Gold has traded between $1,217 and $1,227 so far today, just above a support band that runs from $1,215 down to $1,200…as of 7:00 am Pacific, bullion is flat at $1,219…Silver is off 11 cents at $19.09…Copper is down slightly at $3.15…Crude Oil is up 77 cents at $94.59 while the U.S. Dollar Index is down one-fifth of a point at 80.69…

Interesting comments from Markus Craton, CEO of Craton Capital, at the Money and Mines Conference in London, England, as reported by Mineweb’s Geoff Candy in an article this morning (www.mineweb.com)…Craton pointed out in a speech that in the Gold sector over the last 10 years, while shareholders have seen a 158% return, governments over the same period have seen a 1,488% increase in their share, while the direct packages of executives have risen 1,032% over the same 10-year period…“There is a huge disconnect between the shareholders and the executives,” Bachmann said, “there is too much fat cat behavior, too much free-riding,” though he acknowledged that things have begun to change and that 2013 could well be a watershed year for the sector…

This has long-term implications for Gold, in our view – the Chinese currency is gaining broader usage, and China’s plan it appears is to back its currency with bullion…the renminbi has surpassed the euro as the second most used currency for trade finance by value, according to a study released by banking services group SWIFT…highlighting how the Chinese currency has increasingly internationalised, SWIFT said that its own recent data showed renminbi usage for international trade finance grew from an activity share of 1.89% in January 2012 to 8.66% in October 2013…SWIFT defines trade finance as the use of letters of credit and collections…the euro’s share of international trade finance is now 6.64% as of October, according to SWIFT…the U.S. dollar remains far and away the most used trade finance currency, with an 81.08% share…the top five countries using the renminbi for trade finance in October 2013 were China, Hong Kong, Singapore, Germany and Australia…

Today’s Markets

Asia

Japan’s Nikkei Index gained 95 points overnight to finish at a 6-year closing high of 15750…Japan reportedly will craft an economic stimulus package this week worth about $53 billion to bolster the economy ahead of an increase in the national sales tax in April – Japan’s biggest step in decades toward curbing its enormous debt…

China’s Shanghai Composite jumped 15 points to close at 2223…

Europe

European shares are down significantly in late trading, thanks to some negative economic data…prices of goods leaving the euro zone’s factory gates fell at the fastest annual rate in almost four years in October, a development likely to reignite fears that too little inflation, rather than too much, could threaten the fragile recovery in Europe and the world…the European Union’s statistics agency said today that producer prices fell by 0.5% from September, and were 1.4% lower than in October 2012…that was the largest drop over a 12-month period since December 2009…the decline in prices over the month and year was larger than expected…

North America

The Dow is down for the third consecutive trading session, off 44 points through the first 30 minutes of trading…as you can see in this chart from John, minor pullbacks in the Dow over the last six months (and good buying opportunities) have occurred each time the Index has fallen below its RSI EMA(25) as it did with yesterday’s close…

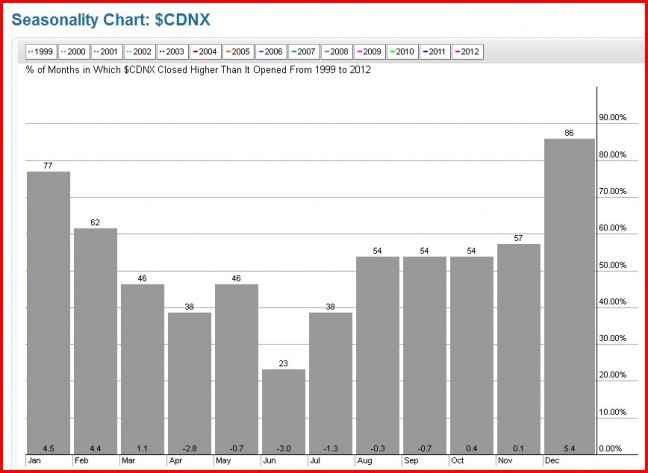

The TSX is down 57 points as of 7:00 am Pacific while the Venture is off a point at 922…Venture support in the low 900’s is very strong as we emphasized yesterday…while choppy seas in this market can often occur during the first couple of weeks of December, the last month of the year historically is the Venture’s strongest…below is a very interesting “seasonality” chart from John for the Venture Exchange going back to 1999…December, January and February are traditionally the strongest months…

