Gold has traded between $1,130 and $1,146 so far today…as of 8:00 am Pacific, bullion is down $13 an ounce at $1,132…Silver is off a dime at $14.88…Copper is off 3 cents at $2.48…Crude Oil is down 58 cents at $50.33 while the U.S. Dollar Index has edged one-fifth of a point higher to 97.78…

Gold prices are headed for a 6th straight day of losses, the longest rout since November…options trading this week has demonstrated the current bearishness…the 5 options contracts with the most volume on Wednesday, for example, were all bets on price drops…it’s reasonable to expect that Gold will test the bottom of a downsloping flag around $1,100 on John’s regular 2.5-year weekly chart we post at least once a week…given the drop in the loonie, Gold in Canadian dollar terms has been performing much better, and that’s why a producer like Richmont Mines (RIC, TSX) is actually up nearly 8% this week (through yesterday)…

Gold Downside Limited – HSBC

Although the climate for Gold remains negative, analysts at HSBC say the metal’s weakness may be limited, even if they expect short-term losses…n a research note yesterday, they pointed out that imminent interest rate hikes, low inflation, the stronger dollar, equity markets as well as subdued geopolitical risks are all weighing on Gold. “These factors make further Gold losses likely, in our view, at least in the near-term,” they stated. “But EM buying from China and India has just very recently perked up…so the downside appears limited and we expect bargain hunting to consistently pare losses.”

China Gold Reserves Up 57% Since 2009

In its first disclosure in 6 years, China has revealed that it has increased its Gold reserves 57%, overtaking Russia to become the country with the 5th-largest hoard (the U.S. has the largest reserves at 8,133.5 tons according to data from the World Gold Council)…China has boosted its bullion assets to 1,658 metric tons (53.31 million fine troy ounces), the People’s Bank of China said in a statement today…that’s an increase from 1,054 tons (33.89 million fine troy ounces) in 2009, when it last updated the figures…some analysts had speculated China might actually hold reserves well in excess of 2,000 metric tons, so the updated number today is a disappointment to some…nonetheless, it’s obvious China has been stockpiling Gold as part of its plan to diversify its foreign-exchange reserves…policymakers are pressing to add the yuan to the International Monetary Fund’s basket known as the Special Drawing Right, which includes the dollar, euro, yen and British pound…

China is pushing hard for a greater role for its currency globally, and that means greater transparency is critical – hence the decision to update the world now as to its current Gold reserves…

Platinum prices have fallen to their lowest level since February 2009, dipping slightly below $1,000 per ounce as investors continue to lose faith in the fundamental demand outlook…output from South African Platinum producers has been rising this year after crippling strike action in 2014…in addition, Chinese jewellery consumption has been soft, while indications of a slowdown in the global car industry, which uses the metal in catalytic converters, is also undermining sentiment toward the metal, according to various analysts…

Today’s Equity Markets

Asia

China’s Shanghai Composite jumped 134 points or 3.5% overnight to finish the week at 3957, about 100 points below key resistance…is this just a “dead cat bounce” or the actual beginning of a major turnaround in the Shanghai after a 30% plunge to cleanse temporarily very overbought conditions?…we’ll likely find out in the coming weeks…the Shanghai really needs to push through the 4050 level to prove this might not be a “sucker’s rally”…

Europe

European markets were mixed today…the ECB re-opened financial lifelines to Greece following its approval of reforms in a fraught parliamentary vote…

The British pound has enjoyed its best week against the euro since 2011…Bank of England governor Mark Carney has spent the week preparing UK investors for higher interest rates, saying the time for such a move will become much clearer by the end of the year…the central bank’s key interest rate has been stuck at 0.5% since March 2009…

“The need for the bank rate to rise reflects the momentum in the economy and a gradual firming of underlying inflationary pressures,” Carney stated in a speech yesterday…

North America

The Dow is off 70 points as of 8:00 am Pacific…in Toronto, the TSX has lost 118 points while the Venture has retreated 4 points to 635…

Economists anticipate that the housing market will mitigate the drag on the U.S. economy from a struggling manufacturing sector…U.S. housing starts rebounded strongly in June, in line with expectations, and building permits surged to a near 8-year high…

U.S. consumer prices rose for a 5th straight month in June as the cost of gasoline and a range of other goods increased, further signs of firming inflation that could strengthen the Fed’s case for an interest rate hike by year-end…the Labor Department said this morning that its Consumer Price Index rose 0.3% last month after increasing 0.4% in May…last month’s increase pushed the year-on-year CPI rate into positive territory for the 1st time since December…has the energy-driven disinflationary trend reversed?…too early to tell just yet, and Crude prices are vulnerable to a fresh slide, but a report Wednesday showed producer prices rose in June for a 2nd straight month…

NASDAQ Ready To Surge?

