2:30 pm Pacific

(Exclusive to BMR subscribers – Not for Distribution or Posting on any Board).

Venture Prepares For Powerful Finish To 2025

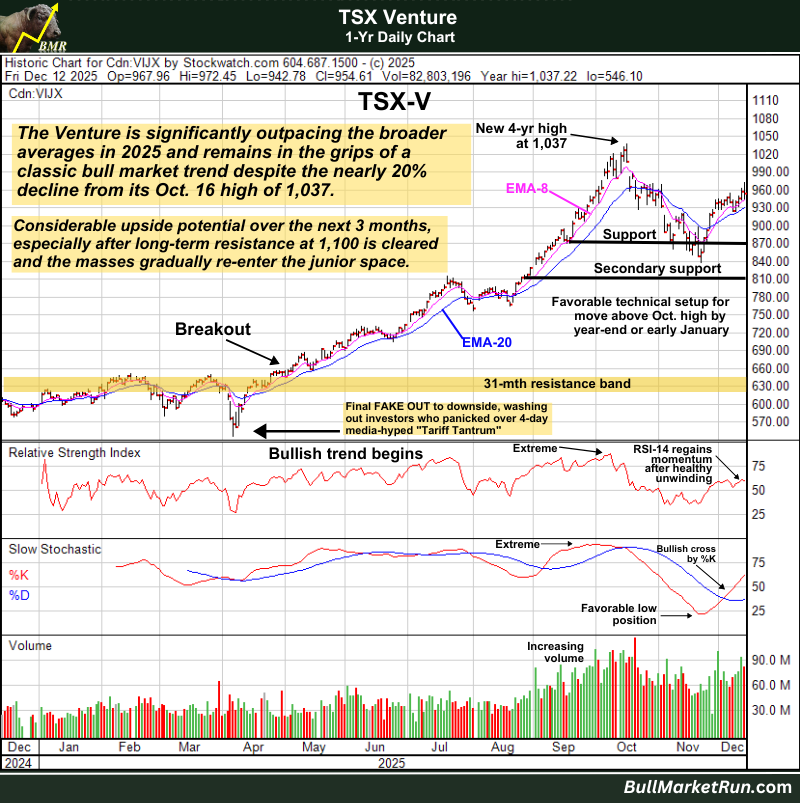

The Big Picture remains strikingly bullish for the Venture and broader markets heading into year-end, with limited further downside given such solid technical support and the right backdrop for a further lowering of rates from the Fed in Q1. The Venture endured a healthy ~20% pullback between mid-October and late November, a lot like the 20% correction in 2010 in the midst of the 2009–2011 cycle.

In bull market years, December lows typically occur early in the month – so there’s reason to believe the 924 intra-day low last Tuesday (Dec. 9) was the December bottom with the “January Effect” already underway. The Venture has an excellent chance of eclipsing its October high by month-end, setting the market up for the potential of a new 13-year high in Q1.

After surging to 1,037 October 16 when Gold and Silver hit new all-time highs, the Venture corrected 19.2% over 27 sessions with the bottom occurring Friday, November 22, when the Index dipped as low as 838 intra-day and reversed to close in the green at 854. That was the “TSN Turning Point”.

The 870–840 support band held perfectly.

The Venture’s 7-month winning streak came to an end but November’s loss was only 21 points or just over 2%. It’ll be back in the green for December.

Equity markets in general continue to have strong technical and fundamental tailwinds, much of it driven by astute policy choices in Washington and the capital markets’ confidence in how President Trump has approached the key issues of the day. The resource sector has an aura to it now, thanks to Trump’s energy and critical mineral policies that have forced a shift in thinking across the globe including Canada.

Investors believe there’s about a 25% chance the Fed will cut rates by another quarter point at its next meeting in January, while 50% expect another rate cut by March.

The Fed has recently been perplexed by the fact the U.S. economy is growing robustly based on GDP, but isn’t producing a lot of jobs. Inflation and tariffs are another obsession of some voting members. A key factor that’s really positive is that U.S. worker productivity (unlike Canada) is running very high, and that’s allowing for strong economic growth (~4%) while keeping inflation under control. Oil prices are under $60 a barrel, well below inflationary levels. There’s no reason for the Fed not to keep cutting rates – Trump is 100% correct about that, as he is about most things much to the chagrin of the left and their mainstream media surrogates.

This Trump bull market will have its occasional pullbacks but we see a Golden Age of prosperity and international peace emerging during this 2nd Trump term, and a high likelihood of a sustained primary bull cycle leading into the 2028 Presidential elections – particularly if Republicans are successful in next November’s mid-terms. They have some work to do on that front, but we’re optimistic.

