Gold has traded between $1,245 and $1,259 so far today…as of 7:30 am Pacific, bullion is down $5 an ounce at $1,248…Silver is off 8 cents at $18.95…Copper has fallen a nickel to $3.05, a four-week low…Crude Oil is up 24 cents to $102.72 while the U.S. Dollar Index has gained more than one-tenth of a point to 80.49…

Important Gold levels to keep in mind – a strong support band exists between $1,220 and $1,240 (bullion fell to the top of that support this week) while resistance is at $1,260…for now bullion is range-bound between these levels…

Important Gold levels to keep in mind – a strong support band exists between $1,220 and $1,240 (bullion fell to the top of that support this week) while resistance is at $1,260…for now bullion is range-bound between these levels…

Investors in India – retail, corporates, banks and foreign institutional investors – continue to exit Gold ETFs, new data show…the retail folio in Gold ETFs fell by nearly 7% during the second half of the financial year ended March 31, 2014, as compared to a 5% decline in the first half of FY14…the move away from Gold ETFs can be attributed to a strong showing by the Bombay Stock Exchange…the rally in equities has pushed India’s market capitalization share across the world to an 18-month high…the market cap has grown 14% so far in 2014, to around $1.4 trillion through June 4, which is the best showing in percentage terms across emerging markets as well as developed markets like the U.S. and Japan…

Today’s Equity Markets

Asia

China’s Shanghai Composite fell 11 points overnight to close at 2020 despite promises from the country’s banking regulators to maintain steady monetary policy and tighten supervision over shadow banking…reports that the People’s Bank of China will pump $11.7 billion into the market through money market operations was also unable to spur gains…the move would follow Beijing’s comments last week that it plans to increase lending to help rural communities and small and medium enterprises…meanwhile, the World Bank and the International Monetary Fund are urging China to focus on controlling risks from rapidly rising debt due to its reliance on credit-fueled growth…

Japan’s Nikkei average was off slightly overnight but still posted a strong weekly gain…interestingly – and we’ll see how this bodes for global equity markets in general – the Nikkei has broken out above a descending triangle in place since the beginning of this year as you can see in this 2.5-year weekly chart…the technically overbought conditions that emerged during the first half of last year have completely unwound…

Europe

Spanish blue chips led European stocks to their eighth straight weeks of gains today following the ECB’s announcement yesterday of a further easing of monetary policy…the ECB has turned the deposit rate negative for the first time as policy makers aim to boost inflation and encourage growth through increased bank lending and spending, among consumers and businesses…will it work?…

North America

The Dow is up 65 points as of 7:30 am Pacific…U.S. Non-farm payrolls continued to grow about in line with recent trends, rising 217,000 in May as the unemployment rate held steady at 6.3%, according to numbers released at 5:30 am Pacific by the Bureau of Labor Statistics…the fourth month in a row of above 200,000 job gains is encouraging and points to modest economic growth…most of the job gains came on lower-paying industries as wages rose modestly, increasing 5 cents an hour to maintain the modest 2.1% growth over the past 12 months…a broader measure of joblessness that includes those working part-time for economic reasons and those who have quit looking remained elevated at 12.2%, though that was a low for the year and the best “U6” measure since October 2008…

Keep in mind that in 19 out of the last 20 months, non-farm payrolls have been revised UP and by an average of 36,000…

The TSX is up 19 points while the Venture is flat through the first hour of trading…

SEC To Address Computer-Driven Trading

Long overdue – Securities and Exchange Commission Chairman Mary Jo White unveiled a sweeping set of initiatives yesterday to address mounting concerns about the impact of computer-driven trading on the stock market, including proposals that would extend oversight of high-frequency traders and dark pools…

No Fed Interest Rate Increase Until Mid-2015?

The U.S. Federal Reserve is likely to keep interest rates ultra-low well into next year, Fed Governor Jerome Powell said at a meeting in London today according to a report from CNBC. “We’ve said that we will not raise rates or are unlikely to raise rates before a significant time after the end of the asset-purchase program, so we’re talking about the middle of next year at the earliest, assuming the economy stays on this track,” he said at the Institute of International Finance’s spring meeting. Powell said he expects asset purchases to end in the fourth quarter of this year and “market conditions seem to be well aligned with this guidance as well.”

