Gold has ranged between $1,263 and $1,270 so far today, easing from yesterday’s three-week high as traders await fresh developments in Iraq and Ukraine…as of 4:20 am Pacific, bullion is down $7 an ounce at $1,265…Silver is off 17 cents at $19.50…Copper is up a penny to $3.06…Crude Oil is off 69 cents to $106.21 while the U.S. Dollar Index has gained one-tenth of a point to 80.52…this is a slightly abbreviated edition of Morning Musings due to travel today…

Gold has ranged between $1,263 and $1,270 so far today, easing from yesterday’s three-week high as traders await fresh developments in Iraq and Ukraine…as of 4:20 am Pacific, bullion is down $7 an ounce at $1,265…Silver is off 17 cents at $19.50…Copper is up a penny to $3.06…Crude Oil is off 69 cents to $106.21 while the U.S. Dollar Index has gained one-tenth of a point to 80.52…this is a slightly abbreviated edition of Morning Musings due to travel today…

Silver Outlook Improving?

John’s updated Silver charts yesterday, plus the current bullish COT structure, suggest that a significant move to the upside in Silver is quite possible this summer, and it appears the move may already have started given last week’s 3% advance…high quality juniors with strong exposure to Silver should out-perform the metal, so those are situations to watch for…any dip in Silver over the near-term may provide one final highly favorable entry point in certain stocks…

The “longer-term path of least resistance” for Silver may be higher as the metal rallies with other cyclical commodities, according to ETF Securities. “With the most recent data from China showing signs of a rebound and the reserve ratio cuts by the PBOC (People’s Bank of China) adding to potential momentum, we expect cyclical commodities like Silver to continue to benefit,” ETF Securities stated (source: Kitco). “China is the world’s largest user of Silver and the cumulative data to April show China Silver imports are up 17% (year-on-year). Unlike Gold, Silver ETP inflows have been strong and sales of Silver coins are growing at a record pace. U.S. Mint Silver coin sales in 2014 are running about 6% above the record pace of 35 million ounces in 2013 – roughly equal to total U.S. Silver mine production. Most of the demand for Silver is for industrial purposes and the largest growing category is electronics related, notably solar panels. Total available Silver bullion inventories have declined substantially to about a year’s worth of mine production, compared to about seven times in 1990. The price of Silver has averaged about U.S. $20/oz in 2014, approximately a 15% discount from 2013, which is increasing demand and reducing secondary supply. Silver volatility recently reached the lowest levels in a decade, indicating a sharp price move soon. We expect that the longer-term path of least resistance is up.”

Today’s Equity Markets

Asia

China’s Shanghai Composite shed 1% or 19 points overnight after ending at its highest level in nearly a month yesterday…data out today showed that foreign direct investment fell to a 16-month low in May, and that weighed on sentiment…in Japan, the Nikkei climbed 43 points to finish at 14976…

Europe

European shares are up modestly today, tracking gains in U.S. stock markets and bouncing back from yesterday’s losses…

North America

Futures as of 4:20 am Pacific are pointing to a positive open on Wall Street in a couple of hours…fresh CPI numbers will be released at 5:30 am Pacific along with housing starts and building permits data…meanwhile, the Fed begins a two-day policy session this morning…

The TSX finished 39 points higher yesterday to close at 15040 while the Venture added a point to close at 998…

