Gold has traded between $1,117 and $1,130 so far today…as of 9:15 am Pacific, bullion is down $2 an ounce at $1,123…Silver has added 35 cents to $14.46…Copper has surged 9 cents to $2.33…Crude Oil has jumped $3.15 a barrel to $41.75 after a fall in U.S. Crude inventories, while the U.S. Dollar Index has gained another three-quarters of a point to 95.89 after yesterday’s sharp climb…

Gold has traded between $1,117 and $1,130 so far today…as of 9:15 am Pacific, bullion is down $2 an ounce at $1,123…Silver has added 35 cents to $14.46…Copper has surged 9 cents to $2.33…Crude Oil has jumped $3.15 a barrel to $41.75 after a fall in U.S. Crude inventories, while the U.S. Dollar Index has gained another three-quarters of a point to 95.89 after yesterday’s sharp climb…

Gold is still up 3% for August, set for its 1st monthly advance since May…holdings in bullion-backed exchange-traded funds have climbed slightly to 1,527.63 tons as of yesterday, according to data compiled by Bloomberg…could China give Gold a further boost in the near future by reporting another increase in its reserves?…they provided updates for the end of June and July after going 6 years without reporting…July’s numbers showed a significant pick-up in the monthly rate of accumulation by China’s central bank…

A rare 1794 U.S. Silver dollar will be placed on the bidding block next month and is expected to sell for between $3 million and $5 million…there are only 150 of the coins known to exist, and this is one of the 3 best preserved…the coin (pictured to the left) will be up for auction in New York City on September 30…CNN reported that John Kraljevich, a consultant for the auction house Stack’s Bowers that’s handling the sale, said the coin’s historical significance has collectors craving it…

A rare 1794 U.S. Silver dollar will be placed on the bidding block next month and is expected to sell for between $3 million and $5 million…there are only 150 of the coins known to exist, and this is one of the 3 best preserved…the coin (pictured to the left) will be up for auction in New York City on September 30…CNN reported that John Kraljevich, a consultant for the auction house Stack’s Bowers that’s handling the sale, said the coin’s historical significance has collectors craving it…

“The whole idea for the dollar begins with this coin,” Kraljevich said in a report from CNN. “It’s foundational for…the U.S.’s place in world commerce.”

U.S. Q2 Growth Revised Higher

The U.S. economy expanded at a faster pace than initially thought in the 2nd quarter as businesses ramped up investment…however, they also built up inventories, offering mixed signals for growth prospects the rest of the year…

GDP, the broadest measure of goods and services produced across the economy, expanded at a 3.7% seasonally adjusted annual rate in Q2, the Commerce Department reported this morning, up sharply from the initial estimate of 2.3% growth…economists surveyed by The Wall Street Journal had forecast a 3.3% rate…

Given developments in China and turbulent global equity markets, investors will be keeping a close eye on meeting of central bankers that has started today at Jackson Hole…the annual Economic Policy Symposium in Wyoming brings together academics, financial market participants and many of the world’s leading central bankers…Fed Vice Chair Stanley Fischer is scheduled to speak on Saturday with a focus on inflation (or lack thereof)…

Obama To Deny Keystone XL Permit Next Week

This comes as no surprise, but the Financial Post is reporting this morning that President Obama is expected to finally deny a permit to the Keystone XL pipeline. “The latest in the United States capital is that an announcement will be made next Thursday or Friday,” wrote Claudia Cattaneo, “when many are out of town, reducing potential for blowback, said a well-connected source.”

Today’s Equity Markets

Asia

China’s Shanghai Composite rallied 5.4% overnight, climbing back above the 3000 level…as pointed out yesterday, however, the Shanghai has suffered significant technical deterioration and this week’s lows are likely to be tested and breached looking out over the balance of the year…

Europe

European markets were up sharply today after a rebound across Asia and yesterday’s strong close and this morning’s continued climb in New York…

North America

The Dow has shot up another 302 points as of 9:15 am Pacific…in Toronto, the TSX is up 367 points while the Venture continues to gain steam, adding 14 points to 543 as the Index approaches its 10-day moving average (SMA) which has provided stiff resistance since the beginning of May…keep in mind, the Venture is nearing the end of another 39-week “cycle” – a period that historically has consistently marked a shift in the market…

Pure Energy Minerals (PE, TSX-V) is up 2 cents at 44 cents as of 9:15 am Pacific as it once again tries to challenge Fib. resistance at 47 cents…

Biorem (BRM, TSX-V), which we’ve been mentioning recently, is up a nickel this morning to 35 cents following the release of very strong Q2 financials…this is a company with only 13 million shares outstanding which has net earnings now of 9 cents per share for the 1st half of 2015 on total revenue of $9.4 million (see story and chart below)…

