Updated at 7:50 am Pacific

Gold is taking a breather today after climbing $62 an ounce last week and blasting through critical resistance around $1,350…as of 7:50 am Pacific, bullion is down $9 an ounce at $1,368 after touching an overnight high of $1,383…Silver is down a dime at $23.16…(see updated Silver charts below)…Copper is off 3 pennies at $3.30…Crude Oil is flat at $107.40 and should continue to be underpinned by strong demand and unrest in Egypt…the U.S. Dollar Index, meanwhile, is off slightly at 81.26…

SPDR Gold Trust, the world’s largest Gold-backed ETF, says its holdings rose 0.26% to 915.32 tonnes on Friday…the fund posted a 0.4% climb in holdings last week – the first increase in nearly a year…while western Gold investors have been moving out of ETF’s, with holdings falling by a dramatic 402.2 tons in the 2nd quarter, that selling has been “absorbed” by a 71% rise in demand from India and an 85% jump in demand from China during the same quarter, according to the World Gold Council…the effort by India’s rather incompetent government to convince its citizens not to buy Gold is simply not working, and may even be having the opposite effect…whether legally or illegally, Indians want their Gold and may even desire it more – not just because of a cultural affinity for bullion, but for safe haven purposes as well…

SPDR Gold Trust, the world’s largest Gold-backed ETF, says its holdings rose 0.26% to 915.32 tonnes on Friday…the fund posted a 0.4% climb in holdings last week – the first increase in nearly a year…while western Gold investors have been moving out of ETF’s, with holdings falling by a dramatic 402.2 tons in the 2nd quarter, that selling has been “absorbed” by a 71% rise in demand from India and an 85% jump in demand from China during the same quarter, according to the World Gold Council…the effort by India’s rather incompetent government to convince its citizens not to buy Gold is simply not working, and may even be having the opposite effect…whether legally or illegally, Indians want their Gold and may even desire it more – not just because of a cultural affinity for bullion, but for safe haven purposes as well…

Even though central banks are expected to buy fewer Gold bars than previously expected in 2013 (they are now expected to be net buyers of 300 to 350 tonnes of Gold in 2013, down from an earlier forecast of 400 to 450 tonnes, according to the WGC), demand from China and India should pick up the slack…they were the runaway leaders and indications are that Q3 demand from “Chindia” will also be very impressive…

Venture Exchange Long-Term Chart

Was the Venture’s June 27 intra-day low of 859 the bottom in the 2+ year bear market cycle for junior resource stocks, as Eric Sprott suggested last week?…Gold hit a low of $1,180 June 28 before reversing higher, and since those late June lows the Venture is up 9.4% while bullion has climbed 17%…when the Venture is really flying, when it’s in a bull phase, it typically out-performs Gold…that pattern hasn’t emerged yet but that’s something to watch for as a possibility in the coming weeks…

Below is a 13-year Venture monthly chart that offers some encouragement…there’s a long-term support band between 844 and 887…notice, as well, how the RSI(14) is now moving higher after being in decline since late last year…this indicator may have bottomed out just slightly above its 2008 low when the Venture sank to 679…at the very least, a significant rally appears to be in the works with this important turnaround in the RSI(14)…

The Venture posted a 19-point gain last week, thanks to the breakout in Gold prices and continued firmness in Crude Oil and Copper…the Index closed Friday at 940, its 100-day SMA (which is still in decline, may provide some minor resistance), and seems destined in the near future to test strong resistance at 970…a key technical event that certainly could occur before the end of the month – even potentially this week – is a reversal to the upside in the 50-day SMA…this would add some much-needed fuel…the long-term chart also shows that the -DI indicator may have recently peaked as it did during the 2008 Crash…

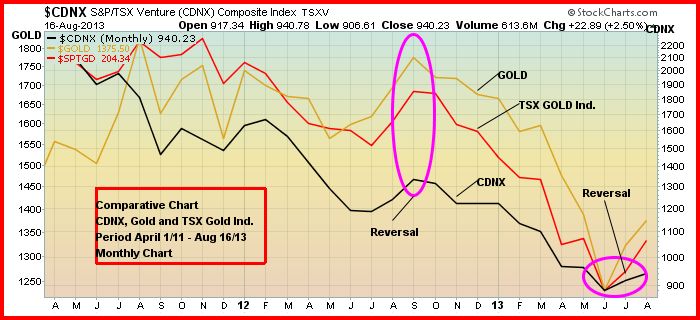

Venture-TSX Gold Index-Gold Comparative Chart

Below is a monthly comparative chart that goes back to April, 2011, shortly after the Venture bear market began…the Index went from being an “out-performer” to an “under-performer” even though Gold prices took off in the summer of 2011 to an all-time high…at the very least, what this chart tells us is that we’re currently in the midst of a strong rally for Gold and Gold stocks that could have some legs to it…it’s too early to tell, though, whether this is the beginning of a new bull phase…for confirmation of that, we’d like to see the Venture out-performing Gold and even the broader markets…

