Gold has traded between $1,351 and $1366 so far today following yesterday’s intra-day reversal…as of 8:35 am Pacific, bullion is down $10 an ounce at $1,358…Silver is off 39 cents at $20.80…Copper is up a penny at $2.96…Crude Oil has added more than $1 a barrel to $99.16 while the U.S. Dollar Index is up slightly at 79.44…

Gold’s 50-day moving average (SMA) on the daily chart is just $11 below the 200-day SMA, which implies that barring a Gold collapse, we should see bullion make a “Golden cross” in the very near future…according to www.usfunds.com, going back to 2000, a Golden cross in Gold is followed on average by a 50% rally lasting on average 15 months…interestingly, a “Golden Cross” has already occurred on the weekly chart as shown by John this morning (see below)…”Golden Crosses” aren’t always 100% reliable, however, and should be viewed in the context of other technical indicators…

How will Gold react to the Fed this week?…the Fed begins a two-day policy meeting today under the leadership of Janet Yellen who will give her first news conference tomorrow as the new Chair…the Fed is expected to continue to scale back its bond buying program but its language and Yellen’s words will be weighed carefully…new economic forecasts from the Fed will also be released…after cutting its monthly bond buying by $10 billion at the prior two meetings, the Fed will trim purchases by another $10 billion to $55 billion, and continue reductions at that pace at every meeting before announcing an end to the program at its Oct. 28-29 gathering, according to a Bloomberg survey…

5-Year Weekly Gold Chart

This 5-year chart tracks Gold’s RSI(14) and the 50 and 200-day SMA’s on a weekly basis…we’re seeing some volatility in the $1,300’s, but it’s hard not to be bullish about the overall trend that appears to be shaping up for 2014 after last year’s double bottom…

Today’s Markets

Asia

China’s Shanghai Composite was essentially unchanged overnight, closing at 2025, while Japan’s Nikkei climbed 134 points to finish at 14411.

Europe

European markets were solidly in the green today…a March survey of German investor confidence came in lower than anticipated…however, some positive trends were reported this morning…the 18 countries that share the euro had a surplus in their trade of goods with the rest of the world in January, an indication that the currency area’s economic recovery continued at the start of the year…meanwhile, European car sales rose by nearly 8% in February, the sixth consecutive monthly gain, as a gradual economic revival in southern Europe and price cuts boosted demand for new models…

North America

The Dow is up 97 points as of 8:35 am Pacific…the Commerce Department reported this morning that housing starts were little changed last month, illustrating the industry is stabilizing after harsh weather dented home building…separately, the Labor Department’s Consumer Price Index edged up 0.1% last month (inflation remains very subdued) as a drop in gasoline costs offset an increase in the price of food…

The TSX is 69 points higher as of 8:30 am Pacific while the Venture is even at at 1034…Doubleview Capital Corp. (DBV, TSX-V) announced this morning that it’s mobilizing for drilling at the Hat Property in the Sheslay Valley…drilling will focus initially on the discovery area at “Anomaly B”…John has an updated DBV chart this morning (see below) showing how the stock landed on very strong technical support yesterday…tomorrow we’ll take a look at some of the inviting targets DBV has to begin this new round of drilling…

The Scale Of The Sheslay Valley – BMR Interviews GGI’s Steve Regoci

The distance between Garibaldi Resources’ Corp.’s (GGI, TSX-V) Grizzly West porphyry target and Doubleview’s Hat discovery is a whopping 22 km along a NW/SE trend, with Prosper Gold Corp.’s (PGX, TSX-V) Star, Pyrrhotite Creek and Copper Creek discoveries and targets in between…this is an impressive long corridor with an excellent chance of broadening out as GGI reported at the end of last week, giving the Sheslay Valley incredible potential scale and the opportunity to emerge as a world class exploration and mining district…

This morning, some very interesting comments from GGI President and CEO Steve Regoci regarding the 262 sq. km Grizzly Property in particular and the Sheslay Valley in general in an exclusive interview with BMR (click on the forward arrow to listen to this 3-minute excerpt – requires Adobe Flash Player version9 or above):

[audio:https://bullmarketrun.com/wp-content/uploads/2014/03/Regoci-GGI-clip-1.mp3|titles=Regoci GGI clip 1]We’ll have more parts of this interview throughout the week…

Doubleview Capital Corp. (DBV, TSX-V) Updated Chart

This is a very simple chart to understand – previous resistance at 25 cents has become new support for DBV as demonstrated yesterday when it slipped to an intra-day low of 25 cents before closing at 26.5 cents…DBV is also strongly supported by its rising EMA(20), currently at 25.5 cents…the overall trend remains very bullish…DBV is up half a penny at 27 cents as of 8:35 am Pacific…

