that Imperial Metals in 2007 collared hole 07-335 vertically in the core of the East zone at Red Chris and it returned over 1 km (1,024 metres) grading 1.01% Cu and 1.26 g/t Au, extending mineralization in the this zone down another 270 metres from its previously known extent (the hole actually bottomed in strong mineralization). A world-class porphyry deposit, indeed. And as the saying goes, the best place to find a new mine is near an old one or an existing one.

What if Colorado finds another Red Chris? Or another company makes a discovery? All the necessary infrastructure is in place, and the geology of this area supports the belief that more deposits could be found. So that helps to explain the excitement behind Colorado Resources, which has a strong technical team, and the attention other players in the area are receiving. We’ll be reviewing all of the players in the days ahead.

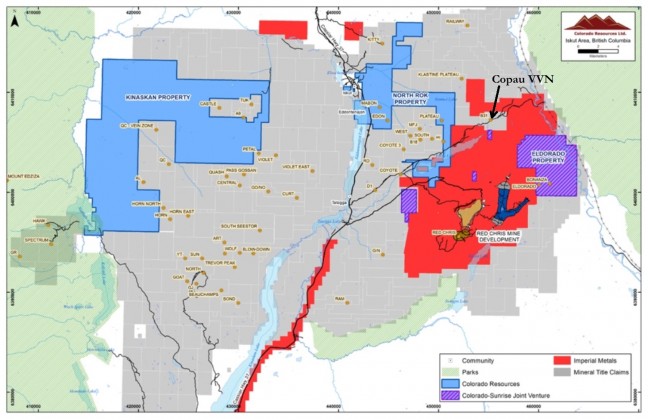

Besides Colorado, the company investors should be watching most closely at the moment is Victory Ventures (VVN, TSX-V) which has a drill program commencing imminently (within the next couple of weeks) at its Copau Property, immediately to the north of Red Chris and to the east of North ROK. Victory is not a Johnny-Come-Lately to the area. They’ve had this drill program lined up since the beginning of the year, before Colorado announced its discovery. What has us (and others) excited about Copau is what the IP survey revealed after it was carried out last year – more on that in a moment. First, below is a map showing the exact location of Copau which has never been previously drilled. What we did is that we took a map from the Colorado web site that specifically points out the “B31” showing – this was a discovery by the B.C. Geological Survey in 1994, and Victory’s claims cover this showing and the immediate area around it (the size of the property is approximately 5 sq. km). The arrow that we inserted highlights the B31 showing. According to a 2012 technical report from Imperial Metals, a NE trending fault is inferred to follow the trace of Coyote Creek and the Ealue Lake Valley (through what appears to be the southern edge of Victory’s claims, south of B31) and continues to the east for an additional 30 km. The significance of this potential fault for Victory remains to be seen, but it’s an interesting point.

An IP survey carried out by Victory last summer located a strong chargeability response underlying the southwestern portion of the property. The chargeability anomaly occurs from depths of approximately 200 metres with increasing response to 450 metres (similar to patterns at North ROK), which was the maximum reading depth of the IP. The present known extent of the anomaly varies between approximately 300 and 400 metres wide (east-west) and over 1,200 metres long (north-south), appearing open to both the west and south and at depth. The interpretation is that there is increasing sulphide content within a southwest-dipping body of syenite rock. Rock outcrop samples containing traces of pyrite, chalcopyrite and magnetite in syenite were found during the survey work, and their locations coincide with underlying IP chargeability responses.

There is easy access to the Copau Property. The company will be drilling to depths of approximately 400 to 500 metres in a relatively flat area immediately off a logging road from Highway 37. Water for drilling is readily available. As we mentioned, this property has never been drill-tested before, so the potential upside with this is undeniably big. All Victory needs to do is get a “sniff” of significant mineralization and the game is on. Easier said than done, of course, but we like the odds. Speculation should ramp up. This is a company with a tight share structure (just 17 million shares outstanding prior to the current financings), and they’ll be armed with nearly $1 million as they begin to tackle Copau. Given the fact Victory has spent two years in the area, we wouldn’t be surprised if they expand their footprint with the acquisition of additional claims.

As always, perform your own due diligence. A very active summer of exploration is shaping up in the Iskut River area – it should be the hottest Copper-Gold exploration play in the country – and this enhances the chances for additional discoveries.