Today’s Markets

The Venture is off 1 point at 939 as of 7:50 am Pacific…Intertainment Media Inc. (INT, TSX-V) is the runaway volume leader so far this morning, climbing 4 cents to 9.5 cents on news that its Ortsbo Inc. subsidiary has formed a partnership with Telus International to support global customer care…Zenyatta Ventures (ZEN, TSX-V) is strong this morning, back above the $4 level…

Zara Resources (ZRI, CNSX) is trying to throw its weight around again, what little it has…Zara announced 3 simultaneous takeover bids this morning (all for shares in ZRI) of Greencastle Resources (VGN, TSX-V), Altai Resources (ATI, TSX-V) and Visible Gold Mines Inc. (VGD, TSX-V)…previously, ZRI made an offer to accredited investors of VGD for up to 19.9% of Visible which expired July 25…it’s now making an offer for all VGD shares in addition to 100% of VGN and 100% of ATI…this is Danny Wettreich on steroids this morning…is he a schemer, as one of our readers suggested this morning, an opportunist, an entrepreneurial genius, a dreamer, an lunatic, or what, exactly?…one thing’s for sure – he’s no Pete Bernier…at least Wettreich is providing some entertainment and giving a few companies a push…

“The enlarged Zara group of companies will have approximately $13,738,000 in net cash and securities after payment of all current liabilities and a resource development portfolio of Gold, nickel-copper, and oil and gas, located in Canada in Quebec, Ontario, British Columbia, Alberta and Saskatchewan, and also in Nevada, USA,” stated Zara CEO Wettreich. “This is a dramatic and innovative simultaneous offer for three public companies, and is designed to offer the shareholders of these companies the opportunity of participating in the creation of a viable natural resource company led by the dynamic, experienced and innovative management team of Zara.

“I expect annual savings of approximately $1,200,000 by putting these companies together. Substantial savings will result from the elimination of excessive management fees, duplicated public listing costs, duplicated office and administration costs and other wasteful practices. The enlarged Zara will be lean, efficient, cash rich, asset strong and managed by directors who are sensitive to shareholders best interests.

“Over the last three years, these companies have seen share price declines ranging from 79 per cent to 96 per cent, while the directors of these companies have paid themselves a total of $2,505,640. Shareholders of these three companies, which comprise about 3,000 investors, can transform their investment by becoming shareholders of a significant new company with a bright future. Further, by accepting the Zara Offer shareholders can establish a tax loss on their investment.”

The TSX is off 61 points as of 7:50 am Pacific while the Dow, coming off its worst week of the year, is up slightly through the first 85 minutes of trading…Fed watchers will be dissecting Wednesday’s release of minutes from the August Federal Open Market Committee meeting for clues on how and when a scaling back of the $85 billion in monthly bond purchases could occur…the annual Kansas City Fed gathering in Jackson Hole starts Thursday, and while Fed Chairman Ben Bernanke will not be there, other officials will be, and they are bound to continue to express their views on Fed policy…

China’s Shanghai Composite led Asian markets higher overnight with a gain of 17 points to close at 2086…Japan’s Nikkei average finished 108 points higher at 13758…European shares were down modestly today…

Amarc Resources Ltd. (AHR, TSX-V)

The junior resource market since early 2011 has taken its toll on just about every junior, and Amarc Resources (AHR, TSX-V) is certainly no exception as it’s trading at all-time lows…we’ve mentioned AHR occasionally in recent months and we’ll have more later this week…with a decent cash position ($6 million as of its March 31 year-end) and a portfolio of high quality properties in B.C., however, the opportunity for a significant turnaround in AHR clearly exists…it seems traders/investors love to buy when they see everyone else piling in, even at the top of a market, but few individuals have the nerve to jump in at or near the bottom after a stock has taken a beating…the chart tells us that AHR has been forming a strong base between a nickel and 6.5 cents, a foundation it has a good chance of building on over the next couple of months – especially, of course, if the company can create some excitement on the exploration front which it clearly has the ability to do…patience is a virtue…as always, perform your own due diligence…as of 7:50 am Pacific, AHR is up half a penny at 6 cents…

Radius Gold Inc. (RDU, TSX-V)

Simon Ridgway’s Radius Gold (RDU, TSX-V) is beginning to come to life…it gained 2.5 cents last week on increased volume to close at 12 cents…keep in mind, the company holds approximately 4 million shares of B2Gold (BTO, TSX) which reported excellent Q2 results recently with the stock climbing as high as $3.69 last week after trading as low as $2.17 in July…BTO has weakened this morning, however, on news that it has launched a private offering of $225 million U.S. of convertible senior subordinated notes due 2018…Radius has JV’s with B2Gold in Nicaragua and Fortuna Silver Mines (FVI, TSX) in Mexico…