Another Venture company that reported interesting earnings this morning was Lingo Media Corp. (LM, TSX-V) which has jumped 6.5 cents to 35.5 cents on its best single day volume ever – more than 1 million shares…worthy of our readers’ due diligence…

Dow 6-Month Daily Chart

The very extreme Volatilty Index (VIX) readings Monday and Tuesday were indicative of at least a temporary bottom in the Dow as it touched an intra-day low of 15370 Monday, a drop of 2200 points or 12.5% in just 5 trading sessions…

This 6-month daily chart helps explains the sudden collapse as the Dow closed below the critical 17250 level last Thursday with confirmation Friday of a breakdown below a descending triangle in place since the beginning of May…the immediate challenge for the Dow will be to reclaim that area above 17250 which won’t be easy…the declining 50-day SMA is currently at 17586 while the 200-day, which is beginning to roll over, provides resistance just below 17800…

Dow Long-Term Chart

This fascinating long-term monthly chart for the Dow shows a plunge in the RSI(14) this week to nearly the 45% critical support…there have been 5 other similar steep plunges in the RSI(14) that found support at the 45% level going back to 1984, with the Dow then recovering strongly to new highs over time…those corrections from the market highs to the RSI(14) 45% lows ranged from as little as 17% to as much as 41%…this drop from the high of 18351 was 16.2%…

The only major crashes that have occurred in the Dow have come when the RSI(14) on this monthly chart has fallen below 45%, so that’s a key level to watch…

Volatility Index (VIX) Short-Term Chart

The VIX spiked as high as 53.29 intra-day Monday (it closed at 41) and has since retreated significantly…RSI(14) on the VIX 10-year daily chart below even exceeded the high during the 2008 Crash…that kind of panic has always resulted in buying opportunities as we mentioned earlier this week…

Historically, there have only been 6 occasions in which the VIX closed higher than 45…

- September 1998: Russian default

- October 1998: Long Term Capital Management (LTCM) implosion

- August 2002: WorldCom collapse

- September 2008: Lehman Bros. bankruptcy/Panic of ’08

- May 2010: ‘Flash crash’

- August 2011: S&P downgrades U.S. Treasury Debt

Biorem Inc. (BRM, TSX-V) Update

Is there value on the Venture right now?…absolutely, though follow the 80/20 rule – only 20% of the companies are really worth considering, the other 80% are junk…within that 20%, you can narrow things down even more to the very best opportunities…

Our last update on Biorem was August 7 when it was trading around 30 cents…this morning the company reported its Q2 financial results, showing net earnings for the quarter of $718,000 or 5 per share (undiluted)…this brings net earnings for the 1st half of the fiscal year (January 1 to June 30) to $1.25 million or 9 cents per share (vs. a net loss of $1.36 million for the 1st 6 months of 2014)…

Biorem’s revenues for Q2 were $4.7 million, a 91% increase over the $2.2 million in revenue recorded during the same period last year and consistent with the $4.7 million recorded in Q1…year-to-date revenue has totaled $9.4 million, a $5 million or 112% jump in revenue over the 1st half of 2014…the revenue increase came from each of the geographic markets in which Biorem operates…

Biorem, which has only 13 million shares outstanding, is an environmental biotechnology company that designs, manufactures and distributes a comprehensive line of high-efficiency air emissions control systems used to eliminate odors, volatile organic compounds and hazardous air pollutants…

“The company is well positioned to deliver consistent results for the second half of the year,” said Derek S. Webb, President and CEO. “Overall booking activity in the near term is expected to be consistent with the previous two quarters. We expect continued growth in our overseas markets as new regulatory structures are implemented to curb the release of greenhouse gas emissions and communities demand a higher quality of life free of nuisance conditions.”

Technically, what’s interesting about BRM is the fact that it’s very close to confirming a breakout above a downtrend line that has been in place for several years as shown in this 10-year monthly chart…all aspects of this chart are encouraging…this company is making money, and that’s a rarity on the Venture…

Kiska Metals Corp. (KSK, TSX-V) Update

It’s during times like now, when junior exploration and mining companies are so much out of favor, that the greatest opportunities emerge for 10-baggers, 20-baggers and even 50-baggers…

Patient investors in our view have a chance to cash in handsomely, at some point down the road, near-term or longer-term, on Kiska Metals (KSK, TSX-V) which is trading at an all-time low of 1.5 cents…Kiska will survive even a greater storm than the one the junior resource sector has been through over the last 4+ years given their working capital position, their model, and their prudence…they’ve had repeat business relationships with Barrick, Newmont, AngloGold, Xstrata, Teck and most recently First Quantum…

One of the reasons for the decline in Kiska’s share price this year has been selling from Sprott Securities – check the Sedar filings on that…Sprott’s funds of course have indiscriminately unloaded dozens of juniors this year as part of a diversification strategy…

