Gold has traded between $1,307 and $1,318 so far today…as of 7:50 am Pacific, bullion is up $4 an ounce at $1,315…Silver is 21 cents higher at $21.75…Crude Oil has retreated 25 cents to 103.06 while the U.S. Dollar Index is up one-tenth of a point to 80.30…

UBS AG has boosted forecasts for Gold in 2014, citing a change in U.S. investors’ attitudes toward the precious metal that’s rallied this year on increased haven demand and buying from Asian consumers…the one-month forecast was raised to $1,280 an ounce from $1,180, while the three-month outlook was increased to $1,350 from $1,100, analysts Edel Tully and Joni Teves said in a report…Gold may average $1,300 in 2014 from a previous estimate of $1,200, they said, while holding the 2015 target at $1,200…

UBS AG has boosted forecasts for Gold in 2014, citing a change in U.S. investors’ attitudes toward the precious metal that’s rallied this year on increased haven demand and buying from Asian consumers…the one-month forecast was raised to $1,280 an ounce from $1,180, while the three-month outlook was increased to $1,350 from $1,100, analysts Edel Tully and Joni Teves said in a report…Gold may average $1,300 in 2014 from a previous estimate of $1,200, they said, while holding the 2015 target at $1,200…

Check out the excellent article yesterday by Mineweb’s Lawrence Williams (www.mineweb.com) on the potential impact on Gold of an ETF reversal this year after major outflows in 2013…“If we assume ETF sales become a net zero this year, which is certainly possible, that immediately takes 880.8 tonnes off the market and if Eastern demand remains at anything like 2013 levels that is going to create a huge shortage in physical Gold supply,” Williams wrote…

WTIC Updated Chart

For the past four years Crude Oil (WTIC) has traded within an ascending triangle, so predicting good entry points like late last year has been quite easy…at some point, though, Crude is either going to break below the ascending triangle and trade lower, or it’s going to push through the post-Crash resistance level of $110…the implications for Gold, either way, will be significant…

Today’s Markets

Asia

Japan’s Nikkei extended losses from the previous day, giving up 317 points or 2.2% to close at 14449 following trade data…the country logged a record monthly trade deficit in January, despite a weaker yen which in theory should make the country’s exports more competitive…on the export side, many point to the declining competitiveness of Japan’s consumer electronics industry and a steady outflow of manufacturing capacity to foreign countries…

China’s Shanghai Composite was off 4 points to finish at 2139…China’s factory activity lost ground in February as a key gauge of manufacturing slipped to a seven-month low, once again stirring concerns over the health of the world’s second-largest economy…the preliminary HSBC China Manufacturing Purchasing Managers’ Index, a gauge of nationwide manufacturing activity, fell to 48.3 in February from 49.5 in January – the second straight month the PMI has been below 50, which signals contraction…

Europe

European stocks are mixed in late trading overseas…fresh economic figures from France were disappointing…consumer price inflation for the country posted a worse-than-expected dip of 0.6% for January, whereas Markit PMI for February showed a slide from last month…

North America

The Dow has climbed 58 points through the first 80 minutes of trading today…the Fed has held short-term interest rates near zero since December 2008 but, interestingly, a “few” Fed officials argued at the January 28-29 policy meeting that increases might be needed soon to prevent the economy from overheating, according to minutes of the meeting released yesterday…these officials were most likely from the Fed’s band of policy “hawks” who have largely failed in resisting the central bank’s easy-money policies…

The TSX is 74 points higher while the Venture is flat at 1006 as of 7:50 am Pacific…the Athabasca uranium play heated up on a couple of fronts yesterday…NexGen Energy Ltd. (NXE, TSX-V) nearly doubled on total volume (all exchanges) of 7.5 million after reporting that it has discovered a new zone of uranium mineralization at its Rook 1 Project, unrelated to any other known occurrence in the region…hole RK-14-21 (the first hole drilled at “Arrow”) is still in progress…26.2 m of highly anomalous radioactivity was intersected between 204.8 m and 231 m downhole…NXE is off 1.5 cents at 41.5 as of 7:50 am Pacific…

Fission Uranium Corp. (FCU, TSX-V)

More spectacular high-grade results from Fission Uranium (FCU, TSX-V) at its PLS Property, and the stock responded well by climbing 8 cents to close at $1.27 on total volume (all exchanges) of 16.5 million shares…what investors should look for today is a potential confirmed breakout above the $1.25 chart resistance as shown in this 6-month daily chart from John…FCU is up a penny at $1.28 in early trading…