For the quarter ending March 31, Radius reported working capital of $15 million or 17 cents per share with BTO trading at about the same price as it is now…so RDU is currently trading significantly below its working capital position, and the outlook for BTO appears to be very bright as we mentioned last week…what’s going to be particularly interesting in the coming weeks is whether or not Radius “seizes the moment” and pulls the trigger on a property deal of some sort…the company’s stated objective is to use its treasury “to acquire distressed projects or companies and unlock their potential…the drying up of equity funding for junior explorers is creating a unique window of opportunity”…

In late February, Radius stated the following in a news release:

“Management is conducting an extensive review of precious metal exploration projects that may be available for acquisition or joint venture. A number of projects have been identified internally or submitted to Radius’s management team for review. Radius has signed confidentiality agreements with a number of companies to allow detailed technical and legal/fiscal reviews to be carried out, and its geologists have recently completed site visits to some of the projects.

“Management is optimistic that the company will be able to acquire significant stakes in one or more projects within the next six months. Further news on the acquisition effort will be reported as and when the terms of any deals are negotiated”.

That 6-month window is closing rapidly, and given improving market conditions Radius would probably be wise to pull the trigger sooner rather than later…we’ll see what happens…

Below is a 2.5-year weekly RDU chart that shows 3 critical developments: 1) Strong up momentum in RSI(14); 2) A bullish +DI/-DI crossover; and 3) A prolonged period of sell pressure has been replaced with buy pressure which is increasing…RDU has 87 million shares O/S (no warrants outstanding which is positive)…as always, perform your own due diligence…

Castle Resources Inc. (CRI, TSX-V)

As the junior resource market continues to heal, a situation to watch closely in northwest British Columbia is how the high-grade Granduc Copper Project near Stewart plays out…just over a month ago, Castle Resources (CRI, TSX-V) engaged KPMG Corporate Finance to identify, analyze and execute a transaction that will fast-track the development of Granduc…the company is considering a range of transaction structures, including a joint venture, off-take agreement, earn-in or some form of business amalgamation or merger…since that announcement, the stock has traded between a low of 2.5 cents and a high of 6 cents on total volume (all exchanges) of 54.1 million shares (27 trading sessions)…this huge spike in volume included a 22 million share day July 29…volume spikes typically precede big share price moves…

In February, Castle issued a Granduc PEA using a measured/indicated resource of 11.3 million tonnes grading 1.47% Cu, 0.17 g/t Au and 12.4 g/t Ag, and an inferred resource of 44.6 million tonnes grading 1.43% Cu, 0.19 g/t Au and 10.7 g/t Ag…the capex is estimated at $494 million…the payback period is 4 years with annual production averaging 70 million pounds of payable Copper equivalent over a 15-year mine life…resources are open for expansion, and excellent infrastructure is in place…the PEA envisions an underground mining operation similar in scope to the historic mining operations at Granduc in the 1970’s and 1980’s…

Below is an 8-month weekly CRI chart from John…a bullish reversal pattern has formed in the last 3 weeks, RSI(14) is beginning to show strong momentum and the overall bearish trend is clearly weakening…CRI collapsed from a high of nearly $1 in early 2011 to a multi-year low of 2.5 cents…as the saying goes, you sell high and buy low…there is significant value in Castle’s Granduc Project, especially considering the high-grade nature of it…with nearly 200 million shares outstanding, CRI’s market cap is just under $10 million based on Friday’s 5-cent close…it’s off half a penny at 4.5 cents in early trading today…

Contact Exploration Inc. (CEX, TSX-V)

A junior oil and gas company we’re watching closely, for technical and fundamental reasons, is Contact Exploration (CEX, TSX-V) which is currently producing at a rate of 450 Boe/d (vs. 66 Boe/d in Q1 2013)…CEX is positioned in the heart of the Montney trend and tripled its reserves in fiscal 2013 (ending March 31), thanks in large part to its East Kakwa discovery, a liquids-rich natural gas play, in the Deep basin in Alberta…on August 8, Contact announced the closing of an over-subscribed $6.5 million financing…the company has no debt and is poised to continue to grow its reserves and production (it has assets in Alberta and New Brunswick)…since late last year, CEX has traded in a horizontal channel between 18 and 28 cents…it closed Friday at 26 cents, and a breakout above that horizontal channel at some point in the near future appears quite possible given the progress this company is making…CEX has 250 million shares outstanding, following this latest financing, for a total market cap of $65 million…as always, perform your own due diligence…

