Updated at 7:45 am Pacific

Gold slipped below $1,300 overnight and has fallen as low as $1,278 this morning where there is some support (near Friday’s intra-day low)…we”ll see if it can rally to close back above $1,300 support today as it did Friday, but clearly there is some technical pressure on bullion at the moment…as of 7:45 am Pacific, Gold is down $20 an ounce at $1,284…Silver is off 13 cents at $19.59…Copper is up a penny at $3.17…Crude Oil is $1.14 lower at $105.42 while the U.S. Dollar Index is off one-third of a point to 81.55…

China’s net Gold imports from Hong Kong fell 4.8% in June when the government also curbed the use of bullion in financing deals…mainland buyers purchased 101 metric tons, after deducting flows from China into Hong Kong, compared with 106 tons a month earlier, according to calculations by Bloomberg based on data from the Hong Kong statistics department today…

Impairments among base and precious metals companies have totaled more than $30 billion for Gold and $2.7 billion for base metals so far in 2013…what’s shocking is that the cumulative number since 2008 likely exceeds $200 billion, according to Frank Holmes at www.usfunds.com…with roughly 20 companies expected to report in the coming 2 weeks, the number could rise significantly…

Holdings in the SPDR Gold Trust, the biggest bullion-backed exchange-traded product, have declined another 0.2% to 917.14 metric tons, the lowest since February 2009, according to data on the fund’s website…investors in Gold ETF’s have sold around 650 metric tons of bullion so far this year, driven by improving prospects for the U.S. economy and expectations for a scaling back of the QE3…this is equivalent to the amount that rushed into the market 8 months after the collapse of Lehman Brothers when investors were searching for a safe haven, according to the World Gold Council…

After a strong July in which it posted a gain of 7.3%, Gold bulls have lost some momentum during the first few trading days of August with the price dropping below $1,320 on a closing basis, and perhaps below $1,300 on a closing basis today…sustained declines under the 20-day moving average (SMA), at $1,302 entering today, would be a negative signal for the near-term…Gold needs to bust through the stiff resistance band between $1,320 and $1,350 as that will put the bears on the defensive and set the stage for a potential strong rally…we believe that’s a very possible 3rd quarter scenario…below is a 2-year weekly chart from John…it takes out the “noise” of a shorter-term daily chart and shows that while the primary trend remains bearish, it has also started to weaken…RSI(14) is recovering out of oversold conditions…again, the $1,350 resistance area is key…a strong support band exists between $1,150 and $1,180…investor patience is required…

2-Year Weekly Gold Chart

Gold Stocks – Time For A Recovery?

The chart below shows that Gold stocks are down on average more than 40% year-on-year…historically, this kind of drop has offered an attractive entry point on the rare occasions when it has occurred…the last time this happened, Gold stocks went on to post a 160% return on a year-on-year basis…

Kenyan Government Doubles Gold Royalties, Revokes Some Mining Licenses

Yet another example of jurisdictional risk which is just 1 factor that has hurt Gold stocks the last couple of years…the Kenyan government has revoked some mining licenses and doubled Gold royalties to 5%, according to Reuters…all licenses issued between January 14 and May 15, 2013 – with the exception of the oil and gas sectors – have been revoked, and a panel has been created that will review all licenses granted since January 2003…Najib Balala, Kenya’s mining secreatary, said the government, which was elected in April, wants to “ensure the country gains from the mineral potential”…if that’s the case, they have a funny way of showing it…the African nation has proven deposits of titanium, Gold and coal, and possible reserves of Copper, magnese, niobium and rare earths…Pacific Wildcat Resources Corp. (PAW, TSX-V), with assets in Kenya, was halted prior to the open this morning with news pending…

Producers Hit Hardest As Financings Drop In Q2

Some interesting figures from IntierreRMG, a resource intelligence company geared toward exploration and mining companies…in its State of the Market: Mining and Finance Report, the company stated what everyone already knows – how financings across the sector have decreased substantially in 2013 due to falling metal prices, nervous banks and risk-adverse investors…they gave some interesting specifics, however…the 555 global companies monitored by the IntierraLive mining database that had an end-June market capitalization of over $100 million raised just $1.43 billion in the 2nd quarter of this year, compared with $4.08 billion in the first 3 months of the year, a drop of 65%…IntierraRMG added that funding by exploration companies in its database fell 28% to $1.04 billion in the 2nd quarter…

