8:00 pm Pacific

A new chapter has started in an exciting exploration story that has captured the market’s attention in recent weeks in particular as the drill is now turning at Equitas Resources’ (EQT, TSX-V) Garland Nickel Property 20 miles southeast of the Voisey’s Bay mine, as announced by the company following today’s close.

This is an area that has intrigued top Nickel specialists for many years as highly prospective for another Voisey’s Bay-type deposit, but for a variety of factors it has been vastly under-explored until now. So the Equitas group deserves credit, and is being rewarded by the market, for doing exactly what a junior exploration company is supposed to do (but few are doing or are able to do right now) – search hard, albeit cost effectively, with a talented, proven team using cutting-edge techniques to find the next important Canadian discovery. This is grassroots exploration at its finest. Yes, it’s a risky “swing for the fences”, as we’ve repeatedly stated, but the potential pay-off is huge. The market is starving for a new discovery (it’s in dire need of something big) and Equitas has a chance to feed that appetite and restore investor confidence in the struggling junior resource sector. The stakes are high. This company is cashed-up and heavily armed for battle.

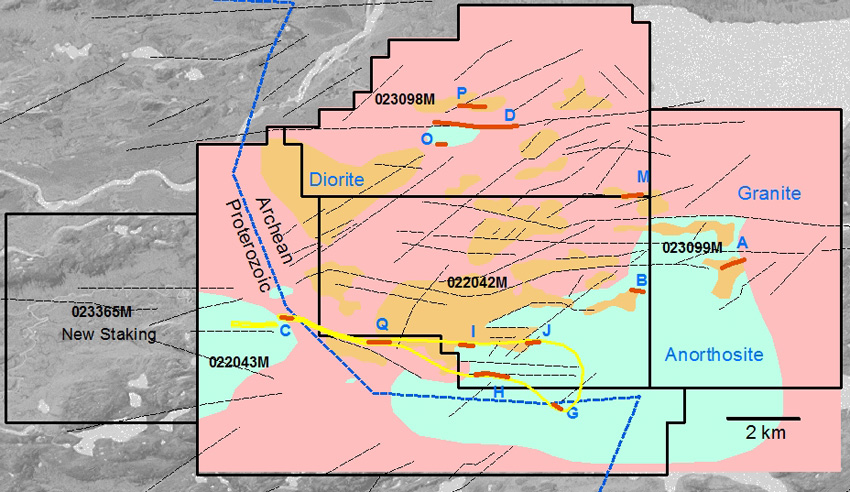

John’s latest chart, which we’ll get to in a moment, shows continued strong momentum in EQT with a possible breakout looming above a new pennant formation, similar to the pattern that emerged in August. First, though, a quick review of today’s news which shed some fresh light on key areas of interest that are emerging on this large land package that has now grown by another 15% to over 280 sq. km with an extension to the west. Two targets have been dropped – we would have been shocked if at least a couple weren’t following additional mapping and geophysics – while three have been added.

Drilling is starting at anomaly “D”, part of a 2 km trend of variable conductivity featuring a Nickel-Copper-Cobalt lake sediment anomaly and resident in an east-west structure of the Gardar-Voisey’s Bay fault set. Coincident with a magnetic low (interesting, as the western extension that was added today covers a very broad and intense mag low according to government data), the nearest geochemical anomalies of this type in the Nain province occur in a chain of lakes 4 km to 7 km east (an interpreted down-ice direction of glaciation) of the Voisey’s Bay mineralization.

An important paragraph in today’s news:

“At Anomaly C, surveying with Crone PEM resulted in the definition of a good-quality east-west-trending conductor, flat lying with minimum core dimensions of 15 m by 300 m, occurring 70 m below surface. Definition of this response helps to validate the interpreted southern response trend, a multi-km east-west-trending area of conductivity, magnetic and structural features, straddling a large east-west offset of the Archean-Proterozoic suture, analogous in scale, morphology and setting to the Voisey’s Bay intrusive complex, and related mineralization. This sparked the recent staking of licence 023365M, consisting of a 132-claim block comprising 3,311 hectares, designed to cover the western extension of the SRT.”

