Gold prices hit their highest levels in three weeks today amid escalating tensions in Iraq with bullion trading between $1,272 and $1,286 so far today…as of 8:30 am Pacific, bullion is down $1 an ounce at $1,275…how Gold handles near-term Fib. resistance in the mid-$1,280’s will be interesting – it reacted at that level this morning…Silver is up a penny at $19.68 (see updated Silver charts near the bottom of today’s Morning Musings)…Copper is higher for a second straight session, up 2 pennies at $3.05, after the central bank in China extended a reserve-requirement cut in an effort to support economic growth…Crude Oil is up slightly at $106.98 while the U.S. Dollar Index is down nearly one-fifth of a point at 80.44…

Gold is coming off one of its best weeks of the year, aided by the situation in Iraq and a slew of data from China on Friday that showed that the economy is stabilizing, supported by targeted stimulus measures from Beijing…China, the largest global Gold consumer, nearly doubled its first-quarter Gold imports relative to the same period last year, according to a recent study by data provider Global Trade Information…

Gold is coming off one of its best weeks of the year, aided by the situation in Iraq and a slew of data from China on Friday that showed that the economy is stabilizing, supported by targeted stimulus measures from Beijing…China, the largest global Gold consumer, nearly doubled its first-quarter Gold imports relative to the same period last year, according to a recent study by data provider Global Trade Information…

New Zealand decides this week whether to approve an underwater iron-ore operation that would likely become the world’s first commercial metals mine at the bottom of the sea…a green light to allow New Zealand’s Trans Tasman Resources to start iron-ore dredging off the country’s west coast will encourage others looking to mine Copper, Cobalt, Manganese and other metals deeper on the ocean floor…along the Pacific Rim of Fire, as deep as 6,000 meters underwater, volcano crusts, “black smoker” chimneys and vast beds of Manganese nodules hold promise for economic powers like China and Japan as well as many poor island states busy pegging stakes on the ocean floor. “A lot of people are watching the Trans Tasman Resources outcome,” said Michael Johnston, CEO of Nautilus Minerals Inc. (NUS, TSX) which is working on a deep-sea project off Papua New Guinea and is also in talks with New Zealand…

Crude Oil (WTIC) Update

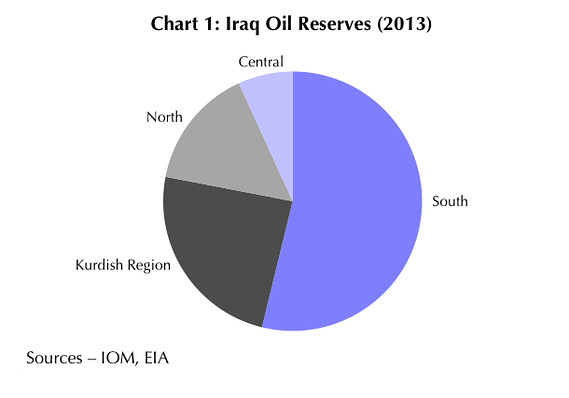

Is an Oil shock on the way this summer?…an underlying fear in the Oil market is that the fighting in Iraq will spread to the country’s main Oil producing areas in the south…most of Iraq’s Oil flows from terminals in the Shiite-dominated south where a majority of reserves are located as you can see in the chart below…Iraq has been suffering a low-level civil war for three years and production has still remained consistent at around 3 million barrels a day, but the threat of supply disruptions in the coming months has certainly increased given the emergence of the militant group (that’s a polite term) ISIS…most analysts believe that the immediate threat to Iraq’s Oil supplies – most of which are hundreds of miles to the south of the fighting – remains limited…northern exports have run at a trickle for months, and few had expected a rapid recovery…

Technically, the strong resistance band between $108 and $110 is a key area to watch in WTIC…a confirmed breakout above $110 a barrel would be a very bullish development given the posture of this 1-year weekly chart and some longer-term charts…

Today’s Equity Markets

Asian markets were mixed overnight…China’s Shanghai Composite gained 15 points to close at 2086 while Japan’s Nikkei average slipped 165 points…

HSBC’s June flash PMI for China will be reported Friday…the bank’s final reading for May rose to 49.4, lower than a preliminary reading of 49.7 but up from 48.1 in April…

China has more outstanding non-financial corporate debt than any other country, according to Standard & Poor’s, having overtaken the U.S. last year…in a report published today, S&P estimates that non-financial corporate debt in China reached $14.2 trillion at the end of 2013, compared with a U.S. figure of $13.1 trillion…from now until the end of 2018, Chinese companies are expected to borrow $20 trillion, a third of corporates’ debt requirements globally, a trend supported by the increased willingness of the Chinese authorities to allow more government-related entities to issue debt securities. “The concern is that if China did experience a faster slowdown, property prices came off and there was an issue in the shadow banking sector, that would have significant knock-on effects globally,” said Paul Watters, head of corporate credit research at S&P.

