Gold has traded between $1,256 and $1,274 so far today…as of 7:30 am Pacific, bullion is up $4 an ounce at $1,268 as it looks to finish the week on a strong note…stiff resistance is around $1,275…Silver is 14 cents higher at $20.16…Copper is flat at $3.28…Crude Oil is down 47 cents at $96.85 while the U.S. Dollar Index has rebounded after some early weakness and is now essentially unchanged at 80.46…

Gold’s five-week rally – a gain of nearly 5% – is the metal’s longest winning streak since August-September…short-covering, weakness in the U.S. Dollar Index, and unconfirmed news reports yesterday that India’s government is considering lifting at least part of its Gold import duties are among the factors that have driven bullion to its highest levels in two months today…Peter Schiff, CEO and chief global strategist of Euro Pacific Capital, and a long-time Gold bull and dollar bear, told CNBC in an interview, “Gold has already priced in whatever taper is coming. If anything, it has overpriced it.” The Fed, he argues, is trapped in a vicious cycle of easy money, unable to fully revive the economy yet hesitant to end the very programs that it hoped would do just that…

The Fed is indeed in a difficult position as it prepares for another policy meeting next week – the worst sell-off in emerging-market currencies in five years is beginning to reveal the extent of the fallout from the Fed’s tapering of monetary stimulus, compounded by growing political and financial instability…while China, Brazil, Russia, India, and South Africa were the engines of global growth following the financial crisis in 2008, emerging markets now pose a threat to world financial stability – especially if the Fed continues to taper as that is encouraging capital outflows from these countries…the International Monetary Fund has already predicted that the growth advantage of emerging markets over advanced economies will shrink this year to the smallest since 2001…fundamental weaknesses in some emerging markets’ economies are being exposed now that the Fed has started the “tapering” process…

Benoit Anne, head of global emerging market strategy at Societe Generale, told CNBC the emerging markets’ “panic mode” was directly linked to the Fed. “We have huge psychological fear that is going to emerging markets, despite a global environment that hasn’t changed that much,” he said. “My bias at this stage – although it’s a bold one – is that this is all about the credibility of the Fed with respect to its forward guidance. This fear that the Fed is going to tighten quicker than expected is translating into emerging markets.”

Today’s Markets

Asia

Japan’s Nikkei fell to a one-month intra-day low of 15,288 overnight before recovering modestly to finish the week at 15392, but that was still a 304-point drop (1.94%) for the session…China’s Shanghai Composite bucked the trend, gaining 12 points to close at 2054…

Updated Shanghai Composite Chart

On an encouraging note, it’s possible the Shanghai may have put in a “triple bottom”, or at least let’s hope it has…below is a 2.5-year weekly Shanghai chart entering today’s trading…a rebound appears to be in the works after a sharp sell-off of more than 10% since early last month…the Shanghai has a strong support band between 1950 and 2000 with significant resistance around 2250…