Colorado Resources Ltd. (CXO, TSX-V) Update

Colorado Resources’ (CXO, TSX-V) turnaround started December 20 when the company announced it had assembled a 300 sq. km land package (the “KSP” Property) 15 km along strike to the southeast of the past producing Snip mine which, from 1991 to 1999, produced over one million ounces of Gold at a recovered head grade of 24.5 g/t (KSP is also about 40 km west of the prolific former producing Eskay Creek mine)…this is another area of B.C. to watch closely in the coming months…CXO’s exploration program will be aided both by new geological models developed in the Kerr sulphurets camp by both Seabridge Gold Inc. (SEA, TSX) and Pretium Resources Inc. (PVG, TSX) as well as by recent infrastructure development which has brought roads and power lines to the area’s doorstep…Garibaldi Resources Corp’s (GGI, TSX-V) King Property, which has returned high-grade Silver and Zinc numbers from sampling, is also in the heart of this district…

Colorado will be following up this year on its North ROK Property near Iskut but it appears the market prefers the scale and potential of its newly acquired package…below is a 14-month weekly CXO chart from John…the stock clearly bottomed in December at 14 cents…it staged an unconfirmed breakout yesterday above an ascending triangle and chart resistance at 34 cents, so today’s trading activity will be interesting to see if that breakout is indeed confirmed…next major chart resistance is at 45 cents while strong support exists at 25 cents, a penny above the rising 50-day moving average (SMA)…