Exodus Out Of Gold Nearing Its End: World Gold Council

The exodus out of Gold this year, triggered by heavy exchange traded fund (ETF) selling, is likely nearing its end, according to an executive at the World Gold Council (WGC), who expects prices to pick up toward the end of this year…“We feel that speculative money has largely come out of the Gold market,” Marcus Grubb, managing director of investment at the WGC, told CNBC this morning…“Gold is nearer the bottom than the top right now,” he added…“You’ll see a stronger market towards the end of the year, and into next year”…contrary to what many believe, Grubb says that higher interest rates will not be negative for the precious metal…“A lot of analysis shows if real rates stay between 0 to 4%, Gold can return about 7-8% per annum or more…that’s our point of difference with the longer term bear view of Gold, even rising rates could be positive if real rates aren’t too high,” he said…in addition, he argues that investors should not underestimate the support physical demand will provide to the Gold market…“A huge amount of demand coming from India and China has underpinned the market at this level,” he said, adding that China’s rebalancing towards a consumption-driven economy will be even more positive for Gold demand…

Today’s Markets

Markets are under pressure across the board today…adding to woes, Atlanta Fed president Dennis Lockhart said the initial taper in the central bank’s asset purchase program could come as early as September…Lockhart said he was not disappointed by the July unemployment report and said he’ll be watching data closely for “the next few weeks” to see if the economy is on track for faster growth…the Dow is down 116 points through the first 75 minutes of trading…

The TSX has fallen 159 points as of 7:45 am Pacific with the Gold Index off for the 6th straight session at 169…RSI(2) on the daily Gold chart is very close to its low in late June, so a rebound in the Index is likely imminent…the Venture is down 7 points at 916…

Japan’s benchmark index reversed earlier losses overnight to rally 1% as the yen weakened while the rest of Asian stocks were mixed in choppy trading…the Nikkei closed up 143 points to 14401…the International Monetary Fund yeserday made a fresh call on Japan’s government to bring its flow of red ink under control, saying the central bank’s monetary easing could backfire if investors believe it is “monetizing” the growing mountain of government debt, a step that often leads to financial turmoil…China’s Shanghai Composite closed at a 3-week high, gaining 10 points to finish at 2061…the market will be paying close attention to trade and industrial production data out of China later this week…

European shares are down modestly in late trading overseas…a report published by the British Retail Consortium showed U.K. retailers enjoyed their best July in 6 years…meanwhile, Italy’s 2nd quarter GDP figures showed the Italian economy contracted for the 8th consecutive quarter but shrank less than analysts had expected, in line with the broader trend in the euro zone and offering hope that the country is slowly emerging from recession…

Is Richmont Mines Inc. (RIC, TSX) Turning The Corner?

From technical and fundamental perspectives, there are signs that Richmont Mines (RIC, TSX) – down nearly 90% since early last year – is starting to “turn the corner”…last Friday, the company reported a 2nd quarter loss of just over $1 million, following losses of $2.24 million and $2.6 million (on continuing operations) the previous 2 quarters…there are a couple of important developments concerning Richmont…first, continuing exploration and development of RIC’s promising Island Gold deep project could be a critical catalyst in propelling this company forward again…currently, there are 4 rigs at Island Gold…14,000 metres of exploration drilling took place during Q2…additional drilling continues, largely comprising step-out holes from previously established inferred resources in the “C” zone which appears to be an extension of the areas currently being mined but at higher grades and greater widths…in February, RIC released an initial inferred resource for the C zone at depth (1.5 million tonnes grading 10.73 g/t Au for 508,000 ounces) and an updated resource estimate is expected to be provided before the end of next month…the language in last Friday’s RIC news release suggests the company likes what it’s seeing in the core “with preliminary analysis indicating that the C zone continues to expand and remains open in all directions”…this is very positive…the company has also lined up a potential credit facility that it could tap into for up to $50 million to finance the long-term development of this project…as of June 30, Richmont had $26 million in working capital and virtually no long-term debt ($1.3 million)…so we could see some impressive drill results from Island Gold in the near future…what’s also encouraging about Richmont is that they’ve been able to substantially reduce costs at their Beaufor Mine in Quebec…the nearby Camflo Mill is also now running at full capacity (1,200 tonnes per day), a level expected to continue for the remainder of 2013 and through 2014 with added material from the W zone and Monique projects…after disappointments at Francoeur and Wasamac, and a substantial drop of course in Gold prices, it has been a very tough year-and-a-half for Richmont but there now appears to be some light at the end of the tunnel…

