Gold has been volatile today, trading between $1,221 and $1,251…as of 8:00 am Pacific, bullion is up $8 an ounce at $1,240…Silver has swung between $17 and $17.80 and is currently up 11 cents at $17.50…Copper has retreated 7 cents to $3.03…Crude Oil briefly fell below $80 a barrel but has since recovered to $81.90, up 6 cents, while the U.S. Dollar Index has dropped three-quarters of a point to 85.20…Russia’s Prime Minister Dmitry Medvedev told CNBC today that the world must move away from its dependence on the U.S. dollar, arguing that the global economy would benefit from a more diversified currency system…on Monday, Medvedev and China’s Premier Li Keqiang signed energy, trade and finance agreements and agreed on a 150 billion yuan ($25 billion) currency swap…

Fading confidence in the global economy has fueled speculation that the Federal Reserve may delay raising interest rates until well into 2015 – this has put the brakes on the U.S. Dollar Index, temporarily at least, giving bullion a lift…

Weakness in equities continues to attract some safe-haven buying into Gold…technically, bullion’s immediate obstacle is the $1,240 area – a confirmed breakout above $1,240 would put the bears on the defensive…$1,250 is also another key area, and that’s where Gold hit a wall this morning…

Keep a close eye on Canadian Gold producers – they will benefit significantly from a combination of lower Oil prices and a weak Canadian dollar…this morning we have an updated chart on the TSX Gold Index – accumulation patterns are showing up during this period of high volatility…

Today’s Equity Markets

Asia

Asian markets were mostly higher overnight…benign Chinese inflation data fueled hopes of additional easing, while a weaker currency provided support for Japanese shares…the Shanghai Composite gained 15 points to close at 2374 while the Nikkei average added 137 points to climb back above 15000…

Chinese consumer prices rose 1.6% from the year-ago period, compared with the 1.7% gain forecast by Reuters and after climbing 2% in August…wholesale prices, meanwhile, dropped 1.8%, versus expectations of a 1.6% decline and after falling 1.2% in the month before…producer prices in China have been declining since February 2012, weighed by falling commodity prices, overcapacity and weakening demand…

Europe

European markets are down sharply but off their lows in late trading overseas…

North America

Weak economic data this morning, along with other concerns, weighed heavily on the major indices at today’s open but losses have been trimmed…U.S. retail sales slipped 0.3% in September, slightly more than expected; the PPI for September fell 0.1% as opposed to expectations of a 0.1% gain; and a gauge of business conditions in New York declined in October, with the Empire State’s business conditions index falling to 6.17 this month from 27.54 in September…

The Dow is off 177 points as of 8:00 am Pacific after tumbling as much as 368 points…the S&P 500 is 22 points lower at 1856…keep in mind that energy companies are among the largest components of the S&P 500 by market capitalization…the TSX has retreated 144 points while the Venture is now trading below another support level (800)…the Index is 18 points lower at 785 through the first 90 minutes of trading…

TSX Gold Index Chart Update

A “dead-cat” bounce or the beginnings of an important upside move in the producers?…this 6-month TSX Gold Index chart shows the potential for an October reversal after a plunge of 22% between September 2 and October 8…the short-term bearish trend has clearly been weakening…the Gold Index, however, faces considerable overhead resistance which likely can’t be overcome without Gold staging a breakout through $1,250 – which certainly has to be considered a possibility given the unusual market conditions we’re in…the Gold Index is up slightly at 170 as of 8:00 am Pacific…

Contact Exploration Inc. (CEX, TSX-V) Update

Contact Exploration (CEX, TSX-V) is an excellent illustration of how Oil and gas plays have played a significant role in dragging down the Venture since the beginning of September…Crude Oil prices have tumbled more than 25% since their June highs and this has certainly taken its toll on all the junior producers in that space who did some heavy lifting while the Venture climbed to 1050 earlier this year…

Since hitting John’s Fib. resistance level bang-on at 56 cents in early September, nearly $60 million has been wiped off the market cap of Contact after yesterday’s close at 36 cents…recently, we warned that CEX had broken below an upsloping channel in place since the summer of last year, and it has continued to weaken…13.7 million flow-through shares from a private placement that are now free-trading aren’t helping matters…

