Gold has traded between $1,130 and $1,143 so far today…as of 9:50 am Pacific, bullion is down $4 an ounce at $1,134…Silver is up 38 cents at $15.64…Copper has added 2 pennies to $2.34…Crude Oil has jumped by more than $1 a barrel to $46.63 on reports that Russia has indicated it’s “ready” to meet other Crude producers to “discuss the market”…rest assured, Vladimir Putin will likely do everything in his power, whatever he deems necessary, to give Crude a boost…Oil and gas revenues, of course, are critical to Russia’s economy and Putin’s ability to carry out an aggressive strategy on the global stage during the final 15 months of the Obama presidency…the U.S. Dollar Index is up one-quarter of a point to 96.15 after falling as low as 95.50 this morning…

In response to their country’s stock market sell-off, Chinese investors may be returning to precious metals as a safe haven…retail sales of Gold and Silver in China during August rose 17.4% year-over-year, representing about $3.9 billion in sales…

In response to their country’s stock market sell-off, Chinese investors may be returning to precious metals as a safe haven…retail sales of Gold and Silver in China during August rose 17.4% year-over-year, representing about $3.9 billion in sales…

Glencore, which has had a tough 2015 and really got hammered early last week before beginning to recover, surged again today on reports that the miner was (or is) in talks with a few parties including a Saudi Arabian sovereign wealth fund to sell a stake in its agricultural business with the aim of cutting its debt load…the firm, however, said it’s “not aware of any reasons for these price and volume movements” in a statement issued this morning…meanwhile, Ivan Glasenberg, the billionaire head of Glencore, said at a news conference in London today that Copper prices should rise as more companies cut back mine production (historically, Copper producers have shown to be quite astute at doing this)…Glasenberg said that inventories of the metal will decline and supplies will eventually tighten…Glencore has said it will close Copper mines in the Democratic Republic of Congo and Zambia that account for about 2% of global supply…

Canadian Energy Takeover

Calgary-based Suncor Energy Inc. (SU, TSX), Canada’s biggest energy company, has made an unsolicited offer to buy out Canadian Oil Sands Ltd. (COS, TSX) for about $4.3 billion, taking advantage of plunging Crude prices to add production in Alberta…Suncor is offering a 43% premium to Friday’s closing COS share price and promised higher dividends to Canadian Oil Sands shareholders if the proposal is accepted. “This is a financially compelling opportunity for COS shareholders,” Steve Williams, Suncor’s President and CEO, said in a statement this morning. “We’re offering a significant premium to COS’ current market price and also providing exposure to a meaningful dividend increase.”

COS is up nearly $3 a share to $9.15 through the first 3+ hours of trading today while SU has dipped 83 cents to $34.54…

Crude Oil Update

Saudi Arabia yesterday made deep reductions to the prices it charges for its Oil, hard on the heels of cuts last month by rival producers in the Gulf…with U.S. production still increasing despite low Oil prices, OPEC members are still battling to keep their share of growing markets in Asia…in a list of official prices sent to customers, state-owned Saudi Aramco cut the price of its light Crude deliveries to Asia by $1.70 a barrel…as a result, it switched to a discount of $1.60 a barrel against the rival Dubai benchmark from a premium of 10 cents a barrel previously…the company also cut its prices for heavy Oil by $2 a barrel to the Far East and by 30 cents a barrel to the United States…the move came as Iran, Iraq and other countries in the Middle East made deeper cuts in their official prices than Saudi Arabia last month…

Russian Oil output rose to a post-Soviet record last month as producers continue to take advantage of the weak ruble to push ahead with drilling…

While there are certainly some supply issues regarding Oil at the moment, the demand side is clearly picking up with the global growth rate higher than at any point since 2010…according statistics collected by the Joint Organization Data Initiative (JODI), Oil demand rose 3.3% in the first half of 2015 compared to the same period in 2014…this data comes from 59 countries that together account for about 80% of the world’s Oil consumption and suggests that in 2015, demand will increase by an average of 1.65 million barrels per day…this figure is in line with the International Energy Agency’s (IEA) estimate that global Oil consumption this year will increase by 1.7 million barrels per day…the major share of the increase belongs to China, which reported a petroleum consumption growth of 1.3 million barrels per day, a more than 13% lift…the Chinese are Oil guzzlers…we love it…

Where Are All The “Environmentalists” & Canada’s Left-Wing Media On This One?