Updated Silver Charts

Silver has been out-performing Gold recently with the Gold-Silver ratio (GSR) beginning to decline (we’ll have a couple of interesting charts on that tomorrow)…this typically indicates positive money flow into precious metals and a bullish trend for precious metals…Silver gained a whopping 13% last week to close at $23.26 while bullion jumped 4.7%…sales of American Eagle Silver coins by the U.S. Mint rose to 31 million ounces year to date, closing in on the 33.7 million ounces sold in all 2012…

Silver Long-Term Chart – 11-Year Monthly

The long-term chart, which we’ll start with this morning, shows very stiff and critical resistance at $26 which will take time to overcome…notice that the RSI(2), which is coming off historical lows, is now at 73.98%…it will likely push higher and remain in the overbought zone for a modest period of time before correcting – similar to previous patterns in 2008-2009 and 2012…

Short-Term Silver Chart -6-Month Daily

The Silver-Gold ratio has broken decisively above its downtrend line, an interesting development…RSI(14) is showing strong momentum and is now at 77%…it’s in the overbought zone but still has room to move higher…looking for conifrmation of a breakout above the $22-$23 resistance band…next significant resistance would be at $24…

Note: John holds a share position in AHR. Jon holds share positions in CRI and VGN.

29 Comments

ggi 200,000 for sale at .135

Big int news!!!!! Hate to say I told you so. Any apologies????

int from 3 buks to 3 cents who cares about int

Zara as a company may be just a shell then goes after beaten down compnaies with ‘lifestyle’ management.

regardless, they have no cash flow but do have properties that have 43-101’s filed…

Winston Resources is also at the same address… hmmmm

other companies may do well by paying attention to this because more vulture companies like Zara will spring up…. and the cash cows for the lifestyle peeps will be over.

brilliant if you ask me… and yet disgusting at the same time…. but it is biz yes??

oup halted so check out the connection to acn

Bob guys like you always avoid the issues eh. How the shortened ran int sp up has nothing to do with company. Maybe you should read their latest release and then ill go over it with you as in sure you won’t understand it.

Your pumping zen with no more then couple hundreds k volume each day to substantiate the huge rise???? Oh boy like the writing isn’t on the wall there.

your pumping int pos thats what it is

Thanks Heath, looking forward to your take on the latest NR.

Bob is it to much to ask for you to contribute something of intelligence? Ur last post was incoherent off topic unrelating to the topic being discussed and looked like it was written by a five year old whilst in a temper tantrum

@jon. You got nothing to say on int news. I specifically remember you asking my in a sarcastic manner for int update a while back no? Also u mentioned int couple times in ur musings.

I’m very happy for you, all shareholders and the market as a whole that INT is doing so well today, Heath, and on great volume. Hopefully this is the beginning of a new uptrend for INT.

heath you ran around here trashing everything you want respect grow up

regardless of individuals, INT has had a great platform…. bad implementation…

I loaded up at .80… knew that tech support, and live chats would be a boon for this technology.. as well as mobile push… POYNT was another star that dimmed…

but I think that was orchestrated by INT…

regardless global technolgy needs real time translation… int has it, and this telus deal may just validate it.

earnings??? remains to be seen….

Heath may have been more diplomatic, but thats not who he is:) dont trash anyone for being themselves!! just my opinion of course:)

Jon I was expecting a bit more actually. You did a int write up a while back how they acquired poynt well today’s news is huge. A signed contract with Telus!!!! And just the start. Going to be lots more surprises by summers end. Ortsbo has what people need to globalize and there platform has proven far superior to even Microsoft translation tech.

ACN 300,000 share bid just popped in as i understand they have there drill holes collared in nevada so must be getting ready to drill new discovery

awesome property 15 mil OS shares

INT financing announced in June is enough to make me wary. 12% interest,an 8% commission , 10 cent convertible shr, 3yr wt at 12 cents to the undersubscribed holders of the deb they are offering, initiated by an offshore fund. hmmm add to the 400MM shrs out, by no means a bottom fish

David – ture enuff… I have asked Heath repeatedly about who he knows, and what he knows with no response…

I know one that knows Lutach… and the Telus deal refutes this person opinion that INT is a scam…

so here are some insider sells… INT – lutach a ton in Jan of this year

HAO – none

TJ – CFO on the upswing… sold into the rally

BKT – none

so if these deals, and NR’s are so fkn good then wheres the insider support..??? huh????

thus one needs to continue to be vary!! but still no doubt that the telus deal is a good one!

Jon

what is your opinion of CFO, Clifton Star, thanks

There are better opportunities, I think…..volume and price have both picked up in recent days and now the stock is up against resistance at its still-declining 100-day SMA…I don’t know if they’ve got all the issues sorted out yet with Duparquet, I’d really have to spend some time to review it and probably speak to some geos in that area again…it’s certainly quite possible the stock has bottomed out in the low 20’s….appears that way……they do have a significant resource there, and if the Gold market and overall market go higher as we expect then CFO would certainly go along for the ride…….will keep an eye on it…..

