Gold has traded between $1,309 and $1,319 so far today…as of 7:15 am Pacific, bullion is up $1 an ounce at $1,316…Silver is up 3 cents to $20.91…Copper has gained another 2 pennies to $3.12…Chinese Copper imports fell in May but the factors impacting this have reversed in June, according to Citi Research…Crude Oil is off 63 cents a barrel to $106.19 while the U.S. Dollar Index is relatively unchanged at 80.35…

Bank of America recommends investors buy Gold into the third quarter as the seasonality trade kicks in with Ramadan and Indian buying…historically, the July-August period sees a demand boost from religious festivities, which Bank of America believes could push Gold past $1,400 this year…

Bank of America recommends investors buy Gold into the third quarter as the seasonality trade kicks in with Ramadan and Indian buying…historically, the July-August period sees a demand boost from religious festivities, which Bank of America believes could push Gold past $1,400 this year…

The World We Inhabit: Four suspected illegal miners were found dead Saturday with gun shot wounds to the head at a Gold mine near Johannesburg…the bodies were found by security guards employed at the mine, South African police stated…motives for the killing were unknown…illegal mining of abandoned shafts is common in the Gold mines around Johannesburg, with informal miners living underground in dangerous, cramped conditions for weeks on end as they dig out small parcels of Gold-bearing ore…meanwhile, the Montreal Gazette reported over the weekend that Denis Lefebvre, one of the three fugitives arrested yesterday morning after a recent helicopter jail break, allegedly supplied a helicopter as part of an aborted plan to rob Gold ingots from a mining company in Val d’Or in 2010 (the company was not identified)…

Today’s Equity Markets

Asia

China’s Shanghai Composite fell 2 points overnight to 2024 despite a very positive flash PMI reading from HSBC…it rose to 50.8 in June, the first expansion in six months…the figure was well above May’s final reading of 49.4 and Reuters’ estimates for 49.7…

Japan’s Nikkei rose 20 points to finish at its highest level since January 29 after data showing that domestic manufacturing activity in June expanded for the first time in three months…investors were also optimistic ahead of Prime Minister Abe’s announcement of more reform measures, part of his “third arrow” plan, sometime this week…

Europe

European markets are down modestly in late trading overseas…new figures for France showed that the manufacturing and services sector in the country had continued to contract in May…Germany’s reading showed an expansion but slipped from May’s number…

North America

The Dow, which has advanced for six straight sessions to a new all-time high, is off 27 points through the first 45 minutes of trading…the U.S. manufacturing sector expanded more strongly than expected in June, with the rate of growth and key sub-indexes advancing to their highest levels in more than four years, an industry report showed this morning…financial data firm Markit said its preliminary or “flash” U.S. manufacturing PMI rose to 57.5 in June, above economists’ expectations for 56.5 and the highest reading since May 2010…the final read for the index last month was 56.4…

U.S. home resales rose more than expected in May and the stock of properties for sale was the highest in more than 1.5 years, suggesting that housing was pulling out of a recent slump…the National Association of Realtors reported this morning that existing home sales increased 4.9% to an annual rate of 4.89 million units…May’s increase was the largest since August 2011…more housing data is due tomorrow…

The TSX is down 1 point as of 7:15 am Pacific while the Venture is flat at 1026…North American Nickel (NAN, TSX-V), one of our favorites this year, continues to push higher after breaking out above important resistance at the end of last week…it’s up 3 pennies at 56 cents through the first 45 minutes of trading today with a drilling campaign now under way at the company’s 100%-owned Maniitsoq NI-Cu-PGE Project in southwest Greenland…

