Gold has traded between $1,274 and $1,290 so far today…bullion climbed as high as $1,300 yesterday morning after prepared remarks from Ben Bernanke were released and considered rather dovish, but bullion retreated once the Fed Chairman started testifying on the economy and monetary policy before the House of Representatives…Bernanke really didn’t say anything new, reiterating that the Fed expects to start scaling back its bond buying purchases later this year but this will hinge on economic developments…”Our asset purchases depend on economic and financial developments, but they are by no means on a preset course,” Bernanke said in his statement to the House of Representatives Financial Services Committee…Bernanke also emphasized that there could be a lengthy time-lag between the end of asset purchases and a hike in interest rates…the Fed Chairman speaks again today before a Senate Committee…

Traders hit the sell button on Gold yesterday when it couldn’t push through $1,300 and after Bernanke started speaking…some observers pointed out there may also be some limited producer hedging around $1,300…as of 7:45 am Pacific, bullion is up $11 an ounce at $1,285…Silver has added 15 cents to $19.44…Copper is flat at $3.11…Crude Oil has jumped $1.12 a barrel to $107.60 while the U.S. Dollar Index has gained one-quarter of a point to 82.94…

Holdings in the SPDR Gold Trust, the biggest Gold-backed exchange-traded product, fell to 936.07 metric tons yesterday, the lowest since February, 2009…prices may be near the bottom as demand in India and China, the largest consumers, is expected to exceed last year’s levels, according to Marcus Grubb, managing director of investment research at the World Gold Council (source: Bloomberg)….

Detroit Gears Up For Bankruptcy

The Wall Street Journal reported this morning that Detroit, America’s automobile capital and onetime music-industry powerhouse, could within days become the country’s largest-ever municipal bankruptcy case, people familiar with the matter said, as the city’s emergency manager accelerates his plan for restructuring nearly $20 billion of long-term liabilities…the expected bankruptcy filing would come after Kevyn Orr, the emergency manager, failed to reach agreements with enough of the city’s bondholders, pension funds and other creditors to restructure Detroit’s debt outside of court…Detroit has spent an average of $100 million more than it has taken in since 2008…most at risk under the expected bankruptcy case is the city’s $11 billion in unsecured debt…that includes almost $6 billion in health and other benefits for retirees; more than $3 billion for retiree pensions; and about $530 million in general-obligation bonds…

Today’s Markets

Asian markets were mixed overnight…Japan’s Nikkei average gained 193 points or 1.3% to close at 14809…China’s Shanghai Composite, meanwhile, fell 22 points to 2023…European shares are moderately higher in late trading overseas, while the Dow has hit a new record high this morning…through the first 75 minutes of trading, it’s up 99 points at 15569… the number of Americans filing new claims for jobless benefits dropped more than expected last week to its lowest level in four months, a possible sign that hiring could pick up in July…initial claims for state unemployment benefits fell by 24,000 to a seasonally adjusted 334,000, the Labor Department said this morning…the TSX is 95 points higher while the Venture has added 2 points to 913…

Prosper Gold-Firesteel Complete Definitive Agreement For Newly-Named Sheslay Porphyry Project

The starting gun is almost ready to go off near Telegraph Creek in northwestern British Columbia, an area that we believe will rapidly emerge as a powerful Copper-Gold exploration play…Prosper Gold Corp. (PGX.H, TSX-V) and Firesteel Resources Inc. (FTR, TSX-V) announced this morning that they’ve concluded a definitive agreement allowing Prosper Gold to earn as much as an 80% interest in Firesteel’s highly prospective Copper Creek Property which has been renamed the Sheslay Porphyry Project…

“Since the sale of our last company, Richfield Ventures in 2011, it has taken us two years to identify a multiple bulk tonnage Copper-Gold target area, with historical drill confirmed discoveries that met our exploration criteria for Prosper Gold,” stated Pete Bernier, the Company’s President and CEO…”The Sheslay Project area is close to infrastructure, drill permitted and drill ready…we look forward to advancing the project in the near-term“…

Fieldwork at Sheslay is anticipated to commence in the coming days and will include regional scale soil geochemistry, prospecting and trenching to be completed in association with a 12-square-kilometre detailed IP survey…a 5,000-metre Phase 1 drill program is scheduled to commence in early August…

BMR spoke with Bernier yesterday and we’ll have much more on the Sheslay Project Monday and the significance of Garibaldi Resources‘ (GGI, TSX-V) 17,000-hectare Grizzly Property which adjoins the western and southern borders of Sheslay…the heat source for the mineralizing fluids in the district may indeed originate in the northwest corner of the Grizzly with the Kaketsa Pluton, referenced in this morning’s news…it measures approximately 4 km by 5.6 km in surface extent…the Grizzly and the Sheslay appear to be intimately connected, though Sheslay is much more advanced from an exploration standpoint…mark our words, the Grizzly will be key to Prosper Gold’s plans for the area…

