10:30 am Pacific

(Exclusive to BMR subscribers – Not for Distribution or Posting on any Board).

Macro Happenings

- President Trump is moving at lightning speed to implement a MAGA conservative agenda that’s going to make liberals’ heads spin, reshaping American society for decades to come, given who has been nominated to his Cabinet in recent days plus the tapping of Elon Musk and Vivek Ramaswamy to head a new government agency focused on regulating and overhauling federal spending (no friends of Justin Trudeau on Trump’s team). In a statement released yesterday, Trump referred to the new agency as the “Department of Government Efficiency” (DOGE – that great acronym in a wink to 1 of our favorite cryptocurrencies that 1st came to life 3 years ago, thanks to Elon). “Together, these 2 powerful Americans will pave the way for my Administration to dismantle Government Bureaucracy, slash excess regulations, cut wasteful expenditures, and restructure Federal Agencies – Essential to the ‘Save America Movement'”, Trump wrote. “I look forward to Elon and Vivek making changes to the Federal Bureaucracy with an eye on efficiency, and at the same time, making life better for all Americans”;

- Bitcoin continues its post-election rally, topping $90,000 for the 1st time today. As of 10:30 am Pacific, BTC is up 3.4% at $92,769. Dogecoin, meanwhile, climbed as high as 43 cents this morning (currently 40 cents) and is now up more than 250% over the past month;

- U.S. consumer prices edged up in October after having recorded the slowest rate of growth in 3.5 years in the previous month, a sign of how inflation continues to move lower on an uneven and bumpy path. The latest report likely won’t derail another interest rate cut from the Federal Reserve in December. But together with solid consumer spending and steady hiring, firmer or stubborn inflation could kick off a bigger debate at officials’ next meeting over whether to slow the pace of rate cuts early next year. The Labor Department today reported that consumer prices in October rose 2.6% from a year earlier. That marks a pickup from the previous month, when the consumer-price index was up 2.4%. Core prices, which exclude food and energy items in an effort to better reflect inflation’s underlying trend, were up 3.3%. Both results matched the expectations of economists polled by The Wall Street Journal;

- The potential return of Stephen Harper: Former Prime Minister Harper may become the new chair of the Alberta Investment Management Corp., following the UCP government’s dismissal last week of executives and entire board of the public sector pension fund manager. Sources close to government say Premier Danielle Smith has wanted Harper to take on the role for some time. AIMCo’s board members have to be free of any potential business conflicts, so that’s something that apparently still has to be worked out with Harper;

- The National Post’s Michael Higgins hit the nail on the head this morning. “Those who love Canada will remember the sacrifices of our forefathers; those who don’t will become school Principals. Left to our virtue-signalling elites, our hapless leaders and our ignorant educators, Canada would have forsworn its solemn duty to remember the dead and honour those who served. But what can we say to the likes of Aaron Hobbs, the Principal of Ottawa’s Sir Robert Borden High School, whose characterization of Remembrance Day was that it was usually about ‘a white guy who has done something related to the military’? Hobbs’ insult to every Canadian who has served and serves still was made in defence of allowing an Arabic-language Palestinian protest song to be played during a Remembrance Day assembly at the school (the only song that was played). Only after righteous anger ensued did Hobbs issue a pro forma apology. Thankfully, ordinary Canadians are less susceptible to the vagaries of woke culture and DEI (diversity, equity and inclusion) policies, and understand that bravery, duty and sacrifice are virtues that require us occasionally to pause, reflect and honour those who served.”