Thanks Jon

been watching it for a while and it seems that it did bottom in the low 20’s, the key to this and others is the gold price, if gold can strongly break 1400, then I think CFO and others will really start to move again. thanks for your feedback

Jeremy the insider sales were explained in an nr. Do your research. Why do you not mention the 100s of thousands dl bought ??? It’s all right there clear as day my friend had you actually looked!!!

And Jeremy what you basically just said in your own words is that your friend that claims to know dl is a. A liar or b. just hasn’t a clue

INT 10 mil warrants at .10 cents to hit the market as they expire in Sept

INT 35 mil share debenture at .10 plus warrants

rollback candidate wouldn’t touch this with anybodies money

INT 400 mil OS share already

The pres at one time had 30 mil shares i see he is now around 12 mil

if they off spin there won’t be much left

Heath… thx for proving yourself…. when I looked at the insider reports there were NO buys… only sells… if I could post the screen shot I would.

you dont have to continually defend yourself you know… but since you seem to think you have to makes everyone wonder about your agenda…

the last you will hear from me Heath…

Providing Insider News and Knowledge to Investors

Company Report: Intertainment Media Inc. (V:INT) August 19, 2013

A snap shot of company officer and director insider public-market activity for the past year, recent marker data plus a

list of all insider transactions and holdings.

Public Market Activity: Company Officers and Directors

Price and volume charts represent common share or trust unit transactions by company officers and directors reported in SEDI. Information on the charts may not

include transactions by insiders of subsidiaries, 10% security holders or other insiders, or trades in other securities such as options or convertible debt.

One Year Public Market Bias

Company Officers and Directors

Buying Selling

CEO $160,350 -$729,215

CFO None None

OFFICER None None

DIRECTOR None None

Total $160,350 -$729,215

Net Selling -$568,865

CEO and CFO titles of insiders are provided on a reasonable efforts basis,

as are the elimination of duplicate filings across multiple accounts in net

buying or selling totals. All data presented should be treated as estimates as

it is based on insider filings subject to input errors. This report does not

constitute a buy or sell recommendation for the security.

Previous Day’s Marker Trading

(Insiders and Marked Significant Shareholders)

Ticker

Volume

Buy Sell Net

No Activity Reported

Previous day’s marker trades may not be represented on the charts.

Before using this data, see last page for details on Marker reports.

Report Tutorial Video: inkresearch.com/pdf_tutorial/company.html English

About INK Research

Through our PDF reports, as well as our alerts, interactive charting and analytical services delivered via inkresearch.com, INK

provides insider news and knowledge to investors.

For sales and trial subscription information please contact [email protected] or call us at 604-669-4465 #333.

See important disclaimer at the bottom of the last page.

inkresearch.com Page 1/9

Providing Insider News and Knowledge to Investors

August 19, 2013

Latest Filings Over the Past 12 Months – Maximum 60

/ CEO / CFO / OTHER OFFICER / DIRECTOR / ISSUER / 10% HOLDER / SUBSIDIARY EXECUTIVE / DEEMED INSIDER

– Information that has been adjusted or estimated by INK – Amended filing

Transaction Shares/ Account

Date Insider Name Ownership Type Nature of Transaction Security Price ($) Units Change* Account Balance

May 15/13 Lucatch, David Marc Direct Ownership Private sale Exchangeable Shares Warrants 0.00 -1,500,000 -54.5% 1,250,000

May 15/13 Lucatch, David Marc Direct Ownership Private sale Common Shares 0.100 -1,000,000 -7.7% 12,030,665

Apr 25/13 Lucatch, David Marc Direct Ownership Prospectus exempt sale Exchangeable Shares Warrants 0.290 -1,500,000 -35.3% 2,750,000

Apr 23/13 Lucatch, David Marc Direct Ownership Private sale Common Shares 0.00 -800,000 -5.8% 13,030,665

Feb 4/13 Lucatch, David Marc Direct Ownership Public market sale Common Shares 0.135 -25,000 -0.2% 13,830,665

Feb 4/13 Lucatch, Jana Gayle Indirect Ownership Public market sale Common Shares 0.135 -25,000 -0.8% 2,996,666

Jan 17/13 Lucatch, David Marc Direct Ownership Public market sale Common Shares 0.150 -20,000 -0.1% 13,855,665

Jan 17/13 Lucatch, Jana Gayle Indirect Ownership Public market sale Common Shares 0.140 – 0.150 -20,000 -0.7% 3,021,666

Jan 16/13 Lucatch, David Marc Direct Ownership Public market sale Common Shares 0.150 -20,000 -0.1% 13,875,665