Alix Resources Corp. (AIX, TSX-V) Updated Chart

Alix Resources (AIX, TSX-V) has aggressively been building an impressive land package in the Sheslay Valley including recently announced claims contiguous to the eastern border of DBV’s Hat Property…technically, AIX is climbing an upsloping channel – this is a very bullish scenario that matches well with what’s developing on the ground…the 200-day SMA has also reversed to the upside…the Sheslay Valley is clearly a company-building opportunity for AIX, so the next several months could prove to be very interesting…President and CEO Mike England’s last major “area play” in B.C. (Geo Minerals) got taken out by New Gold Inc. (NGD, TSX-V) in late 2011…AIX is unchanged at 4.5 cents as of 8:35 am Pacific…

Goldeye Explorations Ltd. Updated Chart (GGY, TSX-V)

Goldeye Explorations (GGY, TSX-V) has backed off slightly this morning after staging an unconfirmed breakout yesterday – surging 4 cents to close at 18 cents on strong volume – thanks to solid drill results from its Weebigee Project in northwestern Ontario…we initially brought GGY to our readers’ attention in late February when it trading around 11 cents, and Weebigee is showing increasing potential…more encouraging high-grade results were released yesterday from 7 more holes with drilling continuing through at least the end of this week…results from the Knoll zone included 8.59 g/t Au over 6.83 m…interestingly, at the RvG4 zone, 500 m to the northwest of Knoll, GGY intersected 23.15 g/t Au over 3.97 m in hole BK14-18…the relationship between these two zones is not yet known, however alteration, quartz veining, and host lithologies are similar…

Below is a 2-year weekly chart from John…GGY is off 1.5 cents at 16.5 cents as of 8:35 am Pacific…

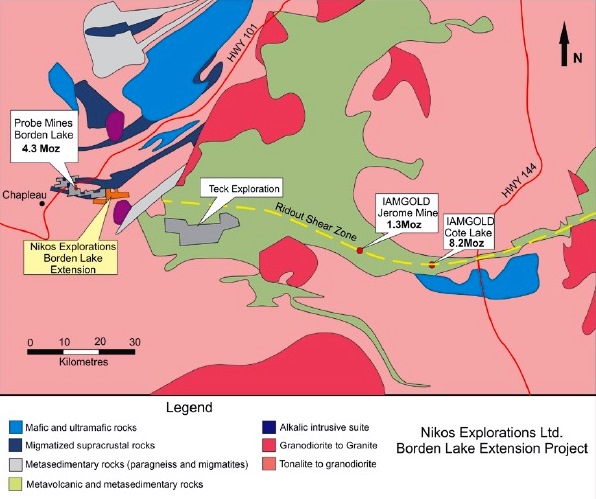

Opportunities Around Borden Lake

As Reliant Gold Corp. (REC, TSX-V), demonstrated yesterday, there are clearly opportunities for investors in the area around the multi-million ounce Gold discovery of Probe Mines Ltd. (PRB, TSX-V) at Borden Lake in northwestern Ontario…Probe continues to drill the high-grade southeast extension of that deposit, and it’s an exciting exploration story we’ve been following closely at BMR for quite some time…investors may wish to perform their due diligence on little-known Nikos Explorations Ltd. (NIK, TSX-V) which was rolled back 1-for-5 late last year and is actively exploring its Borden Lake Extension Project immediately adjacent (5 km southeast ) to Probe’s discovery along the western extension of the Ridout shear zone…Nikos holds an option to earn a 100% interest in the 1,600-hectare property which has never been previously explored…NIK has approximately 11 million shares outstanding and closed yesterday at 12 cents…

The Strategic Importance of Crimea

As members of Vladimir Putin’s inner circle shrugged off “sanctions” aimed at them personally by President Obama and European countries yesterday, the Kremlin said late yesterday that Putin had signed a decree recognizing Crimea as an independent state – a necessary step before Russia can proceed with annexation, in what would be the most significant land seizure in Europe in decades…equity markets are moving higher today after Putin, addressing the Russian parliament, said he does not want Ukraine divided further, while asserting that Crimea should be under Russian sovereignty…

With no Ronald Reagan or Margaret Thatcher on the world stage to confront him, Putin knows he has some space within which to maneuver…he has likely carefully calculated the economic risk-reward ratio in terms of bringing Crimea back under Russian control…as Frank Holmes pointed out at www.usfunds.com, Russia’s significant dependence on Ukraine for gas exports has long been a source of friction between the two countries…as a result, Russia has been diversifying its supply options through the South Stream pipeline but (see graph below) Crimea may prove to be crucial for reducing the astronomical costs of the project as both depths and distances could be reduced substantially…in addition, annexing Crimea may offer Russia access to the major part of the explored offshore gas deposits and prospective hydrocarbon resources in the Black Sea…

Note: John and Jon both hold share positions in GGI, AIX and DBV. Jon also holds a share position in PGX.

