Gold has traded between $1,273 and $1,293 so far today…as of 7:40 am Pacific, bullion is unchanged at $1,285 after coming off its largest percentage weekly increase in nearly 2 years…Silver is also flat at $19.92…Copper is off 2 pennies to $3.12…Crude Oil is 31 cents lower at $105.64 while the U.S. Dollar Index is off its highs of the day but still up one-quarter of a point at 83.21…

Bloomberg reported this morning that physical Gold delivered to buyers by China’s largest bullion bourse in the first half of this year almost matched the entire amount taken from its vaults in 2012, and was more than double the country’s annual production…the Shanghai Gold Exchange supplied 1,098 metric tons in the six months through June, compared with 1,139 tons for the whole of last year, according to data from the bourse today…output in China, the world’s largest Gold producer, reached a record 403 tons last year, according to the China Gold Association…

The surge in deliveries underscores buying interest in China, which may pass India as the largest bullion consumer as early as this year after the government in New Delhi raised import taxes while regulators in Beijing made investing in the metal easier…miners, smelters and refineries are required to sell Gold via the Shanghai bourse, the only state-sanctioned marketplace for spot bullion in China…

“The number shows demand for bullion as an underlying asset in China that investors here remained big buyers of the physical commodity this year,” said Fu Peng, a commodity strategist in Beijing at Galaxy Futures Co, a brokerage controlled by the country’s sovereign wealth fund…

Updated Gold Chart

Despite the intense doom-and-gloom, which of course is bullish from a contrarian standpoint, Gold hit a 3-week high last week…its next major challenge from a technical perspective is to push through a band of resistance between $1,320 and $1,350 as you can see in John’s 2-year weekly chart below…RSI(2) has climbed out of the oversold zone to 31…sell pressure is gradually abating, and a period of seasonal strength for Gold (the last half of Q3) is rapidly approaching…the strong support band between $1,150 and $1,180 has remained intact but at some point during the second half of 2013, it’s reasonable to expect that there will be a re-test of that area…for now, though, the bulls have regained some strength which could persist for a while…

China’s Q2 GDP Growth Slows But Matches Expectations

China’s gross domestic product slowed during the 2nd quarter but not as much as expected by some analysts…China announced this morning that its GDP growth in Q2 fell slightly to 7.5% (we don’t assume this number is true, could be inflated) from 7.7%, marking the slowest pace of growth (year-on-year) since the third quarter of last year…the figure was in line with general expectations…China is set to contribute 13% of global economic activity this year, compared with 5% in 2005, so that’s why it’s so important to keep a close eye on developments in that country…the U.S. hasn’t felt China’s recent slowdown because demand for some of its top exports to China – airplanes and high-tech computer goods – has remained strong…as Alex Frangos and Eric Bellman reported in this morning’s Wall Street Journal, “China is trying to pull off a tricky rebalancing…it hopes to reshape its economy to be less reliant on construction and heavy industry, and more reliant on consumer spending…this is sparking optimism among industries such as car makers and food producers…to boost domestic consumption, the government has raised minimum wages to put more money in people’s pockets and loosened controls on interest rates to give household savers better returns…it has tilted tax and land incentives toward industries that cater to consumption, such as food and autos, and away from heavy industries suffering from overcapacity, such as steel making and ship building“…

China also said today that industrial output rose 8.9% in June from a year earlier, compared to a forecast of 9.1% and lower than May’s 9.2% growth…fixed-asset investment also disappointed slightly, with 20.1% growth in the first half compared to a forecast of 20.2%…consumer spending was a bright spot, as retail sales accelerated to 13.3% in June, compared with 12.9% growth in May…but disposable income growth for urban households slowed to 6.5% year-on-year in the first half, down from 9.7% growth in the first half of 2012…

Today’s Markets

China’s Shanghai Composite gained 20 points overnight to close at 2059…the Index has so far held at or above critical technical support at 1950…markets in Japan were closed today due to a public holiday…European shares are up moderately in late trading overseas…in New York, the Dow is up 10 points as of 7:40 am Pacific…U.S. retail sales rose less than expected (0.4%) in May…economists polled by Reuters were expecting a 0.7% increase, up from 0.6% increase in May…meanwhile, growth in New York state’s manufacturing sector accelerated to 9.46 in July from 7.84 in June, according to the New York Federal Reserve…economists surveyed by Reuters expected a reading of 5 (a reading above zero indicates expansion)…the TSX has jumped 82 points after the first 70 minutes of trading while the Venture is up 2 points at 900…