It has been a good week for the NASDAQ…John’s Wednesday chart showed a rapidly growing opportunity of a new high in the index, and that’s what has occurred with the index hitting 5196 in early trading today with the biotech and tech leading the way…Google (GOOG, NASDAQ) has surged by more than 10% after reporting better than expected earnings yesterday…

The NASDAQ is on track to confirm an important breakout today above Fib. resistance at 5132…

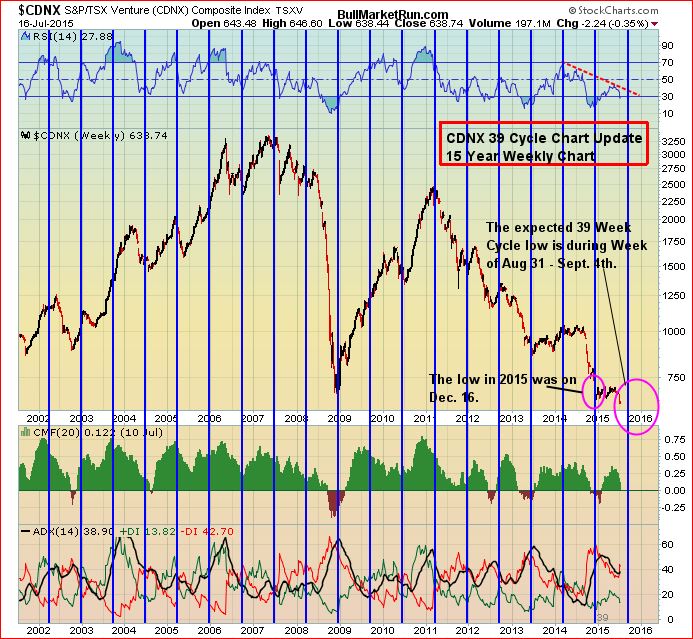

The Venture’s 39-Week Cycle

We’ve shown this on several occasions before – the Venture’s really odd but obvious 39-week cycle going back nearly 15 years…roughly every 39 weeks, there’s a trend reversal as you can see in this weekly chart below (the blue vertical lines define each 39-week period)…what this is telling us right now is that an important bottom could form in the Venture during very early September, with a reversal at that point to the upside going into the end of the year…note the current RSI(14) downtrend line from the 2014 high…the next 39-week cycle is when this downtrend line should be overcome…

Deveron Resources Corp. (DVR, TSX-V) Update

We believe we’ve uncovered something quite intriguing here, and we have mentioned it before at lower prices…now it’s looking even more interesting…Deveron Resources (DVR, TSX-V) is one of the few companies on the Venture that hasn’t obliterated its share structure over the last 2+ years, and it has been a top-performing stock over the last few months despite no news…the chart tells us there are expectations for some developments here – Deveron only has 11.8 million shares outstanding, and out of that the public float is only around 3 million shares…so this is a “tight” deal trading above its late 2012 IPO price (25 cents) with strong financial backing – an attractive vehicle for a smart entrepreneur to making something happen…

This 2.5-year weekly chart shows a confirmed breakout above 25 cents with 2 measured Fib. resistance levels…this obviously isn’t a big volume play given the small float, but the share structure gives it very explosive upside potential in the event there is the right news to drive it…

DVR is off 2 pennies at 27 cents as of 8:00 am Pacific…

Tribute Pharmaceuticals Inc. (TRX, TSX-V) Update

A non-resource play that has been a spectacular performer this year…John warned about the overbought conditions that emerged last month, but an “unwinding” of that has occurred and Tribute Pharmaceuticals (TRX, TSX-V) is once again attempting to push through Fib. resistance just below $2.10…

TRX is down 2 cents at $2.05 through the 1st 90 minutes of trading…

BitGold Inc. (XAU, TSX-V) Update

Hard to put a value on this one, which is one reason why there has been so much intrigue surrounding BitGold (XAU, TSX-V) – and why it’s so important to follow the technicals with this particular play…

XAU has been volatile, racing strong out of the gate in May to $8 a share from $2.35 in 5 days, and then retracing to strong support at the Fib. 23.6% level…recently, it has broken out and is now resting the top of cup resistance at $6.50…

XAU is down 22 cents at $6.00 as of 8:00 am Pacific…

Walker River Resources Corp. (WRR, TSX-V) Update

Walker River Resources (WRR, TSX-V) has shown some life this week, trading as high as 3.5 cents with more than 2 million shares changing hands yesterday…keep in mind, 2-cent paper from the March financing is now free-trading, so there’s a process involved in terms of cleaning that up…the company has yet to announce the start of drilling at its promising Lapon Canyon Property in Nevada…we’ll be watching events very closely when they do…

Technically, key near-term resistance for WRR is 3.5 cents…

WRR is unchanged at 2.5 cents as of 8:00 am Pacific…

Note: John and Jon both hold share positions in DVR and WRR.