Venture Short-Term Chart

The winning strategy during a bull market is to confidently embrace periods of relatively brief weakness as they lay the foundation for another leg to the upside for new highs.

Every pullback in the Venture since the breakout in late April has been an incredible buying opportunity.

With this ~20% correction out of the way, this next leg extending into 2026 should be the biggest yet from a purely technical standpoint if you understand Elliott Wave Theory.

This is a beautiful short-term chart with the Venture recently overcoming resistance at its 8 and 20-day EMA’s with those important moving averages also reversing to the upside.

For the week, the Venture was up 15 points to close at 955, bringing its yearly gain to nearly 60%.

Venture 2-Year Chart

The Venture was up 6.1% in May (“Buy in May and make some hay!”), 5.6% in June, 5.2% in July, 7.7% in August, 14.2% in September and 1% in October! It fell 2.2% in November to break a 7-month winning streak, but another winning streak will begin in December. The best time to be a buyer is right now before the “Seasonal Effect” drives prices up another 10 to 20%.

As predicted, there were no summer doldrums in 2025!

RSI(14), as you can see in the chart below, became quite extreme on the daily chart in July so an “unwinding” was in order which occurred between July 23 and August 1. The Index dipped as low as 756, rebounding from highly reliable support as predicted at the time.

The next “unwinding” and significant correction occurred starting October 16 with the Index falling as much as 199 points or 19.2% over 27 sessions.

Unshakeable support exists from 870 to 840. Immediately below that are other layers of support, so this bull market isn’t ending anytime soon.

- The bull market actually started in late 2023 and note how the long-term uptrend support was successfully tested in early April this year during the “Tariff Tantrum” correction – investors who were selling in panic on the Legacy Media’s headlines should have been greedily loading up at the uptrend line!

- Early April was the 5th brief spike below the 200-day moving averages (SMA, EMA) and each drop was followed by a powerful upside reversal – very bullish!

- 200-day SMA reversed to the upside in the 2nd half of last year and that’s a highly reliable indicator of a bull market that should carry on for many more months – perhaps for another year or 2 or more if the right political dynamics play out, punctuated of course by occasional pullbacks

We’re Well Into A New Market!

More investors are beginning to see what they should have seen developing many months ago – their eyes are finally opening to a bull market that very quietly began in late 2023 as we consistently stated at BMR.

No “summer doldrums” this year, a prediction that was bang-on.

Thanks in large part to an aggressive Trump administration putting an emphasis on resource development and a host of other business and market friendly policies, indices are on fire and we see a continuation of the current pattern through the rest of the year and possibly next year as well. Trump needs to keep things on a roll through at least the mid-term elections in November 2026. The full impact of his policies, from tax cuts to trillions of dollars in new investments, won’t be felt for another 6 to 9 months, just in time for the mid-terms.

Occasional pullbacks in the Venture are healthy and required in order to wring out some excesses in the market. Until July, we hadn’t seen 800 on the Venture since early May 2022. The Index bounced modestly off this support 3 times in the 1st quarter of 2022 before succumbing to it in May of that year, kicking off a rather violent plunge to below 600 by early summer as the bear market intensified. 800 then became new resistance, which was on display this year from late July into late August. With 800 now conquered, that’s a really powerful new level of support.

Now is the mirror image of 2022 – it’s a bull market, not a bear market, and the Venture has so far overcome every resistance area since its April lows. Increasingly it appears the Venture will challenge and likely eclipse its early 2021 high around 1,100 over the next couple of months. The winning strategy is to continue to embrace any dips and ride this bull market to its peak which is still at least many months away.