Europe

European markets were down slightly today…

North America

The Dow has retreated 37 points as of 8:30 am Pacific…U.S. stock markets suffered their biggest losses in two months last week, which also snapped the longest weekly rally this year…

The U.S. industrial sector showed some signs of life in May as the Federal Reserve reported an increase of 0.6% in industrial production today, in line with estimates…the Federal Reserve revised April’s data, reporting a decline of just 0.3%, up from its initial drop of 0.6%…

The Fed is widely expected to announce another $10 billion monthly reduction in QE in Wednesday’s FOMC statement, which will be followed by a Janet Yellen news conference…the focus will be on the Fed’s economic assessment, and investors will be looking for any clues that the first interest rate hike may come earlier than mid-2015…

“With inflation still below target, albeit rising, and unemployment still high, but falling, the committee faces a classic monetary policy challenge,” stated James Bullard, the president of the St Louis Fed, in a recent speech…

New figures out this morning from the IMF which foresees the U.S. economy growing a modest 2% this year, below its previous estimate of 2.7%…that would be nearly identical to the economy’s 1.9% growth in 2013…

The TSX is up 34 points through the first two hours of trading while the Venture has added 2 points to 999…ATAC Resources Ltd. (ATC, TSX-V) has commenced Phase I drilling at its 100%-owned Rackla Gold project in the Yukon…work will focus on recent Carlin-type Gold discoveries at the Osiris and Anubis areas within the Nadaleen Trend…ATC is up 6 cents at $1.15 as of 8:30 am Pacific…

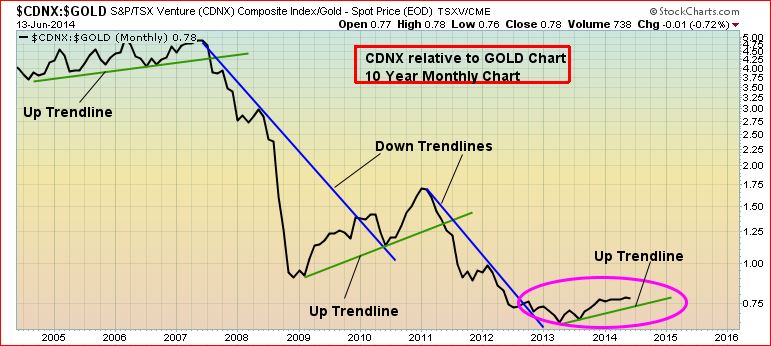

CDNX Relative To Gold

Below is an update to a recent fascinating 10-year monthly chart from John that shows how the Venture’s out-performance vs. Gold is a bullish indicator for both…on the chart below, you’ll see three uptrend lines – one that’s currently in progress – and two downtrend lines…the best time to be positioned in the Venture (and Gold for that matter) is when the Index (the black line on this chart) is out-performing the yellow metal…this Venture uptrend vs. Gold has been established since the second quarter of last year and should continue for an extended period, during which time we also expect Gold to ultimately push higher…

Venture 3-Year Weekly Chart

The Venture 3-year weekly chart has been an extremely valuable guide, and shows a primary uptrend that’s regaining momentum approaching Q3…note how the Venture broke above its long-term downtrend line in October of last year, tested that area as new support, then took the path of least resistance and climbed as high as 1050 in March…a mild pullback from that level was predicted and merely took the Index down to exceptional support around 970…the primary trend is bullish, and on Friday there was a confirmed breakout above a short-term downtrend line in place since March…the CMF shows the longest period of buy pressure since the bear market started in early 2011…

Venture 5-Year Weekly Chart + Gold Comparative

Below is another, more extended technical look at the Venture in comparison with Gold…the Venture’s extreme oversold RSI(14) condition that emerged in the second quarter of last year, coinciding with the bear market bottom at 859, was essentially a mirror image of the extreme overbought levels that existed in late 2010/2011…

Edge Resources Inc. (EDE, TSX-V) Update

Edge Resources (EDE, TSX-V), a very promising Oil and gas play we strongly encourage our readers to check out, hit a new 52-week high recently at 28.5 cents before pulling back to support in the low 20’s last week…with the possibility of a hot Oil sector over the summer, and rapidly improving fundamentals, EDE appears to be on track for a strong second half of 2014…EDE is up half a penny at 25 cents as of 8:30 am Pacific…

Silver Long-Term Chart

This 11-year monthly chart confirms that the metal has exceptional support in the high teens…note that Silver has two downtrend lines it needs to break above on this particular chart – in the immediate future we’ll be watching for a potential confirmed breakout above the first downtrend line…