Technically, the stock is also looking healthier…a key event to watch for is a breakout above the downsloping wedge as John shows in this 1-year weekly chart…RIC closed Friday at $1.58 for a total market cap of $63 million, and is down just a few pennies in early trading today…it hit a post-Crash low of $1.37 near the end of June…

Eldorado Gold (ELD, TSX)

Eldorado Gold (ELD, TSX) is leading by example among producers…ELD produced 184,000 ounces of Gold during Q2 at an average cash operating cost of $478 per ounce (vs. 141,000 ounces at $480 in Q2 2012), and recorded net income for the most recent quarter of $43.3 million or 6 cents per share…”Our Gold mines continue to perform to plan and generate significant cash flows,” stated CEO Paul Wright…“With its strong balance sheet and comparatively low-cost Gold mining operations, Eldorado is well positioned to confront the recent weakness in Gold prices”…

Below is a 1-year ELD weekly chart from John…note the break above the down trendline…it’s now retracing back to that trendline which is normal technical behavior, so look for strong support around this $7 level…ELD is off 30 cents at $7.36 as of 7:45 am Pacific…

Updated Venture Exchange Chart

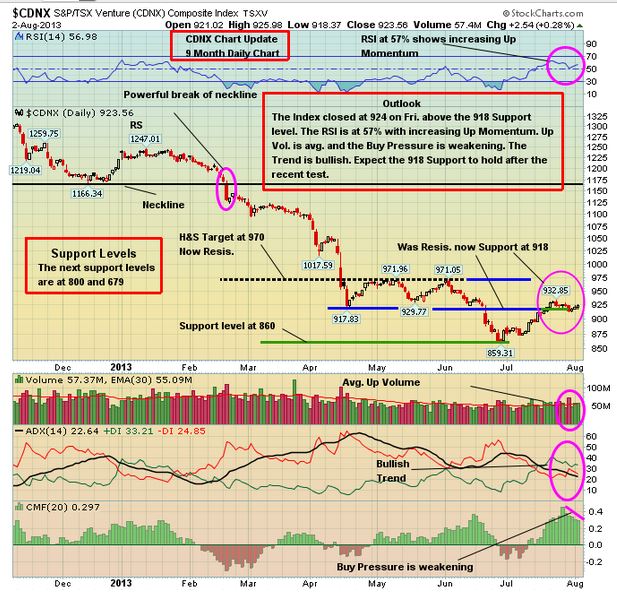

After 4 consecutive weekly gains, the Venture declined by just a single point last week with today of course being the first trading day of the new week after yesterday’s holiday…importantly, the Index held support at 918 last week…the rising 20-day moving average (SMA) is at 913 while the 50-day SMA has flattened out at 915…a reversal to the upside in the 50-day will be necessary in order to power the Index through critical resistance at 970…John’s 9-month daily chart below gives us encouragement that the very gradual trend higher recently could accelerate as the quarter progresses…importantly, the ADX trend indicator remains bullish at the moment…

Macro Enterprises Inc. (MCR, TSX-V)

Macro Enterprises (MCR, TSX-V) is a simple story and it’s making money, 2 reasons why MCR has been an island of safety for a Venture stock (and a market leader) since late last year…MCR announced superb Q1 earnings near the end of May, and has gained about 60% since then when we introduced it to our readers…since late last year, it has risen in Zenyatta-like fashion from below $1 a share…Macro specializes in construction and maintenance of small-to mid-inch pipelines, facilities and gathering systems…operations are centered in Fort St. John, B.C., with a satellite office located in Hinton, Alberta…Macro maintains one of the most modern fleets of heavy equipment in the industry…Friday, MCR hit a new all-time high of $4.95…note John’s Fib. level, though, in this 6-month weekly chart…as always, perform your own due diligence…

Aldrin Resource Corp. (ALN, TSX-V)

If you’re bullish on the Fission-Alpha uranium play in Saskatchewan, as we are, then you should also be paying attention to Aldrin Resource Corp. (ALN, TSX-V) which we’ve been tracking with interest over the last few months…ALN has staged a confirmed breakout above the 11-cent level, an event we’ve been anticipating, and below is a 6-year monthly chart from John that shows the next major technical resistance around 18 cents…an August field program will follow up any anomalies detected by a high-resolution radiometrics survey covering the company’s Triple M Property, 10 km southwest and on trend to the Patterson Lake discovery…the primary goal of the airborne geophysical surveys and surface geochemical work is to generate the best drill collar locations to test the already-identified basement conductors when drilling starts, as anticipated, next January…ALN is down a penny at 11.5 cents as of 7:45 am Pacific…