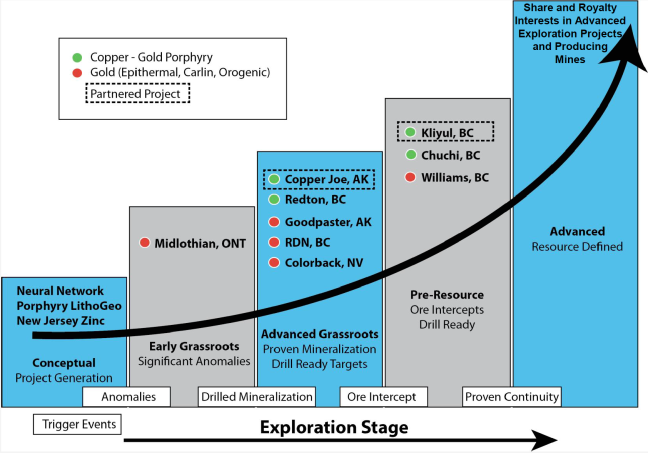

Kiska features:

- Quality assets from grassroots to advanced stage projects

- Royalty portfolio with potential for cash generation

- Current and past partnerships with top tier mining companies

- New and innovative project generation ideas

- Proprietary databases and exploration technologies

Near-term, what excites us the most about Kiska is its Kliyul Project in central B.C. (bordered actually by Garibaldi Resources’ Red Lion Project, but that’s not why we like it)…geologists at Teck Resources Ltd. (TCK.B, TSX) are very excited about the potential of Kliyul, and so they should be given the area and historical drill results from this property showing significant Cu-Au grades in outcropping breccia, tested to date only by shallow holes which are open to depth…this is an exceptionally promising system which Teck began drilling last month…

We’ll have more on Kliyul in the coming days…

Just recently, Kiska announced a deal with Brazil Resources (BRI, TSX-V), a company we also encourage readers to check out, whereby KSK will receive 3.5 million shares of Brazil over the next 20 months for the sale of the Whistler Gold-Copper Project and certain related assets in south-central Alaska to BRI…

We’re not usually enamored by prospect-generator type companies, but at a penny-and-a-half (market cap of $1.7 million which essentially matches KSK’s working capital position as per its March 31 financials – not including the BRI transaction), this one is too good to pass up, even it means waiting for another year or more to cash in big…

Below is a graphic from KSK’s website showing the current stage of its projects…as always, perform your own due diligence…

Note: John and Jon both hold share positions in GGI. Jon holds a share position in KSK.

34 Comments

Pure Energy PE looking great today. Maybe a new high today?

Roger – looks like PE is ready to take out the old high of .47 cents, last at .46 cents, up .04 cents on 645,000 shares. Some big blocks of shares are going at the ask. She’s marching upward …. perhaps news is due soon on some developments. This could be the ticket to letting the boss know about early retirement.

Found this on another board….now if the Tahltans were to invest in DBV at this early stage they would reap much bigger rewards that buying late in a project like the Red Chris………another piece of the puzzle???? We know the Tahltan’s motives for the blockade…..

http://tahltan.org/tahltan-nation-invests-in-imperial-metals/

a cut/paste from the news….

Tahltan Central Government (TCG) President Chad Day said: “When our Nation shows support for a project, we want it to be a true partnership. This investment backs up the promises made in our co-management agreement with Red Chris and Imperials Metals. It means we are directly involved in a major project that affects our economy and the day-to-day lives of so many Tahltan people.”

Tahltan Nation Development Corporation board chair Calvin Carlick said: “This investment is a unique opportunity to contribute to a project that has tremendous economic value to our Nation. Red Chris is a significant employer of the Tahltan Nation, both directly on the project and through TNDC contracts. TNDC’s investment reinforces our commitment to a long term-relationship with Imperial Metals.”

Vepper, yes I agree PE may break out soon. Sure looks like something is in the works that may be announced soon. PE and EQT are my top holdings right now and looking forward to an exciting fall. Early retirement? Like the sounds of that. Six more years and I will be retired but if these 2 companies come thru, maybe it will be early lol

The Tahltan want to be in the project right now!

At this point shareholders are hostages of Chad Day with the blockade and Shirvani with hole 23 which could mean the beginning of a major discovery!

It’s pretty much September, Dbv sitting at 8 cents with no idea what is happening, interest is fading..at some point it’s time to forget about chad day and the tahltan, if we have the legal right to drill, let’s drill!

One economist told CNBC Thursday that if China fired enough stimulus into its economy, a longer-term bounce back in commodities could be on the horizon.

“We certainly think that the authorities in China have the firepower in terms of monetary and fiscal policy to enact enough stimulus for the economy to at least meet the growth rate they’re targeting,” Caroline Bain, senior commodities economist at Capital Economics.