Wow…if there’s a leak at a tailings pond, “environmentalists”, other “activists” and the left-wing media herd go on a stampede…but if you’re a city that’s dumping 8 billion liters of raw sewage into a river system, that’s perfectly okay…where are all the mining and pipeline haters on this one?????

Montreal officials are moving forward with a controversial plan to dump 8 billion liters of raw sewage into the St. Lawrence River…the sewage dump, which has come under some criticism, was temporarily put on hold so the city could study alternatives…but officials confirmed Friday that emptying a major sewer interceptor into the river is the only viable option that will allow necessary construction on the Bonaventure Expressway to be completed…officials have said the raw sewage will not affect drinking water, but residents are being asked to avoid coming in direct contact with the water on the southeast shores of the Island of Montreal and to avoid recreational activities like fishing during the dump…Environment Canada has said it cannot authorize the sewage dump, but stopped short of saying whether it has the power to stop the city from proceeding…

Today’s Equity Markets

Asia

Japan’s Nikkei reclaimed the 18000 level overnight as it added 280 points or 1.6% to close at 18005…China’s Shanghai remains closed for the extended National Day holiday…an extended national holiday…

Europe

European stocks were up strongly today, extending gains from Friday, after a weak U.S. employment report dampened expectations that the Fed will start raising interest rates soon…

North America

The Dow, coming off its biggest intra-day reversal in 4 years Friday, is up another 239 points as of 9:50 am Pacific…in Toronto, the TSX has climbed 196 points while the Venture is up 4 points at 530…

Biorem Inc. (BRM, TSX-V) Update

Biorem (BRM, TSX-V), one of our favorite non-resource opportunities and a profitable enterprise, announced this morning that it has received 3 new orders totaling $2.4 million…the orders are for air emission abatement projects in North America and China with anticipated delivery in early 2016…

“These recent orders support management’s strategy for market diversification,” said Derek Webb, BRM President and CEO. “Facing the challenge of high-profile dense urban applications, customers are turning to Biorem to ensure they meet their compliance obligations. On one of the orders, Biorem is providing an advanced solution for an underground waste water treatment facility in China, while on another, we are providing a standard modular unit for a North American customer requiring a simple and cost-effective solution.

“These recent orders demonstrate our ability to compete in both the high-value and commodity segments of the global air emissions abatement market with our innovative product offerings. We continue to be excited at the opportunities being developed by Biorem across diverse geographical areas,” Webb concluded.

BRM is up 3.5 cents at 50 cents as of 9:50 am Pacific…

Garibaldi Resources Corp. (GGI, TSX-V) Update

Garibaldi Resources (GGI, TSX-V), which is looking very powerful technically and fundamentally at the moment, has pushed above resistance on strong volume morning as accumulation begins ahead of what could be some very exciting near-term developments on the ground at Grizzly Central as reported by the company September 17…

