Greetings from the Sheslay Valley, northwest British Columbia, where BMR is on an extensive research mission to gain an even greater understanding of this rapidly emerging Cu-Au porphyry district (1,500+ sq. km) that clearly has the potential to develop into the most exciting and prolific Canadian exploration story in 2014, though the “masses” have yet to discover it…one company, Doubleview Capital Corp. (DBV, TSX-V), is already drilling while two more companies – Prosper Gold Corp. (PGX, TSX-V) and Garibaldi Resources Corp. (GGI, TSX-V) – are gearing up for drill programs as well…

Today we’re reporting directly from the Hat Property (wireless Internet is available) and as we get settled in, we’ll be starting our coverage with excerpts of an interview with DBV President and CEO Farshad Shirvani, and some pictures to give our readers an initial glimpse into how things look on the ground and from the air at the Hat…much more to come in the days ahead as we gather and organize material from the Hat and elsewhere in the district…Doubleview has done an exceptional job setting up camp…also, our visit has opened our eyes to a potential game-changing infrastructure issue – direct road access to the Hat Property…we’ll quickly update the markets first, then return to what’s happening at the Hat…

Gold has traded between $1,300 and $1,315 so far today…as of 8:10 am Pacific, bullion is down $2 an ounce at $1,306 as traders anxiously wait to see the minutes – due later this morning – from the the most recent Fed meeting…investors will try to discern if there is a more hawkish tone coming out of the Fed, particularly after Chair Janet Yellen stated during her March 19 press briefing that the Fed could start raising short-term interest rates about six months after ending its bond-buying program…Silver is down 29 cents at $19.77…Copper is off 4 pennies to $2.99…Crude Oil is up 8 cents at $102.62 while the U.S. Dollar Index has slipped another one-tenth of a point to 79.66…

Gold has traded between $1,300 and $1,315 so far today…as of 8:10 am Pacific, bullion is down $2 an ounce at $1,306 as traders anxiously wait to see the minutes – due later this morning – from the the most recent Fed meeting…investors will try to discern if there is a more hawkish tone coming out of the Fed, particularly after Chair Janet Yellen stated during her March 19 press briefing that the Fed could start raising short-term interest rates about six months after ending its bond-buying program…Silver is down 29 cents at $19.77…Copper is off 4 pennies to $2.99…Crude Oil is up 8 cents at $102.62 while the U.S. Dollar Index has slipped another one-tenth of a point to 79.66…

Holdings of the SPDR Gold Trust fell 2.7 tonnes to 806.48 tonnes yesterday…that reduced its net inflow for the year to just 8 tonnes…the fund has not seen any fresh inflows since March 24…buying has picked up slightly in China…bullion prices on the Shanghai Gold Exchange reached a premium of about $1 an ounce to spot prices for the first time since early last month…they were at a discount of as much as $10 at the end of the month…

U.S. Dollar Index Updated Chart

One factor in Gold’s favor at the moment is a U.S. Dollar Index that continues to struggle…after a brief run to climb out of temporarily oversold conditions, the Dollar Index ran into resistance and must hold critical support around 79 in order to avoid a potential free-fall…below is a 4-month daily chart update from John…it’s hard to imagine that the Dollar Index won’t face a serious test of the 79 area in the immediate or near future…

Today’s Equity Markets

Asia

China’s Shanghai Composite gained 7 more points overnight to close at a near two-month high, 2105…Japan’s Nikkei, however, lost over 300 points or 2% to finish at 14300…

Europe

European shares were up moderately today…

North America

The Dow is up 28 points as of 8:10 am Pacific…the TSX is 27 points higher while the Venture is unchanged at 999…

Direct Road Access Coming To The Hat?

Below is a picture of a helicopter picking up fuel at the start of the Golden Bear access road, approximately 30 km SE of the Hat and immediately off the very well maintained Telegraph Creek road…

Our visit is already giving us valuable new insight into infrastructure issues in the Sheslay district…of particular importance is the distinct possibility of near-term ground access directly to the Hat from a road that was built by Utah Mines many years ago, branching off from the Golden Bear access road…the Utah Mines route, which also passes through Garibaldi’s Hat East claims and Ashburton Venture Inc.’s (ABR, TSX-V) Hackett Property, requires improvements to a bridge, an effort that is expected to be spearheaded by Doubleview with the goal of completion before the start of summer…this would provide a very economical “shortcut” route to mobilize personnel and equipment to the the Hat Property, and potentially other properties, as an alternative to long distance and/or fixed wing aircraft support…the savings in exploration costs would be substantial…

Fixing of the Utah Mines route would be a major development, connecting a potential deposit at the Hat by ground…although remote, overall infrastructure in the Sheslay Valley district suggests that exploration costs – and ultimately capital costs to develop any deposits that are ultimately proven up – could be significantly less than remote properties elsewhere in the province…we’ll explore that issue more in the days ahead…