CEX is off 1.5 cents at 34.5 cents as of 8:00 am Pacific…

Three Shell gas stations in Calgary rolled back their pricing to 1984 levels (40 cents a liter) for a day last week, celebrating 30 years of refining gas in Fort Saskatchewan. While we’re not about to see regular prices at those levels, some savings at the pump (the equivalent of a modest tax cut for North American consumers) are one benefit to the slide in Crude prices…

Crude Oil Slide

Oil prices posted their biggest 1-day drop in nearly 2 years yesterday amid a glut of crude, threatening the stability of some countries and providing an economic lifeline to others…the Saudis have clearly accelerated the decline by quietly telling Oil market participants that Riyadh is comfortable with markedly lower prices for an extended period, a sharp shift in policy that appears to be aimed at slowing the expansion of rival producers including those in the U.S. shale patch…earlier this month, state-owned Saudi Aramco stunned the rest of OPEC by slashing its November prices to defend its share of Asia’s growing market…Saudi Arabia also said it increased its output in September…meanwhile, Kuwait, Saudi Arabia’s traditional Gulf ally, is now challenging its bigger neighbor in an increasingly competitive battle for market share as it sells Oil to buyers in Asia at the widest discount to a comparable Saudi grade in 10 years…

The Saudis are putting the screws to Vladimir Putin, which is perfectly acceptable, as Russia – a high-cost producer with an economy that relies very heavily on its Oil sales – is hurting severely with prices at current levels…however, they’re also likely targeting a perceived threat from rapidly growing U.S. Crude production which is at a 25-year high (8.5 million barrels a day compared to 4.5 million in 2008)…it’s believed that marginal U.S. shale producers need about $85 a barrel to break even – bankruptcies could literally be on the horizon in the U.S. (and Canadian) Oil patches if prices were to fall below $80 for an extended period…

This downturn in Oil is also sure to do some serious damage to certain hedge funds and may force additional selling due to margin calls…

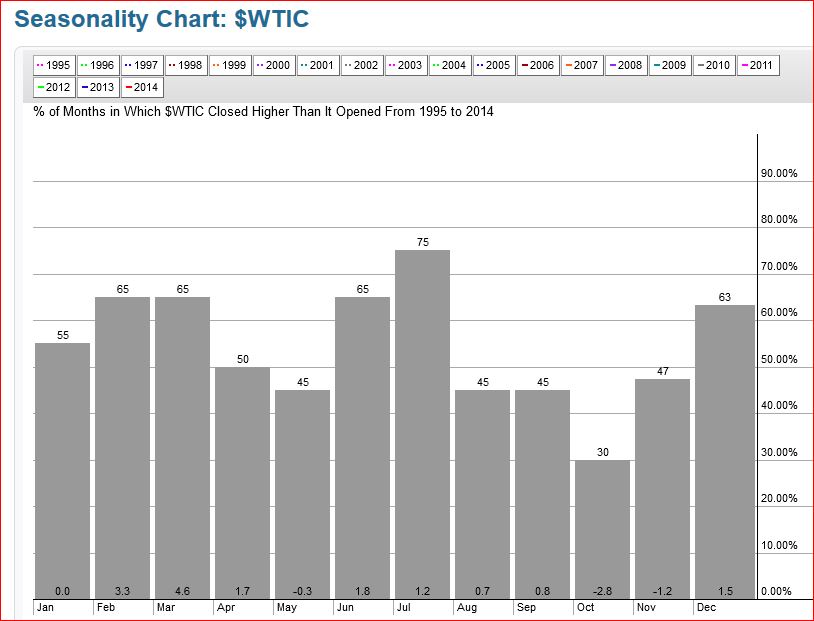

WTIC Seasonality Chart

Going back to 1995, October has been the worst month of the year for Crude Oil prices while November is the second-worst in terms of average overall monthly percentage declines…this is normally followed by an upswing over the winter through early spring…

