Iskut, British Columbia – 7:20 am Pacific

Greetings again from Iskut, British Columbia, home of one of Canada’s newest mines (the massive Red Chris Copper-Gold deposit) set to begin production next year upon completion of the very important Northwest Transmission Line which will have a profound economic impact on this region…

The 287 kV NTL from Skeena substation to Bob Quinn is under construction by BC Hydro with a planned completion date of May, 2014…a subsidiary of Imperial Metals (III, TSX) will construct the 93 km extension (NTL Extension) from Bob Quinn to Tatogga…

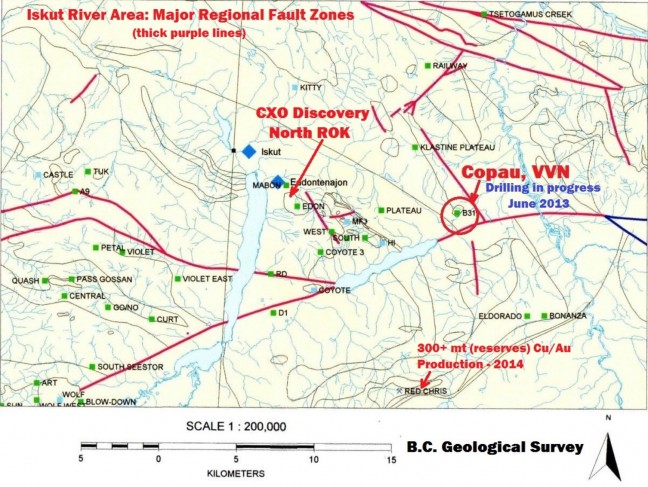

We have extended our visit to this incredible region due to important developments on the ground from the Telegraph Creek area (west of Iskut) to Colorado’s exciting North ROK discovery – quite possibly the next Red Chris – where drilling commences again next week and takes aim at a continuous magnetic high 300 to 400 metres wide and 1200 metres long, trending southeast from holes #1 and #4…the prospective area for mineralization continues to expand thanks to geophysical surveys and other techniques Colorado is employing – the mapped Mabon-Edon porphyry body strike is now at least 3 km long and greater than 1 km wide, similar in size to Red Chris but different in trend direction…both sub volcanic intrusives are of the same Jurrasic age and occur within the same general volcanic rock host assemblages…so far, grades and widths at North ROK are very comparable to those at Red Chris…

Helicopters continue to buzz overhead and locals are preparing for an extremely busy summer…Colorado is clearly aiming to stay in mineralization – not always easy when figuring out a porphyry deposit – as they focus on this continuous and strong magnetic high core…where they have intersected the magnetic high feature in 3 drill holes, the average grade over 694 metres of cumulative length is 0.40% Cu and 0.60 g/t Au…keep in mind that the economics for Red Chris are very robust with reserves of over 300 million tonnes grading 0.36% Cu and 0.27 g/t Ag, providing for a 28-year project life at a milling rate of 30,000 tonnes per day…

Doubleview Capital Corp. (DBV, TSX-V)

Northwest of Telegraph Creek, which is about 100 km west of the North ROK discovery, is another area that’s going to receive a lot of attention this summer…this is where Peter Bernier and his former Richfield Ventures‘ team at Prosper Gold (PGX.H, TSX-V) believe they have an excellent shot at another major discovery, and these guys have as much credibility in the business as anyone after finding perhaps the biggest Gold deposit west of Ontario in Canadian history (Blackwater)…Prosper Gold remains halted until its qualifying transaction with Firesteel Resources (FTR, TSX-V) is approved by the Exchange, perhaps within the next few weeks….as soon as approval is received, drilling is ready to go according to Bernier…

In the meantime, Doubleview is drilling on ground contiguous to Prosper Gold’s proposed Copper Creek acquisition…yesterday, following the close, Doubleview interestingly announced that Hole #6 intersected “sulphide mineralization comprising pyrite and chalcopyrite…from near-surface to current depth of 230 metres“…the hole is still in progress and looks promising…it’s the initial test of a geophysical target 800 metres south of the first 5 holes that ntersected altered andesitic volcanic rocks and dioritic intrusive rocks with short intercepts of weak to strong pyrite and chalcopyrite mineralization…