19 Comments

Jon

I like what Regoci says at the end, we are going to surprise the market by how quickly we get to the drill stage…also he mentions mineralization from Pyrrhotite creek all the way to the Teck border, that’s huge… can’t wait for them to get started, sounds like they may have several drill sites going at once??

The scale of all of this cannot be understated, Greg, it is truly world class, and a few months from now a lot of people will be kicking themselves when they’re chasing all of these stocks at potentially much higher levels as this plays out….each company has a lot of work to do but they have the geological teams (and the financial backing) to pull this off….right now this is a 22-km long mineralized corridor and it’s broadening out, and I believe it will broaden out not just to the south down to Teck’s Eagle Project, but also to the north which makes AIX’s land package so valuable….the Pyrrhotite Creek/West Kaketsa area is going to loom very large….not to mention the possibilities for the Hat, the Star targets on the Sheslay, Grizzly West and Grizzly Central…….can you see what’s unfolding here? Very simple – we’re witnessing the emergence of a major new exploration/mining district in N.W. B.C. and that’s going to be great for this market…somewhere along this trend there also has to be a high-grade starter area (or areas), and that’s going to be an important part of the overall equation….perhaps several deposits being served by one facility and a high-grade starter area – that’s the ideal scenario for robust economics……right now it’s full throttle on the exploration side and that’s going to be exciting….

I found very helpful to have the 3d map from GGI website opened and looking at it while listening to the GGI interview, really helps to understand how huge GGI’s property really is and the many possibilities of several discoveries…

Very exciting few months coming up Jon!! But I woukd caution that there is much drilling to take place before we can say a new mining district no? Although I’m excited and optimistic lets not get ahead of ourselves

Great interview with Regoci. Seems like they’re moving and grooving, which is great. I just whish they’d release the drills results from Mexico. Any news on that front, Jon? Thanks.

Well, there goes Flaherty. Either he’s stepping down because of health issues, or he sees an iceberg ahead an jumping ship before the ship hits its. If his resignation is due to health issues, I wish him a speedy recovery. That being said, Canada’s housing bubble has to pop someday. Sixty year old shacks going for over half a million dollars is not healthy. When will the madness end? What do you guys think?

Jon, I understand you have done your DD on this area. But simply said, it is still a pure gamble at this point. a couple of average holes (which PGX put out) will kill the momentum in this area. There is simply no way that these tiny penny stocks are a sure thing. I appreciate your enthusiam but we have seen it before.

Pete, that’s almost funny. Just follow the money and follow the trends. I personally like the odds of that “gamble” and so do others, especially considering the skills of those involved. You don’t agree but that’s what makes a market. Individuals a lot smarter and with much deeper pockets than you and I are positioned, and are positioning themselves, in this play. And there isn’t a knowledgeable geologist on the planet who wouldn’t want to pull out not two but six “average” holes, as you refer to them, like PGX did (at least you’ve upgraded your assessment of the PGX results to “average” from “poor” back on Nov. 7th). By the way, what’s your guess on the current tonnage of just the Star porphyry, Pete?

Jon do you know if Garibaldi was there before teck resources or vise versa. if teck was in the area first why didnt they stake everything. Was there any exploration done on teck side as far as drilling or grab? And to the north it seems like nothing was done historically.

Teck didn’t come into the picture until 3-4 years ago, Martin. GGI staked in 2006, so Teck followed. No drilling yet but very encouraging early results over the northern half/two thirds of the Eagle Project by Teck in 2011 and 2012 according to assessment reports. Outcropping areas in the Sheslay Valley received the most attention historically, but just 42 total drill holes before Prosper and Doubleview (23 at the Star, 10 at Copper Creek and 9 at Pyrrhotite Creek). Every area has its time. This area’s time has arrived.

My gest is AIX will come up with something big as far as land expansion in the days to come. Probably will be there last staking in the area. just a feeling 🙂

Keep an eye on Aldrin Resource (ALN-V) boys. Its about to start drilling right next door to Fission.

Once drilling is announce she will run.

Looks like gold fell thru support. Not good news at all!!

What matters is the closing price, Hs, not intra-day fluctuations, and there are various levels of strong support including the March low in the upper $1,320’s…if Gold were about to collapse, the Venture is giving no indication of that…Gold could even retreat to $1,300, wouldn’t negate the new uptrend that has formed…

Thanks Jon. Maybe good thing my funds aren’t quite free as of yet. Might be great opp for me to buy lower. Ie. Paul et al, looks like I might get my Dbv entry point after all eh?

Maybe but you’ll have to pull the trigger instead of just talking about it..eh!

@paul. I’ll put my bid in at 20

Okay, goood luck with that!

Hi BMR,

You have CMB.V on one of your lists.

They have just comming out with good news:

cmcmetals.ca/s/NewsReleases.asp?ReportID=642779

What is you comments on this play, BMR?

Kind Regards