Updated Equitas Chart

Temporarily overbought RSI(10) conditions on this 3-month daily chart have been “cleansed” with RSI(10) bouncing off support at the 50% level. As we indicated recently, EQT remains firmly within an upsloping channel. New support at 15 cents has held, while nearest Fib. resistance is 23 cents. Importantly, as John also pointed out, a new “pennant” has formed, similar to the one in August. Watch for a potential breakout above that pennant. Buy pressure (CMF) continues to gradually increase while the overall bullish trend (ADX indicator) remains strong.

EQT closed up 2.5 cents at 19 cents today, posting its 19th straight session of daily volume greater than 1 million shares.

Note: Both John and Jon hold share positions in EQT.

12 Comments

Looking at the symmetrical triangle ( John calls them pennant, same thing) I was expecting the breakout in about a week when the trading days reached where the blue and green line cross. Of coarse with news out it can happen earlier in the pattern.

Jon, what I find interesting is the additional staking on the western side is where the Archean and Proterozoic faults kinda meet. So this can get interesting. It will be fun to watch how this develops.

The paragraph in blue is very significant. thank you Jon for putting this together.

Now for GGI, cmon get the drill going.

Dave, we’ve come across some new information tonight concerning the extension to the west that is interesting, and we’ll be elaborating on this more as soon as we can. This was staked late last week and trends toward numerous troctolite bodies that have been mapped in the past. Drilling is starting with “D”, which should be interesting. I haven’t spoken with Everett yet but the news tells me – and our research tonight builds on this – that there is clearly heightened interest in the southwestern portion of the property…Everett is seeing something in the southern response trend (SRT) and that explains the pick-up to the west. Keep in mind, this is now a 280 sq. km package, it’s huge. “D” will test some theories. I suspect they’re very actively working on developing multiple drill targets over the SW section.

Jon, agreed. I have a good feedback of what is going on, but your input is unmatched. I can’t explain things as well as you. Hats off to you for putting it in a more comprehensive, yet understandable scenerio for the members holding EQT. There are many things in the fire still and I must say that Hardy is brilliant in his chess game.

One more thing, keep in mind that EQT is going to have days in the red, it can’t happen any other way. But it does amaze me when the market is getting creamed and EQT goes down .02 everyone thinks the sky is falling down. Remember, it had green days too when the market was getting creamed.

Has anyone checked the green vs. the red. You realize that EQT has only had 7 red days since 08-25 and Monday /Tuesday were the first back to back red days.

There are strong forces within this play. I think many on this board maybe are younger than myself and do not realize the money and the eyes on this play. There is so in the fire going on in case of a “hit”. Remember this: it does not have to be a big hit. But, if this stock is trading in the .50’s range and its halted on a Friday. After market news hit the wire with a decent distance of 4% nickel, where do you think this thing opens on Monday. HINT – there will be a number to the left of the decimal.

It’s time to cross your fingers and your toes, but I like very much like the chances here.

I am not slighting GGI either, this could be another discovery to rock North America, they both have all the earmarks.

My sentence structure on post #4 was not proper in some area. ” There is so much in the fire going on”, and ” but I very much like their chances”. I’m exhausted. Good night gang.

Jon

thanks for the update on the Garland/EQT

this is why I am a paying member…

I hope there are many more plays to come form you guys too…

Looks like that triangle pattern stays intact. It all lines up, closing of the PP and day 3 or 4 into drilling with core being seen as she then runs up. I have a few days, no biggie.

Looks like PE may have had its reversal…

Jon, what’s it going to take to get this Venture market going? Gold is up $25.00 and the Venture is as usual, down again.

Anything new from GGI or WRR?

Thank you!!

From a technical standpoint, Jeff, the Venture must clear its EMA(20) and the resistance up to 560 (we’ll show that again in a chart this morning)…fundamentally, if Gold were to blast through resistance at $1,160, that could make a difference, along with a discovery somewhere, a success story – like a hit in Labrador or Sheslay district or elsewhere…market is starving for something significant on that front…it’ll be interesting to see how the Index closes this month…a rally and a finish above 560 would be the ideal set-up for October…

PE- textbook bounce off support….

anyone have any idea how far/close Garland is to the SVB projects of Donner et al from a few yrs back? can’t seem to find any maps that show enough detail to see what lies where

thx