History has shown that some of Canada’s most important mineral discoveries have occurred at or near the bottom of a market cycle, so this turbulent period is precisely the time when investors need to pay more attention than ever to key areas of the country where a single drill hole literally could inject new life and confidence into the junior exploration sector, and send some stocks soaring in the process.

From one corner of Canada to the other, there are not many but at least a handful of key opportunities that are being actively pursued. At BMR, we’re focusing a lot on northwest B.C., particularly the emerging Sheslay district described by the Association of Mineral Exploration British Columbia as the province’s premier greenfield project, but there’s another highly compelling project on the opposite side of the country in Labrador that is drawing increasing attention, and for good reason.

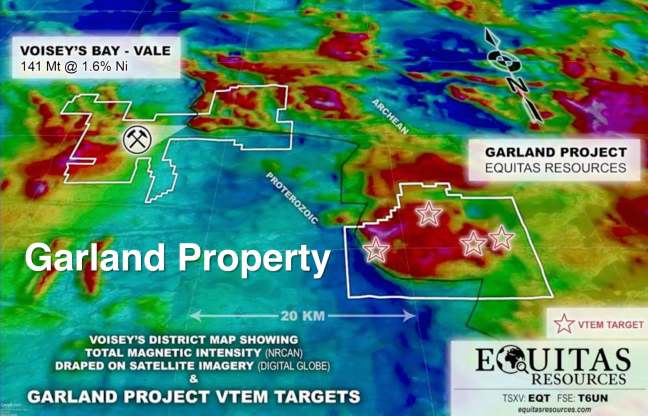

Equitas Resources’ (EQT, TSX-V) Garland Project is in the hands of an astute and proven technical team in addition to an aggressive entrepreneur as President who knows how to operate in logistically complex areas. Garland is an under-explored package, less than 20 miles southeast of the Voisey’s Bay mine, that represents a consolidation of promising properties previously held by 9 different companies.

We initially brought Equitas to our readers’ attention for their due diligence in mid-April. EQT quickly climbed 40% before retracing to strong support at the uptrend line in place since late last year as John’s charts have shown, including this updated version below. Friday, EQT staged an unconfirmed breakout above resistance at 10 cents.

We’re in a period of overall market turbulence, but this play has held up extremely well and bargain hunters have taken advantage of any dips. In challenging conditions, the company was also able to complete a hard dollar financing of $520,000 last month at 8.5 cents.

Strong Case For Discovery Potential

New technology has been put to use at Garland with Equitas being the first junior since the Voisey’s Bay discovery in 1993 to own such a large-scale land position (250 sq. km) this close to the rich deposit. The company has presented a strong conceptual case for a potential new high-grade Nickel discovery. There are no guarantees here and success in exploration can be a painstaking process, as experienced investors know, but this is a legitimate opportunity that realistically should generate increased speculation as the information flow picks up and drilling draws closer.

After carrying out a VTEM (versatile time-domain electromagnetic) airborne survey earlier this year that delivered very encouraging results, Equitas recently announced mobilization of crews for a ground exploration program that will include mapping and prospecting, a large loop (approx. 30 line km) EM survey, followed by 4,000 m of diamond drilling once final targets have been defined. Keep in mind, historical EM airborne surveys over this large area only went to depths of about 70 meters. The recent VTEM Plus survey that was carried out by EQT went to much greater depths, and 9 distinct areas of anomalous conductivity prospective for Nickel-Copper sulphide mineralization were identified – 4 that are particularly intriguing.

Major Nickel camps such as Sudbury, Thompson, Norilsk and Raglan comprise clusters of deposits. To date, Voisey’s Bay stands alone and that doesn’t really make sense. The question is, where is the rest of the system?

In a regional context, magnetic signatures and structural interpretations indicate Garland shares the same style and scale of structural deformation documented at Voisey’s Bay. The east-west strike of the anomalies is certainly notable at Garland. The trend of the anomalies, up to 1 km or greater, offers further encouragement for the discovery of significant mineralized systems.

Kyler Hardy took over as Equitas President after a major company restructuring late last year. He’s a “go-getter”, and he looked very relaxed and confident when we met him again briefly in Vancouver just recently. Below is an exclusive BMR photo of Hardy on a prospecting mission last year.

The EQT Team

Hardy is backed by a highly qualified team with expertise in all facets of the business, so we believe this is a group that investors can have trust and confidence in. Everett Makela, VP-Exploration, brings over 30 years of exploration experience to Equitas which includes important roles with Inco and Vale (he retired from Vale as Principal Geologist, North America, in 2012). He excels at target generation, design and implementation of exploration programs, and the creation of joint venture and alliance opportunities.

Interpretation of geophysical data is being handled by Alan King, a recognized expert in electromagnetic exploration methods who previously served as the chief geophysicist for Vale’s global exploration operations.