If and when Silver clears stiff resistance at $26, watch out – you’ll want to back up the truck and load up…the COT structure, as mentioned last week, has become very favorable, suggesting Silver is gearing up for a strong move over the summer…

Silver Short-Term Chart

Silver gained 3.5% last week and pushed above a support band between $17.50 and $19.50…this “breakout” does require confirmation…

Early this year, Silver broke above a downtrend line in place since late 2012 on this 3-year weekly chart…similar to the Venture pattern during the fourth quarter of last year, Silver has found support at the top of this downtrend line…a bottoming pattern has been forming in the SS…overall sell pressure has been in decline since early 2013…these are encouraging signs…the support band between $17.50 and $19.50 should therefore hold while the next major chart resistance is $22…

Note: John holds a share position in EDE.

7 Comments

This is 2008 all over again. If the situation in Iraq spins out of control, which I think it will, oil will shoot up considerably. I believe oil touched $140 in June 2008, which put the final death nail to the world’s economy. The Venture is holding on- let’s see if we can close above 1000 these next few days and hold it.

From Martin Armstrong…. be careful out there….

COMMENT: Mr. Armstrong

Your statements about having to crash and burn were borne out by the recent election in Ontario Canada where the Liberals, admittedly one of the most corrupt governments in Canada, having doubled the deficit in about 11 years, were handed a majority government because they promised the moon to everyone, including no cuts to any civil service jobs and a brand new provincial pension plan (a new payroll tax).

People did not care about the corruption so long as party time kept rolling with new pensions and no cuts to the government.

Unions played an astounding part in the election, spending millions of dollars on TV and media ads about how society was going to fall apart if anyone tried to deal with the deficit. Fiscal responsibility was equated with a form of right-wing extremism. It truly is unbelievable that a populace could become so stupid.

Thanks for your blog. Can you give any insight into Canada’s place in what is coming? Certainly, I see no future for Ontario but bankruptcy.

B

REPLY: There seems to be no exception to the crash and burn. Politics has become so corrupted everywhere thanks to Marxism that this is what the civil unrest will be about. What started in Ukraine and Thailand is spreading everywhere. Canada will see civil unrest in line with the USA after 2015.75. You cannot keep promising everything that is never funded. A moron would figure that much out one day.

Alot of sellers of ABR today!

Weak hands into strong hands on ABR, Martin – in a way, that’s good to see. ABR has an extremely compelling scenario with the Hackett, based on all of our regional research, and this stock now has a paltry $1 million market cap. Gotta love it. The sellers have no clue what’s emerging in this part of the Sheslay corridor, and not only that but ABR has a possible western extension of GGI’s Grizzly. Keep the faith – and remain patient – because this one is going to roar yet IMHO, long before summer is over.

@Jeremy: I chuckle when I hear people say that Canada is the strongest fiscal country in the world. Give me a break. Canada is a basket case. I can throw a brick and hit a public sector employee within seconds. How will the provinces and federal government find the money to pay pensions, salaries, entitlements, I have no clue. When this house of cards comes tumbling down, it will not be pretty up here in the Great White North. But it doesn’t matter, keep charging those European vacations on MasterCard and buying those overpriced 1950s shacks.

In other news, Obama is deploying troops to Iraq and Kerry is saying ISIS cannot take Baghdad. Prepare yourselves for the mother of all clusterf**ks. If this doesn’t tear the Middle East apart, I don’t know what will. I am just waiting for Israel to join the party.

Chris, at the federal level Canada’s fiscal situation is not alarming (budget surplus, very manageable debt to GDP ratio) but it is at the provincial level in terms of Ontario and Quebec…Ontario is almost certainly on the verge of a credit downgrade with total debt around $270 billion, annual interest payments of $10 billion a year, and a Liberal government that has terribly managed the affairs of the province just rewarded with a majority government on a platform of spending more, increasing the deficit, and increasing the debt. So Ontario is definitely a basket case fiscally, alongside Quebec. Both those situations are very serious and unfortunately will affect – and are affecting – the nation as a whole. Ontario cannot spend its way out of the predicament it’s in. It’s going to get downright ugly there within a year or two.

Jon, I agree with you on the federal level the situation for now is manageable, but not for long. Once Ontario and Quebec receive a credit downgrade, and deservedly so, it will drag the whole country down. I am preparing to get out of dodge here in Montreal- once the goodies are taken away here in La Belle Province, there will be riots and protests every single day. The same will happen in Ontario.

Regarding the win by the Liberal party in Ontario, it was a no-brainer. Once they started talking about spending more, I said to myself they are going to win the election by a wide margin. It’s what the people want- more spending, more deficits. Just keep the gravy train rolling. This is why I have never voted for the main political parties in my life. They offer no solutions to our problems.