Gold has traded between $1,246 and $1,259 so far today…as of 8:00 am Pacific, bullion is down $7 an ounce at $1,249…Silver is off 11 cents at $18.95…Copper is up a penny at $3.12…Crude Oil is $1.09 lower at $91.66 a barrel, while the U.S. Dollar Index has gained more than one-tenth of a point to 84.26…

HSBC sees potential for Gold to ease some more if a statement from the Federal Open Market Committee next week should be more hawkish than expected…HSBC attributes Gold’s 3-month low to a reassessment of U.S. interest rate expectations following a recent Federal Bank of San Francisco report…HSBC says the report suggests investors may be underestimating how quickly policy makers could raise rates…HSBC’s U.S. economic outlook is for growth in U.S. GDP to average 2.5% in the second half and for full-year 2015, with the forecast for next year below consensus estimates…still, HSBC sees potential for the Fed to start hiking in June 2015 as the labor market improves, forecasting a jobless rate of 5.5% by the end of 2015…

HSBC sees potential for Gold to ease some more if a statement from the Federal Open Market Committee next week should be more hawkish than expected…HSBC attributes Gold’s 3-month low to a reassessment of U.S. interest rate expectations following a recent Federal Bank of San Francisco report…HSBC says the report suggests investors may be underestimating how quickly policy makers could raise rates…HSBC’s U.S. economic outlook is for growth in U.S. GDP to average 2.5% in the second half and for full-year 2015, with the forecast for next year below consensus estimates…still, HSBC sees potential for the Fed to start hiking in June 2015 as the labor market improves, forecasting a jobless rate of 5.5% by the end of 2015…

India’s trade minister, Nirmala Sitharaman, says the government is not considering an immediate cut in the country’s Gold import duty…New Delhi had hiked the import duty on the yellow metal last year to 10% to limit overseas purchases and trim its bloated current account deficit…however, a dramatic improvement in the deficit had raised market expectations of a duty cut…

U.S. District Judge David Campbell in Phoenix says he will rule in two weeks if a ban on the filing of new hard-rock mining claims near the Grand Canyon is bad public policy or protects cultural assets, water and the environment…the region surrounding Grand Canyon National Park is believed to contain as much as 40% of the known U.S. uranium resources…in 2012, former Interior Secretary Ken Salazar announced a 20-year ban on new mining claims that covered more than 1 million acres surrounding the Grand Canyon National Park…

Geopolitics Take Center Stage On Eve Of 13th Anniversary Of 9/11

In a high-stakes televised address to the nation tonight (9:00 pm ET), President Obama is under pressure to lay out a clear strategy for the administration’s campaign against ISIS, a group he not so recently dismissed as akin to a junior basketball team trying to play in the big leagues…

Almost two-thirds of respondents in a new Wall Street Journal/NBC News poll believe it’s in the nation’s interest to confront Islamic State, the well-funded terrorist group that has swept through Syria and northern Iraq and recently beheaded two U.S. journalists…the survey also found indications that more people were coming to believe the U.S. should play a more active role on the world stage, a shift from WSJ/NBC surveys earlier this year that found war-weary Americans wanting to step back from foreign engagements…the reports about the beheadings were the most closely followed news events in the U.S. in five years, according to the WSJ/NBC poll…

Meanwhile, eight weeks before the midterm elections, a new CNN/ORC International poll shows that voters in key geographic regions favor Republican candidates heading into November, highlighting significant challenges for Democrats trying to protect half a dozen vulnerable Senate seats and control of the chamber…

U.S. Dollar Index Updated Chart

The strengthening U.S. Dollar Index has had a lot to do with Gold’s weakness this month and the pressure as well on commodities and the Venture Exchange…the Dollar Index has hit a Fib. resistance level (84.50), which doesn’t mean it has peaked just yet but a near-term pullback to unwind temporarily overbought conditions wouldn’t be surprising…the Index has a history of sudden spikes like we’ve seen over the last six weeks…

We’ll continue to monitor the Dollar Index closely…below is a 2.5-year weekly chart…