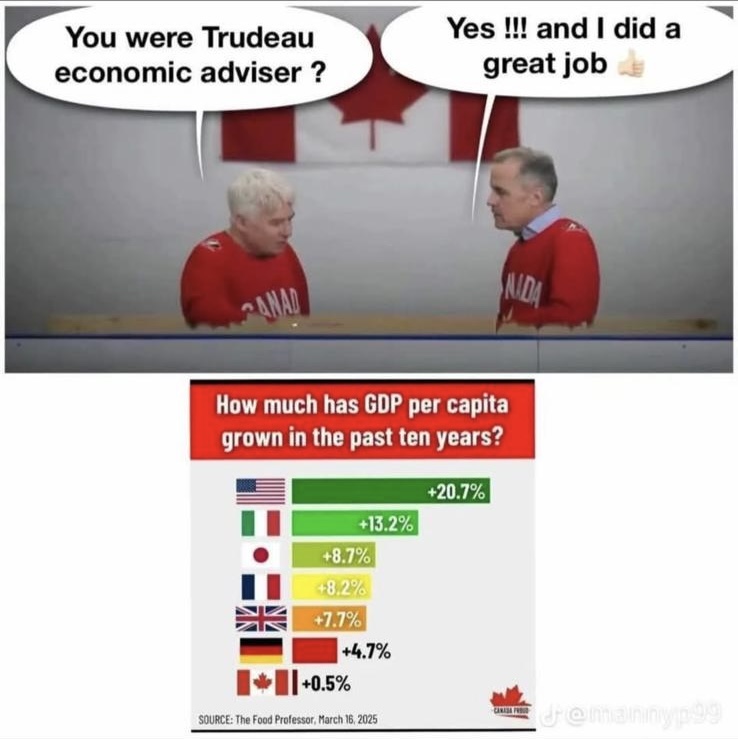

The Venture has jumped 357 points this year, for an impressive 59.7% gain, far better than any of the major North American averages. In our view this also foreshadows a big finish to the year on Wall Street, and why not with deep tax cuts, deregulation, increased business investment and productivity, and declining interest rates. It’s a perfect recipe for a booming market. Meanwhile, most commodities are hot, and Canada is very much a commodity-driven economy. But the politicians driving the bus in Canada have no idea where they’re going, so some words of caution are important.

Somehow, Canadian Industry Minister Mélanie Joly – an annoying left-wing Quebecer who clearly suffers from TDS – thinks America is “getting weaker”. Really? Notably, her opinion is shared by virtually all of her naive colleagues and a big swath of the electorate in Canada who identify as “progressives”. They actually believe their own bullshit. This group of left-wing ideologues, who put their faith in government (not the people), has done irreparable harm to Canada over the last decade and has even put national unity at stake, despite the (silly and damaging) “elbows up nationalism” promoted by the media and political elites.

The liberal mainstream media in Canada, blind to reality as they cover for their favorite party, didn’t challenge Joly on her crazy comment recently but of course we will. It’s essentially only “progressives” (with TDS) who believe America is “getting weaker”, and they are fools – they don’t know that they don’t know – because the USA is actually the hottest country in the world right now. It’s Canada that became weak and woke, and still is, under Joly and her incompetent Liberal colleagues over the past 10 years, a decade filled with “terrible lawsn” that still need to be overturned as Alberta Premier Danielle Smith reminded everyone while Carney was on vacation earlier this summer and Trump was piling up more wins.

The recent much-touted “energy deal” between Alberta and Ontario does nothing to change horrible Liberal laws that have severely damaged Canada’s competitiveness over the last decade – in fact, it will only further sow the seeds of the breakup of Canada as it’ll create expectations in Alberta and elsewhere in the West that simply won’t be met. B.C.and First Nations effectively have a veto over a new pipeline to the West Coast that Alberta so desperately needs. Meanwhile, federal Environment and Climate Change Minister Julie Dabrusin – what a piece of work she is – insisted the federal government is not rolling back its climate policy. And it’s not. Carney’s blarney is all about optics. Meanwhile, it’s puzzling that Danielle Smith would agree to any deal that binds the province to a future framework of higher industrial carbon pricing – makes no sense.

Never in its history has Canada been so poorly served by its political “leaders”. The Ford government in Ontario and the federal Liberals lied to the Canadian people and stirred up hatred against Trump, wrapping themselves in the Canadian flag in the process, simply to win their respective election campaigns (power is all they are interested in). Canadians fell for it, hook, line and sinker – Eastern Canada, in particular, and they still think everything is okay under “Carney the Saviour”.

Canada’s GDP is in decline or stagnant, while U.S. GDP is ripping well above 3% according to the latest data from the Atlanta Fed. Of course the Canadian media wants to blame “Trump’s tariffs” instead of going after the Liberals for their stupidity and failed “progressive” policies that have killed productivity, killed jobs, and killed investment, while also contributing to unsafe streets and immigration levels that are still way too high. The budget they’ve introduced, full of deception, won’t come close to driving the deep fundamental change that’s required in this country.

As each day passes, Canada becomes less competitive vs. Donald Trump’s tax-cutting, regulation-cutting, government-shrinking, crime-fighting, pro-business America which has already reversed course from the failed Biden-Harris “progressive” woke era (Canada needs to do the same) that delivered the highest inflation in decades, a border and immigration crisis that Trump quickly solved, and overseas wars that never would have started under Trump.