Doubleview Capital Corp. (DBV, TSX-V) Update

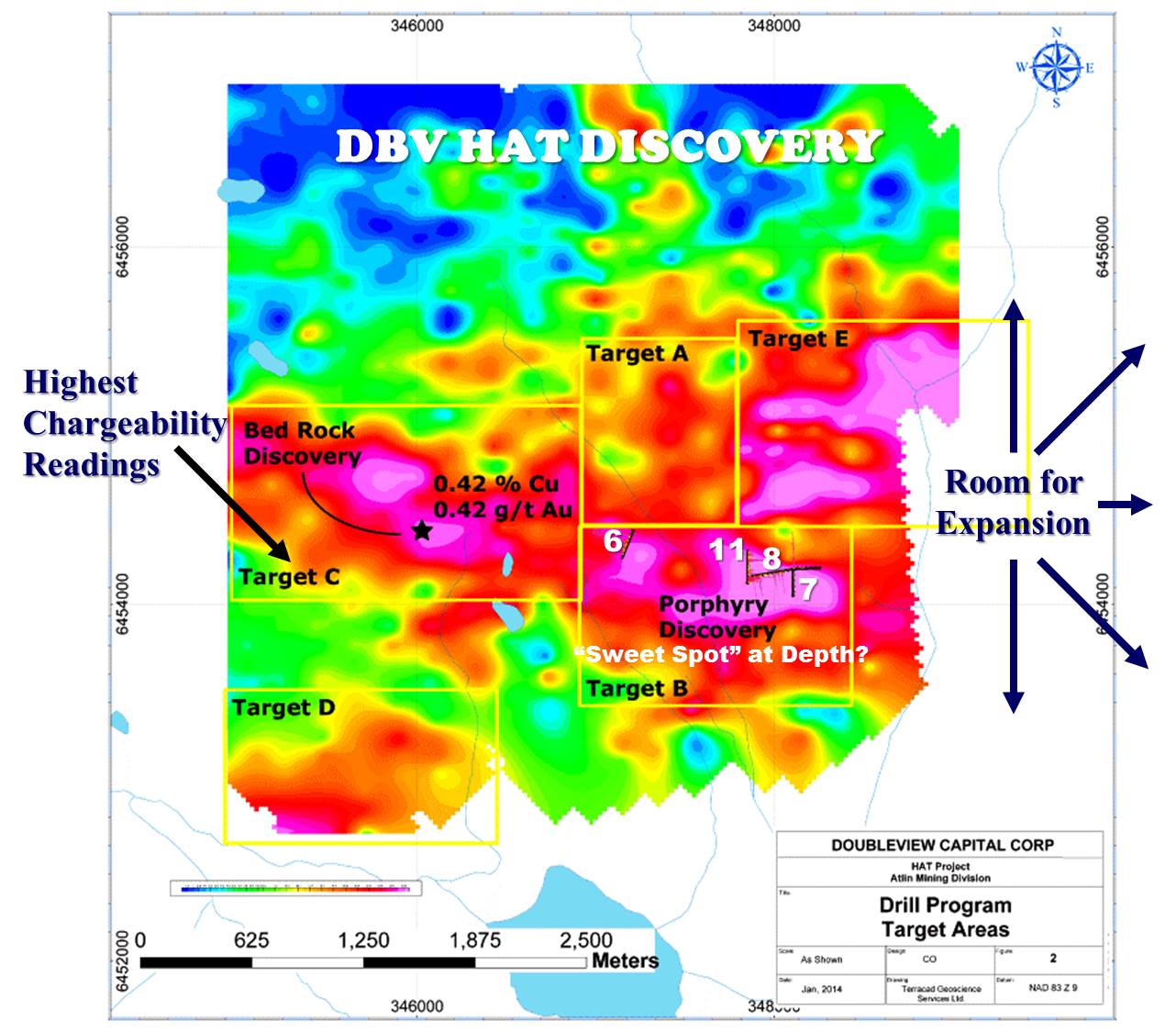

Doubleview Capital (DBV, TSX-V) weakened yesterday, falling below its 20-day SMA for the first time in over two months but in the context of a rise from a December low of 4 cents to a February all-time high of 30 cents, the pullback is normal and healthy from a technical standpoint…it also presents a second chance for investors to jump in at favorable levels prior to another potential major advance in DBV, the catalyst for which could be the commencement in the near future of a new phase of drilling to follow up on the company’s important discovery at the Hat Property reported January 20…these are still the early stages of the Sheslay Valley area play, and the time to get positioned is before the masses start piling in – otherwise you face the prospect of chasing some of these stocks at much higher prices…as always, perform your own due diligence…

When you look at DBV’s drill hole locations and results – the nearly one km horizontal distance from mineral zones in H-6 to H-8, and the fact that H-8 and H-11 ended in strong Cu-Au mineralization – the Hat is clearly showing volume and grade potential, and DBV has some very inviting initial targets to go after once the next round of drilling starts…we’ll get more into the significance of the map below in the days ahead, particularly in Part 2 of our feature on DBV, but we can’t help but like what we see below…

Updated DBV Chart

Below is a 3-month daily DBV chart from John…importantly, RSI(14) is now landing on previous support…a very strong band of price support also exists between 15 cents and 18 cents, so it wasn’t surprising to see bargain hunters step in this morning with bids when DBV touched 18.5 cents…a bullish downsloping flag bodes well…

Canada Zinc Metals Corp. (CZX, TSX-V)

A good opportunity in our view is opening up in Canada Zinc Metals (CZX, TSX-V) which has backed off, as John suspected it would…CZX is yet another very interesting B.C. play…the company is a dominant landholder in the Kechika Trough featuring several known Zinc-Lead-Silver deposits including the company’s Cardiac Creek deposit which has a NI-43-101 resource…Cardiac Creek forms one of CZX’s two 100%-owned projects – the other is the Kechika Regional which holds significant exploration upside…CZX announced some FT financing Tuesday and is down 6 cents at 45 cents as of 8:00 am Pacific…strong technical support in the low ’40’s as shown in this 3-year weekly chart…

Note: John and Jon both hold share positions in GGI and DBV.

5 Comments

Well I took a small position in Ggi today.

great close for the venture today. And a big thanks to bmr John for taking the time in replying to my fnc.v chart question yesterday. Much appreciated 🙂

For awhile now, Fridays’ have been the best trading

days’ of the week, take notice tomorrow. Good night ! R !

Awfully quiet on here all of a sudden! Please don’t tell me the the sound of nothing but crickets is due to a lack lustre day in gold. Hope everyone is scared off so easily. Even if things have turned for the better there will as always be down days as usual. Jon where have you gone? I am expecting you to say thst now that I have taken my position in Ggi that tomorrow there will be a halt pending amazing assays!!!! 😉

Smart move, John. I think it’s probably safe to assume GGI will have an update for shareholders prior to PDAC. They’re the only one of the three major players in the Sheslay Valley with a booth at PDAC. Typically the week before PDAC is quite intense for news from many companies. Keep an eye also on Paramount Gold & Silver which is looking very good on the charts and recently reported impressive high-grade Gold-Silver assays from the Don Ese area at San Miguel in Mexico (originally discovered by GGI, then the ground covering this option GGI had was sold to PZG in 2009). PZG has been continuing to drill there in the last few weeks, so it’s going to be interesting to see the next set of results. GGI held 1.8 million PZG shares as per latest financials and PZG is up 55% so far this year. Another example of how GGI has produced value in Mexico and identified resources. Let’s hope they can do the same at La Patilla.