41 Comments

GGI on sale.

Guys,

I used to check out the comments here on a daily basis but have now stopped mainly because day in day out it seems that 99% of the comments are about DBV and GGI. Both stocks are trading at or near their lows. As usual, the market price says it all, I think they are still going lower.

Start following WRR and PXA which today has traded some 2.5 million shares. I’m hearing that there will be major news out next week on PXA. WRR will start drilling not too far from where PXA properties are located in Nevada.

Cheers

Gold has broken it’s 1140 support and now on its way to 1000 or lower . July is usually a strong month for gold but so far not the case this year.

let the us buck go up,all its going to do is bite them big time shortly,whos going to buy thier goods, whos going to want to visit there,ill bet travel agents are busy takeing calls on cancellations from canadians,and elsewhere,border towns in the us will be first to feel it imediately,jon,it will be interesting to catch globals camera on the peace arch crossing,should be pretty quiet,good buys rite now.

BigRig , they are all on sale ( fire sale ) unfortunately so many people have lost so much money in the venture no one has money to buy much of anything . At this point if I had money I would be buying not only DBV and GGI but a lot of other over sold and undervalued stocks .

It looks like Questrade is dumping both DBV and GGI.

Jeff,

If you wish to go to a website that has one main index (for all companies) and individual rooms, check out http://chat.ceo.ca/index.html . I use this site plus BMR.

There has been a fair bit of mention on IMT.V earlier this year and I believe there are more results to follow from the work that’s been completed. Excellent management and outstanding project. IMT.V appears ready to make another move as we wait for more news.

Where is the ask ?

Guy- the big asks disappeared…lol. I guess they weren’t serious and were probably trying to shake out some shares for themselves.

Guy , looks like they changed their mind and aren’t going to sell at that price . Wish I had level I I so I could see if they were moved higher or removed

Guy. On what stock are you referring to above in comment 10? Thank you.

On the CDNX the ask is removed ask .10-.125 136,500 !

DBV ask @ .10 for more than 450,000 shares was removed and not moved higher .

The large offer at .10 this morning, Les, possibly may have been a “fear” tactic – to induce some selling into the market…those games are played.

Andrew, it’s DBV

Jon, unless some news of progress being made in these nogoations is forthcoming soon , a fear tactic will not be necessary to open the flood gates. I’m sure you are doing your best to keep us all informed .

Les, even though we haven’t written anything on this issue over the last 2 days, believe me, we’re very much on top of it as we are putting together all the pieces of the puzzle, for an in-depth report as soon as we can put it out—-we are in the process, even as I write this, of fact-checking and reaching out to some additional sources for clarification. Obviously that’s what good journalism requires. Keep the faith. If you bought DBV because of the project, or GGI because of the Grizzly, then believe in those projects and those companies even more, IMHO, because this whole issue comes back to value and Chad Day’s rather reckless attempt to use that value and more than 400 sq. km of land as a bargaining chip with the govt., as we’ve been reporting all along. More facts to back that up are coming. These “hostages” have value.

Thank you Tom. I was hoping someone would clarify the stock symbol. I picked up some GGI today in any event.

I just want to know the evolution of the situation for DBV, after 10 days he certainly decide what option !

Yes as soon as ggi went to 6.5 I grabbed a little more, hope Jon is rite and we get some news on the sheslay next week, and let’s not forget about Mexico, it’s due…I’m sure dbv&ggi have their options decided, time to implement them.

Wow. Venture reaches another near all time low 628. Let’s face it; the venture is,unfortunately, done.

Jon , thank you for your continued flow of factual information . With out it many of us would be having doubts about the Sheslay area . Keep up the good work.

tony T – Why do you say that? It has been this low before and I assure you that, although it may go even lower,….it will recover. Sit Tight.

As Guy Delisle said, a favourably evolving situation would be most welcome.

Fortune Minerals was boycotted because it threatened three rivers. Red Chris poured millions of cubic metres of polluted water downstream as the Mount Polley pond collapsed. Are DBV, PGX & GGI realistically a threat to the Sheslay River

Watch the area at Garibaldi Resources –> Maps –> Grizzly –> 3D Google map

The burial sites excuse was debunked, the excuse that the province did not consult with the Tahltan to grant drilling permits was debunked. Can the Sheslay river excuse hold any water?

Also check the Regional Map on Garibaldi website… Why did the Tahltan thumbs up Golden Bear and Teck Resources?