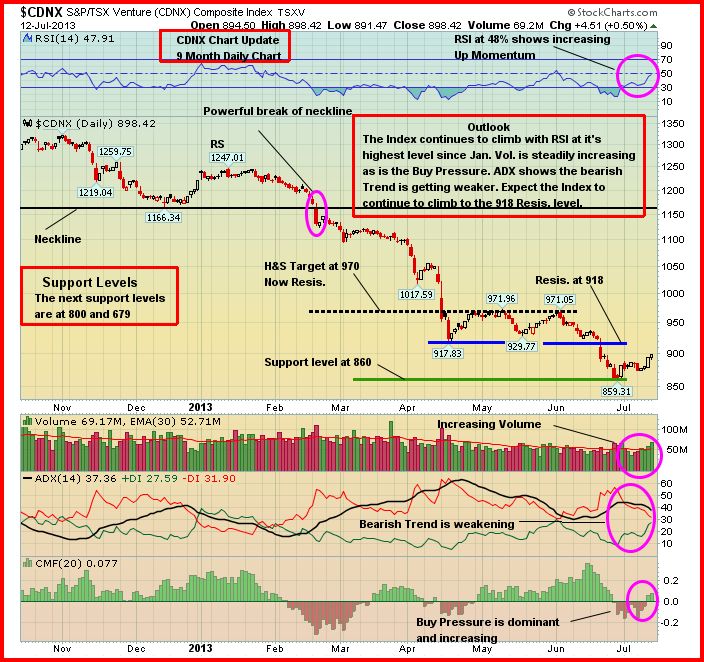

Venture Exchange Updated Chart

The Venture climbed 15 points last week to finish at 898, its highest close since June 19…support at the 860 level was strong as expected…RSI(14) is showing increasing up momentum and is now at its highest level since January…the next important resistance is around 920…look for the rising 10-day moving average (SMA), currently at 885, to provide support as this gradual uptrend continues…

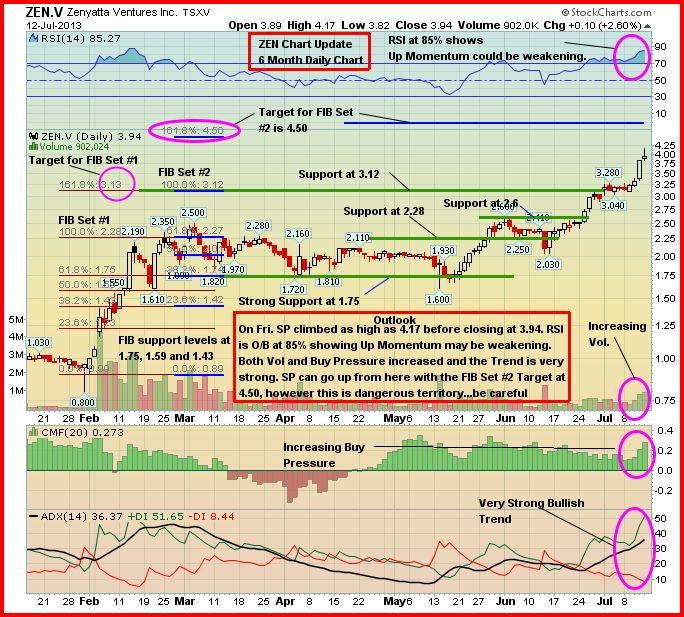

Zenyatta Ventures Ltd. (ZEN, TSX-V) Updated Chart

Even in a challenging overall market, there are shining stars…one of those of course has been Zenyatta Ventures (ZEN, TSX-V)…management has shown a tremendous ability to execute both on the ground and in the market, and now some penny plays are trying to ride their coattails by staking around them…John’s charts on ZEN have proven to be very accurate…below is some fresh TA from John on ZEN after Friday’s close…ZEN is off a penny in early trading at $3.93…

Garibaldi Resources (GGI, TSX-V) Updated Chart

We’ve written quite a bit recently regarding the fundamentals concerning Garibaldi Resources (GGI, TSX-V)…we like their Mexican projects but the near-term catalyst for this stock in our view is their 100%-owned Grizzly Property, a 17,000-hectare strategic land package contiguous to the western and southern boundaries of the important Copper Creek Property just northwest of Telegraph Creek at the top of the “Golden Triangle” in northwest British Columbia…Copper Creek and the Grizzly are about 60 miles west of Colorado Resources‘ (CXO, TSX-V) North ROK discovery…we’re convinced the Telegraph Creek area is going to blossom into an exploration hot spot this summer, and we’ll give more reasons why later this week…