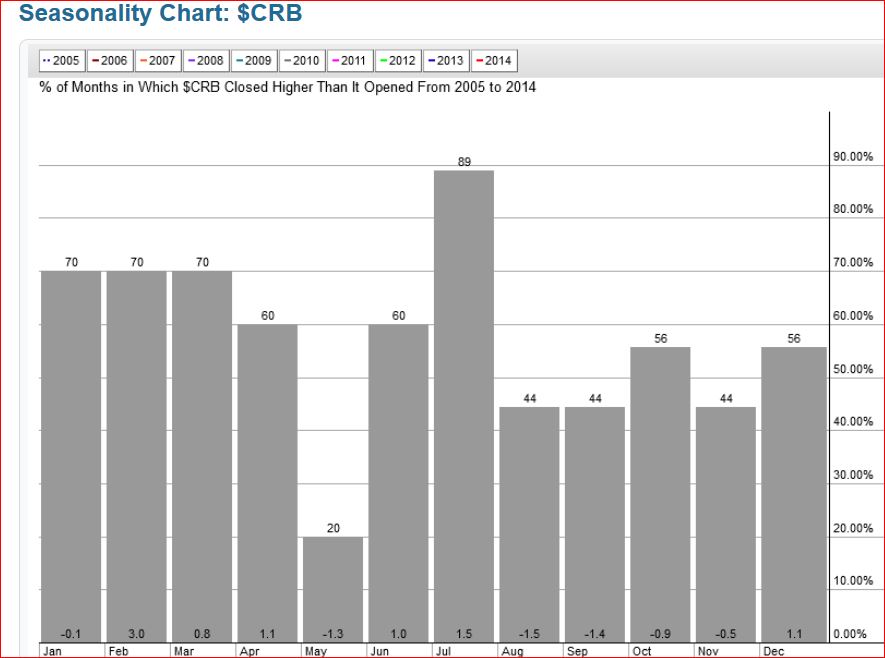

CRB Seasonality Chart

As The Wall Street Journal’s E.S. Browning pointed out in a weekend commentary, some analysts argue that weak global growth and an aging population will for years keep inflation and bond yields lower than many consider possible, potentially changing the way investors view the world…others still warn that complacency at the Fed will lead to damaging inflation…how this turns out will have a big impact on where stock, bond and other asset prices go in the months and years to come…

Some factors definitely argue for “creeping” inflation – the growing possibility of a major breakout in Oil prices being one contributing factor…this week, we’ll study the CRB Index in more detail to see what kind of technical clues it’s giving…Gold’s rise last week was clearly attributable to the perception of a more inflationary environment on the horizon while the Fed remains committed to record low interest rates…

In the meantime, below is a seasonality chart for the CRB Index…there is a whopping 90% probability of a higher CRB Index in July given monthly performances going back a full decade – another reason for the Venture to push higher in the coming weeks…

Venture 3-Year Weekly Chart

Below is John’s latest Venture 3-year weekly chart, based on Friday’s close of 1026…this chart has served as our incredibly reliable guide over the last nine months in particular, and clearly points to an Index that’s gaining momentum and will push higher in Q3…RSI(14) has been following an uptrend line since last summer…buy pressure has recently been strengthening…

Note how the Index broke above a long-term downtrend line last October, then retraced to that area as new support until late December before taking the path of least resistance…exceptionally strong support around the 970 area held as expected during the spring pullback from the mid-March high of 1050…

Not shown on this chart is the 300-day moving average (SMA) which is now reversing to the upside – time for the bears to go into hibernation…the bulls now control this market…

Silver Long-Term Chart

What’s particularly revealing and important about this long-term Silver chart is that the metal has staged a confirmed breakout above a downtrend line in place since last year…this is something we’ve been watching for…a further immediate or near-term push higher makes sense, followed by a brief consolidation period during which the downtrend line is possibly tested as new support…what’s also really encouraging is the position of the Slow Stochastics (SS)…it has formed a low “W” pattern – extremely bullish…that type of pattern suggests a critical trend change and a major advance are on the way – history tells us this should occur during Q3 which is consistent with how the bullish indicators are lining up with the Venture…

If and when Silver clears stiff resistance at $26, watch out – you’ll want to back up the truck and load up…the COT structure, as mentioned recently, has become very favorable, suggesting Silver is indeed gearing up for a strong move over the summer…

Silver 3-Year Weekly Chart

The Silver 3-year weekly chart shows near-term resistance at $22 and an RSI(2) that’s now in extreme territory at 95%, so it’s reasonable to suggest that a sustained breakout above $22 is not immediately in the cards…this market will need to consolidate, catch its breath and “fuel up” for a major push at some point during Q3…

Like the Venture (except in February, as opposed to last October), Silver broke above a long-term downtrend line and then successfully re-tested that area as new support…Silver advanced more than 6% last week and has confirmed a breakout above a support band between $17.50 and $19.50…

Abcourt Mines Inc. (ABI, TSX-V) Update

Higher Gold and Silver prices are good news for Abcourt Mines (ABI, TSX-V) which continues to move toward full commercial production at its Elder Mine near Rouyn-Noranda…this project has been guided along in very astute fashion during challenging market conditions over the past couple of years, and investors should really start to see the fruits of that labor during the second half of the year…

Importantly, ABI has pushed above a long-term downtrend line on this 2.5-year weekly chart…ABI closed Friday at 8 cents and has yet to trade so far this morning…

