Gold has hovered between $1,255 and $1,277 in advance of today’s October Fed minutes…as of 7:30 am Pacific, bullion is off its lows but down $11 an ounce at $1,264…Silver is off 6 cents at $20.28…Copper is flat at $3.16…Antofagasta Plc, the Copper company controlled by Chile’s billionaire Luksic family, predicts global supply and demand will remain in balance longer than previously thought on project delays and an increase in orders…Crude Oil is down nearly 50 cents at $92.86 while the U.S. Dollar Index has climbed one-quarter of a point to 80.78…

Gold Fields announced a return to profitability yesterday for the quarter ending September 30 ($9 million) vs. a net loss of $129 million in the June quarter…like many producers, the company is also significantly reducing the scope of its greenfields exploration activities – their 16 projects around the world will be cut to a much smaller nucleus…all these cutbacks in exploration by producers and juniors alike will serve to limit the number of future discoveries and new potential mines that eventually can come on stream which has to be considered bullish for long-term prices…

As far as this year is concerned, output from the world’s Gold mines is expected to hit record highs according to GFMS analyst William Tankard in a report from Reuters…“What we’re seeing is an ongoing response not to the slide in prices, but the decade-long stretch of fairly heavy capital investment into the mining industry that preceded it”, Tankard stated…the world’s top three Gold miners – Barrick Gold, Newmont Mining and AngloGold Ashanti – all reported higher production in the most recent quarter…metals consultancy Metals Focus says it expects Gold mine output to break through 3,000 tonnes a year in 2014 for the first time…that compares with an estimated 2013 output of 2,920 tonnes and 2012’s 2,861 tonnes, according to GFMS…global Gold production could start moderating in 2015…Thomson Reuters GFMS expects average all-in costs easing back to around $1,200 an ounce in 2013 from $1,228 last year…

Fed Minutes In Spotlight, Market Weighs Bernanke Comments

The U.S. Federal Reserve’s FOMC minutes from its October meeting will be released later toay (11:00 am Pacific), and as always traders and investors will be scrutinizing the report for any fresh clues on Fed monetary policy moves upcoming…some strategists do not expect to see much, if any, discussion of slowing bond purchases, but traders have been handicapping whether the minutes will show more Fed members leaning toward tapering…

Speaking last night at the National Economists Club in Washington, Ben Bernanke said the U.S. economy remains far from where the Fed wants to see it and that the central bank is still committed to its stimulus policies…Bernanke gave no hint as to precisely when Fed policymakers might begin cutting back the $85 billion a month bond-buying program, saying they remain “committed to maintaining highly accommodative policies for as long as they are needed”…he did state, however, that the FMOC “still expects that labour market conditions will continue to improve and that inflation will move towards the 2% objective over the medium term…if these views are supported by incoming information, the FOMC will likely begin to moderate the pace of purchases”…

Other comments from Bernanke last night (his first substantive monetary policy speech since March, although he has testified to Congress several times, and it could be the last such speech he gives before stepping down as Fed chairman in January) – typical Fedspeak…

“The economy has made significant progress since the depths of the recession. However, we are still far from where we would like to be, and, consequently, it may be some time before monetary policy returns to more normal settings.”

“I agree with the sentiment, expressed by my colleague Janet Yellen at her testimony last week, that the surest path to a more normal approach to monetary policy is to do all we can today to promote a more robust recovery.”

“In particular, the target for the federal funds rate is likely to remain near zero for a considerable time after the asset purchases end, perhaps well after the unemployment threshold is crossed and at least until the preponderance of the data supports the beginning of the removal of policy accommodation.”