WTIC Short-Term Chart

Technically, a breakdown of channel support in WTIC occurred last Thursday (on high volume) as you can see in this 6-month daily chart…that helps explain this week’s acceleration to the downside…the trend has been bearish since early July after a -DI crossover…RSI(14) could easily plunge further into oversold territory…

WTIC Long-Term Chart

What’s more worrisome about this plunge in Oil prices is the breakdown below a multi-year uptrend…based on this 10-year monthly chart, it’s reasonable to expect WTIC to fall into the mid-$70’s – the Fib. 50% retracement level is $75.31 – before a sustained rebound may kick in…sell pressure has now replaced buy pressure, dominant – remarkably – for a decade, even through the 2008 Crash…

Mission Ready Services Inc. (MRS, TSX-V)

This company could be in the right space at the right time – Mission Ready Services (MRS, TSX-V) provides solutions to the global defense, security and first-responder markets in the areas of cleaning, logistics, maintenance, program management and client representation…last Friday, the company, which is gaining momentum with some its clients, announced the closing of a $4 million private placement at 25 cents per unit…

Recently, MRS was awarded a $1.5 million contract for research and development of the U.S. Marine Corps’ next-generation body armor architecture…this followed the awarding of a larger contract MRS is participating in for warehousing and operations support services to clean and launder, stock, and store up to 7,800 pallets of individual protective personnel equipment (IPPE) for the Marine Corps’ Logistics Systems Command (MCLC)…on that note, MRS President and CEO Rod Reum commented: “This significant award, coupled with our ongoing contract to clean and repair the U.S. Special Operations Command Spear equipment at our JBLM and Fort Bragg facilities, helps to further broaden our business credentials within the various military communities and validates our technology. To date our advanced cleaning system has enabled us to place equipment back into service at approximately a 91% saving compared to replacement cost. We believe this award will be advantageous in gaining further recognition by the various military services and private organizations seeking to cut costs while maintaining the integrity of their equipment.”

Technically, MRS has been climbing an upsloping channel since the beginning of August with resistance in the mid-30’s and strong Fib. support in the mid-20’s…MRS started trading late last year after completing its qualifying transaction (formerly Priceless Piranha Capital Corp.)…as always, perform your own due diligence…MRS is off a nickel to 31 cents as of 8:00 am Pacific…

Note: John, Terry and Jon do not hold share positions in CEX or MRS.

23 Comments

DBV getting some attention: https://globenewswire.com/news-release/2014/10/15/673450/10102761/en/Smart-Money-Flows-Into-Copper.html

I for one, will not accept as gospel, any statement made by Prime

Minister Mededev. They are in trouble at home & of course, blames

everything on the west, in particular the U.S. They have proven

during the Ukraine war, that their handling of the TRUTH, leaves

much to be desired.. As for the Oil situation, the lower the price,

the more companies go out of business & the more companies leaving,

leaves us with a lack of supply, which creates a demand & anything

in demand brings higher prices. The only thing this will take some

time.. It’s elementary my friend, it’s all about supply & demand &

that’s precisely how our system works.

Great article on DBV!! I hope they come out with some news shortly on their plans for the next drill program and for financing.

It’s not my intention to be negative for the sake of

being negative, but it’s out there for everyone to see

and as i mentioned several times before, in a down market,

technical readings can be thrown out the window, even Doris

Day couldn’t predict the future. The Dow is down 408 pts

at this time. Would suggest you watch Crude oil, if it

breaks below $80.00, watch out below. On the positive

side, now that our little stocks have found a place to

rest, they are holding up fairly well. All the best…

The DOW traded below 450 pts.& is now coming back somewhat,

on the positive side, Gold plays, Barrick, etc., etc., are

in the green..

that article is not only good for dbv,but the whole valley should bring in more attention as well.

a little support on GGI today strange to see something green on my screen.

This should help GGI as well.