As we’ve repeatedly pointed out, Concerned Citizen, exploration has been carried out in this district for more than 6 decades, the Tahltan helped build the Golden Bear mine access road and maintained it, and of course this access road included the infamous Bridge Over The River Sheslay. So why all of a sudden, after so many decades, is there suddenly this fierce “opposition” to exploration and mining activity in the Sheslay district – and after legal permits were issued following full consultation??? Keep asking yourself that question. Also, an observation: We’ve all experienced this in our lives, especially in our younger years (i.e., teens, 20’s) – you told one lie and then you ended up having to tell a web of lies, even bigger lies, to back up the first lie and subsequent lies. You ended up with one big huge lie and a horrible mess. That’s how this started May 21.

Yes, thanks guys for your tireless work, the world has slowed which has slowed the demand for commodities, can’t just say, that’s it, the world will never need commodities again like oil, lumber, metals, ect.the world didn’t evolve to where it is today without them, like John said, hang in there, it will recover very soon.

Thank you Jon. You are right, let’s keep digging and exposing Chad Day’s fairy tales. Seriously, his historical revisionism is damaging his credibility.

It turned out even a bigger mess when those lies were to elders, parents, aunts and uncles, I think frustrations will come to a head very soon here Jon, and it won’t be us, it is disrespectful to lie to your elders, and the tahltan people should stand up for the truth…

I agree with comment 17. At this point in the game who cares about scare tactics, the stock will keep correcting until we see some updates. I think the seller is just getting tired of this delay and decided to get out. Guaranteed it will be back next week for sale. Market scare tactics is the least of our concern right now.

Jon, when did you publish a copy of Chad Day’s may 21/2015 letter to PGX, GGI,DBV and BC Govt?

Robert, we broke that story June 7. You’ll see a copy of Chad’s May 21 letter in that report. Perhaps not coincidentally, that letter has been removed from the TCC web site.

Jon do we have someting about Shealay this week end ?

Jon- BMR has done a great job in identifying inconsistencies of the Chris Day stories. As shareholders it helps us make an informed decision and not panic while we await DBV’s response. Although I’m sure DBV also recognizes the inconsistencies they are very busy and may miss some information…..plus more people working the cause means more angles uncovered. Have you been sharing your findings/thoughts with Farshad?

Jon- you mentioned that the Tahltan were properly consulted during the permit process. Where and how did you confirm this? Thanks

d4, we’re continuing to work on the facts, and we’ll have more ASAP, hopefully by tomorrow sometime…the permit process was very thorough…we’ll be able to back that up.

Jon: didn’t you say before that we would have a great 2nd Quarter? now, we wait till then 4th Quarter or end of 3rd Quarter?…..middle of summer but August can pull surprises on the CDNX…..

Steven, we actually pointed out that the April-May-June quarter is historically the weakest period of the year for the Venture…and a Q3 turnaround is likely, which it still seems to be if you look at the 39-week cycle chart that John posted Friday…remarkably reliable going back 15 years…we’re coming up to the end of that 39-week cycle at the end of August/beginning of September, so the set-up now could be for a situation that’s quite different than what we saw last year…in 2014, July-August were fairly decent, then the turn to the downside in September…looks like what we have now is a weak July-August, and a turn to the upside, a recovery, starting in September…Venture closed at the 628 Fib. level Friday…I don’t think there’s any doubt we’ll see levels that are a little bit lower…if this forces capitulation, that’s what you want to see for the turn higher – just as it took capitulation during the fall of 2008 to get to the real turnaround…

Thanks Jon…hopefully, some stocks like WRR,etc can gain traction soon….the sentiment out there, including myself, is at ‘all time lows’,so, you may be right for a bounce from here once it forms a complete bottom, hopefully, soon as its hard to watch!

I wish I was better with words but how’s this, this is proof Obama is a hypocrite, after 6 years of debate and a majority of the senate and the us people to approve keystone xl, Obama shot it down on reasons of climate change and global warming, and on tues struck a deal with Iran to flood the market with oil, really!.. We are not a corrupt nation, we don’t supply terrorists with arms and money, yet the head of Iran was quoted fri in saying the us is”arrogant”. I hope the senate votes against this deal, this is one great big SLAP IN THE FACE to all of canada.

The Iranian leadership has stated very clearly, Tom, that it’s not going to change its approach to U.S. or Israeli relations, yet they get rewarded with a deal that has an inspections component that’s going to be really difficult to properly enforce. We’ll see how Republicans line up against this. The interesting dynamic in the Mideast is the increasing rivalry between Iran and Saudi Arabia and other regimes. Iran continues to flex its muscles on a regional scale, and we’ve seen what has happened in Yemen and other areas. The Mideast is a powder keg – it’s going to blow up again, at some point, and when it does that’s going to drive Oil higher.