Jan 16/13 Lucatch, Jana Gayle Indirect Ownership Public market sale Common Shares 0.145 -20,000 -0.7% 3,041,666

Jan 15/13 Lucatch, David Marc Direct Ownership Public market sale Common Shares 0.160 -26,000 -0.2% 13,895,665

Jan 15/13 Lucatch, Jana Gayle Indirect Ownership Public market sale Common Shares 0.160 – 0.165 -40,000 -1.3% 3,061,666

Jan 15/13 Patterson, Girvan Leigh Direct Ownership Options granted Options 0.170 285,000 30.8% 1,210,000

Jan 14/13 Lucatch, David Marc Direct Ownership Public market sale Common Shares 0.170 -14,000 -0.1% 13,921,665

Jan 11/13 Lucatch, David Marc Direct Ownership Public market sale Common Shares 0.175 -20,000 -0.1% 13,935,665

Jan 11/13 Lucatch, Jana Gayle Indirect Ownership Public market sale Common Shares 0.175 -20,000 -0.6% 3,101,666

Jan 10/13 Lucatch, David Marc Direct Ownership Public market sale Common Shares 0.175 -20,000 -0.1% 13,955,665

Jan 10/13 Lucatch, David Marc Direct Ownership Warrant exercise Common Shares 0.130 1,250,000 9.8% 14,015,665

Jan 10/13 Lucatch, David Marc Direct Ownership Warrant exercise Exchangeable Shares Warrants 0.130 -1,250,000 -22.7% 4,250,000

Jan 10/13 Lucatch, Jana Gayle Indirect Ownership Public market sale Common Shares 0.175 -40,000 -1.3% 3,121,666

Jan 10/13 Lucatch, Jana Gayle Indirect Ownership Warrant exercise Common Shares 0.130 900,000 39.4% 3,181,666

Jan 10/13 Lucatch, Jana Gayle Control or Direction Warrant exercise Exchangeable Shares Warrants 0.130 -900,000 -100.0% 0

Jan 9/13 Jonasson, Edward Direct Ownership Options granted Options 0.170 500,000 50.0% 1,500,000

Jan 9/13 Lucatch, David Marc Direct Ownership Options granted Options 0.170 1,250,000 41.3% 4,278,572

Jan 9/13 Lucatch, David Marc Direct Ownership Public market sale Common Shares 0.180 -20,000 -0.2% 12,725,665

Jan 9/13 Lucatch, Jana Gayle Direct Ownership Options granted Options 0.170 225,000 6.2% 3,875,000

Jan 9/13 Parry, Brad Direct Ownership Options granted Options 0.170 500,000 50.0% 1,500,000

Jan 9/13 Pearlman, Anthony R. Direct Ownership Options granted Options 0.170 500,000 33.3% 2,000,000

Jan 9/13 Puritt, Jeffrey Dana Direct Ownership Options granted Options 0.170 450,000 100.0% 900,000

Jan 9/13 Shea, Kevin Direct Ownership Options granted Options 0.170 290,000 100.0% 580,000

All data based on insider regulatory filings which are subject to input errors.

* Indicates percentage change of shares or units for the account in which the security is held. Many insiders have more than one account and the balance for each is calculated separately. See Holdings Summary for balances across all

ownership types as reported in SEDI.

See important disclaimer at the bottom of the last page.

inkresearch.com Page 2/9

Providing Insider News and Knowledge to Investors

August 19, 2013

Latest Filings Over the Past 12 Months – Maximum 60 (cont’d)

/ CEO / CFO / OTHER OFFICER / DIRECTOR / ISSUER / 10% HOLDER / SUBSIDIARY EXECUTIVE / DEEMED INSIDER

– Information that has been adjusted or estimated by INK – Amended filing

Transaction Shares/ Account

Date Insider Name Ownership Type Nature of Transaction Security Price ($) Units Change* Account Balance

Jan 9/13 Willer, Herb Direct Ownership Options granted Options 0.170 450,000 45.0% 1,450,000

Jan 8/13 Lucatch, David Marc Direct Ownership Public market sale Common Shares 0.170 -20,000 -0.2% 12,745,665

Jan 8/13 Lucatch, Jana Gayle Indirect Ownership Public market sale Common Shares 0.170 -20,000 -0.9% 2,261,666

Jan 7/13 Lucatch, David Marc Direct Ownership Public market sale Common Shares 0.200 -20,000 -0.2% 12,765,665

Jan 7/13 Lucatch, Jana Gayle Indirect Ownership Public market sale Common Shares 0.200 -20,000 -0.9% 2,281,666

Jan 4/13 Lucatch, David Marc Direct Ownership Public market sale Common Shares 0.130 -20,000 -0.2% 12,785,665

Jan 4/13 Lucatch, Jana Gayle Indirect Ownership Public market sale Common Shares 0.135 -20,000 -0.9% 2,301,666

