TSX Venture Exchange and Gold

The Venture’s December reversal kicked in pretty much on queue last week with Tuesday the 16th marking the infamous “low” (637) for this always volatile month which typically ends on a very bullish note. This year’s reversal is met with particular jubilation given the intensity of the sell-off that started at the beginning of September. After closing August at 1024, the Venture slipped on a few Oil slicks over the next few months with the junior market landing in critical condition. Fortunately, the CDNX is now back on its feet recovering just in time for Christmas with the hope that 2015 will be a healthier year. The first 8 months of 2014 certainly weren’t spectacular but they were solid with the Index posting a modest gain. From September 1 to December 16, the Venture tumbled a whopping 38% – very much in line with Crude Oil’s 40%+ drop.

After previous steep weekly losses of 6.8%, 5.4% and 6.0%, the Venture posted a gain last week of 20 points or 3% to finish at 674. The prospect of an imminent turnaround was quite obvious given not only historical trading patterns for December, but the RSI(14) divergence with price (the RSI low last week was above its October bottom even though the Index plunged to 637 in December, about 140 points under its October low).

Historically, there have certainly been situations when we’ve seen powerful reversals after major Venture declines. Over the next couple of weeks, it’ll be interesting to see what kind of strength comes into the Venture and how Gold and Oil also perform. A 10% to 15% move to the upside by the Venture over the short-term would not be surprising, and in that environment some high quality individual stocks could climb much more than that.

Below is a 9-month daily chart showing the Venture resistance levels all the way up to 800.

The Venture’s December-January “Effect”

Going back to 2011, the December low has occurred on the 15th (2011), 13th (2012), 19th (2013) and 16th (2014) of the month. Only once over the past 14 years has the December low been put in after December 19. By picking away at the best opportunities during the weakness over the first half of this month, and seizing on some bargains that are still available in the days ahead, it’s almost impossible NOT to make money looking out over the next month if you’re inclined to be a trader.

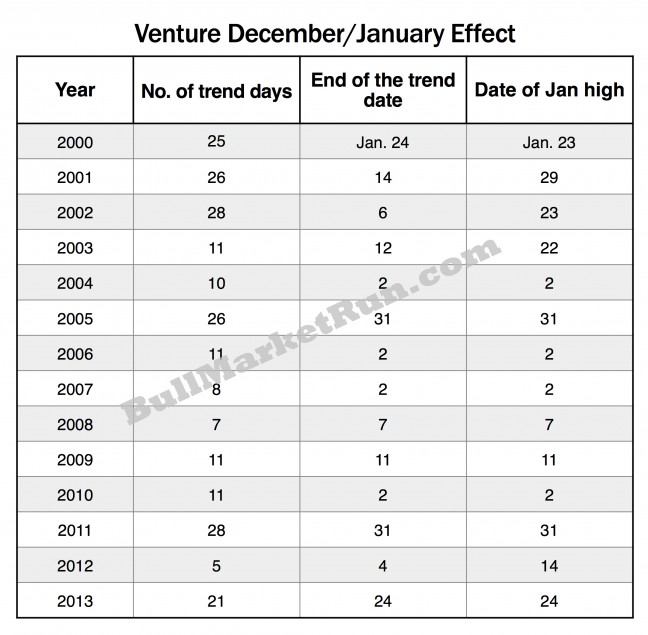

Over the last 14 years, as you can see in the table below, the December/January “Effect” uptrend has lasted for 20 or more trading days on 6 occasions. On only 5 occasions has the uptrend lasted less than 10 trading sessions. The average duration of the bullish period is about 3 weeks – 14 trading days.

The Seeds Have Been Planted (And Continue To Be Planted) For The Next Big Run In Gold Stocks

There’s no better cure for low prices than low prices. The great benefit of the collapse in Gold prices in 2013 is that it forced producers (at least most of them) to start to become much more lean in terms of their cost structures. Producers, big and small, have started to make hard decisions in terms of costs, projects, and rationalizing their their overall operations. Exploration budgets among both producers and juniors have also been cut sharply. In addition, government policies across much of the globe are making it more difficult (sometimes impossible) for mining companies to carry out exploration or put Gold (or other) deposits into production, thanks to the ignorance of many politicians and the impact of radical and vocal environmentalists (technology has made it easier for groups opposing mining projects to organize and disseminate information, even in remote areas around the globe). Ultimately, all of these factors are going to eventually create a supply problem and therefore great opportunities in Gold and quality Gold stocks. Think about it, where are the next major Gold deposits going to come from? On top of that, grades have fallen significantly just over the past decade.

Gold

Gold lost some momentum last week, falling below an RSI(14) uptrend that was in place since early November after bullion briefly plunged to a new multi-year low around $1,130. The key for Gold at the moment is to maintain support at the $1,180 level. Resistance between $1,200 and $1,240 has been quite strong. That $60 range ($1,180 to $1,240) could continue over the near to short-term, but we’ll probably see either a breakout or a breakdown sooner rather than later.

On an encouraging note, as you can see in the 6-month daily chart below, the general pattern since early November has been higher highs and higher lows. However, some analysts argue that we haven’t yet had a true capitulation in the Gold market yet, and the $1,000 level could be tested at some point during 2015 given the bullish state of the greenback and other factors.

For the week, Gold settled down $28 an ounce at $1,194 after posting back-to-back strong weekly gains.