Analysts have questioned whether China is on track to meet its 7 percent growth target this year, but Bain forecast an upturn in the economy, potentially in the last three months of 2015.

“As the stimulus starts to feed into the economy – we expect probably in the fourth quarter of this year, which is a seasonal upturn in activity – that we will start to see better numbers come out of China.”

If GGI were to commence drilling in the next few weeks it would create a real dilemma for Chief Day . Would he risk another blockade with more followers than the few granny’s he took to the Hat on his so called claim to the whole area or would he stand down?

If he did nothing with regards to GGI it would give everyone a green light . Just some random thoughts.

I bought PE yesterday, loving it. Excited for both PE and EQT.

GGI never drill during the blockade of DBV !

GGI wasn’t quite ready to drill, Guy, when DBV was blockaded. They are much closer to being ready now. The last bit of ground work in a setting such as this would be infill geochem sampling and IP to double check and finalize the most prospective specific targets, in order of priority. That’s a quick process.

Dave – welcome to the PE club.

Finally pulled the trigger and bought EQT today.

Re DBV, I think that the next few weeks can see a change in the sheslay. The govt of B.C. has been consulting with the Alaskan govt people re future mining in n.w. b.c. this took place only last week, the mt. polley situation brought their potential salmon losses from polluted Canadian rivers to the forefront. It also seems to me that although dbv etc. have the legal right to drill tey would be put on hold as the b.c. would hopefully be in consultation with the tahltan, the taku, and the mining camps to come to some sort of understanding. I could be completely out to lunch on this. Richard l

Jon, take a look at a small oil company named Simba Energy (SBM) on the venture. They just announced that a billion dollar comany, Essel, just committed 100 million investment and more to come. The stock went up 60 percent (3 million shares traded) in the half hour it had to trade after the halt. Tomorrow morning should be interesting, the current market cap is aprox 16 million and trading at .08-.085.

Richard , I think it’s all about money and nothing but an attempt to grab as much as they can from the Sheslay district. It’s funny the Tahltan don’t have any problems with Red Chris mining just a few kilometres from the Hat.

Jon wha you think about the comment by Richard !

Guy, any discussions between B.C. and Alaska re: transboundary river issues are absolutely irrelevant at this point to the Sheslay district situation. The dynamics have already changed with GGI on the ground and advancing to the drill stage, and DBV is taking care of things on their end and gearing up. Interestingly, the transboundary river issue came up in a couple of those articles from Juneau a little while back. The Alaskans are understandably sensitive about the salmon-rich Taku River which flows in just south of Juneau. So, I actually called one of those reporters who wrote one of those stories – she literally had no idea exactly where the Hat Property was. She had not looked at a map, she was assuming it was right along the Sheslay River. She had no idea there was a Land Use Plan, and she had no idea the Taku also lay claim to the Sheslay district (and have a federal comprehensive claim no less, at Stage 4 of the treaty process). And of course, the Hat is only in the exploration stage at the moment – the most exciting stage, but there’s not a mine going in there tomorrow. So the story was, in essence, a whole lot of fiction. But that’s the spin that Chad wanted to get out in the media. It backfired, just like his remark that DBV has filled the creeks at the Hat with timber.

Jon “Dbv is taking care of things on their end and gearing up”. Are you hearing this from your sources or is this an assumption based on GGI news release?

A combination of both, Sam.

Thanks Jon !

If you had to take a guess, when do you think Dbv will get back to drilling?

My best guess, Sam, is that we’ll hear from Farshad by sometime next week. And there’s no reason why it shouldn’t be encouraging news. The district should really heat up again next month.

GGI has fresh video on web site.

That has usually been a “signal” from them, Robert. Show-time coming?

Fresh video, GGI Crews Attack Grizzly As Sheslay District Reignites

This is the email from GGI !

A good news from GGI August 14 and 2 weeks later (today)an email who prove the serious of the first one !

“Carl Icahn takes largest stake in Freeport-McRoran (FCX), stock surges 28%”

This is significant for commodities.

Anyone else notice the venture’s 15.87pt green day today? It’s been a while!

Venture 4-month chart is looking better than it has at anytime in, well, the last 4 months, Tony…update in the AM. Finally a close above the EMA(8) today. Requires confirmation Friday. Next target is then the EMA(20). The 39-week cycle chart could actually be bang-on here for a reversal coming out of Monday’s low.

Jon, no doubt that the “smart money” will start to accumulate near the bottom. Carl Icahn buying heavily into FCX is really good news. I have little doubt that I will look back a year from now and say that the shares I bought of GGI at .05 were one of the best investments I have made. I could be wrong but I like the risk/reward scenario. I just need to be patient.

Wich email Guy?

Martin I receive an email from GGI about the new video on his website !