Jan 3/13 Lucatch, David Marc Direct Ownership Public market sale Common Shares 0.125 -20,000 -0.2% 12,805,665

Jan 3/13 Lucatch, Jana Gayle Indirect Ownership Public market sale Common Shares 0.125 -20,000 -0.9% 2,321,666

Dec 17/12 Lucatch, David Marc Indirect Ownership Private sale Common Shares 0.00 -1,000,000 -62.4% 602,558

Nov 20/12 Lucatch, David Marc Direct Ownership Private sale Common Shares 0.130 -1,475,000 -10.3% 12,825,665

Nov 15/12 Lucatch, David Marc Direct Ownership Option exercise Common Shares 0.130 1,475,000 11.5% 14,300,665

Nov 15/12 Lucatch, David Marc Direct Ownership Option exercise Options 0.130 -1,475,000 -32.8% 3,028,572

Sep 12/12 Jonasson, Edward Direct Ownership Option exercise Common Shares 0.140 50,000 58.8% 135,000

Sep 12/12 Jonasson, Edward Direct Ownership Option exercise Options 0.140 -50,000 -4.8% 1,000,000

Sep 12/12 Lucatch, David Marc Direct Ownership Option exercise Common Shares 0.140 171,428 1.7% 10,325,665

Sep 12/12 Lucatch, David Marc Direct Ownership Option exercise Options 0.140 -171,428 -3.7% 4,503,572

Sep 12/12 Lucatch, Jana Gayle Direct Ownership Option exercise Common Shares 0.140 150,000 15.4% 1,125,000

Sep 12/12 Lucatch, Jana Gayle Direct Ownership Option exercise Options 0.140 -150,000 -3.9% 3,650,000

Sep 12/12 Parry, Brad Direct Ownership Option exercise Common Shares 0.140 50,000 100.0% 100,000

Sep 12/12 Parry, Brad Direct Ownership Option exercise Options 0.140 -50,000 -4.8% 1,000,000

Aug 31/12 Lucatch, David Marc Direct Ownership Prospectus exempt buy Exchangeable Shares Warrants 0.290 2,500,000 83.3% 5,500,000

Aug 31/12 Lucatch, David Marc Direct Ownership Prospectus exempt buy Common Shares 0.200 2,500,000 24.6% 12,654,237

Aug 31/12 Lucatch, David Marc Direct Ownership Public market buy Common Shares 0.190 – 0.196 120,000 1.2% 10,154,237

Aug 30/12 Lucatch, David Marc Direct Ownership Public market buy Common Shares 0.185 50,000 0.5% 10,034,237

Aug 29/12 Lucatch, David Marc Direct Ownership Public market buy Common Shares 0.187 – 0.205 650,000 7.0% 9,984,237

Aug 28/12 Lucatch, David Marc Direct Ownership Public market sale Common Shares 0.200 -3,451,000 -27.0% 9,334,237

All data based on insider regulatory filings which are subject to input errors.

* Indicates percentage change of shares or units for the account in which the security is held. Many insiders have more than one account and the balance for each is calculated separately. See Holdings Summary for balances across all

ownership types as reported in SEDI.

See important disclaimer at the bottom of the last page.

inkresearch.com Page 3/9

Providing Insider News and Knowledge to Investors

August 19, 2013

Holdings Summary

Data is based on SEDI filings. Identified former insiders who ceased to be an insider more than a year ago are not shown. Roster may include

unidentified former insiders. Charts include identified former insider holdings up to the date they ceased to be an insider. Insiders and their

holdings are only included under one insider category. See last page for regulatory insider filing relationship definitions.

CEO’s Holdings (000’s) CFO’s Holdings (000’s)

Lucatch, David Marc Jonasson, Edward

Relationship as filed with regulators: 6 Relationship as filed with regulators: 5

Latest filing date: May 23, 2013 Latest filing date: January 15, 2013

Direct Ownership Direct Ownership

Common Shares 12,030,665 Common Shares 135,000

Convertible Debentures 0 Options 1,500,000

Exchangeable Shares Warrants 1,250,000 Special Warrants 0

Options 4,278,572 Warrants Exercise Price $2.00 42,500

Special Warrants 0

Warrants Exercise Price $2.00 119,530

Indirect Ownership

Common Shares 602,558

See important disclaimer at the bottom of the last page.

inkresearch.com Page 4/9

Providing Insider News and Knowledge to Investors

August 19, 2013

Holdings Summary (cont’d)

Data is based on SEDI filings. Identified former insiders who ceased to be an insider more than a year ago are not shown. Roster may include

unidentified former insiders. Charts include identified former insider holdings up to the date they ceased to be an insider. Insiders and their

holdings are only included under one insider category. See last page for regulatory insider filing relationship definitions.