Europe

European markets are down sharply in late trading overseas…

North America

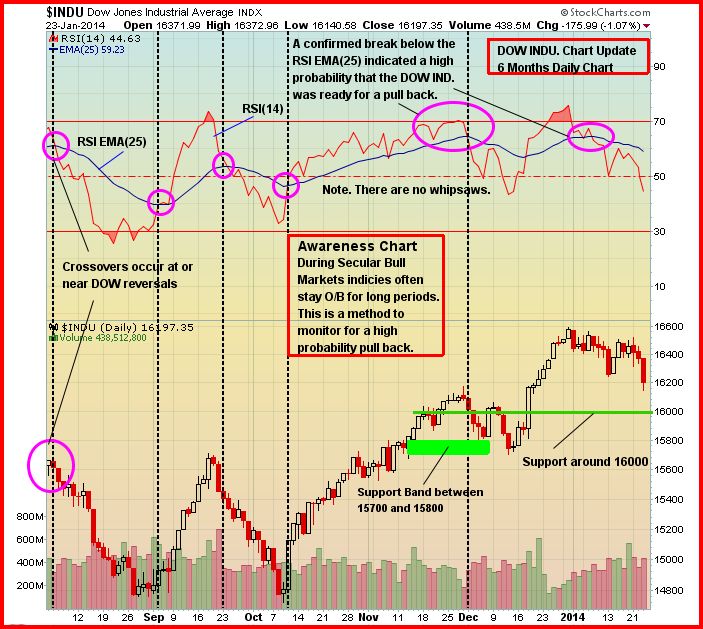

After losing 261 points Tuesday through Thursday, the Dow is off another 134 points at 16063 through the first hour of trading today…the current weakness in the Dow may have nearly run its course, especially with RSI(2) at an extreme low where previous reversals have occurred, though some analysts are saying a deeper correction is in the works…this is interesting, and we’ve shown it before – a reliable leading indicator of potential weakness in the Dow is whenever the RSI(14) breaks below its EMA-25…this has happened on six occasions going back to last September as you can see in this Dow 6-month chart…a mild sell-off then occurs in the Index before it quickly bounces back…the Dow has strong support around 16000 as shown on this chart…

Dow 6-Month Daily Chart

The TSX is off 146 points as of 7:30 am Pacific while the Venture has fallen 10 points to 974…

Venture Chart Update

The Venture is still trying to push convincingly past the 970’s for a “confirmed” breakout, but hasn’t yet managed to do that…while the Index is off in early trading today, momentum is still on its side and there’s plenty of support between 960 (the rising 20-day SMA) and 970…amazingly, the Venture has recorded 11 consecutive positive Fridays – it hasn’t experienced a “down” Friday since November 1, so it’ll be interesting to see if there’s an intra-day reversal today though it would have to be a dramatic one for the Index to finish in the green for the 12th straight Friday…a minor pullback during an overall uptrend is always healthy for technical reasons…of course it also creates even better buying opportunities…

What’s particularly significant about the 3-year weekly chart is the breakout in the RSI(14) – it has pushed past all resistance levels since the bear market began in early 2011…

Revolver Resources Inc. (RZ, TSX-V) Update

We noted last month that Revolver Resources (RZ, TSX-V) was worthy of our readers’ due diligence with the stock sitting at about 4 cents and a drill program just getting underway at the company’s property near Colorado Resources‘ (CXO, TSX-V) North ROK…Revolver has had a good week and closed at 8.5 cents yesterday…however, we caution that it is in overbought territory on the 2.5-year weekly chart (see below) and is now approaching resistance at the 10-cent level…on January 13, RZ announced that it had completed the first 400-metre drill hole of its planned 1,000-metre 3-hole program at Summit B with initial results expected “in the next weeks” which we interpret to mean likely during the first half of February…RZ is unchanged at 8.5 cents as of 7:30 am Pacific…

Probe Mines Ltd. (PRB, TSX-V) Updated Chart

Probe Mines (PRB, TSX-V) is one of the country’s best exploration stories as it continues to build on a high-grade Gold zone discovered last year at its multi-million ounce Borden Lake deposit in northern Ontario…the company announced a couple of weeks ago that drill crews were mobilizing to commence the 2014 drill program at Borden, which will be supported by four rigs…drilling will focus on the HGZ, and particularly its expansion along strike…below is a 2.5-year weekly chart from John…PRB has consistently out-performed Gold since the spring of last year…PRB is up 7 cents at $2.73 through the first hour of trading…

Note: John, Jon and Terry do not hold share positions in PRB or RZ.

6 Comments

DOW CLOSED BELOW 15,900 SO IT MEANS IT MAY OPEN LOWER ON MONDAY? OR, IT MAY BOUNCE FROM HERE…..? BMR?….VENTURE HELD IN SOMEWHAT DESPITE THE DROPS IN THE BIG BOARDS

Everything looks good, Steven, you can sleep well. We’ll provide a full review Saturday.

Many small cap stocks are off 80 to 90 percent from their 2 year highs selling at 10 to 20 cents on the dollar.There is a way to buy them at a 50 percent discount to market instead of paying 10 or 20 cents buy them at 5 or 10 cents. anyone interested

Very interested!!

tell us more thanks

A higher power in my household is trying to limit my time on the internet will give you the answer Monday