Today’s Markets

Asia

China’s Shanghai Composite slipped 8 points overnight to close at 2318 as concerns about the country’s credit supply hurt sentiment…Premier Li Keqiang said yesterday that China’s money supply grew 12.8% in August, slower than July’s 13.5% growth and modestly below analysts’ expectations, Xinhua News Agency reported…

Japan’s Nikkei finished nearly 40 points higher overnight to close at 15789…

Europe

European markets are down moderately in late trading overseas…

North America

The Dow is off 34 points as of 8:00 am Pacific…the TSX is down 77 points while the Venture has retreated 3 points at 985 after posting a 3.5-point gain yesterday, its first winning session this month…

Venture Long-Term Intra-Day Chart

If you don’t already subscribe to Frank Holmes’ (free) weekly Investor Alert, we suggest you do by going to www.usfunds.com…while he doesn’t often comment specifically on the Venture Exchange, Holmes did recently include this intra-day chart for the 2+ year period beginning in January, 2012, that traders may find interesting:

“With the TSX Venture,” Holmes observed, “it’s generally smarter to sell rather than buy in the morning. Over the last two-and-a-half years, this is when prices tend to be high. There’s heavy volatility as the market is reacting to what might have happened since the previous trading day’s closing bell. Unless you really know what you’re doing in this particular market, if you buy in the morning, you can often expect to see your shares sink as the day unfolds. The ‘safest’ time to buy would be in the late afternoon. The market has cooled somewhat and traders are gauging where things might be headed. The challenge during this time, however, is that volume has dipped and, as a result, spreads have widened.”

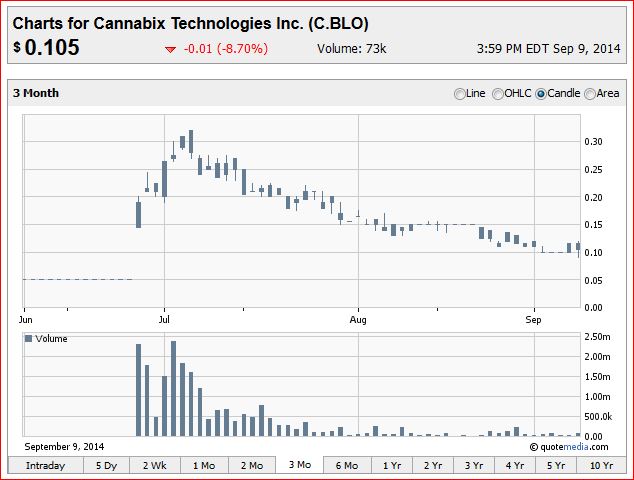

Cannabix Technologies Inc. (BLO, CSE) Update

Keep a close eye on Cannabix Technologies Inc. (BLO, CSE) which we believe not only has upside potential over the near-term, but tremendous long-term possibilities as well…excitement over the company’s patent-pending marijuana breathalyzer technology drove the share price as high as 32 cents within 7 days of BLO trading on the CSE, but since then – on relatively low volume – the stock has gradually retreated to the 10-cent area, reducing the company’s market cap to just under $4 million…since the CSE listing, company officials have been focused primarily on BLO’s business model and behind-the-scenes efforts to roll this story out to the critical U.S. market…we believe they’re on track, and patient investors could be handsomely rewarded…as always, perform your own due diligence – management is very approachable…

Below is a chart of how BLO has traded since late June…a base appears to be forming around the 10-cent level (may have hit an important low yesterday at 9 cents), and note how the retreat from the 20-cent area has been on low volume…BLO is unchanged at 10.5 cents as of 8:00 am Pacific…

Discovery Ventures Inc. (DVN, TSX-V) Update

Discovery Ventures (DVN, TSX-V) continues to aggressively push ahead with its Willa-Max high-grade Gold-Copper Project in southeast British Columbia…yesterday, the company announced it recently engaged Micon International Ltd. to update and refine the geological of the Willa resource…the interest in DVN has been driven by the obvious synergy of the the Willa combined with the Max mine and milling facilities Discovery negotiated to acquire at a bargain-basement price earlier this year…

Technically, DVN is temporarily consolidating after hitting the chart resistance outlined by John at 40 cents…the 20-day SMA, currently at 34 cents and not shown on this 2.5-year weekly chart, has provided strong support for DVN since its big move began near the end of May…there is also Fib. support at 30 cents…DVN is off half a penny at 34.5 cents as of 8:00 am Pacific…