Other Officers’ Holdings (000’s)

Belgue, William Scott

Relationship as filed with regulators: 5

Latest filing date: January 27, 2011

Direct Ownership

Common Shares 0

Options 274,000

Parry, Brad

Relationship as filed with regulators: 5

Latest filing date: January 15, 2013

Direct Ownership

Common Shares 100,000

Options 1,500,000

Special Warrants 0

Warrants Exercise Price $2.00 25,000

Pearlman, Anthony R.

Relationship as filed with regulators: 5

Latest filing date: January 15, 2013

Direct Ownership

Options 2,000,000

Wiseman, Mark

Relationship as filed with regulators: 5

Latest filing date: July 27, 2006

Direct Ownership

Common Shares 50,000

Options 50,000

See important disclaimer at the bottom of the last page.

inkresearch.com Page 5/9

Providing Insider News and Knowledge to Investors

August 19, 2013

Holdings Summary (cont’d)

Data is based on SEDI filings. Identified former insiders who ceased to be an insider more than a year ago are not shown. Roster may include

unidentified former insiders. Charts include identified former insider holdings up to the date they ceased to be an insider. Insiders and their

holdings are only included under one insider category. See last page for regulatory insider filing relationship definitions.

Directors’ Holdings (000’s)

Novak, Brian Elliott

Relationship as filed with regulators: 4

Latest filing date: July 27, 2006

Direct Ownership

Common Shares 206,934

Options 150,000

Patterson, Girvan Leigh

Relationship as filed with regulators: 4

Latest filing date: January 15, 2013

Direct Ownership

Common Shares 100,000

Options 1,210,000

Puritt, Jeffrey Dana

Relationship as filed with regulators: 4

Latest filing date: January 15, 2013

Direct Ownership

Options 900,000

Shea, Kevin

Relationship as filed with regulators: 4

Latest filing date: January 15, 2013

Direct Ownership

Common Shares 260,000

Options 580,000

Snowden, Thomas Brent

Relationship as filed with regulators: 4

Latest filing date: July 15, 2010

Direct Ownership

Common Shares 750,000

Options 350,000

Sparks, Lindsay Alexander

Relationship as filed with regulators: 4

Latest filing date: February 16, 2010

Direct Ownership

Common Shares 0

Options 625,000

Turack, Frederick Donald

Relationship as filed with regulators: 4

Latest filing date: July 27, 2006

Direct Ownership

Options 150,000

Willer, Herb

Relationship as filed with regulators: 4

Latest filing date: January 15, 2013

Direct Ownership

Common Shares 460,000

Exchangeable Shares Warrants 100,000

Options 1,450,000

Indirect Ownership

Common Shares 909,090

Convertible Debentures 0

Exchangeable Shares Warrants 909,090

See important disclaimer at the bottom of the last page.

inkresearch.com Page 6/9

Providing Insider News and Knowledge to Investors

August 19, 2013

Holdings Summary (cont’d)

Data is based on SEDI filings. Identified former insiders who ceased to be an insider more than a year ago are not shown. Roster may include

unidentified former insiders. Charts include identified former insider holdings up to the date they ceased to be an insider. Insiders and their

holdings are only included under one insider category. See last page for regulatory insider filing relationship definitions.

10% Holders’ Holdings (000’s)

Lucatch, Jana Gayle

Relationship as filed with regulators: 6

Latest filing date: February 12, 2013

Direct Ownership

Common Shares 1,125,000

Exchangeable Shares Warrants 250,000

Options 3,875,000

Warrants Expiring May 6-2012 0

Indirect Ownership

Common Shares 2,996,666

Special Warrants 0

Warrants Exercise Price $2.00 270,833

Control or Direction

Exchangeable Shares Warrants 0

See important disclaimer at the bottom of the last page.

inkresearch.com Page 7/9

Providing Insider News and Knowledge to Investors

August 19, 2013

Holdings Summary (cont’d)

Data is based on SEDI filings. Identified former insiders who ceased to be an insider more than a year ago are not shown. Roster may include

unidentified former insiders. Charts include identified former insider holdings up to the date they ceased to be an insider. Insiders and their

holdings are only included under one insider category. See last page for regulatory insider filing relationship definitions.

Deemed Insiders’ Holdings (000’s)

O’Connor, Robin Richard

Relationship as filed with regulators: 8

Latest filing date: July 27, 2006

Direct Ownership

Common Shares 579,126

Options 100,000

See important disclaimer at the bottom of the last page.

inkresearch.com Page 8/9

Providing Insider News and Knowledge to

Lucatch, David use to own around 30 mil shares of INT on the 1st run to over 3 buks

down to around 12 mil

Bobbo… ur the best man…. the company STILL may be viable… but it is no where near what it could be…

thx for this mate