TSX Venture Exchange and Gold

The roller coaster ride in the markets this past week was even more wild than Vancouver’s infamous roller coaster at the annual PNE currently in progress. As we stated last Sunday, “the best scenario in our view for the coming week would be an immediate further sharp sell-off in this index (specific reference to S&P 500 chart) and other equity markets for ‘cleansing’ purposes, and that could create some interesting opportunities. The action in the VIX (Volatility Index) suggests something dramatic is building, so hang on to your hats as the ride could be wild.”

Equity markets went into panic mode Monday morning with a “flash crash” following technical breakdowns the previous week, and the Venture followed the pack with a gap down and an intra-day all-time low of 509 before a hammer reversal kicked in. By week’s end, the Venture was up 9% from its low with the strongest close above its EMA(8) in 4 months.

For the week, the Venture was up 3.3%, even beating the Dow, the TSX and Gold, as it finished at 556.

Clearly, a pattern change has occurred here which is also consistent with the Venture’s cycle chart (scroll down further for that fascinating updated piece).

Here are the key takeaways from John’s 4-month Venture “awareness” chart:

1. A confirmed breakout has occurred above the EMA(8) which has also reversed to the upside;

2. Next key resistance is the EMA(20), currently 562. A confirmed breakout above the EMA(20), and its reversal to the upside, would give the Index some fresh momentum – this would also help verify that a new uptrend is underway and gaining traction;

3. RSI(14) has climbed out of oversold conditions which it had been trapped in since the beginning of July;

4. Sell pressure (CMF) peaked in late July and has been declining steadily since;

5. The recent bearish trend (ADX indicator) weakened dramatically this past week;

6. Fib. support at 515 held – on a monthly basis, Fib. support around 560 may also hold.

These are all highly encouraging signs, though history has taught us that it’s too early at this point to declare an end to the Venture bear market (Crude Oil is just 1 of several significant challenges still facing the Index). However, what certainly could be unfolding here is a very strong rally, the likes of which we haven’t seen since the end of 2013/early 2014.

If an important discovery is made somewhere, watch out.

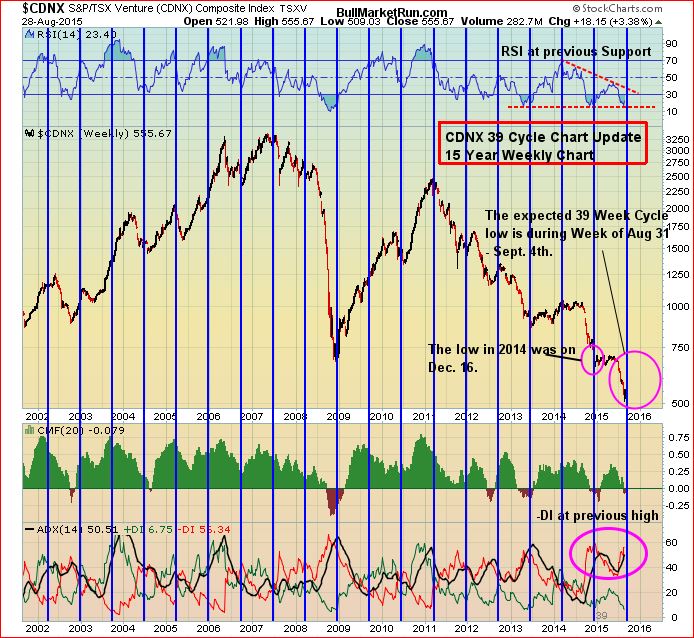

Venture 39 Cycle Chart

It’s fun to at least imagine. Look at the chart below and compare the end of the current Venture 39-week segment with the end of the 39-week period following the 2008 Crash (plus compare the ADX indicators). A remarkable similarity.

Again, it’s premature at this point to suggest the Venture is about to enter a new bull phase, especially considering that the outlook for Crude Oil is simply not favorable (unless a major Middle East conflict suddenly erupts). However, July and August for the Venture were very different than those same months last year, and it’s reasonable to believe – based on all the technical evidence at least – that the September-December period coming up for the Venture will also be much different than that same 4-month period last year when the Index took a beating.

The Seeds Have Been Planted (And Continue To Be Planted) For The Next Big Run In Gold Stocks

There’s no better cure for low prices than low prices. The great benefit of the collapse in Gold prices in 2013, and recent weakness with the drop below $1,100, is that it has forced producers to become much more lean in terms of their cost structures. Producers, big and small, continue to make hard decisions in terms of costs, projects, and rationalizing their overall operations. Exploration budgets among both producers and juniors have also been cut sharply. In addition, government policies across much of the globe are making it more difficult (sometimes impossible) for mining companies to carry out exploration or put Gold (or other) deposits into production, thanks to the ignorance of many politicians and the impact of radical and vocal environmentalists (technology has made it easier for groups opposing mining projects to organize and disseminate information, even in remote areas around the globe). Ultimately, all of these factors are going to eventually create a supply problem and therefore great opportunities in Gold and quality Gold stocks. Think about it, where are the next major Gold deposits going to come from? On top of that, grades have fallen significantly just over the past decade.