VANCOUVER, British Columbia, Oct. 15, 2014 (GLOBE NEWSWIRE) — The smart money is flowing into copper. Lundin Mining just agreed to pay $1.8 billion to buy the Candelaria copper mine in Chile. Mining legend Frank Giustra recently purchased 19.9% of Catalyst Copper. Last month, Mexican metal tycoon German Mota-Velasco spent $25 million of his own money buying up shares of Southern Copper.

As it builds on a fresh discovery in a prolific region of British Columbia, Doubleview Capital Corp. (DBV.V) is well positioned to attract international copper investors placing bets on the growing copper-supply deficit. Interest in Doubleview’s rapidly emerging Hat Cu-Au porphyry deposit in northwest B.C.’s Sheslay district can be expected to intensify as the company prepares to commence another round of drilling.

“The Hat Copper district is under-explored,” stated Doubleview President and CEO Farshad Shirvani in an exclusive interview with Financial Press. “It’s one of five or six major potential discovery areas in Canada. We’re on a minimum 30 kilometer long NW-SE trend that still has countless undrilled targets. And the drilling that has been done has shown an extremely high success ratio.”

Doubleview’s latest hole, HAT-022, intersected the strongest mineralization encountered at the property including a 118.4-metre interval grading 0.80% copper equivalent. Shirvani believes that there is a potential for higher grades and additional length within the Sheslay “red stock” and the zone identified earlier this year.

“The Hat Copper Project is our lead asset,” confirms Shirvani. “This is where we are focussing the bulk of our energy. There was a lot of work done by majors in the past, though no drilling, and we inherited millions of dollars of data at virtually no cost. IP and magnetic surveys revealed numerous anomalies and the initial drilling is certainly confirming that we have a very good shot at proving up a large deposit in a mining-friendly district.”

Shirvani points out that the copper values at the Hat are increasing with depth. Before the end of October the company intends to move the rig to the east of Hole 22 and commence an aggressive new drill program.

“These latest results confirm our belief that the Hat Property is an important new discovery,” stated Shirvani. “We have ample reasons to expect fresh breakthroughs as work continues. Mineralization remains open in all directions at the Lisle Zone (Anomaly “B”) where the vast majority of our holes have been drilled so far.”

Shirvani has recently recruited legendary geologist Patrick McAndless to the Doubleview team. The former V.P of Exploration for Imperial Metals, McAndless has over four decades in the mining industry primarily exploring for base and precious metal deposits.

“We now have seven geologists working on the Hat Project,” states Shirvani. “Pat and his team have a track record of developing similar deposits in the same region. To investors who know the local history of copper-gold porphyry exploration, the McAndless name is important. The strength of our technical team is now the equivalent to a senior mining company.”

In January of this year, Doubleview reported two discovery holes that sparked a staking rush in the area and breathed new life into the junior exploration sector in B.C. Shirvani believes this is only the beginning of much more excitement for this district which has certain infrastructure advantages not seen in other remote areas of the province.

“With each round of drilling the grades are getting better, our understanding of this system is improving, and we are building tonnage,” stated Shirvani. “Our team of geologists is unanimous in their belief that this could become a very important new deposit in northwest B.C.”

The latest 7 holes show a continuity of mineralization within the Lisle Zone. Geological, geophysical and geochemical testing have revealed highly prospective additional targets, within this zone and well beyond it, that have yet to be drill-tested.

“Just over a year ago, this was a grassroots project,” stated Shirvani. “In this challenging market, we’ve been able to execute a series of successful drill programs. We have confirmed high gold values and increasing copper values. These are still the early stages. Given the progression of this, we have every reason to believe the Hat has world class potential in a district where multiple new discoveries could be made.”

The International Copper Study Group has predicted that there will be a 466,000 tonne copper supply deficit in 2014. Copper analysts at Morgan Stanley recently stated, “We remain comfortable with our forecast for deficit conditions this year and next, as well as progressively higher prices.”

Doubleview Capital is currently trading at .17 with a market cap of $9.5 million.

Read more at StockHouse website

The Sheslay is starting to wake up again. With DBV drilling again before end of October, maybe GGI will follow. The bids seem to be increasing on GGI. Maybe news from Mexico?