The Importance Of Scale

We’ve stated this before but it’s worth repeating – investors need to grasp the potential size of the Sheslay Valley porphyry system and understand how the strong possibility of a series of deposits over a long and broadening corridor could turn this area into a world class mining mining district…there are never any guarantees in the risky exploration business, but this is looking about as good as it ever gets…so far, the numbers back that up that statement…only 59 holes have been drilled into this district – 48 into the Sheslay Property (42 historically and six by Prosper Gold last year) and 11 by Doubleview, all last year, with DBV just starting a new round…remarkably, the “hit ratio” on those holes is approximately 75% with three important discoveries (still in the early stages) over wide distances – the Star target, about 9 km northwest of where we are right now, Pyrrhotite Creek, 4.5 km southwest of the Star, and of course the Hat…those facts clearly demonstrate that the Sheslay district, for lack of a better term, is

“pregnant”…significant catalysts over the last year have rekindled interest in a geologically prolific area whose time has finally arrived…

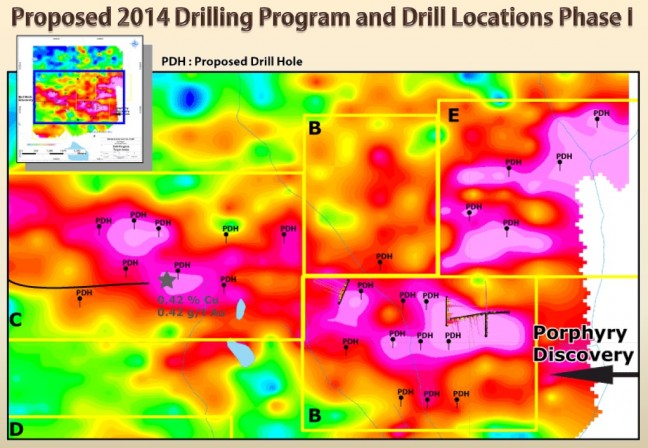

Exploring The Hat – Drilling Follows Up On Anomaly “B” Discovery With Anomaly “C” The Next Target

Refer to the map below and click on the forward arrow to listen to an excerpt of an audio interview (just over 3 minutes) between Jon and DBV CEO and President Farshad Shirvani– requires Adobe Flash Player version 9 or above):

7-Picture Slide Show From The Hat & Surrounding Area

We will have many more pictures to share in the coming days but below is a start (pictures will automatically rotate):

[aslideshow effect=”fade” play=true playframe=false controls_play=true]

An aerial view from the east-southeast toward the Sheslay Valley with Mount Kaketsa, a critical topographical feature, in the far background.

Topography over many parts of the Sheslay Valley is gentle to moderate sloping, very favorable for potential mining. This is an aerial view of a portion of Doubleview’s Hat Property.

Coming in for landing at the Hat – parts of the camp can be seen on the far right.

Doubleview has constructed 9 fully winterized camp “tents” including a kitchen and other services, currently serving a crew of more than a dozen.

Doubleview President and CEO Farshad Shirvani (right), standing beside consulting geologist and geophysicist John Buckle, at discovery hole HAT-11. Farshad is pointing toward hole #12 to the west.

Shirvani and Buckle review some core from HAT-11 which returned 313 m grading 0.32% CuEq including a 52-m section of 0.42% Cu and 0.34 g/t Au near the bottom of the hole.

Shirvani and field manager Ty George examine outcropping mineralization as reported at Anomaly “C”.

[/aslideshow]

Updated DBV Chart

Below is an updated 3-year weekly chart for DBV…notice the recent “cleansing” of the overbought RSI(14) condition…previous Fib. resistance in the low 20’s is now support…as always, perform your own due diligence…as of 8:10 am Pacific, DBV is off a penny at 22 cents…

Rackla Metals Inc. (RAK, TSX-V)

Simon Ridgway has turned his attention away from the Yukon and is finding success in South America – one example being Cordoba Minerals Corp. (CDB, TSX-V) which recently raised $15 million for an exciting porphyry project (the Cordoba and San Matias properties) in Colombia…mere speculation on our part, but it wouldn’t surprise us if Ridgway were to find something new in the exploration sector (not medical marijuana) for Rackla Metals Inc. (RAK, TSX-V) – perhaps far away from the Yukon and somewhere in South America?…RAK has been firming up a little bit recently with an increase in volume as well – this caught John’s attention, hence the 2.5-year weekly chart below for our readers’ due diligence…RAK is up a penny at a nickel on light volume as of 8:10 am Pacific…

North Arrow Minerals Inc. (NAR, TSX-V) Updated Chart

North Arrow Minerals (NAR, TSX-V), aggressively on the hunt for diamond discoveries, continues to look strong fundamentally and technically…below is an updated 1-year weekly chart from John…at 80 cents, NAR is threatening to breakout to a new 52-week high…

Note: John and Jon both hold share positions in DBV and GGI. Jon also holds share positions in PGX, ABR and RAK.

6 Comments

GBB.V halted pending news.

Nothing will be excited… This one has finished long time ago…. too many shares….

Still alot of snow, 🙂

Sold all BGG at a loss last week, invested in CTKH.

Just a short note for our readers—-we will be posting today’s Morning Musings later than usual (approximately 10:30 am Pacific) to allow for a special aerial tour.

GBB.V Memorandum of Understanding with IAMGOLD!!!