Gold 5-Year Weekly Chart

Up momentum remains evident on this 5-year weekly chart, following last month’s $1,130 low, but of concern is the RSI(14) trend line which is sloping down. To put the bears on the defensive, Gold must push through this resistance.

Bullion is currently trading within a downsloping flag, and how that resolves itself during the first quarter of next year will be of great interest and importance.

Silver fell by just under $1 an ounce last week to close at $16.07. Copper lost a nickel to $2.91. Crude Oil (WTIC) finished down 70 cents for the week at $57.13 despite a jump of nearly $3 a barrel Friday. The U.S. Dollar Index closed the week at 89.59, up more than a point over the previous Friday.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, the long-term bull market in Gold has been driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, has had a huge impact on bullion and will continue to support prices. Despite Gold’s largest annual drop in three decades in 2013, the fundamental long-term case for the metal remains solidly intact based on the following factors:

- Growing geopolitical tensions, fueled in part by the ISIS terrorist group (air strikes won’t stop them) and a highly dangerous and expansionist Russia under Vladimir Putin, have put world security in the most precarious state since World War II;

- Weak leadership in the United States and Europe is emboldening enemies of the West;

- Currency instability and an overall lack of confidence in fiat currencies;

- Historically low interest rates;

- Continued strong accumulation of Gold by China which intends to back up its currency with bullion;

- Massive government debt from the United States to Europe – a “day of reckoning” will come;

- Continued net buying of Gold by central banks around the world;

- Flat mine supply and a sharp reduction in exploration and the number of major new discoveries – 2014 could be “Peak” Gold in terms of supply.

9 Comments

Hi…new to the site..like what i see so far..what do you think of LSA (Lachlan Star) by chance??

Welcome, Kersmash…LSA is not a situation we’ve followed, but we appreciate u bringing this to everyone’s attention. We’ll check into it. Tell us what u like about it.

I’ve just stumbled upon it myself..I’m heavily into GBB since this summer and I am just looking for the gold in the rough you might say.What I like about LSA is that they are producing 80,000 oz/yearish with some silver in Chile…they are multi-million oz. unfortunately not the highest grade though.Debt isn’t extraordinarily high.Shares out are lowish at 164 million.It seems like they have frequent news releases(wish more companies would steal a page out of GBB play book and have a forum)and all this for 3 cents a share.I would like to think this would take off when gold eventually decides too.Thanks for you time.

ps..nice write up on GBB …

Thanks, Kersmash, we appreciate your input. As far as GBB is concerned, we’ve never kept our eyes off of it even after retreating on our coverage in 2011 as a series of negatives (including the overall market) emerged. We’ve been waiting for the right time to give the “all-clear” signal and now is it. They are very close in our view to receiving their final permit; the overall asset value far exceeds the current market cap; the economics on the high-grade rolling start are robust with payback under a year; the low Canadian dollar and weak Oil prices will impact the project positively; the LONG Bars Zone features a multi-million ounce resource with only 20% of it explored so far; Quebec is looking more favorable as a jurisdiction with the socialist/separatist PQ out of power; and GBB’s Castle property has under-appreciated exploration upside to it. We’ll have our boots back on the Granada Property in January during our upcoming northwest Quebec visit, so sparks are going to fly.

I concur the time is right for GBB I was able to get 3 cent shares there back in June I was hoping that the CofA would have come quicker but when dealing with the government you never know.As they say the gold is still in the ground and more then we think I am hoping.Looking forward to what you think about LSA..Cheers

Jon: are you concerned about the US$ taking off over 90 as its almost there and Gold??? What are the hopes for the Venture to rebound….I remember you yourend last year outlook for 2014 was ‘way’ higher than we are ending……thanks…

The Dollar Index is a concern, Steven, but it is pushing up against some significant near-term resistance around 90-91, and technically overbought conditions can’t last forever. Interestingly, Gold has held up very well given the big move in the Dollar Index in recent months and the drop in Oil. Traditionally, the Venture runs counter to the Dollar Index, so a reversal in the greenback would be a welcome sight but how soon that happens is anyone’s guess. The dollar is sort of like the best house in a raunchy currency neighborhood – Japan is a fiscal, economic and demographic mess, while the euro zone could face trouble in 2015. So in a relative sense, the dollar is looking strong. I think a theme we could be looking at in 2015 is geopolitical upheavel and that may allow Gold to surprise to the upside, even if the Dollar remains solid. Both could be safe havens. On a separate but somewhat related note, I can’t believe Obama called the North Korea cyber attack “cybervandalism” on CNN this weekend. Not sure what he’s smoking during his vacation in Hawaii. Greatly understates the problem, one of many on the geopolitical front.

Looks like Obama doesn’t care anymore, looks like he’s in legacy mode, look what’s going on in the rest of the world and the us is the only game in town. Don’t think it’s solely on there improving economy either. They have some very big problems of their own, that we don’t hear much about, and wow, add another bush to it in 2016, lookout. Hope to hear from ggi before the end of the year,but I’m leaning towards early jan. Hope I’m wrong. Happy holidays everyone.

hello bmr boys agan I bring to your attention heron resources (her:tor exch) latest press release dec21 2014 :Woodland High Grade Assays and New Massive Sulphide Intercepts: merry Christmas walter emond