Dolly Varden Silver Corp. (DV, TSX-V) Update

Dolly Varden Silver (DV, TSX-V), following the recent successful completion of a $5.7-million financing, has commenced a diamond drill program of up to 8,000 metres, or 20 holes, on the Dolly Varden Property in northwestern British Columbia…numerous untested epithermal and Eskay-Creek style targets will be drilled, and the program will also attempt to expand known Silver mineralization on the Torbrit-Red Point corridor where DV last year intercepted a 17.1-m interval grading 509 g/t Silver…DV closed yesterday at 12 cents, just slightly below its 200-day moving average (SMA) which has flattened out…keep in mind that most of the shares from the flow-through private placement completed at 12 cents over the summer will become free trading in mid-December…DV is unchanged at 12 cents through the first 90 minutes of trading…

Houston Lake Mining (HLM, TSX-V) Update

As we mentioned September 3, a company worthy of our readers’ due diligence is Houston Lake Mining (HLM, TSX-V) which broke out above a long-term downtrend line earlier this year, retraced to new support, and then powered higher again beginning in early August…after hitting a multi-year high of 16 cents September 2, a minor pullback occurred (to 10.5 cents) as predicted to unwind temporarily overbought conditions…HLM then quickly recovered on increased volume and hit another new multi-year high of 16.5 cents yesterday…

On September 2, HLM released results of two infill drill holes from its 2014 Phase II, 9-hole diamond drill program on the Pakeagama Lake pegmatite in Ontario…PL-011-14 intersected 1.68% lithium oxide (Li2O) over 104 m from 9.1 m to 104.7 m…PL-011-14, meanwhile, included a 12.8-m-wide high-grade lithium zone averaging 4.01% Li2O from 35 m to 47.8 m…results from 7 more holes are pending…

HLM President Trevor Walker stated, “These results with particular focus on the UIZ (high-grade) intercepts not only confirm grade from our maiden resource calculation but should increase the zone’s tonnage. These features of size and grade, combined with the pegmatite’s low inherent iron (less than 0.1 per cent iron oxide [see June 11, 2014, press release]) give HLM the confidence in its potential ability to economically produce a technical-grade quality spodumene product and/or concentrate that could appeal firstly to the established specialty glass and ceramics segment of the lithium market. This could be possible in contrast to many others, who would require a sizable capital investment in order to remove and produce a low-iron product. We are pleased with these results and look forward to releasing pending assay results in the near future from the remaining drill holes on our phase II diamond drill program.”

Below is a 10-year monthly HLM chart…note the sudden increase in buy pressure after dominant sell pressure since late 2007…HLM is unchanged at 16 cents on light volume as of 8:00 am Pacific…

Constantine Metal Resources (CEM, TSX-V) Update

Constantine Metal Resources (CEM, TSX-V), which we first brought to the attention of our readers when it was trading under 20 cents this summer, continues to be a strong performer…yesterday, the company announced it has secured a large and prospective land package surrounding its Palmer VMS Project in Alaska…

On July 22 the company released results from the first two holes of a 10,000-m drill program at the Palmer…initial drilling intersected a thick lens of massive sulphides 150 m down dip of the lower edge of the South Wall zone, a major expansion of the zone to depth…hole CMR14-54 returned 22.1 m grading 2.48% Cu, 4% Zn, 24 g/t Ag and 0.39 g/t Au…if additional holes can return even better grades, then CEM could gain a lot more attention…

The current drilling is part of a $6.2-million (U.S.) budget for 2014 financed by partner Dowa Metals & Mining Co. Ltd. of Japan…Dowa is in the second year of an option agreement in which it can earn 49% in the Palmer project by making aggregate expenditures of $22-million (U.S.) over four years…at this early stage, Palmer hosts a 4.75-million-tonne inferred resource grading 1.84% Cu, 4.6% Zn, 0.28 g/t Au and 29 g/t Ag…

Below is an updated 2.5-year weekly chart from John…CEM is trading at levels not since seen 2011, a very bullish sign…note that there is measured Fib. resistance at 21 cents, which CEM appears to have overcome, followed by 31 cents (not shown on this chart)…the 20-day SMA, currently at 23.5 cents, has been providing rock-solid support since the beginning of June…good potential through the remainder of the year…CEM is up half a penny at 24 cents as of 8:00 am Pacific…

Note: John and Jon both hold share positions in BLO.