Don’t forget about AIX where $5000 will get you 1 million shares. The question as always is whether that is a good buy with your money or a goodbye to it?

Jon, your thoughts on the Venture. Have we bottomed or do we still have more downside?

There’s something interesting immediately developing in Gold, Chris (and Gold producers), we’ll show in an updated Gold chart tomorrow morning…this ultimately may have important implications for the Venture. We’re in a very volatile situation – too early to call a bottom on the Venture, I doubt we’ve seen one just yet. Support again is 800 (we’ll see if a breakdown of that is confirmed tomorrow), 760 and 680 (a double bottom for the Venture around 680 is certainly possible as Tony suggested). Will it bounce back – yes it will, a lot of people thought it was over in the final quarter of 2008. That was the greatest buying opportunity ever. If Gold were to suddenly run significantly higher, this could be an important new dynamic.

Seems like Dow is rolling over, that leaves the way for the Venture! Probably Venture will retest 680 before turning around. We hope for the best!!!!

Ivan

If you wanted a million shares, you would more than likely

have to be buy at the ask & that is 0.01, which would cost

you $10,000.00… Sorry to have caused you to lose $5,000.00…

Double bottom for the venture coming. But the real question is will it bounce back?

Crazy day today. Surprisingly most of my stocks are holding well. At one point I had a stock that was down 42% and ended the day unchanged. My gut feeling is telling me we are close to bottoming. I believe this time around gold will drag stocks higher, not the other way around.

Jon

I am willing to learn, therefore am asking, how you can

state that support again is 800, when we closed at 778.36..

If i may, i would suggest that the Venture, will not seek

out support, if something positive happens before the Venture

opens tomorrow. Good luck Jon, i feel you may be also sweating,

like the rest of us. Good night ! R !

Bert

Bert, I would let John answer this but I believe he’s in bed after a long travel day. Anyway, in TA, confirmation of a breach or a breakout is required. So an intra-day move or a 1 day close below support or above resistance is not good enough for confirmation – could be a false breakdown, false breakout, those often occur. The recent action in Gold was a good example – if you look at John’s last 6-month Gold chart, it states, “The support at $1,200 is deemed to have held because the breakdown was not confirmed on the following day.” With regard to the Venture, of course it will seek out support—–that’s what markets always do—–but no one knows if that support will be 800, or (more likely) the other known support levels at 760 and 680. Monday’s long-term Venture chart shows we should expect a bottom on the Index when the -DI indicator hits DI peaks witnessed at previous important reversals going back to 2008. With regard to your last comment, I’m not sweating at all. I love this. These are times of great opportunity but you need to fire your bullets at the right time and at the right target. Could be a very big move coming in Gold producers—bullion is looking very interesting and the huge drop in Oil will be a significant cost-cutter and go straight to producers’ bottom line. The best-run, highest quality juniors will bounce back, perhaps with a vengeance.

Jon – I’m not sweating at all. I love this.

Bert – You’re the Man Jon. Maybe i am not sweating either, it could

be Stockitis. How about a loan.. (All in fun)..

Before i start my chores this a.m. i will post to suggest that things

don’t look much better this morning. Although Goldman Sachs beat

expectations by a large mark, i feel it may not be enough. We may

bounce back later in the day, but since copper has dropped below $3.00,

oil close to breaching the $80.00 support level, Gold down, Silver down,

Europe down, Japan, Hang Seng & Shanghai down, Bert down, Jon on top of

the stock world, but even that may not do it. Where’s the bottom ? below

one’s back bone. Have a good day.

REBOUNDING ON ALL MARKETS AS OF 7:00AM PDT

Gold alert…could be gearing up for a MAJOR advance…fresh chart as part of Morning Musings by 8:15 am Pacific…

Very, very positive, not only has Tor. fought it’s way back

from over 200 pts in the red to over 100 pts in the green,

but how about our dear Venture, which has fought it’s way

back from over 9 pts down to almost in the green. I haven’t

seen that happen for awhile. I would suggest Jon’s smile

will show in today’s musings. Way to go Jon, your optimism

is about the only thing we have to hang onto these days.