Propser Gold remains halted until final approval from the Exchange on its qualifying transaction with Firesteel…given the credibility and the efficiency of the Prosper Gold team, however, there’s every reason to believe that Exchange approval is imminent…

Firesteel Resources (FTR, TSX-V) Updated Chart

Keep a close eye on Firesteel which appears to have completed a normal retracement after climbing as high as 18 cents in the spring…FTR has generally been a light trader and closed at 8 cents yesterday, putting it well below major resistance which is in the 15-18 cent area as shown in John’s 15-year monthly chart below…Firesteel is also in the process of completing a definitive agreement with a subsidiary of OZ Minerals Ltd. of Australia for the ROK Coyote Property immediately south of Colorado Resources’ (CXO, TSX-V) discovery…

RedHill Resources (RHR, TSX-V) Stars Exploration Near North ROK

Redhill Resources Corp. (RHR, TSX-V) has commenced a program of soil sampling, geological mapping and geophysical surveying over the Yellow Chris South property near Iskut which it has optioned from from Teuton Resources Corp. (TUO, TSX-V)…Yellow Chris adjoins Colorado’s North ROK Property to the north and east, and is situated within a couple of kilometres from CXO’s discovery hole…Redhill closed yesterday at 3.5 cents and has 132 million shares outstanding…

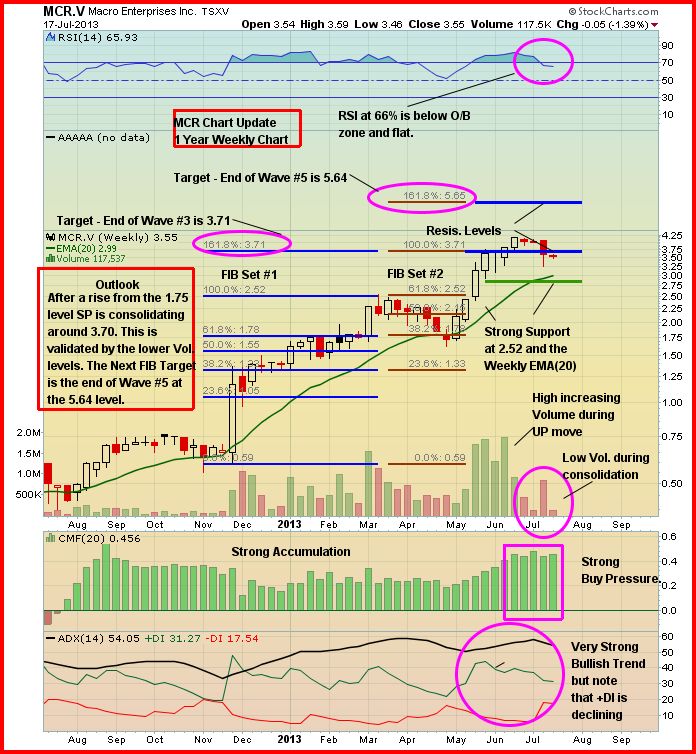

Macro Enterprises Ltd. (MCR, TSX-V) Updated Chart

Actual earnings and earnings momentum with this company, as we’ve reported earlier…MCR has pulled back from an all-time high of $4.18 with the temporarily overbought condition unwinding as expected…below is a 1-year weekly chart…John’s looking for a “Wave 5” move, based on Fibonacci analysis, that could take MCR at least 50% higher from current levels…the fundamentals appear to support that…MCR closed yesterday at $3.55…

Medallion Resources (MDL, TSX-V)

Medallion Resources (MDL, TSX-V) has been a strong performer of late…the company announced earlier this month that it has signed an MOU with Arab Mining Company, a Jordan-based, pan-Arab mining industry investment firm…the MOU grants Arab Mining, for a period of 6 months, the exclusive right to negotiate terms to invest or participate in a joint venture, controlled and majority-owned by Medallion, which will focus on rare-earth production and processing opportunities within the Arab League nations, including a proposed rare-earth processing facility in Duqm, Oman…”Arab Mining has been assessing and investing in significant mining and mineral processing projects for almost 40 years, and brings to the venture an impressive track record and a dedicated development fund backed by shareholder’s equity of over $1.2-billion,” said Dr. Bill Bird, Medallion Chairman and CEO…”These resources, combined with Medallion’s expertise and industry contacts constitute the potential for establishing a significant rare earth value chain in the region…We look forward to realizing this vision with Arab Mining Company“…

MDL closed yesterday at 34 cents, which is double where it was about 2 months ago…long-term, this play could have excellent potential but investors should expect resistance around the Fib. level of 41 cents over the short-term, followed by a period of consolidation before possibly the next leg up…the long-term moving averages have all recently reversed to the upside, a very positive sign…as always, perform your own due diligence…

Note: Jon holds share positions in GGI and FTR.

2 Comments

CCB yesterday had great news….today NRT has great news…again graphite right now! ZEN,etc….

Interesting situation, we were looking at the chart last night…