17 Comments

jon,guess there’s a few nervous nellies out there in regards to ggi.should be any day now.just went outside and didnt get hit in the head from the some who think the sky is falling.

I think you should stick to your field of expertise because your geo political views are way off the real facts. Isis is very well funded because it is funded and armed by the US and their stooges in the middle east such as Egypt and Turkey. This is in deliberate response to the failed attempt to start a war in Syria last year through false flag gas attacks which were actually carried out by the so called rebels who were also openly armed and funded by the US/Nato alliance. The real reason behind this is to have another go at the removal of the democratically elected Assad regime who the neocon war mongerers can’t wait to get rid of. All of this is easily verified if you haven’t swallowed all the war mongering propaganda being spread by the mainstream media.

The fall in GGI is on very low volume. Maybe the weakness in gold price has driven buyers away for the time being. I’m hoping that DBV results will push it’s SP up next week, I’ll take some profits and put them in to GGI. I really fancy GGI in the long term as they have multiple targets in Mexico and a big piece of property in Grizzly. The management team seems to have it’s act together.

Jon, I picked up more GGI shares today and in my opinion this is a great buying opportunity. With pending results from Mexico and imminent drilling at the Grizzly it may wake up in a hurry.

yes tom and dan,just bored and thought i’d throw something out there,yes picked up a little myself,hang in there should be anyday now,ggi should bust out in a big way.patience will be rewarded.

Here is a thorough look at the US/Nato psyop known as Isis. People are not just “war weary” they are weary of the incredible propaganda being used to justify the killing of innocent civilians who simply want to live their lives in peace. Before this website tries to justify more needless killing of innocent civilians maybe they should engage in some REAL research into the causes and the perpetrators of the endless conflicts going on across the globe. Ron Paul is 100% correct when he says the US should cease it’s endless instigation of conflicts all across the globe and should concentrate on looking after it’s own 50 million citizens who are on food stamps simply to survive day to day.

@FRank; did you check out fnc’s volume today? 1.6 million traded on no news. hopefully the magpie news,which is due any week now, is positive and this stock finally sees well deserved valuation increase.

Hopefully the GGI shares picked up today will be in the money soon. We know Mexico drilling is ongoing but when will GGI stick the drill in the ground at the Grizzly? Winter is just around the corner so the drill better hit the ground soon. Recent interviews by Regocci seems to indicate they know where to drill at Grizzly but what is the hold up?

I suspect they’re in a final state of readiness, Dan, and again, it’s all about exquisite target definition on the part of GGI – they’ve been through this in Mexico. They’re not about to waste a single hole; they’re aiming for an “SE-14-01” at the Grizzly right off the bat. My gut tells me there are some pleasant surprises coming up, we’ll see.

Bravo Patrick. How refreshing it us to see someone out there who sees through the lies put forth by the main stream media and the psychopathic ruling class. These false flags as of late are so obvious it’s almost like they are just trying to see how far they can go and what a wonderful job they have done at dumbing people down

Would it be possible to post a chart on Cardiff Energy Corp. (CRS.V)?

It has certainly done well, Randy, thanks for bringing it up. We’ll attempt to look at it shortly.

John… with the CDNX at this time below the 400 which is below all MA’s, what damage is being inflicted????

TIA

What do you mean below the 400, Jeremy? Keep in mind the 970 to 980 support band, and the rising 200 and 300-day SMA’s. Venture is slightly below its 200-day but slightly above its 300-day. Throughout the Dow’s incredible run, it has occasionally dropped below its rising 200-day…

Looking at stockcharts … and the only number lower that the current index is the bottom BB..and please excuse my eyes… the 300 and 400 are still providing support:)

man…. dont lose thos glasses:) sorry John.. thanks for not ripping me a new one:)

DBV begins to moved !!!!

Just a warm-up for the entire Sheslay district, IMHO, but who leads this round may not be who led the January-May round…other dynamics are about to enter the picture…