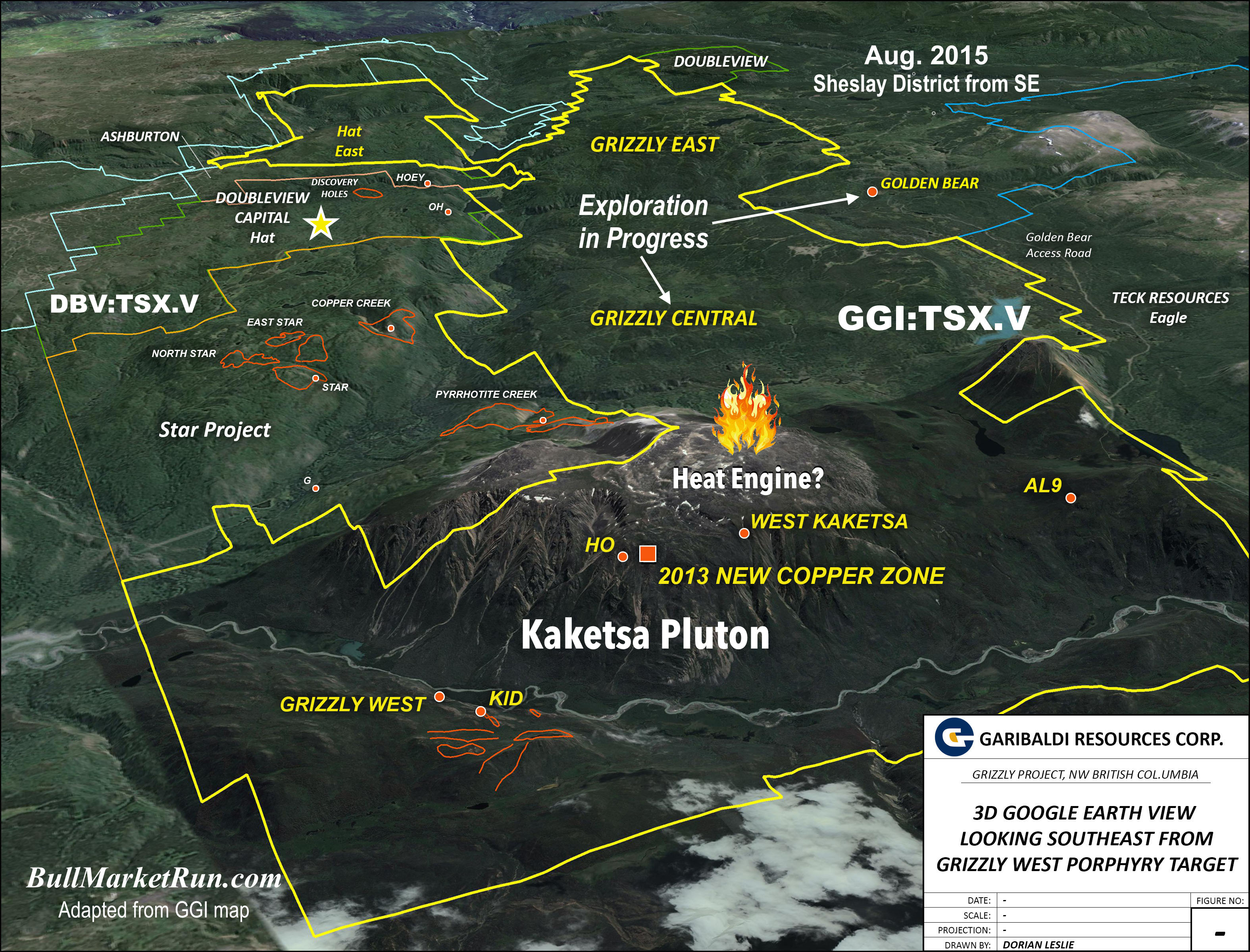

A picture can tell a thousand words, so we urge our readers to look at the Google Earth map below and understand the importance of a fertile pluton, the Kaketsa “heat engine”, which appears to be intimately associated with the fascinating structures at Grizzly Central where a new grassroots drilling discovery in this part of the Sheslay Corridor is a distinct possibility in our view…

Technically, the turning point for GGI came in mid-August when it broke above a downtrend line in place since early in the year…we do exhaustive technical research at BMR, and this is one of the most potentially explosive individual charts we’ve come across on the Venture at the moment…

The breakout above the price and RSI(14) downtrend lines, the reversal to the upside in the 50-day SMA, the near-term reversal of the 100-day (not shown on this chart), the increasing buy pressure (CMF), and the potential for a near-term bullish +DI cross all suggest that indeed there could be “masked deposits” under the extensive overburden at Grizzly Central…the drill rig, the truth machine, will soon start providing some answers…

GGI is up 2 cents at 11 cents on volume of nearly half a million shares as of 9:50 am Pacific…

Equitas Resources (EQT, TSX-V) Update

Equitas Resources (EQT, TSX-V), which may have locked up some additional ground in the Garland Nickel camp according to government staking records viewed by our research team, is off 2 pennies at 18.5 cents as of 9:50 am Pacific after Friday’s major intra-day reversal when it broke above a pennant formation on a massive surge in volume…the interesting thing is the staking rush at Garland and completely surrounding EQT in advance of any drill results (EQT’s drilling at Garland started less than 2 weeks ago)…we can confirm this morning that there are now no contiguous/adjacent claim parcels available to be staked…all the more reason why investors should be taking a close look at Athabasca Nuclear Corp. (ASC, TSX-V) which has assembled a large land package around Equitas as the drill turns…