Reservoir Minerals Inc. (RMC, TSX-V)

Not a new discovery – this hole targeted a known high-sulphidation epithermal zone – but a spectacular and significant result nonetheless from Reservoir Minerals’ (RMC, TSX-V) Tumok Project in Serbia (a joint-venture with Freeport-McMoRan)…drill hole FMTC 1341 returned an interval of 166 metres, from 557 to 723 metres, that graded a stunning 6.65% Cu and 7.75 g/t Au (11.29% CuEq) at the CuKaru Peki target…the company has reported results from 17 holes from this particular target – assays are pending from a further 19 holes…Dr. Simon Ingram, Reservoir President and CEO, commented: “Drilling at Cukaru Peki continues to return spectacular high-grade Copper and Gold values from high-sulphidation mineralization. We are optimistic that the high-grade mineralization may be of sufficient volume and grade to support an underground mining operation while further exploration is carried out on the underlying larger porphyry-style mineralization. We believe that the discovery at Cukaru Peki demonstrates the potential for additional blind discoveries within the Timok magmatic complex and may lead to a renaissance in Copper and Gold production in Serbia.”

RMC is up 29 cents at $5.20 as of 7:00 am Pacific…below is a 2.5-year weekly chart – good chance of a confirmed breakout today…

Barisan Gold Corp. (BG, TSX-V) Update

Important discoveries will help revive investor confidence in the junior resource market, which is why it would be great to see additional strong results from Barisan Gold (BG, TSX-V) as it continues to drill its promising Upper Tengkereng Porphyry Project in Indonesia…this certainly isn’t our favorite jurisdiction, but the results of BG’s last hole (262 m of 1% CuEq) were too good to ignore…Barisan is now attempting to target the potassic core of this porphyry prospect at depth, where grades are anticipated to be higher…the fourth hole is planned to a depth of 1,400 metres and could be completed by the end of the month with assays available early in the New Year…

As John noted in some previous charts following BG’s initial run-up to 33 cents, the “sweet zone” for accumulation was between 15 and 20 cents on a Fibonacci retracement…BG dropped as low as 17 cents and then last Friday blasted through resistance in the low 30’s and climbed as high as 44.5 cents before pulling back once again…technically, BG should now find strong support between 27 and 32 cents – the Fib. 50% and 61.7% retracement levels, respectively…BG is off 2.5 cents at 30 cents through the first 30 minutes of trading…expect continued volatility with this play…below is a 2+ year weekly chart with further details…as always, perform your own due diligence…

LX Ventures Inc. (LXV, TSX-V) Updated Chart

Social media darling LX Ventures (LXV, TSX-V) is another great example of the usefulness of Fibonacci analysis as one technical tool…LXV pushed just 7 cents above John’s Fib. target of 89 cents and couldn’t get above that level and resistance on a closing basis last week…the stock has fallen for three consecutive sessions, and was hit particularly hard yesterday when it fell 19 cents to close at 57 cents – just a couple of pennies above its 20-day moving average (SMA) which could provide some important support…other chart support is at 46 cents as shown below in this 2.5-year weekly from John…LXV fell as low as 49 cents during the first few minutes of trading, but is now off just a penny at 56 cents as of 7:00 am Pacific…

Note: John holds a share position in BG.

4 Comments

According to Yahoo SAM has:

21.35 million market cap

8.45 million in cash

trailing P/E of 3.75

book value of 0.56

Subtracting the cash from their market cap and they are trading like an explorer, not a producer with 100% ownership of their mine. Thanks bears for the buying op.

Justin,a gift !!

V.GGI 12.50%

V.HBK 30.00%

T.SAM -13.51%

V.IO -16.67%

V.TGK -33.33%

V.GTA -9.38%

V.KWG 0.00%

V.RBW -37.50%

V.FMS -5.88%

V.PGX -13.04%

V.GBB -25.00%

V.GMZ -25.00%

bmr members stock picks

Greg, I really hope they keep selling it down, I want all of their shares.