10 Comments

33 at .67g/t. That’s whopping??? Jon that even less than mediocre and you know this!!! Also you talk like this whole area has just been discovered and that’s why you say it’s so hot now. However this historical hole you speak of is years old. This is not a new discovery it’s nothing more than the flavor of the week. Lots of money to be made riding the pump but one wants to be careful to not listen to you and dump these plays fast as they will all be back to pennies in the coming months. That’s fact

What are you talking about, Heath, 33 at .67 g/t???? I think what you’re referring to is actually 333 metres (you left out a number, out by a factor of 10) of 0.67 g/t Au which also includes 333 metres of 0.51% Cu. Do you have any idea how valuable that rock is, Heath? Plus the fact, based on the known geology of the area, grades quite possibly improve at depth. The numbers from CXO’s first hole are what mines are made from – their challenge now is to repeat those grades and lengths elsewhere over a wide enough footprint for an economic deposit. That’s what the market will be speculating on in the days and weeks ahead, but the final answer of course will come from the drill bit – the truth machine. So the market will either be right or wrong. No one can predict if CXO will be successful or not, but the geology of the area is such that one has to think their chances are pretty decent. North ROK itself is a new discovery – obviously this isn’t the uncovering of a previously undiscovered, virgin area. But much of the district has still been under-explored, leaving open a lot of possibilities. Exploration at Red Chris started more than half a century ago, but until 2007 drilling was limited to a standard depth of about 400 metres. Anyhow, Heath, with all due respect, it’s really easy to criticize me because I’m very imperfect just like everyone else. But how about you share with us some of your wisdom as to what you think might be hot over the summer and perhaps can make all of us some money?

SOME PEOPLE PREDICTING BOTTOM IS, OR ABOUT TO BE, IN FOR GOLD….GOLD REBOUNDED FROM 1336 TO 1386 NOW!….BULLMARKET THOUGHTS?

Amazing that you guys conveniently overlook RBW after pumping and pumping and pumping it needlessly for the past year. Indirectly, your advice and DD has lost investors so much money and now you are jumping on the CXO bandwagon with the rest of market and writing analysis like you discovered it before the runup. Jon claims to hold a position in CXO. OK, at what price. Lets see if you money corresponds with you mouth. I would to see this site indicate when you bought and sold stock in a model portfolio for example. I think that would enhance the site’s cred as well as take some of the liability off you guys.

333 is what I meant to write Jon. Any that is a lack luster result. Multiple companies producing results ten fold and stick doing nothing. Funds and banksters have decide to run cxo up just like they did gqc and then short the hell out if it.

I told you guys what to do your dd on and what will make you and your readers money. Int. !!!!! And time to get in at these prices is running out. By years end lets compare int to cxo from where they are sitting right now.

And I’m not criticizing you Jon for your knowledge in picking stocks for I know that you are aware of exactly what you are doing!!!

Thanks, Heath, we agree to disagree on the significance of 333 metres grading 0.67 g/t Au and 0.51% Cu. I don’t think any geologist would say that’s lackluster. That’s world class IMHO for a porphyry deposit. It’s also why an Australian major has entered the scene at Iskut River, which is also helping to bring in a lot of Aussie investors into the play. The market will do what it wants to do, and often speculation goes to extremes. I agree that INT has good potential – speculation went to extremes in INT 2 years ago.

Ort at these sale prices as well.

Gbb is on sale as well.

Top pick is int. this will blow up very very soon!!!!!

Do your homework in the history of int Jon. That wasn’t just speculation gone crazy. That was a calculated assult from funds to pump the shit out if it then release the hounds and short and bash it sll the way back down. They have the goods now and the Curtain will be pulled back soon.

Heath… do you know Lucatch????? important question…

also TAD… anyone should do their DD with Makena (formerly Canasia), Brookemont, Habenaro…

similar BOD’s they only get area land, drill one hole… move the price up after honoring themselves with no hold time shares/options.. and dump for cash.

they could be considered a boiler house…

be very careful…. and yep burned by the story… found out too late about the other crap.

Hey guys you want valuable rock ZEN there graphite sells for 10,000 to 35,000 dollars per ton

No joking this is your stock of the century,Zen already won discovery year award

30 mil tons at 5% = 1.5 mil tons pure graphite the best you can get in the world today

synthetic graphite market zen is going after

crunch the numbers guys and yes they are monster numbers and unbelievable

do yourself a favor and crunch the numbers and go and dd Zenyatta (zen)

warrants are just about finished and zen will have 13 mil in cash

drilling on going more results in 2 weeks

anomaly size there drilling is 1400×800

property is 4F property is 15kms by 20kms with 20 more targets besides the one above