What we wish to point out now, however, are some very interesting technical developments in GGI which closed Friday at 8 cents…we get excited whenever we see this type of behavior because it often precedes a major breakout on high volume, accompanied by some changing dynamics with the company…the changing dynamics in this case, we believe, will revolve around the Grizzly…

You’ll notice in John’s 3-year weekly chart below that GGI has broken above a 6-month horizontal channel…in addition, and this is a critical point, RSI(14) has broken above long-term resistance going back to 2011…there are other bullish technical indicators as well, but those are 2 that John wants to draw our readers’ attention to this morning…as always, perform your own due diligence, and we hope this can help in that effort…GGI is unchanged at 8 cents as of 7:40 am Pacific…

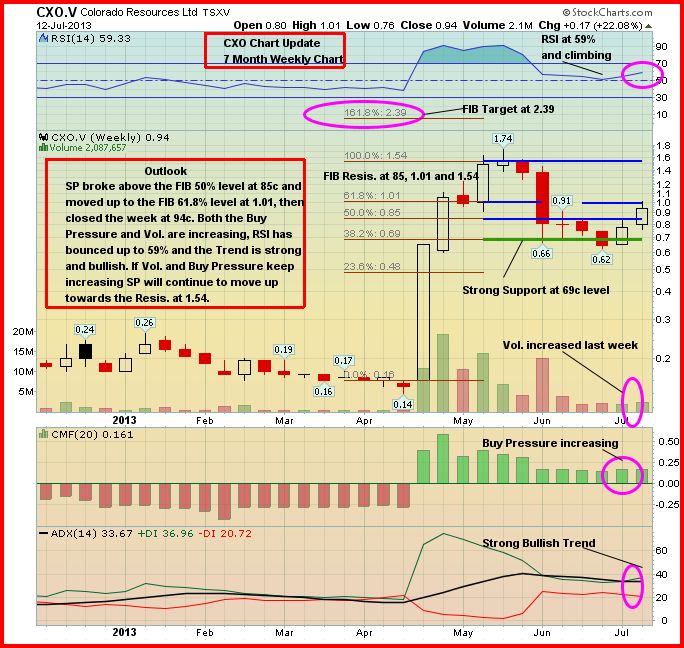

Colorado Resources (CXO, TSX-V) Updated Chart

It was a great week for Colorado which completed its $4 million financing and closed 16 cents higher for the week at 93 cents…there is Fibonacci resistance at $1.01 which also coincides with the 50-day moving average (SMA), currently reversing to the downside …technically, busting through that $1 level on increased volume is going to be key…in the meantime, the 85-cent level is the next obvious support…our hunch is that it could be at least 2 or 3 weeks before CXO releases its next set assay results…below is a 7-month weekly chart…CXO is off a nickel at 89 cents as of 7:40 am Pacific…the trend is bullish as shown in this 7-month weekly chart…

Short-Term Silver Chart Update

The $17.50 – $19.50 support band for Silver has held, and a rally appears to be brewing with up momentum slowly increasing…

Long-Term Silver Chart Update

RSI(2) recently hit its lowest ever level on this 11-year monthly chart…good reason to believe that a summer rally is in the works…

19 Comments

When Zenyatta goes between 7 and 10 bills over the next month you Bmr guys will be saying the same lol

Zenyatta stock of the Decade coming

Pump it bob pump it!!!! Baaahaaaaa!!!!

Yup you’ll learn a good lesson on Zen being a jackass is your problem not mine

Jon, any chance you will be able to catch up with George Heard of v.GMZ for some sort of mine permit update?

Bob your a billboard troll pumping your flavor of the month. It’s already grossly iver priced by about 3.90$. You know it I know it and I bet even Jon will not recommend anyone buying at these ridiculous prices. Can you do some more math for all of us bob?? That chit is priceless!!!!

Hi Heath,could you please do some math on INT,thanks.

The Property is comprised of 51 contiguous mineral claims encompassing approximately

17,503 hectares located in the Liard Mining Division. The Property forms a large “L”

shaped block extending approximately 15 kilometres east-west and 10 kilometres northsouth.

The claims are centred at 58.20° north latitude and 131.75° west longitude.

In March 2009, Garibaldi Resources Corp. (Garibaldi) entered into an option agreement

with Equinox Exploration Corp. (Equinox) whereby Equinox acquired the right to earn up

to a 70% interest in the property by completing $1,000,000 in exploration over four

years. Garibaldi has earned its’ interest in the property from Carl von Einsiedel, the

current registered title owner. That obligation has been met and the claims will be

transferred to Garibaldi.