Athabasca Nuclear Corp. (ASC, TSX-V) Update

We noted recently how Athabasca Nuclear (ASC, TSX-V) has broken out above a long-term downtrend line, a very bullish development in the current junior resource climate…the 200-day SMA, currently 3 cents, is also now just beginning to turn to the upside, so a major reversal appears to be in its early stages here…it’s important to emphasize that ASC is not just a Garland “area play”, though its large land position there could nonetheless give the stock a substantial lift over the near-term depending on developments with Equitas…Athabasca is active on several Uranium and diamond projects, has a clean balance sheet and just under 52 million shares outstanding…President and CEO Ryan Kalt owns 25% of the stock, and the rest is believed to be mostly in retail hands (no major funds involved which is good)…

RSI(14) has pushed above the 50% level, so momentum is building…the lack of liquidity in this play at current levels can be viewed positively in the sense that existing shareholders see value here and very few of them are interested in selling at 3 or 4 cents…liquidity will improve as ASC attains a more reasonable valuation – that’s certainly what the chart is telling us…as always, perform your own due diligence…

ASC is off half a penny at 3.5 cents as of 9:50 am Pacific…

TSX 6-Year Weekly Chart

Below is an updated 6-year monthly chart for the TSX after Friday’s significant intra-day reversal…exceptional support around the 50% Fib. retracement level (12800) has held on the TSX through the turbulent last couple of months…this chart refutes the doomsayers’ prediction of a Q4 crash in the markets…

TSX Gold Index-Venture-Gold Comparative

An unusually large gap has opened between the price of Gold and the TSX Gold Index and the Venture…we see some “catching up” by both the Gold Index and the Venture before the year is out…

HGU (Horizons S&P/TSX Global Gold Bull Plus ETF)

The TSX Gold Index has a bullish tone to it at the moment, and the double-leveraged HGU appears to be in the process of a move that could take it to the top of the downsloping channel you see in this 2+ year weekly chart…the HGU is also now breaking out above its RSI(14) downtrend line, in place for most of the year, while the SS indicator is giving positive signals as well…Gold stocks are set for a run…

As of 9:50 am Pacific, the HGU is up 19 cents at $3.59…

Short-Term Silver Update

Silver continues to be volatile within a range between about $14 and $16…the band of Fib. resistance between $15.29 and $15.78 has proven to be very stubborn since early July, certainly due to the reality of a slowing global economy with Silver having a lot of industrial uses…

Silver’s immediate challenges are to overcome Fib. resistance at $15.29 and $15.79…RSI(14) continues to trend higher which is encouraging…

Silver Long-Term Chart

An explosive push higher (eventually) – is this actually a scenario that could unfold in Silver over the next couple of years?…quite possibly, given the look of this 34-year monthly chart, though at the moment it’s hard to understand all the factors that could come into play to generate the kind of “Wave 5” move that could develop…

Have we seen the bottom of “Wave 4”?…that’s quite possible, but still too early to tell…encouragingly, RSI(14) has so far managed to hold support which goes back to 2001…

Sell pressure continues to remain very intense, however, as shown by the CMF – amazingly, at levels not seen in nearly 25 years since the low of $3.51…this intense sell pressure at the moment, which started modestly in early 2013, could continue for a while yet…this should be viewed in a larger context as a bullish contrarian indicator given historical patterns…it doesn’t necessarily mean, however, that Silver has found a bottom just yet…

Note: John and Jon both hold share positions in GGI and EQT. Jon also holds a share position in ASC.

44 Comments

Jon – you mentioned above that all the land had been staked around EQT. But a NR just came out on DGO staking a few claims. They have very few shares out, but I don’t think their land package is big enough to warrant anything. Of coarse EQT has the largest package with 12 hot prospects. I still agree that maybe ASC is the best area play.

