Commodities are weak across the board today…as of 6:00 am Pacific, Gold is down $17 an ounce at $1,370 but has rebounded slightly from its low of $1,366…Silver is off 34 cents at $21.61…Copper is down a nickel at $3.19…Crude Oil has declined $1.09 a barrel to $94.68 while the U.S. Dollar Index is also under pressure, off its lows but still down over one-tenth of a point to 81.57…

After flexing its muscles beginning in February, the Dollar Index has gone into reverse just recently after being unable to push through important resistance just above 84…it has fallen below its 50-day moving average (SMA), as you can see in the chart below, with the 50-day now beginning to trend downward…weakness in the Dollar Index would normally be bullish for commodities…we’ll see what develops in the weeks ahead…

Bank of Japan Stays The Course, Raises Assessment Of Economy

The Bank of Japan raised its assessment of the Japanese economy for the 6th straight month this morning, noting a “pick-up” in exports and industrial production and continued “resilience” in private consumption…the central bank kept its main monetary policy settings on hold, saying it would buying enough assets to expand the country’s monetary base at an annual pace of 60 trillion yen ($612 billion)to 70 trillion yen to help achieve an inflation target of 2%…the BOJ disappointed some investors who were hoping it would address market volatility in its statement…

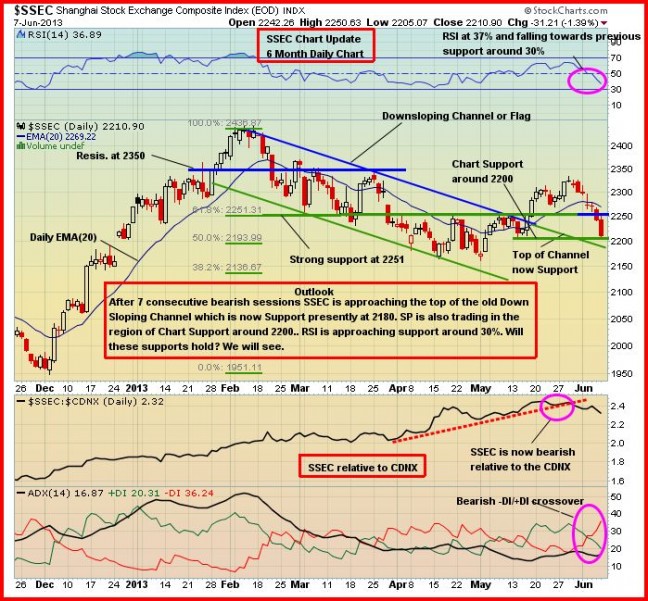

Updated Shanghai Chart

China’s Shanghai Composite is closed until Thursday due to the “Dragon Boat” holiday in that country…when trading resumes, the Index – which closed last Friday at 2211 – will face an important test of support at the old downsloping channel at 2180…the Index is suddenly looking vulnerable (note the bearish -DI/+DI crossover in John’s chart) after a very encouraging May, and that has us concerned especially given what appears to be a weakening economic situation in China including accelerating producer price deflation…

Today’s Markets

Japan’s Nikkei average fell 1.45% or 197 points overnight to close at 13318…European markets are down significantly, around 2%, in late trading overseas…the German constitutional court started a two-day hearing into the legality of the ECB which has played a large role in calming financial markets in Europe…in New York, stock index futures are pointing toward a weak opening on Wall Street…

Bellhaven Copper & Gold Inc. (BHV, TSX-V) Updated Chart

Bellhaven continues to show strength since reporting a significant discovery at its La Garrucha prospect in Colombia last week which appears to be part of a cluster of high-grade Copper-Gold porphyry deposits on its La Mina concession…BHV closed higher again yesterday, finishing at 15 cents cents on total volume (all exchanges) of 1.5 million shares…importantly, BHV broke out of a downsloping channel on last week’s news and momentum has been pulling it higher…more results are pending…below is an updated chart from John…

Solvista Gold Corp. (SVV, TSX-V)

Also in Colombia, Solvista Gold Corp. (SVV, TSX-V) has reported more encouraging results from its Caramanta Project within the last hour including some of the highest Silver values encountered in a porphyry system environment in Colombia…5 holes were completed at El Corral, the second of 6 targets identified so far at Caramanta, and all 5 holes intersected significant intervals of Cu-Au-Ag-Mo mineralization including 197.9 metres grading 0.92 AuEq in CAD-1205…that’s not as spectacular as the 456.3-metre interval grading 1.40 AuEq at El Retten reported May 21, but it’s solid nonetheless…final assay results from the third target area (Ajiaco Sur) are pending…8,000 metres in total were drilled at all 3 targets…Caramanta continues to hold excellent potential for significant new Gold-Copper porphyry discoveries with related mineralized bodies along a stretch of at least 3 km…

Aldrin Resource Corp. (ALN, TSX-V)

Keep a close eye on Aldrin Resource Corp. (ALN, TSX-V) which we’ve mentioned a few times in recent weeks as the company commences exploration at its Triple M Property in the Patterson Lake area of Saskatchewan…the 12,000 hectare property is 9 km south and 11 km west of the Fission Uranium (FCU, TSX-V) and Alpha Minerals‘ (AMW, TSX-V) discovery…the technical picture continues to look quite promising with Aldrin as shown in John’s long-term monthly chart below…

Pacific Potash Corp. (PP, TSX-V) Updated Chart

Pacific Potash (PP, TSX-V) continues to look strong as it threatens to push to a new 52-week high…

Note: John, Jon and Terry do not hold share positions in BHV, ALN or PP. Jon holds a share position in SVV.

2 Comments

vvn watch for 10 cent pp

ZEN an oil Geo guy with PHD figure this out on zen if interested take a look it will open your eyes

Read more at stockhouse.com/bullboards/messagedetail.aspx?p=0&m=32663215&l=0&r=0&s=ZEN&t=LIST#2uFtrm3oMiZLLQwb.99