U.S. Dollar Index Update

Our contention for the last several months is that the Dollar Index put in its high for the year during March-April based on what has proven to be, so far at least, a very reliable 9-month daily chart. Fundamentally, a runaway dollar would not be healthy for the U.S. or global economies, so one can be certain the Fed is keeping a close eye on movements in the greenback (the Chinese appear to be, as well, and recently of course fired some critical shots in the latest currency war).

Dollar bulls were encouraged by the greenback’s climb out of temporarily oversold conditions last week. Support was strong around the 93 level as expected. However, the Dollar Index faces serious technical challenges in terms of moving higher, or significantly higher, from here (note the arrow in the chart pointing to resistance around the former uptrend line).

Ultimately, what we perceive as a growing possibility (albeit not a certainty) over the remainder of the year for the Dollar Index is a test of base support at 88. That’s definitely not a mainstream view but the chart supports that kind of consolidation potential following the record advance that started during the summer of last year. Such a drop in the greenback would be supportive of commodities and the Venture, the reverse of what occurred over the final 4 months of last year.

Gold

Gold disappointed some investors last week by not reacting more vigorously to the extreme volatility in the equity markets. However, the more than $40 pullback during the week and then the recovery back above the $1,130 support area by the end of Friday’s session can be interpreted as healthy trading action. Gold was down $26 for the week, closing at $1,134. August should end a 2-month slide.

Fundamentally, it wouldn’t be surprising if China were to announce another update shortly (for August) regarding its Gold reserves. Their pace of accumulation may have picked up even more from July and the period previously.

Below is a monthly chart for Gold going back 6 years, providing a broader perspective on what’s happening at the moment. Again, note the very strong support at the bottom of the downsloping channel or flag, and the bullish engulfing reversal pattern in late July at approximately $1,070.

RSI(14) is gradually moving up from support at 30%, and it appears a bullish cross is forming in the SS.

It’s reasonable to expect Gold to push above its still-declining MA(10) on this monthly chart, currently $1,180, as we’ve seen on several other occasions since the beginning of 2014. We’ll see what happens from there – $1,200 will be a very important test.

If RSI(14) can overcome critical resistance at the 50% level, then Gold could gain some serious traction. The RSI/price divergence is bullish – RSI(14) appeared to bottom in the spring of 2013 when Gold collapsed to $1,180, and has stayed above that level over the last 2+ years despite last month’s new low in Gold. Something quite significant could be developing here, though it’s still a little early to tell.

Silver had a rough week after posting 4 consecutive weekly advances. The metal plunged to a new 6-year low before bouncing back to close Friday at $14.59. That was still a drop of 76 cents or 5% for the week. Crude Oil snapped an 8-week slide by jumping $5 a barrel to $45.33. Copper added 4 more cents to $2.33 while the U.S. Dollar Index gained more than a full point to 96.15.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, the long-term bull market in Gold has been driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, has had a huge impact on bullion and will continue to support prices. Despite Gold’s largest annual drop in 3 decades in 2013, and fresh weakness now, the fundamental long-term case for the metal remains solidly intact based on the following factors (not necessarily in order of importance).

- Growing geopolitical tensions, fueled in part by the ISIS and al Qaeda, and a highly dangerous and expansionist Russia under Vladimir Putin, have put world security in the most precarious state since World War II;

- Weak leadership in the United States and Europe is emboldening enemies of the West;

- Currency instability and an overall lack of confidence in fiat currencies;

- Historically low interest rates/highly accommodating central banks around the world;

- Continued solid accumulation of Gold by China which intends to back up its currency with bullion;

- Massive government debt from the United States to Europe – a “day of reckoning” will come;

- Continued net buying of Gold by central banks around the world;

- Mine closings, a sharp reduction in exploration and a lack of major new discoveries – these factors should contribute to a noticeable tightening of supply over the next couple of years.

24 Comments

DBV,The blockade by the Klabona Keepers went up Sept. 29 2014 at Red Chris and with an injonction the blockade ended October 15. An agreement was signed april 14 2015, during this time work has continued to make red chris into production!

“Indeed this will be a busy and exciting summer at the Grizzly as productive discussions with all stakeholders concerning this emerging world class district are giving us great encouragement,” stated Regoci.

It’s September next week. Summer passed.

So Guy are you saying it’ll take DBV/GGI/PGX 6-7 months to sign an agreement with Chad Norman Day?

A comparison of apples and oranges there, Concerned Citizen…I believe the point Guy was trying to make was despite the protests by some Tahltan regarding “no mining” at Red Chris, and the blockade there, what emerged not longer after was a “co-management” agreement between the Tahltan and Imperial Metals endorsed by 85% of voters, with Red Chris going into production.

No agreement needs to be signed between GGI and DBV and the Tahltan for either company to proceed to drilling at the moment, nor would I even expect one to be signed. GGI is now on the ground, finalizing targets, and preparing to drill, in accordance with their legal permit (passed thru the consultation stage with both the Tahltan and the Taku) and the law of the land with the Land Use Plan for the district. We’ve all heard from Premier Clark with regard to the importance of the Land Use Plan. It’s a signed legal agreement fully in force and implementation.