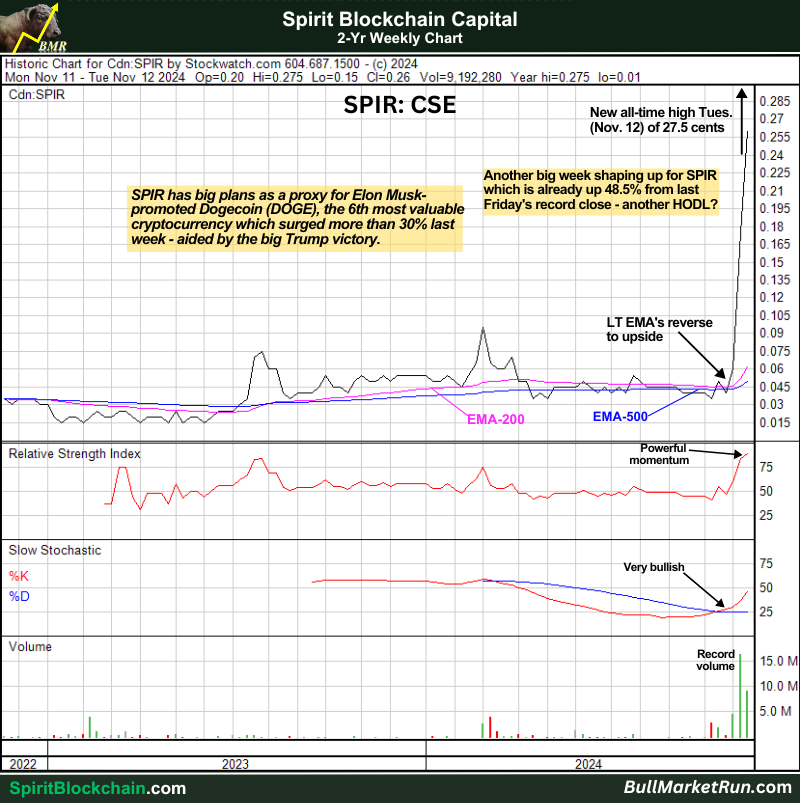

Spirit Blockchain Capital (SPIR, CSE)

BMR subscribers had a chance to grab Spirit Blockchain Capital (SPIR, CSE) in the low-to-upper teens last week. This morning, it touched a high of 34 cents on fresh enthusiasm around DOGE and the potential of this company to really make an impact in the crypto sector.

SPIR is up 3.5 cents at 29.5 cents as of 10:30 am Pacific. New support appears to be in the low 20’s, so any modest pullback on profit taking should be embraced if you’re a speculative investor who can handle volatility (Jon has sold half his holdings to recover his original investment, now playing with house money).

At some point in situations like this, there’s always a “shakeout” like what occurred recently in Sol Strategies (HODL, CSE). Those are typically great opportunities for accumulation (though exact timing is difficult to predict), and they usually land at 1 of the short-term EMA’s (8, 20, 50).

NexGen Energy (NXE, TSX)

It’s really hard not to be bullish about NexGen Energy (NXE, TSX) – emerging new discovery in the midst of a Uranium bull market that should continue for an extended period.

The Trump administration is expected to firmly embrace Uranium as more of a go-to energy source, and that’s bullish for our favorite Uranium stocks including NXE which continues to expand on a new discovery 3.5 km from its world class Arrow deposit as reported yesterday.

The Uranium ore market is expected to continue substantial growth over the next several years. A fresh report from the Business Research Company stated: “The Uranium ore market size has grown strongly in recent years. It will grow from $1.11 billion in 2023 to $1.21 billion in 2024 at a compound annual growth rate (CAGR) of 9.5%. The Uranium ore market size is expected to see strongly grown in the next few years. It will grow to $1.81 billion in 2028 at a compound annual growth rate (CAGR) of 10.5%. The growth in the forecast period can be attributed to government policies and incentives, focus on carbon emission reduction, geopolitical stability, exploration and discovery of new Uranium deposits, public perception and social acceptance. Major trends in the forecast period include advancements in nuclear technology, development of in-situ recovery (ISR) technology, focus on Uranium enrichment technologies, increased scrutiny on environmental and social impact, and diversification of Uranium end-use applications. The growth in the historic period can be attributed to the nuclear power plant construction boom, the cold war and military demand, the Chernobyl and Three Mile Island incidents, global economic trends, and changes in the regulatory environment.”

NXE Short-Term Chart

High probability of new highs in NXE above $12 by year-end.

NXE is off 33 cents at $10.27 as of 10:30 am Pacific.

Note: Jon holds share positions in HODL and SPIR.