According to publicly available technical reports we’ve reviewed on Copper Creek (adjacent to where DBV is drilling), widespread Copper oxides near-surface are underlain by significantly higher grade Copper-Gold values in sulphide mineralization at depth, and the zones there remain open to depth…so the deeper DBV goes at its Hat Property, the better…DBV closed yesterday at 9.5 cents and its trading activity will be interesting to watch today…speculation could easily ramp up in the coming days…DBV opened at a dime this morning and quickly climbed as high as 13 cents…as of 7:20 am Pacific, it’s up 2.5 cents at 12 cents on total volume (all exchanges) of just over 1 million shares…

Victory Ventures (VVN, TSX-V) Update

Meanwhile, Victory Ventures (VVN, TSX-V), which importantly has a tighter share structure than DBV, has been drilling into a strong IP anomaly on its highly prospective Copau Property where two major regional faults intersect…

During our site visit, we of course weren’t able to view drill core and company officials were extremely tight-lipped – but the “body language” was revealing, and that’s something we always look for…we’ve been to numerous drill sites over the years but this one has an unusual aura of excitement around it…in speaking with independent geologists not connected with Victory, the fact the Copau property lies at the intersection of two major regional faults has quite possibly cooked up a very special geological recipe in this under-explored area about 10 km north of the Red Chris deposit…until now, Copau had never been previously drilled despite an initial B.C. Geological Survey discovery (Cu and magnetite at surface) during a 1990’s regional mapping program…it’s reasonable to conclude that speculation will build significantly in VVN in anticipation of initial news on drilling progress, so watch for signs of increased volume…VVN gained 2 cents or 20% yesterday, and the chart is showing potential for a strong immediate move…

Updated Charts – VVN, DBV and CXO

Fundamentals are critical but when they’re combined with sound technical analysis, you get a much better feel for where a stock might be headed…John has updates this morning on Victory, Doubleview and Colorado…

Victory Ventures (VVN, TSX-V)

An impressive upsloping channel remains firmly intact, RSI(14) found support at 50 and the initial Fib. level now looks more certain…the bullish trend remains strong and appears to be getting stronger…next week could herald a major breakout for VVN…

Doubleview Capital Corp. (DBV, TSX-V)

Wednesday and Thursday candles were bullish, and RSI(14) is now showing increased momentum…strong action so far this morning…

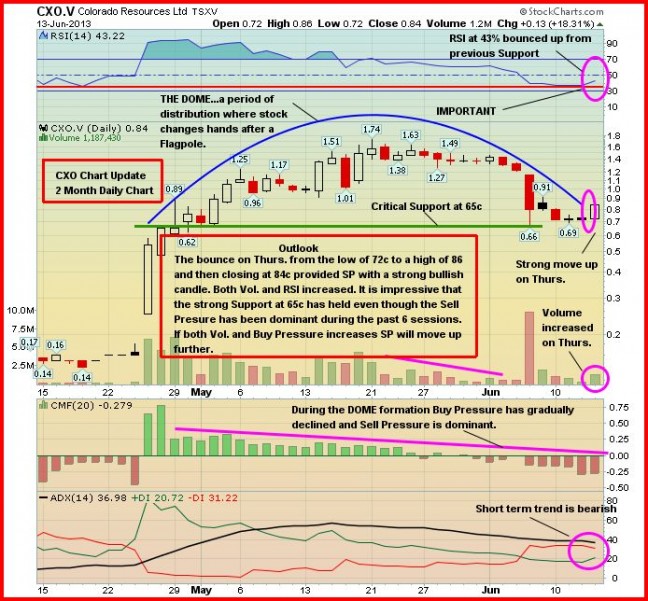

Colorado Resources (CXO, TSX-V)

Strong support in the upper 60’s has held for Colorado, and we just can’t see that support failing given the powerful fundamentals at this point as the North ROK project is looking better than ever despite the market’s silly panic attack last week…

G old traded as low as $1,377 overnight and is now up $3 an ounce at $1,388 as of 7:20 am Pacific…Silver is back above $22, up 21 cents at $22.06…Copper is up a penny at $3.20…Crude Oil is $1.22 higher at $97.91 while the U.S. Dollar Index is flat at 80.80…

old traded as low as $1,377 overnight and is now up $3 an ounce at $1,388 as of 7:20 am Pacific…Silver is back above $22, up 21 cents at $22.06…Copper is up a penny at $3.20…Crude Oil is $1.22 higher at $97.91 while the U.S. Dollar Index is flat at 80.80…

Gold traders turned bearish for the first time in a month as investors reduced holdings in exchange-traded products for an unprecedented 17th consecutive week while India, the biggest buyer, announced curbs on imports…18 analysts surveyed by Bloomberg expect prices to fall next week, with 14 bullish and four neutral, the largest proportion of bears since May 17…investors sold 497.2 metric tons valued at about $22 billion through ETP’s since early February 8 and the 2,117.96 tons left is the least they have held since March, 2011, data compiled by Bloomberg show…