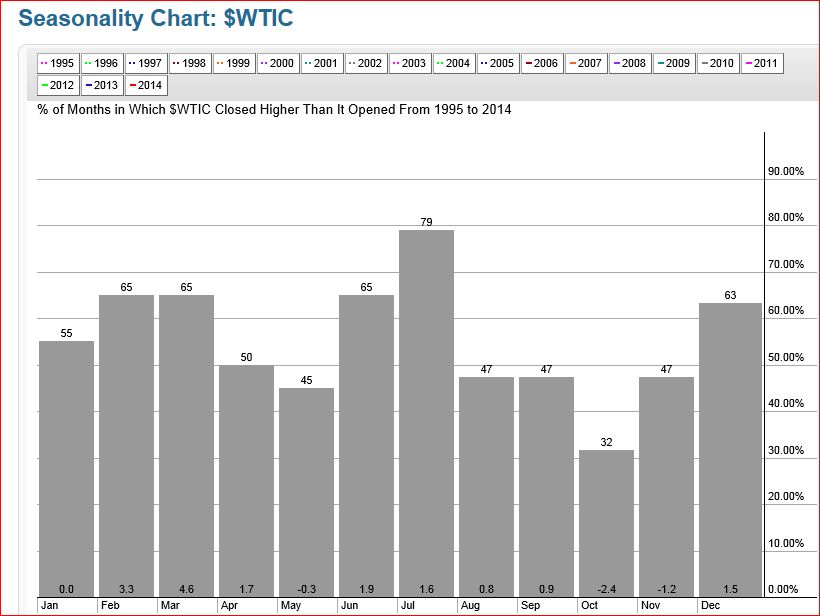

WTIC Seasonality Chart

We’re quickly approaching what has been the strongest month of the year (July) for Crude Oil prices over the last two decades…combined with current events in Iraq and Ukraine, the possibility of a spike in Oil prices has to be considered quite high…

WTIC Long-Term Chart

Following up on yesterday’s 1-year weekly WTIC chart, below is a look at the “Big Picture” with a 12-year monthly chart that has a decidedly bullish bias to it…a long-term symmetrical triangle has changed to an ascending triangle while RSI(14) at 58% has plenty of room to move higher and indeed is threatening to push above a downtrend line that formed after extreme overbought conditions emerged in mid-2008…

Modestly higher Oil prices would directly benefit certain nations’ coffers, and would also help to create some necessary inflation in various parts of the globe including the euro zone which is fighting deflationary concerns…however, momentum on a move through the $110 resistance would be hard to stop, and prices could end up going too high…

CRB Index 4-Year Weekly Chart

Another reason we’re so bullish on the Venture entering Q3 is the state of the CRB Index which broke out at the beginning of this year from a downsloping wedge…expect the CRB Index, which closed yesterday at 310, to push higher during the second half of the year…it has very strong support between 290 and 305…

Brazil Resources Inc. (BRI, TSX-V) Updated Chart

Familiar pattern?…John recently pointed out the opportunity in Brazil Resources (BRI, TSX-V) which hit exceptionally strong support in the mid-80’s…in a pattern very similar to the Venture, note how BRI broke above a long-term downtrend line early this year, retraced and tested that area as new support, and then resumed its primary uptrend…a bullish “W” has formed in the RSI(14) for BRI…

Highbank Resources Ltd. (HBK, TSX-V) Updated Chart

WANTED Technologies Corp. (WAN, TSX-V)

While we remain focused almost exclusively on the resource sector, occasionally we come across a non-resource company that really intrigues us…a good example is WANTED Technologies Corp. (WAN, TSX-V) which we selected in late December as one of 20 plays to watch closely in 2014…late last month, WAN reported strong results (record revenues and net income of nearly $800,000) for its third quarter ending March 31…

Since 2005, WANTED has stored more than one billion detailed records on hiring activity throughout the U.S. and Canada…this proprietary database contains more than 100 billion data elements which are used for analytical applications throughout multiple business sectors…the company’s most recent significant license agreement is one of many applications of WANTED’s “big data” for the employment sector…the challenge for WANTED will be to remain innovative while pursuing its growth in a relatively new and competitive field…new players, new alliances and new technological solutions may very well emerge in this market…

John’s updated 2.5-year weekly chart for WAN shows a cleansing of the overbought RSI(14) condition that emerged late last year…important support held, and the next measured Fib. resistance is above the $2 level (not a price target, just a theoretical level based on Fib. and technical analysis)…

Note: John, Terry and Jon do not hold share positions in BRI, HBK or WAN.

8 Comments

When are you guys doing a Summer Shesleay visit this year? Thanks!

Just examining the exact timing on that, last half of July is a definite possibility.

Jon, can you please post a new/updated chart for v.CCB (Canada Carbon)? Thanks!

anyone know anything about Unigold..??? DR neighbor of goldquest…

TIA

Hows part 2 on DBV coming, its been quite a few months since you announced you would be putting it out, any updates?

We’ll be significantly ramping up our Sheslay coverage very soon, Paul, and that will include Part 2 on DBV…we’re sorting thru a lot of material, and plenty has been learned in just the last couple of months…so when we’re ready….the Hat and the entire Sheslay district are like a huge jig-saw puzzle and the pieces are gradually coming together…obviously the area has been in a bit of a quiet period over the last 4-5 weeks but that’s all going to change rather quickly I suspect…

nice close on Venture yesterday and up again almost 3pts today…

71500 @ 42, Good to see sizable bid on PGX,