Today’s Markets

Asian markets were mixed overnight…China’s Shanghai Composite gained 13 points to close at its highest level in over a month at 2207…currency movements were in focus after China’s central bank said it plans to make the yuan more easily traded, which could mean increased strength for the currency…

European shares were down slightly today…

In New York, the Dow is up 26 points as of 7:30 am Pacific….it has breached the 16000 level for the first time the last two trading sessions but has failed to close above it…a gauge of U.S. consumer spending rose more than expected in October as households bought a range of goods…the Commerce Department reported this morning that retail sales excluding automobiles, gasoline and building materials increased 0.5% last month after advancing 0.3% in September…other economic data released this morning wasn’t as encouraging as existing home sales fell 3.2% vs. an expected increase…the consumer price index, meanwhile, fell 0.1% last month, down from a 0.2% gain in September…the October decrease was primarily due to a 2.9% drop in gasoline costs, the largest since April…over the last 12 months, overall prices have increased 1%, well below the Federal Reserve’s inflation target of 2%…excluding volatile energy and food costs, so-called core prices rose 0.1% in October from September and just 1.7% over the past 12 months…

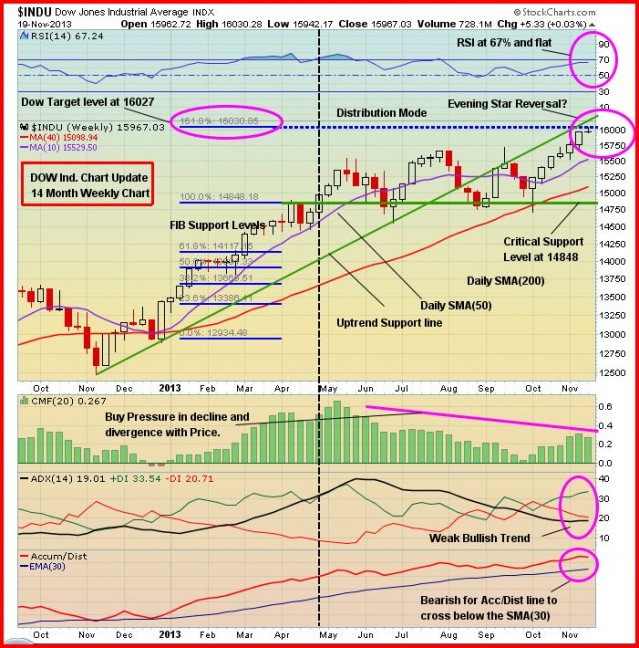

Dow Chart

Below is a technical snapshot of the Dow in a 14-month daily chart from John…the Dow is susceptible to a minor pullback to unwind temporarily overbought conditions…the 50-day SMA, currently at 15530, can be expected to provide strong support…after the kind of performance the Dow has put in so far this year, it’s hard to go against the overall trend at the moment and it would be unusual to see a weak finish in December…the first quarter of next year could be more volatile…

LX Ventures Inc. (LXV, TSX-V)

Social media play LX Ventures Inc. (LXV, TSX-V) has been a strong performer of late, and below is an LXV chart as requested by some of our readers…some investors prefer to “chase” stocks and catch the flavor of the day, and that’s what may be happening here at the moment as LXV has doubled over the past couple of weeks to a new all-time high…that’s not to say this won’t turn out to be an extremely successful play, and the huge increase in volume since late October is certainly impressive…LXV has some power behind it…in situations like this, the 10 and 20-day moving averages (SMA’s) will typically provide support, so watch for that…at 77%, RSI(14) is clearly overbought – could still pop a little higher but will need to unwind soon….LXV closed slightly above a Fib. target (46 cents) yesterday which could be significant…confirmation of this potential breakout would be required today…LXV fell as low as 45.5 cents in early trading but is now up a penny at 48.5 cents as of 7:30 am Pacific…

Wanted Technologies Corp. (WAN, TSX-V)