Steps taken by the Indian government on Gold, combined with a lower rupee, have started yielding results, with imports of the precious commodity plunging in India, the world’s biggest gold consumer…net Gold imports averaged $135 million a day in the first 13 business days in May until May 20…however, in the subsequent 14 business days, it averaged only $36 million, coming down sharply…moreover, the demand for foreign exchange for Gold purchase also appears to have gone down significantly in the past 5 to 7 days (source: www.MineWeb.com)…

U.S. “Core” Prices Remain Tame Despite PPP Rise In May

The prices that U.S. companies pay for finished goods rose for the first time in 3 months in May, reflecting rising energy prices that could trickle down to consumers…the producer price index rose a seasonally adjusted 0.5% from April (higher than expected), the Labor Department said this morning…the increase was driven by energy prices which climbed 1.3% mainly on higher gasoline prices…overall prices were up 1.7% from a year ago, suggesting that inflation at the wholesale level remains subdued…”core” prices, which exclude volatile food and energy costs, also were tame…that index rose a tepid 0.1% in May, matching the prior month’s pace…this morning’s report is the latest sign that underlying inflation remains low in the U.S., as it does in most of the world, amid high unemployment and weak demand, limiting how much businesses can raise prices…

Today’s Markets

Japan’s Nikkei average stabilized after Thursday’s rout…it gained 241 points overnight to close at 12687…China’s Shanghai Composite gained 14 points to close at 2162, 26 points below its 200-day moving average (SMA)…European shares are up modestly in late trading overseas…in North American, meanwhile, the Dow is up 12 points through the first 50 minutes of trading…the TSX is down 23 points while the Venture has climbed 4 points at 934…

What’s interesting technically about the Venture recently is the gradual increase in buying pressure as shown in John’s 9-month daily chart below…

GoldQuest Mining (GQC, TSX-V) Chart Update

GoldQuest Mining (GQC, TSX-V) came out with impressive infill drilling results from La Escandalosa yesterday…this will be helpful in producing an updated NI-43-101 resource estimate for the property, though we suspect GQC may release a combined resource for La Escandalosa and Romero this fall as the two systems potentially could be linked…GQC has been on fire recently and we expect this will continue in anticipation of initial results from the very promising Guama trend where drilling continues…below is an updated chart from John…

Note: John and Jon both hold share positions in VVN. Jon also holds share positions in CXO and DBV.

23 Comments

Jon, can you give us a “ball park” time as to when Victory Ventures will: A) Complete the drilling and B) Release the assay results?

Complete the drilling? I have a hunch these guys are going to be busy all summer……normally, a rush assay procedure at this time when it’s not so busy at the labs is about 2 weeks, then of course a bit of time for interpretation……..first hole started June 2….normal per-day drilling rate would be about 75-100… m…..

Are we speculating now that DBV has a very good chance of hitting great holes as well even though its not in the same area?

Yes we are, Dave, but it’s smart speculation. This afternoon I spoke again with Pete Bernier (Prosper Gold). I have enormous respect for Bernier who also has a tremendous team behind him. As most of our readers may know – we’ve pointed this out – Prosper Gold has optioned the 7,000-hectare Copper Creek Property northwest of Telegraph Creek from Firesteel Resources as their qualifying transaction. DBV’s Hat property is contiguous to the eastern border of Copper Creek. Yes, this is quite a distance from North ROK, Red Chris and VVN’s Copau Property, but it’s no less prospective for a major discovery. It speaks volumes that Bernier and his group searched a couple of years for the right property and settled on this one. In Pete’s own words, which we’ll post in our Musings Monday morning, this area has “huge potential”. Firesteel got some interesting results, just like the previous operators of Blackwater (before Richfield came in) also got some very good indications. The Prosper Gold group will take a fresh approach to Copper Creek and has a very good chance of finding a deposit IMHO. Over the years, there has been work done at the Hat Property but very limited or no drilling. Lots of gold and copper showings (high grade). Based on DBV’s NR, Bernier himself believes DBV may have hit some sort of mineralized system, or at least the edge of it. He’s very curious like the rest of us in terms of how the assays will come out. Speculation should drive DBV higher. Between the Telegraph Creek area, where new geological belts may be discovered this summer, to West Cirque’s Castle Property, to North ROK/Red Chris and the surrounding area, including VVN’s Property, I can say with 100% confidence that this is going to be an incredibly interesting and extremely active summer in this district. I spoke also to a senior B.C. government geologist this afternoon (BCGS) and he agreed completely, and he’ll be on the ground in the area himself in 10 days (he likes Copau very much too by the way). If some investors think this is some sort of a wild pump, they are completely off the mark. We’re here in Iskut for a reason – this is an important story. Those in the know have been positioning themselves and have a great chance of being rewarded handsomely over the next few months.