DBV, I’m sure, is finishing off what they need to do, in the context of the blockade against them, to return to drilling shortly.

It’s safe to assume from GGI’s news at least, as we’ve yet to hear from DBV, that there has been some sort of on-going dialogue among a variety of stakeholders, and that those discussions have proceeded in a positive manner.

The Sheslay district is about to light up like a Christmas tree, IMHO, long before Christmas.

The potential benefits from this district evolving, in time, into a world class mining camp, developing in accordance with the Land Use Plan and all regulatory guidelines, will be enormous for First Nations, company shareholders, and all British Columbians.

No just I’m thinking we can continu exploration during the discussion !

C C It only took Red Chris a couple of weeks to get that court injunction. One has to wonder what’s the hold up with DBV ? I’ve always said DBV could be drilling and any negotiations could carry on for whoever time it takes. Tick tock , summers over.

I’m happy adding DBV here. I think it’s an easy double just on any positive forward moving news. That could come anytime.

Not many sellers left on GGI at these levels. Wait till someone wants a big position…..

With the wind at our back regarding the Venture exchange , any activity in the Sheslay district should give GGI and DBV an up lift.

Gotcha fellas. Bonne chance.

Dan – Ref. your post #37 yesterday. I believe that’s what happened also. I have also heard Kyler took a sudden flight out east. Maybe interesting times ahead.

Decided to copy this post from yesterday musings to today in case it was missed – lol

Danny, I don’t expect Dave to release details either regarding his phone call, but it sure is interesting. Large blocks on the bid on Friday, and volume exploding makes for a very intriguing situation. Someone also posted that Kyler is on a flight east. Why I wonder? Either they stumbled upon nickel laden rocks, or the UTEM shone so bright it made their Geos jaw drop in awe. One thing is certain, the VTEM pin pointed the areas of conductivity that wasn’t detected before. You have 250 sq/km of ground that would make it very difficult to find nickel rocks on the surface. But, when you pin point with a VTEM, it narrows down that search area and makes the possibility of finding something on the surface that much greater.

Dave, I like your comment about owning 100,000 shares of EQT and if it turns out to be even 1/17th of VB. I will be ok as well….LOL

Comment by Dan — August 30, 2015 @ 4:16 am

Jon are’nt you concern about time left to drill vs money to spent by ggi before dec 31?

Lots of time to drill, Martin. The weather up there is ideal for drilling throughout all of September and October. Winter conditions typically don’t emerge until sometime in November, but keep in mind we’re seeing the strongest El Nino on record…could be a late start to winter in B.C., and a warmer than usual winter. And of course in the Sheslay district, you can drill year-round, throughout the winter, as snowfall amounts there are limited by the protection of the adjacent western mountains. If GGI makes a discovery, setting up a winterized camp as DBV did very quickly in 2014 would be very feasible.

Martin, GGI could use more than 1 drill and burn through $1.25m in less than 2 months.

Has anyone heard anything about PGX as they sit in the same Sheslay area ?

Jon, this massive body at grizzly central could be made of different mixure of rock alteration than DBV . What kind of AU CU grade could we expect from there?

In 2004, Firesteel Resources carried out a program of geological mapping, backhoe trenching totalling 500 metres, soil geochemistry and 1555 metres of diamond drilling in 12 holes on the Copper Creek property focusing on the DK zone (104J 035). The best hole of the program, CUCR 04-05, was angled to the north and cut 0.44 per cent copper and 0.32 gram per tonne gold averaged over its full length of 242 metres, the top 52.3 metres of the hole averaged 0.80 per cent copper and 0.73 gram per tonne gold (Exploration and Mining in British Columbia 2004, page 27

Isn’t that we call a discovery hole ?!

Dan, given the uptick in volume Friday and the rumours swirling around regarding EQT I expect an interesting opening Monday morning. Now having said that I will probably be wrong but the weekend usually gives people an opportunity to digest all the info and rumours out there. I bought more Friday afternoon only because of the increase in volume and I watch the volume carefully. Volume is usually the first indicator (stating the obvious I know) that something is going on.

After EQT announces the closing of the PP, I expect it will be 1 or 2 days before the Exchange approval is received.

I would not be surprised to see EQT double quickly here. So much for my .18 to .21 target price when the drill starts turning. That will have to be revised upward. here’s hoping for a fun week in all stocks mentioned here.

Martin for me the grade is good but he miss length !

Over its full length of 242 metres, Guy.

John – I understand that Hardy has already contacted the exchange and request approval right away once it is announced. I think it was NPH back in Dec. of last year that did the same thing and the exchange announce the approval after market close and NPH announced it before open the next morning. So the exchange actually beat NPH to it. I understand they are trying different things in the way of closings though. It will be interesting to see how this unfolds.

Its still early in the game but looking at the venture’s 15 year weekly chart (39 week cycle), does anyone else see the possibility of an inverse head and shoulders pattern down the road?