Yes, Dave, but they would have staked a few days ago….right now, everything contiguous to EQT and immediately adjacent to it is all gone…ASC is the best Garland area play for sure, but I also like what they have in addition to their Garland land package…

Great chart on GGI. If I may add a little more info on the chart. The weekly rsi has broken above the 50 line for the first time since Aug. 2014. Weekly 100 day sma is now pointing upwards and finally the 10 day sma (weekly chart)crossed over the 20 day sma. Will it hold, who knows, but it is a little exciting seeing this movement.

Jon – gottcha

GGI and EQT are going to be the 2 “go to” stocks that are in play.

$$$$$$$$$$$$$$$$$$$

The last Supreme court date in Smithers BC was Oct 1st. Thursday . Nothing scheduled for the 8th so far , looks like Oct 15th Thursday could be the DBV hearing. Chad Day can’t hide forever and the court can rule in his absence. JMO

Jon , I love that map of the Sheslay area with the grizzly smack between Golden Bear and the mineralization on the DBV property. Some time ago I heard a rumour that DBV area E has high content surface gold mineralization. Do you have anything on DBV area E?

Since a long time that we saw the three companies in Sheslay increased !

Reference by DGO to “ground” northwest of target D is a single two parcel claim, 023362M:

thenewswire.ca/archives?tnwcatalyst2=release_id%3D17606

You can see it as a small orange rectangle in the north of the map between ground dominated by ASC and EQT:

athabascanuclear.com/?attachment_id=1102

Look past the bottom right corner of where it shows the date on the map, it is near there.

Yes, it is a bit hard to see given the size of the claim.

Whether a two cell parcel constitutes being part of an area play associated with Garland or not is up to you to decide.

The other two claims are not contiguous/near with Garland.

Ryan, I don’t think their claims are big enough to do anything with, IMO.

John’s new EQT chart just in – confirmed breakout above the pennant. This is going higher.

Mr. Kalt,

What happened with the Alix Resources / Kalt Ind. agreement in 2014? Do you still hold those claims in the Sheslay area?

Thanks.

Keep an eye on SEI.v.About to release news on a huge oil hit in Columbia.Exxon drilled 16,000 feet for a 70% earn in.Rumours are multi-zone hit with plans for multiple fracs per zone.2nd well planned.

They’ve waited more than a month while Exxon and gov’t okays the PR.The stock has been moving up on accumulation.Presentation says a possibility of 210 million barrels for SEI alone.$0.20.Just a heads up people!

Hi Martin – I no longer have any involvement with Alix from an advisory standpoint and don’t believe that they kept the tenure you are referencing in good standing by way of sufficient work expenditures. That said, I think Alix is still active in the Sheslay area though with some of their other property there. Mike England also has Ashburton which still holds tenure in Sheslay last I checked although that vehicle seems to be pursuing Clayton Valley as its’ primary focus. Kind regards, Ryan.

I have done some chart studying with the candle on EQT today. I discovered a bearish harami after a bullish engulfing is not negative nor does it eliminate the breakout. I read it actually happens 63% of the time. The breakout has 1 to 3 days to confirm.

So Jon, I would have to agree with John.

Rubicon Minerals (TSX:RMX) stock dropped by a third after the Ontario government temporarily suspended mill operations at the company’s Phoenix gold project to treat elevated ammonia levels and discharge sufficient water from the tailings management facility.

Shares in Rubicon fell by 31% to 52 cents a share.

Commodity stocks are back in fashion as rumours of a Chinese stimulus package are doing the rounds. The mining industry has been battered and bruised recently, but the possibility of an easing policy from China has seen the buyers flood back in again.

Goldman Sachs Group Inc. says there’s a chance the Federal Reserve will delay its planned interest-rate increase well into 2016, or even later.

Jon do you mean the GGI.v chart rather than EQT.v

GGI chart is looking exceptionally bullish, ChartTrader, with yesterday’s breakout above 10 cents, yes. Next significant resistance is around 15 cents. There are few individual charts in fact on the Venture that are this promising. To me this has the look and feel of a pending massive move, one that would be understandable in the event of a discovery at Grizzly Central. Perhaps the chart is telling us something important, that indeed GGI is going to hit big in the heart of the Sheslay Corridor, then of course there’s Mexico.

In my post last night I was referring specifically to the pennant formation in EQT, which John’s chart shows a confirmed breakout above after yesterday’s close.