Venture companies that can turn a profit can also be lucrative for investors…we’ve certainly seen that with Macro Enterprises (MCR, TSX-V) which we brought to our readers’ attention last spring, and it has more than doubled in price since then…readers may wish to perform their due diligence on WANTED Technologies Corp. (WAN, TSX-V), but keep in mind how overbought the RSI(14) currently is on this long-term weekly chart…the 10 and 20-day moving averages (SMA’s) – currently at $1.07 and 96 cents, respectively – have been providing excellent support on pullbacks…WAN traded as high as $1.31 shortly after the open, but quickly retreated to $1.15 on profit-taking…as of 7:30 am Pacific, it’s down 8 cents at $1.18…

WANTED is headquartered in Quebec City with subsidiary offices in New York…it provides real-time business intelligence for the talent marketplace, and it’s also the exclusive data provider for the Conference Board’s Help-Wanted OnLine Data Series™, the monthly economic indicator of hiring demand in the United States…only 24 million shares outstanding…

Global Cobalt Corp. (GCO, TSX-V) Update

Global Cobalt (GCO, TSX-V) announced this morning that it has mobilized a third drill rig on its Karakul Cobalt Project in the Altai Republic, Russia…“Global Cobalt is now drilling with 3 drill rigs in an effort to provide, as quickly as possible, resource definition drill assay information necessary for the next step of evaluation,” the company stated in its news release this morning…

Expect continued volatility in GCO which has been acting according to script recently – unwinding a temporarily overbought condition after rocketing from 4 cents to 23 cents in just 17 trading sessions (Oct. 22 to Nov. 13)…GCO found support yesterday at its rising 20-day SMA, closing at 15 cents…this morning’s news should keep support at that level, but the potential downside risk from a technical perspective appears quite limited (11 cents based on Fib. analysis) based on John’s 3-month daily chart…the overall uptrend remains firmly intact…GCO is up half a penny at 15.5 cents as of 7:30 am Pacific…

Note: John, Terry and Jon do not hold positions in LXV, WAN or GCO.

17 Comments

RBW news yesterday…looks like they are developing targets for drilling next year

Jon – Some investors prefer to “chase” stocks and catch the flavor of the day,

Bert – Disclosure – I haven’t bought back in yet, took my profit

and ran. but as for the above noted statement, i must state,

why not chase & catch the flavor, if that is what it takes

to turn a profit. It’s better than growing old sitting on

some of the gold plays out there. If LXV should happen to

go to a dollar, how many buyers out there at 0.50, will say,

sure glad i chased and bought at 0.50. Isn’t that part of

positive technical analysis, a stock moving up on good volume.

As for being overbought, i agree the chart shows that, but it

can be in overbought territory for an extended period of time

& yet the stock price may not retreat, so much for charts. R !

LXV may be technically overbought, but it is like a new discovery in the resource sector, if it is big enough you can throw technicals out the window. This one has the potential to go viral which will be explosive for the SP. If a few big names like Beiber enters the picture, who knows what will happen. This one has the potential to go from 10 million dollar market cap to 10 billion if all the stars line up – pardon the pun. It is unique and is attracting a lot of high profile celebrities and their fans. All IMO.

ZEN.v having another good day

WOW! What a close for LXV. As I said in my previous post, market making news will trump technicals. This one is getting real interesting.

Just received the GGI presentation invite…. Interesting…. could there be something in the works?

Join Garibaldi Resources Corp. for a Live Investor Update:

Online Presentation Tuesday, Nov. 26, 2013

“GGI’s Drill Keeps Turning: Moving Forward and Building Value in Mexico and British Columbia”

1:15 pm Pacific (4:15 pm Eastern), 15 minutes after market close.

Participation is limited and booked on a first-come basis.

Please reply to: [email protected] to reserve your space ASAP.

Confirmation and instructions will then be emailed to you.

Easy to log in (conference call/Internet).

Hosted by MarketSmart Communications Inc.

Garibaldi Resources Corp.