As for Carney, the former central banker is no match for Trump and has a horribly weak team behind him.

The resource and Crypto sectors would not be on fire if it weren’t for Trump – the Liberals have done everything to oppose the resource sector over the past decade, and only now – because of Trump – have they changed their tune a little bit. As for Crypto, they’ve been silent.

Government incompetence and inaction reign supreme in this country, not just at the federal level but across almost every provincial jurisdiction as well. In addition, most of the media and the general populace – especially in Eastern Canada – are suffering from TDS. This “cancer” has literally destroyed the Democrat Party in the United States – Marxist Mamdani, AOC and Bernie Sanders are now the faces of a leaderless far-left party devoid of any good ideas – and TDS has the potential to destroy Canada as well, leading to its breakup if Alberta gets so frustrated that it decides to go its own way in a year or two by finally telling Ottawa to _uck off for good. Canadians have a choice but the “progressive” path leads to destruction, just as it has for Democrats in the United States. The example to the south is clear for everyone to see. Canada dangles on the edge of a cliff. Our entire system is in need of a major reset, from the bureaucracy to the judiciary to corporate to medical to security/defence to First Nations who think they own the land and can dictate resource policy. Canada is very much a broken country right now, fundamentally flawed and dysfunctional after a decade of horrible management. Nothing is likely to change until the chickens come home to roost. When Canadians finally come to the realization that government is the problem, not the solution, we’ll all be better off.

Since most people in Canada are blind to the dangers that face this country, and since it may take another 6 to 12 months before very unfavourable Canada-U.S. economic comparisons become evident to everyone, we expect the markets here to continue to perform well into at least early-to-mid 2026. Every BMR subscriber’s goal should be to build strong cash positions by late spring/early summer. Make hay while the sun shines, because post-2026 becomes much more unpredictable for Canada and we will probably want to deploy capital elsewhere (there is already a net outflow of capital from Canada).

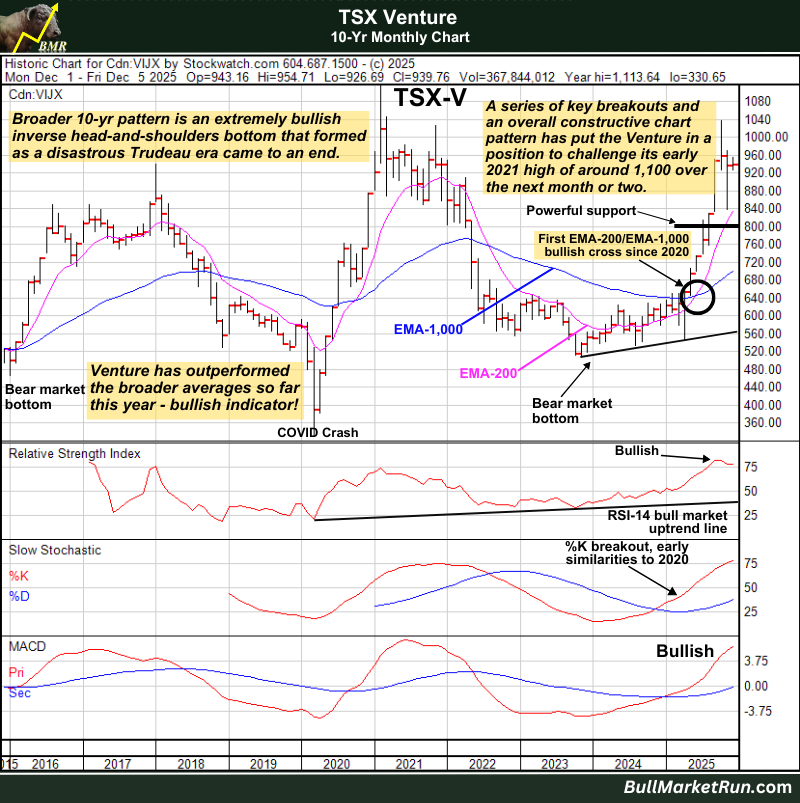

Venture Big Picture View

The Venture did something over the summer that it hasn’t done since 2020 – the 200-day EMA crossed above the 1,000-day EMA on the 10-year monthly chart, an extraordinarily accurate bullish indicator.

- CLASSIC inverse head-and-shoulders bottom in the 10-year pattern

- Strong RSI(14) momentum that should continue through at least year-end

- Breakouts in the SS and MACD similar to post-COVID crash

- The EMA-1,000 is gaining upside traction