In late June, Equitas added mining analyst and industry economist Raymond Goldie to its board of directors. Goldie is the author of Inco Comes to Labrador, a book on Inco’s acquisition, progression and development of the Voisey’s Bay deposit. He frequently appears on national television and as a keynote speaker at mining conferences.

Avoid the junk on the Venture and stick with the top 20% or so of companies that are doing good, honest work that can lead to important new mineral discoveries that the world needs. Equitas is certainly on that list in our view, and we’re excited to see what unfolds at Garland in the coming weeks and months. We’ll be following events closely. As always, perform your own due diligence.

Don’t forget to sign up for FREE BMR eAlerts – click here.

Note: John holds a share position in EQT.

22 Comments

Excellent summary of what EQT is on the cusp of – a major discovery highly possible. Thanks BMR.

bullmarket – EQT well written. It would appear that EQT has brought aboard the best of what Vale had to offer. The one thing that was missed is the fact that Vale has let most of its World wide exploration properties go. EQT’s Garland property was right under Vale nose and Makela and King know all to well that this is a great opportunity. EQT went out to get funding earlier on in the year to do the VTEM, who does that?? A lot of cash was spent on that new tech and guess what the hunch paid off with 9 priority targets through the VTEM. People are starting to pay attention to this World class exploration play.

Jon, of all the years and all the articles you have written, this is top notch. I tip my cap to ya. You hit the nail on the head with many explanations and information brought out that would enlighten a novice investor. As I said, many things going on behind closed doors. The money needed to drill will be coming up to many investors delight. After this step, Mr. Shortie as we call him will have to start covering. I can’t even speculate on this one where the share price will be sitting on day one of drill turning. But where ever that price point is, I’m sure it gets hot from that point forward. What many investors don’t realize is the easy money is always made before the strike. If they hit (and chances are very high) then the share price goes up but at a point you could already be at a triple from where it is now. I never like to speculate where one’s share price might go, but when you look at all the major nickel mines being close to the end of their time and supply starting to dribble up, one can only wonder what EQT could stand for in a few months down the road.

I was a subscriber to Bob Bishop when I first started investing in 1991. I was green behind the ears and knew nothing. I remember Diamond Fields back then at .25. I believe it was 1993 when they were at .40 and made the first hole discovery. To go from .40 to $177 is unthinkable. I blew an opportunity of my lifetime selling to early. If they hit, I sit. GLTA involved as shareholders.

By the way Jon, your first sentence is so true, many major discoveries have come at market bottoms.

They paid $60 thou for Garland and have promoted it to 4 mil on no drill results. Money been made?

That makes them smarter and more effective than 90% of the others who are out there, Jose. Lots of room yet for speculation on this one as the drilling hasn’t even started.

EQT – Here comes Anon again, buying it up. Look at the bids on this thing, 300k and 400k down below, geesh. The way level 2 has changed and the stock slowly moving up reminds me of the old Pac-Man game where he just moves along and eats everything in site. Fun times ahead even with the days it has to rest and go in the red to catch its breath. Look forward to end of August.

A lot of large share block crosses coming in today on EQT, could be insider buying. Just a guess.

EQT I think I love you. Last @.14

is it too late to jump on the EQT train? What are the charts saying? Can this still double or triple from here in the short term?

Thanks for any thoughts / opinions

if they get a sniff on the drill bit it could be a 10 bagger

Paul, I would wait. It is possible for a correction. Dan and Paul, in looking at the chart since Jan., it hit .105 3 times and could not break it. I don’t think we see .10 again but we could see .105 again. But then again, I am not a genie in a bottle. RSI just touched 70 when it hit .14 – This stock is a tough call cause of the momentum. Less traders reluctant to sell cause of what Voisey Bay did. You have to make your own call on this and try to use TA for any eventual correction. I have all my shares at the core position and I am not SELLING, period.

I believe the first parabolic day coming looking ahead on this is when Mr. Shortie has to cover after the flow through is announced and close.

I don’t have level 2 so I don’t know where the support / resistance is.. Thanks guys

Paul, its definitely going higher in time. So its not too late. Where you pick to bid is up to you. This story is just getting started.

in at .12 cents – will see if that was am ok entry or not…

Big EQT Bids at .12 and .125 now.

Paul, if by chance it corrects to .105 or .10, buy more. I would hold those .12 and not sell for dear life right now.

Thanks Dave – I plan on holding these 12’s – and will try to grab more if I can convince my lovely wife!

Cheers all

Looks like they will close her at .13 or .135 – big bids just built at .12 and .125

Paul, go diamond shopping with your wife and ask her how bad she wants one, lol

Paul – 500+ bid at .125, 400+ bid at .13

Ya looking good – didn’t get too much of it though – I’m heavier in DBV…want to wait and see how that goes. If we get a favorable outcome, it might not be a bad idea to take some profits from there and grab more EQT… but what do I know?

Wow. My bid wasn’t filled today. Trying to add a few more but looks like the cheap ones are gone. That short will have to cover soon. Look out then.