11:45 am Pacific

(Exclusive to BMR subscribers – Not for Distribution or Posting on any Board).

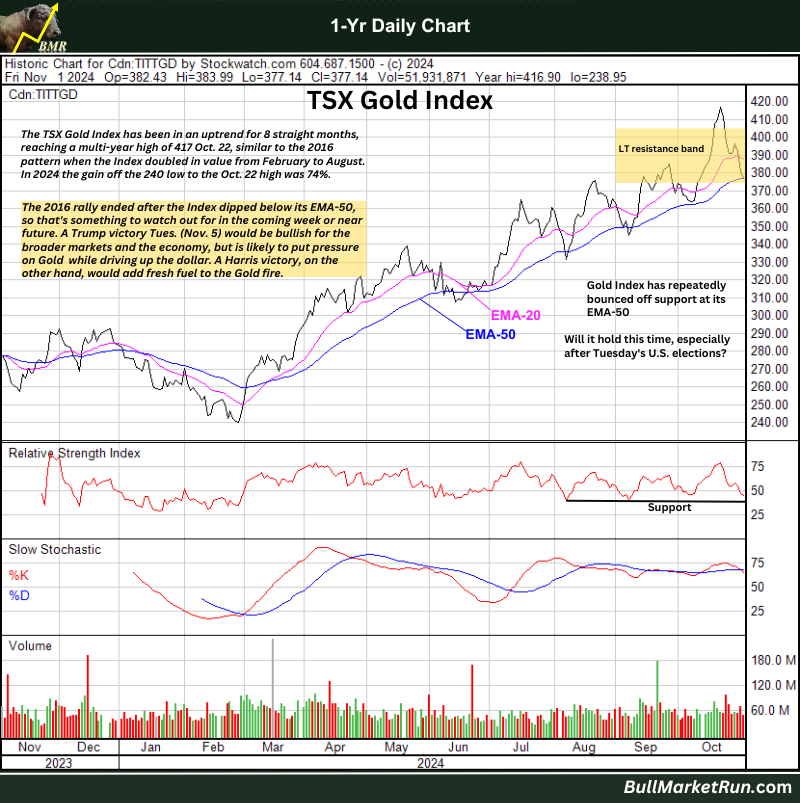

Decision Time For TSX Gold Index

What a week this is shaping up to be with an historic U.S. Presidential election Tuesday followed by a Fed meeting Wednesday-Thursday.

In recent weeks we’ve been encouraging subscribers to take profits on the winning Gold producer trade we got behind in late 2022. The TSX Gold Index nearly doubled from then to last month’s multi-year high of 417 (Oct. 22).

After a correction that started in 2023 and concluded at the end of February this year when the Index landed at 240, Gold producers climbed steadily over the next 8 months from March into October with a gain of 74%.

After a consistent uptrend over 8 months to new multi-year highs, the Gold producer trade has gotten “long in the tooth” and faces a high risk of a sharp pullback, unless of course Kamala Harris somehow manages to defeat Trump (not what we expect) and then takes America into the gutter and a 3rd World War.

Harris would be hugely bullish for Gold and Gold stocks. Long-term, no matter who wins Tuesday, exposure to Gold and Gold stocks will remain a key component of a smart portfolio, but the immediate to near-term outlook is negative in our view under a Trump/Republican scenario (not unlike the situation in 2016).

The 7-month rally in 2016 ended as soon as the Gold Index couldn’t hold support at its EMA-50. That’s where the Index landed Friday.

Lots of money has been made in these producers this year – hence a great time to “CASH UP” and deploy those dollars somewhere else with opportunities that have more attractive immediate/near-term upside potential.

Bracing For A Breakdown In Bullion

We’re nervous about Gold because the metal has hit John’s target on his highly reliable 5-year weekly Gold in Canadian Dollars chart.

That chart from John has been our Bible for Bullion going back more than a decade, with so many correct calls over the years.

We need to be disciplined and go with what it’s telling us.

Measured Fib. Resistance (161.8%) on the 5-Year Weekly

is $3,956 (CDN)

That’s a target we’ve been eyeing for a few years now.

Last week, Gold touched $3,900 (CDN) and is currently trading at $3,813. One cannot rule out a sudden run that briefly overshoots the $3,956 target, but if you’re within 5% of a high it’s smart to get out while you can.

We’re sticking to our guns on the view that a significant correction in Gold is likely to occur very soon. This is a good time to be looking at other opportunities in the market. Once a correction runs its course, it’ll be time to pile back in. The risk-reward right now just isn’t favorable.

We recognize this is not the mainstream view (lots of bullishness out there) but you don’t make the big money by following the crowd.

Gold Short-Term Chart

There hasn’t been a test of Gold’s EMA-50 since July while the metal continues to trade well above its EMA-200, currently $2,416.

In this step-by-step rally since July, Gold has managed to hold support at every major breakout level. It held support at $2,400 in August, at $2,500 in September, and at $2,600 in October.

It’s highly unusual for a market not to occasionally test a rising 200-day EMA as part of a primary uptrend. That’s what could happen to Gold, which would only be a 12% correction from current levels.

2 Comments

And how do things look for oil and gas?

Trump will focus on keeping Oil prices in check as he did in his last term – and drill, drill, drill in the U.S. means more supply. So that’s actually not bullish for Oil stocks in general (look how Exxon, for example, performed during the Trump years), but will help drive down inflation and keep the broader markets buoyant. Uranium, Copper and some other metals could do exceptionally well. Crypto should flourish, no matter who gets elected, but likely more so under Trump and a Republican Congress.