Equitas closes $1.05-million first tranche of financing

2015-10-06 06:15 ET – News Release

Mr. Kyler Hardy reports

EQUITAS RESOURCES CORP. CLOSES FIRST TRANCHE OF NON-BROKERED PRIVATE PLACEMENT

Equitas Resources Corp. has closed a first tranche of the private placement that was previously announced on Sept. 9, 2015. The company has issued 8,411,393 units at 12.5 cents per unit for gross proceeds of $1,051,424.

Each unit consists of one common share and one share purchase warrant. Every share purchase warrant entitles the holder to purchase one common share at a price of 25 cents for 12 months after the closing.

All securities hereunder are subject to a four-month-and-a-day hold from the closing date.

Finders’ fees paid in conjunction with this closing were $5,500 cash and the issuance of 44,000 share purchase warrants exercisable for 12 months from closing at 25 cents per share.

The proceeds received from the units will be used by the company for continuing exploration of the company’s Garland nickel project, corporate development, and general and administrative purposes.

We seek Safe Harbor.

GGI is increasing in the USA also. 8.64 cents as I type this.

Some light reading for anyone interested. The link below is to the March 2015 Supreme Court ruling on awarding costs for the Red Chris vs. Klabona Keepers. I realize the circumstances are different than DBV’s but it gives you a sense of the Courts feelings on illegal blockades. Still hoping we hear something (ANYTHING!) from DBV soon.

courts.gov.bc.ca/jdb-txt/SC/15/05/2015BCSC0589.htm

TmxMoney is reporting EQT insider sales from yesterday. Why would insiders be selling shares just prior to a funding announcement? I don’t get it?

wow.ggi 12 cent bid just exploded. LOV’N it!

EQT insiders – selling to buy shrs w wts? and are they the reason that they can’t get this close on time? hope not

Ted – second small tranche of PP due to close end of week is reason for insider selling. It’s being done to fund the rest of PP.

Jon – why is ITG selling GGI. Is this another major fund that has a ton of shares. Just wondering.

Dave, there is no other major fund in GGI. Just an individual investor in this case with ITG, I suspect. ITG was net about 230,000 shares in GGI in purchases from May 1 to today. So a little profit-taking, I guess. That’s fine. Brings liquidity. They were profit takers on EQT at 12 cents, too. But look what happened there.

GGI and EQT both looking good…….added more DBV as it will soon come back to life….should be this month imo…..great time to add on the weakness before demand takes over like what just happened to GGI….trust your DD…..buy and sit tight….

Cool Jon.

CIBC started buying EQT. Mr. Shortie covers through CIBC and TD in case anyone was interested in knowing.

David – second tranche of PP is spoken for and will close end of week. RELAX

Its going to start to move when we break the .21 here.

MR. Shortie has a buy in and it’s much higher.

My gest is GGI announce start of drilling this evening!

So far today I added more GGI, EQT and DBV…..let the drills turn and create wealth…

EQT – the 2nd PP was cause the first one (aug 18th) was over subscribed + suggesting they were ready to part with the cash then. So, Sep 9, they raised the price and let em in. So those keeners have had a LONG time to find the cash to go along with that very simple paperwork.

Average Joe could have the paperwork filled out this aft and send a chq tomorrow, sell thier current shrs and have it all covered by Monday. So, when the ‘big’ boys drag their feet, someone needs a torch to light em up!

DDD4 – Amen!

DDD4 – were you the lucky one to snag those .09 on DBV this morning.

David – you don’t understand what is going on behind closed doors and I am not allowed to explain it. But as my mom always use to say, if your not happy, then let it go.

David is correct about pp subs dragging their butts. Call the company they will tell you the same.

The DBV .09 shares this morning are an early Christmas gift……lol. DBV will soon get back to its glory days….

Treb – OK, I will call the company. hahahaha

“you don’t understand what is going on behind closed doors and I am not allowed to explain it.” Why aren’t you allowed to explain it do David? Are you implying you have inside info? If so then you should excercise a little more discretion. If not, then maybe Stockhouse is more your style.

Come on guys, we need action before the belt, Jon

Buy some more they are cheap at .115$ :-p

Dave thanks for all the great DD on EQT, much appreciated by myself and many others.

I second MURF! Excellent DD on EQT.