Silver Update Including Charts

HSBC looks for Silver to trade in a range of $17 to $23 an ounce for the remainder of 2013, with rising supply to constrain rallies but greater jewelry, industrial, coin, bar and Indian import demand to be supportive influences…the bank has upped its average 2013 price forecast to $22.90 an ounce from $21…it left its forecasts for the next 2 years at $20 and $20.25…“Silver prices will be determined largely by the interplay between currency levels, monetary and fiscal policies, geopolitics, the price of other precious metals, notably Gold, and Silver’s underlying supply/demand fundamentals,” HSBC said…a couple of interesting notes from HSCB’s commentary…the bank lists total supply of 1.08 billion ounces for 2013, with mine output seen rising to 805 million this year from 787 million last year and Silver scrap sales edging up to 260 million from 254 million…meanwhile, shifting expectations toward U.S. monetary policy have dented the strength of investment demand, the bank said…the net-long position of Comex speculators fell to historically low levels…ETF demand remains positive but is dropping…“We have cut our 2013 forecast for ETF demand growth to 20moz from 50moz, the lowest annual increase on record,” HSBC said…“That the ETF’s are up on the year is impressive, but we expect tepid growth to curb rallies”…

Short-Term Silver Chart

Silver has a very strong support band between $17.50 and $19.50, with sell pressure declining gradually as shown in this 3-year weekly chart…

Long-Term Silver Chart

RSI(2) has been in extreme oversold territory on this long-term chart for quite some time now, and recently has come off its lows but is still only at 7.69%…if history is any guide, RSI(2) on this 11-year monthly chart is telling us that these aren’t the right conditions to be dumping Silver – the best time to be a seller is when RSI(2) is at much higher levels…if anything, now is probably a good time to accumulate in anticipation of a rally at the very least…

Note: John, Terry and Jon do not hold share positions in RIC, ELD, MCR or ALN.

10 Comments

Nice to see VGN updated their website finally

greencastleresources.com/s/Home.asp

Still waiting for an explanation from Jon on this bulls bears stuff?! You speak as if there are literally people sitting behind trading screen (bears/bulls) battling it out. Why would anyone want anything to go down like these bears you speak of? Unless they were shorting something.

Jon, are you still planning on doing an interview with v.GMZ?

Certainly, just waiting for news regarding Alabama….

v.cvn private placement closed Friday. Beside Zen….similar anomalies..looks promising and a bargain at .07!

Check out tcr for a graphite play this stock could skyrocket if their plan works out

Headline: Rainbow Resources Completes Acquisition of Graphite Claims adjacent to Eagle Graphite property (TheNewsWire)

(August 6, 2013 – 2:04 PM EDT)

I warned about chasing stocks and said you would be able to pick up dyg in a few days at .02 when it was trading at .03 today was the day some were traded at .02 .Also ggi is selling much cheaper today then several days ago.

Todays smile lord knows we all need a little humour right now.THE prayer of a realist LORD thou knowest Iam growing older keep me from becoming talkative and possessed with the idea that I must express myself on every subject RELEASE me from the craving to straighten out everyones affairs.KEEP me from recital of endless detail. GIVE me wings to get to the point.SEAL my lips when Iam inclined to tell everyone of my aches and pains they are increasing with the years and I love to speak of them grows sweeter as time goes by.Teach me the glorious lesson that occasionally Imay be wrong.MAKE me thoughtfull but not nosey helpful but not bossy .WITH my vast store of wisdom and experience it does seem a pity notto use it all .BUT thou knowest LORD that I want a few friends at the end.

Terry, John & Jon are involved in a grisly crime and are all sentenced to death.

The executioner told them that they would each get to choose the method by which

they would die.

Their choices were: lethal injection, electric chair or by hanging.

Terry was afraid of needles and didn’t want to be hanged. Terry chose

the electric chair.

He sat in the chair and they pulled the switch and nothing happened.

The executioner said that if this happens a second time that he could go free.

They tried a second time and again nothing happened so they set him free.

John was also afraid of needles and didn’t want to be hanged so he too chose

the electric chair.

Once again, the chair didn’t work and he was free.

Next it was Jon’s turn to pick how he was to be executed.

He said “I’m afraid of needles, the electric chair won’t work so you’re going

to have to hang me”.