There is no useable road access to the claims at present however, the road that was

constructed from Telegraph Creek to the former Golden Bear Mine in the mid 1980’s

passes through the southern part of the Grizzly Property. Although this road is not

presently in use it would certainly be feasible to rehabilitate it if a significant mineral

deposit is defined in the project area. At present the best way to access the claims is by

helicopter from Dease Lake located 100 kilometres to the east.

Regional geological maps published

Gil, we have reviewed the Grizzly (and Garibaldi) in every which way, including sideways and upside down. There is a Cat trail which runs right thru the heart of the property that can be easily refurbished for drilling purposes. The Equinox deal a few years ago, as mentioned in my previous post, is now null and void and was done as a favor to that group for them to get a listing. GGI got some free work out of it. I met again with the President and CEO of Garibaldi yesterday in Vancouver. We will be reporting more on GGI this week as you can be sure the Grizzly and Copper Creek are quickly going to become a major focus of attention in northwest British Columbia. The Kaketsa Pluton on the Grizzly is believed to be the heat engine driving the mineralizing fluids in this whole area, yet few investors are aware of this. This pluton measures 4 km by nearly 6 km in surface extent. One of the best geologists in this country, on a highly skilled team that knows how to execute both on the ground and in the market as they demonstrated with Richfield, is about to tackle Copper Creek and any geologist and prospector who knows this area well will tell u that the two properties are intimately connected geologically. All factors considered, we’re extremely excited about the prospects for both Prosper Gold and Garibaldi, and Firesteel looks good as well as it will maintain a 20% interest in Copper Creek. The best time to jump on something is when most investors aren’t paying attention. This will change fairly quickly, so I don’t believe there’s much time left to continue to accumulate GGI at current prices. The starting gun will go off as soon as Prosper Gold’s QT is approved and word on the street is that that is imminent. Drill permits are in hand and targets are ready for Copper Creek. Bernier has the exact same team in place with Prosper Gold as he had with Richfield, right down to the corporate secretary and the drilling company. There are a lot of people who made fortunes with Richfield. They are going to follow Bernier to Telegraph Creek. You can take your chances on these promo penny plays trying to raise money by riding the coattails of Zenyatta, which is another great play, or you can focus on companies that can execute exceedingly well on the ground and in the market and assume leadership positions through performance and branding.

LOOKS like Garibaldi has given up 70 percent interest in Grizzly

No, that is incorrect, Gil. GGI holds 100% of the Grizzly outright. A few years back, they entered into an option agreement on the Grizzly with a company which allowed that company to complete a qualifying transaction for listing. The company did the minimum amount of work (no drilling) and then went on to its main intention which was exploration in another part of the world. GGI got some free work out of the deal.

Like I said Heath you have no clue on the value of Zen when it becomes the stock of the decade you’ll see the light

you have no idea what they found to date like many,the buyers coming to market are not from people reading bmr

more and more are figuring it out.don’t matter to me one bit if you own zen or not

Synthetic Carbon Gtaphite worth what $10,000 to $35,000 per ton so crunch the numbers

Do the math on 100 mil tons at those prices yes they are unreal but huge numbers

when your done crunching the numbers only take 10% and see if your eyes are seeing it straight lol

were not talking flake graphite like all the other graphite companies trading for pennies now

were talking synthetic straight from the mantle of the earth like were diamonds come from

1 of a kind in the world going to command big dollars soon enough

Call Zen the next Diamond Fields :))))))

Here is a hint at 100 mil tons at $6000.00 dollars per ton

So take Gold EQ to Synthetic grades that equalls $300 dollars for every ton they have in ground to date thats 30 bil

So times that 300 number by 6 = $1800 for nuclear grades if Zen has that :)) thats 180 bil dollar value discounted to 10 percent

Don’t Believe figure it out yourself

The market is figuring it out slowly but surely and the big boys will becoming soon enough

those that figured it out are reaping the rewards and the rewards are going to get a lot bigger yet

Oh ya that was at 6000.oo for synthetic carbon

try 12,000 try 18,000 try 24,000 try 30,000 try 36,000

Actual price is 35,000 for Nuclear Grades so the 36,000 number is just for easy figuring

When all see the light its going to = one huge stock price

call it a pump if you like but its REAL

Zen not 1 news letter writer covering Zenyatta they all missed Zen

BMR gives zen a plug once in awhile on this board

But very few own Zen here to bad

WER just acquired ground close to ZEN today’s news! less than 30M o/s…..

int 4 cents rotflmao go heath go

Bob, Heath called you on your pump, so let the share price demonstrate who is right. If you want to start going at each other exchange e-mail addresses, or better yet arrange to meet in person and have a girlish slap fight. Let’s get back to trying to forget BMR’s former darlings GBB and RBW. I currently hold both!