Jon,

Whats up with rbw? bid at 0.025 – i dont see you talking about it anymore? we done pumping this and moved on?

no news released from them….nothing going on…

Thanks Jon for the information. I was (of course) referring to the “first round of drilling”. Bottom line: It looks like we should have the initial results by the end of July.

Hey, you guys know if Mr RBW Johnston will sell his famous rock? I want a little keepsake and reminder of the money I flushed.

PS I dont blame anybody but myself for investing in them. They fooled everybody.

What about ABR? They appear to be both in the CXO and DBV area plays? raising $500k too!

You’re right, Steven. We’ve brought up ABR previously – they have put themselves in the game.

Hi Jon, RBW had a well above average volume day. Does it have any significance in the context of TA?

John is the TA expert, he’s the better one to answer that. RBW is like many, many others at the moment, it’s suffering, but the potential for a huge comeback is very real. Plenty of value in their properties. Across a wide spectrum of these junior resource stocks, there are some incredible opportunities at the moment for patient investors.

Thanks Jon. We shall wait for John ‘s TA evaluation. Do you have a list of highly undervalued fundamentally sound juniors?

Not sure why cxo rallied on lastest NR as Eldorado results should be coming out soon.

After 2 months of drilling not a peep so put 2 and 2 together they won’t be all that impressive

unless by luck like gqc the last hole hits.

be careful for another down draft on eldorado results

The market, and Colorado, are focused on North ROK, that’s what important. Eldorado is a non-core asset at this time. A hit there is a bonus. If results from there aren’t great, and some investors wish to bring down the value of North ROK as a result, then’s that’s fantastic in my view because it will create an even greater opportunity in CXO. As Clinton said, it’s the economy, stupid. In the case of CXO, it’s North ROK. If they hit at Eldorado (depending on how good), they should ultimately look at possibly optioning it out or spinning it out and stay 100% focused on North ROK. They hold Eldorado under option at this point.

RBW is dead. Whats their plan? Are they just gunna let the whole drill season in BC pass cause they cant close a pp? These supposed rich Calagarians backing them cant fill it? Im sorry BMR but sometimes you have to admit your wrong instead of looking away. Many other companies are closing pps right now so I guess we can assume that they dont have what the market wants.

Rok not even proven yet thats why the haircut,Cook said Eldorado was it lets see the results and again i believe i will be correct

in my guessing cause had they hit on eldorado drill hole results would have been out.

some people need to figure things out a lot

hmm rbw comes to mind if ya remember saying results no good

over 300 holes poked in red chris

rok 4 holes so like i said matket gets all humped up for disappointments

plus people lose there money thats not a good thing either in these crappy markets

don’t need any more bombshells

lets see what qgc has hit on new target results should be out on 1st hole in toughly 10 days or so

have some smarts and see what zenyatta has to date,figure it out

synthetic rock that costs to make by producers 5000 to 15000 per ton

they sell that home made stuff for 10000 to 30000 per ton

zenyatta has the synthetic rock in there deposit that came from the mantle of the earth

15 drill holes released to date not to hard to crunch numbers and see its a huge deposit with big money

diamond fields had 8000 per ton rock with 2.6 mil ton pure nickel grade sold for 4 bil

zenyatta 4 times bigger do the marh here people you want to make money zen is it

over half the venture exchange companies toast maybe the whole exchange it they don’t put some new rules in place very soon

Yukon was a HOT with over 100 companies joining the buzz for stock promotion,look were it is today

cold as ice

Red Chris is lucky they found there deposit years ago had it come along today that needed funding in this market on low grade stuff no way it would have a chance at going into production.

Mega Deposits in Northern BC and Alaska no go today

play the stock promotion and forget the rest

Red Chris has robust economics, even at significantly lower metal prices – read the report. The NTL is huge for this area.

15% irr there are many projects around with that same return they are on the shelf no funding today

like i said good thing red chris was a few years back and had cash and raised cash

Major mining companies in hot water there is nobody to buy anything these days

Goldcorp is very possible they do take out of somebody this fall other than that big miners got there hands full of debt and on going projects with mega cost over runs