7:30 am Pacific

The future is not for the timid or the faint of heart, which is why it’s so encouraging (and significant) to see Equitas Resources’ (EQT, TSX-V) step up to the plate during these unique market conditions to “swing for the fences” at their Garland Nickel Project 20 miles southeast of the Voisey’s Bay mine.

Yes, extending the baseball analogy, they could strike out, pop out, or otherwise disappoint. Of course there are never any guarantees with early-stage, grassroots projects in particular. But a very smart technical team is behind this, and importantly they’ve got not just 1 or 2 but at least a dozen or so chances (12-14 drill holes to depths between 250 to 350 m) at the plate to crank a home run and deliver a discovery hole that could literally breathe new life and confidence into the entire junior exploration sector.

Just the drilling itself, the fact they’re in the game and fired up to take some heavy swings, is going to generate some much-needed excitement and speculation in this market.

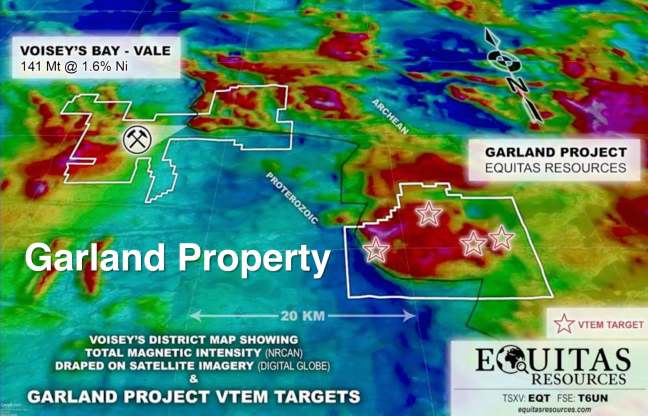

Major Nickel camps such as Sudbury, Thompson, Norilsk and Raglan comprise clusters of deposits. To date, Voisey’s Bay stands alone and that doesn’t really make sense. Is there a “rest of the system” in this area, and may it rest somewhere on Garland’s 250 sq. km land package? Geologists and geophysicists have presented a powerful case for the need to drill-test several promising target areas at Garland.

At a time when so many companies have literally “given up” on the market, the Equitas group has pushed ahead aggressively to state their case and raise the needed capital, and that’s often how discoveries are made. We saw the same determination with Doubleview Capital Corp.’s (DBV, TSX-V) Farshad Shirvani in late 2013. In an extremely challenging market environment at the time, he beat the odds at his grassroots project and drilled 2 discovery holes (#’s 8 and 11) at the Hat Project in northwest B.C.’s Sheslay district as sudden Arctic-like weather conditions set in without a fully winterized camp. DBV was literally out of money and on life support at 4 cents in December 2013 but results from those 2 discovery holes turned the stock into a 10-bagger during the 1st half of 2014, and the excitement sparked a district staking rush B.C. hadn’t seen for years (the story continues and the discovery is bigger than first imagined). That was a great Canadian exploration event and an ongoing drama that could yet develop in a way that lands Shirvani in the Mining Hall of Fame. History could also be in the making again in Labrador, more than 2 decades after the spectacular Voisey’s Bay discovery.

This is exactly what this market needs.

More From The Kyler Hardy Interview

As one of our wise readers (Jim) commented the other day, “This will be where Hardy proves he’s capable of driving the company. Friedland, Pezim, Noront CEO at the time Richard Nemis, and ZEN CEO Aubrey Everleigh all proved to be masters at this…this is Hardy’s opportunity to make a name for himself.”

Indeed it is. The Equitas President is driven by a strong belief in the potential for a 2nd discovery near Voisey’s Bay, and his energy level has been Pezim-like throughout 2015. That’s a critical ingredient for success in this business. Mix in technical expertise, wise strategy and some good luck, and that’s the right set-up for a home run. Could it happen here? It’s possible. For everyone’s sake, let’s hope it does.

Click on the arrow below to listen to another short segment (2-and-a-half minutes) of Jon’s recent interview with Hardy. He’s experienced at conducting programs in remote areas, and the camp at Garland has the flexibility to allow for drilling throughout the winter in the event of a discovery. In this piece, Hardy discusses infrastructure and cost issues.

Note: John holds a share position in EQT.

15 Comments

Tony t – You obviously have not done a lot of DD on EQT. Anon sucking it up this morning. One block buy was 182,000 alone.

Dave, this reminds me a little of the 2007 market when we had a dramatic August plunge…same sort of thing, global panic…Venture fell nearly 30% that month, and immediately roared back (ironically) on a Nickel discovery (Noront)…Venture is down almost 25% since the start of July…this can’t continue, we’re going to get that turnaround…

I like Eric Coffin’s comment re the market sell off.

” I blame Ashley Madison. It’s all bankers raising money for alimony.”

Good one Eric.

Too funny John. Yep Jon, markets already battling back up the daily chart.

Buy the dip, as they say…today’s action is awesome. Better than the roller coaster at the PNE. Looks like the Venture close today above its gap-down price. Wouldn’t that be interesting?

The Fed is not going to allow the market to take a dump. They’ll prop it up as best they can until they can no longer do. Too much wealth at stake. On the other hand, they are all too happy to let the commodity sector crash and burn.

Interesting how the Dow almost touched its rising 1000-day moving average this morning – that’s when the turnaround set in. Strong support at 12750 on the TSX as per John’s call.

Jon, this was not the big one that everyone was expecting. When the big drop happens, they will not let you trade. They will shut the doors trapping everyone inside. That’s why I keep telling people to take profits when they can.

Fortunately we don’t live in China, Chris, but if you’re prediction were to come true, Gold will be King…

The seven year growth cycle out of the last crash is done .Those that bought the dip in 2007 got slaughtered, expect something similar this time and yes when the smoke clears gold will be king.

Those who bought the dip in 2007 made out great, Les, if they got out before the Crash a year later…timing is everything.

Les, a fortune was made in 2007 from Sept. to Dec.

As for EQT – I have my own qoute: A trader trades in and out of a stock that has nothing much going for it other than a chart. You become an investor when there are strong fundamentals behind it.

Dave so true. Hit my bid again today. More EQT shares for that massive run that is about to happen.

The key to get out before the crash.

EQT-

Based on my research (I’m no geologist) and what the Board/Management has been able to do in terms of recruitment and the obvious similarities in property to Voisey’s Bay # 1 this could be quite the discovery.

Global demand for Nickel is also forecasted to rise well above current levels by end of 2016 (TD Economics). Could easily see this at $5 or $10 if drilling proves successful initially. Then who knows what will happen.