U.S. Household Net Worth Hits Record High

U.S. household net worth nudged up 2% to a record high $81.8 trillion in the first quarter as the stock market continued its upward climb and property values rose, data from the Federal Reserve showed on Thursday…the S&P 500 rose 1.4% in the first quarter as the Fed continued with a highly accommodative monetary policy for a recovering U.S. economy…for the year to date, the S&P is up 5%, and hit another new intraday record high yesterday…

Underfunded U.S. Public Pension Funds

Despite healthy gains from the ongoing stock market rally, U.S. public pension funds are still badly underfunded and the shortfall continues to widen…to try to close the gap, many states have shifted pension fund assets into stocks and alternative investments like hedge funds…but in doing so, they face a greater risk of being able to meet their long-term promises to pay retiree benefits, according to a new report from the Pew Charitable Trusts…As of 2012, the latest data available, states had set aside only $3 trillion to meet the more than $4 trillion in benefits earned by public workers…in New Jersey, Republican Gov. Chris Christie, a potential 2016 GOP presidential candidate, recently announced a plan to divert $2.4 billion in pension payments to close a $2.7 billion budget gap…in 2012, the state came up with just 39% of the annual contribution required to meet its estimated $47 billion pension liability…

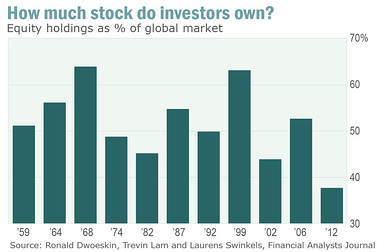

Global Stock Holdings At Low Levels

Hard to imagine a huge market sell-off under these conditions…an authoritative new study published recently in the Financial Analysts Journal shows that all investors – individuals and institutions alike – are keeping the lowest percentage of their portfolios in stock in over half a century…according to three Dutch researchers – Ronald Doeswijk, Trevin Lam and Laurens Swinkels – investors held only 37.7% of the $90.6 trillion in global investable assets in stocks in 2012, the most recent year their data covered…

Updated Crude Oil (WTIC) Chart

Crude Oil’s “moment of decision” continues to draw closer…below is an interesting 10-year chart from John…WTIC is in the middle of an ascending triangle with support around $95 and resistance around $110…a confirmed breakout above $110 would be a major development (the same with a break below the ascending triangle)…this long-term monthly chart shows a trend of declining volume and weakening buy pressure – that’s a pattern that needs to be watched closely…

Edge Resources Inc. (EDE, TSX-V) Update

Edge Resources (EDE, TSX-V), a rapidly growing Alberta-focused energy company, has enjoyed a strong week, importantly closing above a long-term downtrend line the past two sessions…fundamentally, this is a company with a lot of strengths and we suggest readers perform their own due diligence on EDE if they haven’t already…they’ve also produced one of the best corporate videos for a Venture company we’ve seen in a long time…

Technically, the question now is whether previous resistance at the long-term downtrend line (and a Fib. level) becomes immediate new support, as it theoretically should, or whether this process may take a little longer…keep in mind that RSI(14) is in overbought territory on this 4-year weekly chart where the stock has reacted previously, but the breakout above the downtrend line may provide some fresh fuel…EDE is off 2 pennies at 25 cents as of 7:30 am Pacific…

Source Exploration Corp. (SOP, TSX-V)

Encouragingly, Source Exploration (SOP, TSX-V) has been holding support around the 10-cent level, and we expect interest in SOP to pick up over the summer with the company now commencing another drill program at its promising Las Minas Property in Veracruz State, Mexico…the 2,000 m program will focus on expanding the higher grade skarn mineralization outlined by earlier drilling at the Santa Cruz area in preparation for an initial resource calculation…in addition, drill testing of high priority targets at the Juan Bran and Cinco Senores sites is also scheduled…

Below is a 3-year weekly SOP chart from John…RSI(14) appears to have found support at the 50% level and is now attempting to move higher…SOP closed at 10.5 cents yesterday…

Note: John holds a share position in EDE.

2 Comments

”A large gossanous zone was observed along the western portion of the Hackett during recent flyovers, and this area will be the subject of an early work program including sampling and mapping” Jon, how far are we from ABR releasing their grabs result?

Hi Martin, I would imagine we should be getting an update from ABR and others fairly soon. DBV has cooled things off a little, I think more because of their way of explaining things, but some heavy lifting is coming from Prosper in the near future in terms of initial results from their step-out drilling at the Star, and from the mobilization of a second rig, and GGI is firing bullets as well. Of course more drilling is under way at the Hackett, and I like the odds of better success there. So I’m expecting things to heat up again rather quickly in the area, and as momentum picks up so too usually does the news flow. With ABR, there’s plenty of circumstantial evidence that the trend extends onto their ground – the key for them, what would drive ABR higher immediately, is evidence on surface of a mineralized system, to be followed up by drilling. I believe AIX is in excellent shape with what recently has been announced and they should be able to ramp things up accordingly over the summer.