Leadership. Moving Forward. Building Value

LXV up 0.135, even the guys & gals, who chased it today &

bought at 0.50 must be happy campers. As already mentioned, i

sold out, but obviously i sold early & if i am looking to

blame something, it has to be the dismal record of the so

called speculative gold stocks, which are a disaster & may

have influenced my recent decision making.. It’s elementary

my friends, if during those uncertain times, if you are willing

to play with speculative Gold, more than likely, you will get

burnt. The Gold market is far from being healed, no matter what

the so called experts say. When gold shows volatility waiting

to read Bernanke’s lips, something is just not right out there. R !

I read an headline today on Kitco, that Gold needs to hold

$1255.00. Well Mr. Headline, Gold, according to Stock Charts,

closed at $1,242.00… So much for trading below the low of

the mentioned range bound, that is $1,250.00. R !

I just finished checking the chart on LXV, no doubt it is

O/B, but take the Stochastic for example, the %K still

remains above the %D, as it has been for awhile. Before

thinking this run may be over, i would like to see the K

turn down & through the D. R !

My prediction on gold based on no knowledge at all is that gold is on downswing ,will go below $1200 and will plunge below $1000 per oz. It will then make a bottom and slowly climb up to a high in late 2015. So there richard l

Well Richard ! it is my humble opinion that you are as knowledgeable as some

of the so called knowledgeable gold charms out there. R !

Hi Dan

Actually the Technicals worked very well for LXV.

On Mon.SP closed at 46.5c, right at the FIB. Target. Tues. saw the Price range from 43c to a high of 50 and a close of 47.5. Too close to be called a B/O.

Tues. was really a consolidation day because near the FIB Target SP met resis. This was a pause.

Then on Wed. a big strong B/O, up 13.5c to close at 61c.

NOTE. When a stock price reaches a FIB. Target( A probability Level for resistance)it often reverses and retraces but in LXV’s case it just paused for a day before moving up strongly due to high Vol. and strong buy pressure.

For me the technicals worked.

Another point…because a stock is O/B it does not mean it will reverse immediately. When RSI is in the O/B Zone and is moving up it means the Up Momentum is very strong, but it also means there is a higher probability of a reversal than when it was at a lower level. That is why one must be cautious when a stock is O/B.

Technical Analysis is as much an Art as it is a Science.

V.GGI 12.50%

V.HBK -5.00%

T.SAM -10.81%

V.IO -16.67%

V.TGK -33.33%

V.GTA -12.50%

V.KWG -10.00%

V.RBW -12.50%

V.FMS -1.47%

V.PGX 1.45%

V.GBB -12.50%

V.GMZ -25.00

bmr members stock picks

Thanks Jon for that technical explanation. LXV is run by some very high profile, successful entrepreneurs that made billions in the past so they certainly know how to succeed. As you say, a company is only as good as the people running it and LXV has some very smart people running the ship. It is going to get even more interesting leading up to the launch and some people seem to think they have something up their sleeve that will propel this one even higher. The PP was announced at 35 cents and no report of closure yet and the stock is currently much higher than the PP. Rumors have it that the PP is way oversubscribed.

John – Technical Analysis is as much an Art as it is a Science.

Bert – Let me see now, how can i elaborate on John’s line ? Art,

meaning that he attains his chart information by study &

practice, all about the past. The part that i have spoken

out about in the past is, the scientific part & that is, once he

observes, he then makes imaginary use of scientific knowledge.

Am i doing ok John ?

Forget about the LXV technicals, i feel it will reverse tomorrow anyway,

because it’s time for the company to be contacted by the stock police, as

they must be getting suspicious by now. R !

LXV

Up 0.05 already on 1 million shares, leads me to believe

that the power of the story, the power of those, behind the

story, certainly trumps technical analysis o/b. Up over 200 %

since i became aware of this play, leads me to believe that

for whatever reason, it will retract later today. Anyway, this

may be what the Venture needs, lots of folks involved, buying

and selling, profits being made & as a result, confidence may

return, once realization that there is money to be made in the

Venture. R !