Critical Elements Corp. (CRE, TSX-V) Update

Another company with an interesting property in Quebec to keep an eye on is Critical Elements Corp. (CRE, TSX-V), which we started looking at again when it was in the upper teens…the company reported last month that it has started shipping samples of lithium concentrate to a number of users for analysis and validation of the product specifications…the concentrate samples have a low iron content, which is specifically required by certain users…validation of the Rose project material by some of the largest consumers of lithium concentrate with low iron content is part of the process of setting up long-term off-take contracts…

Technically, CRE formed a bullish ascending triangle, as we previously pointed out, and appears well-positioned for an encouraging second half of 2014…as always, perform your own due diligence…CRE is off half a penny at 23 cents as of 7:15 am Pacific…

Pretium Resources Inc. (PVG, TSX) Update

British Columbia has to be on every investor’s radar screen this summer – not just because of the untapped Sheslay Valley and the strong possibility of important new discoveries in that emerging district, but there are significant developments elsewhere as well…

Pretium Resources (PVG, TSX) continues to vigorously advance its Brucejack Project with an updated and robust NI-43-101 Feasibility Study released last week, and more drilling to test Gold mineralization at depth in the Valley of the Kings…

Highlights of the updated Feasibility Study completed by Tetra Tech:

- Increase in mineral reserve Gold grade – Valley of the Kings proven and probable mineral reserves are 13.6 million tonnes grading 15.7 g/t Au (6.9 million ounces) based on a $180-per-tonne cut-off grade;

- West Zone proven and probable reserves of 2.9 million tonnes grading 6.9 g/t Au (600,000 ounces);

- Gold and Silver recoveries of 96.7% and 90% over mine life;

- Mine life of 18 years producing an estimated 7.27 million ounces of Gold;

- Average annual production of 504,000 ounces of Gold over the first eight years and 404,000 ounces of Gold over mine life;

- Estimated project capital cost, including contingencies, of $747 million (U.S.);

- Average operating costs of $163 per tonne milled over mine life;

- Pretax net present value (NPV5%) of $2.25 billion (U.S.), a pretax internal rate of return (IRR) of 34.7% and a pretax payback period of 2.7 years – based on low estimates of $1,100 U.S. per ounce of Gold, $17 (U.S.) per ounce of Silver and an exchange rate of 92 cents.

The plunge in Pretium late last year, due to an unfortunate squabble between geological consulting firms, was unwarranted as we stated at the time, and the share price has since recovered to levels seen just prior to that collapse…what’s interesting now is that Pretium has been forming a bullish ascending triangle and could soon push above a long-term downtrend line as shown on this 3.5-year weekly chart.

There’s a lot of value here, based on that Feasibility Study as the permitting process now ramps up, with strong potential for the discovery of more high-grade mineralization at depth…

Note: John, Terry and Jon do not hold share positions in ABI, CRE or PVG.

8 Comments

are we agreed that the sell in may 2014 crowd didn’t shuffle in??? if the selling is exhausted, then is there an opinion on why the venture is taking its time coming off the 2 year consolidation??

Jeremy, the fact the Venture has been “taking its time” coming off the breakout above the downtrend line in October makes the bullish case that much stronger IMHO…incredible support has been built into this market, and this kind of gradual advance is typical of what one would expect to see prior to a very accelerated move which I’m certain we’ll see during Q3…if you look closely at John’s 3-year weekly chart this morning, which has been so accurate over these last 9 months, I think what we’re moving toward (as the summer progresses) is extreme overbought conditions…RSI(14) is far from overbought at current levels, lots of room for this to head much higher…that’s the trend…and when the Index is in those overbought conditions, you don’t want to jumping on the bandwagon at that point – you want to be selling into that kind of intense buying pressure…September might be a good time for that…right now, continued accumulation is what makes sense…the bulls have wrestled control from the bears, there’s no question about that, and Gold has bottomed as well…

Thx Jon… more later… on hiatus for a couple of days.. reading but not responding:)

I don’t know if this has been posted before but if you look at the long term monthly $XAU/$Gold ratio chart, it has just broken out of a downtrend that has been in place since 2006.

Duncastle to Acquire PGM-Ni-Cu Properties in Southwestern Yukon off abr,

Martin, it’s interesting that this announcement comes after ABR just completed a first phase work program at the Hackett. The fact they’re going to concentrate their resources on the Sheslay area to me suggests they may have seen a lot of reasons for encouragement at the Hackett. We’ll be updating ABR shortly, the chart is looking healthier.

That is what I think also Jon, tell see

I have payed 0.055 and 0.06 for those share