Gold has traded between $1,067 and $1,081 so far today…as of 9:00 am Pacific, bullion is off $4 an ounce at $1,076…Silver is down 3 cents at $14.18…Copper has retreated a nickel to $2.07…Crude Oil is 51 cents lower at $43.32 while the U.S. Dollar Index has added one-fifth of a point to 99.83 after briefly topping the 100 level…

HSBC looks for a recovery in Gold prices next year, maintaining forecasts for the metal to average $1,205 an ounce in 2016 and $1,300 in 2017…the bank lists 3 main supportive factors – solid demand in emerging market nations, a stronger euro versus the U.S. dollar, and renewed buying of Gold ETFs…

The U.S. Mint has sold out of 2015-dated American Eagle 1-ounce Gold bullion coins, with no plans to produce any additional ones at this time, officials reported late yesterday…

Reuters reports that Nickel producers in China plan to gather on Friday to discuss measures to respond to the rout in prices, including possible supply cuts…the metal touched its lowest level in more than a decade yesterday before rebounding to close 5.7% higher, its biggest daily jump since 2012…

Russia has turned on its former ally and trade partner Turkey following the downing of a Russian warplane in disputed circumstances yesterday, warning that diplomatic and commercial relations between the countries are at risk…investors around the world are closely watching rising geopolitical tensions between the two countries after a Russian SU-24 warplane was shot down by a Turkish F-16 fighter jet yesterday…by jumping into the fray in Syria, and likely violating Turkish airspace in the process, Vladimir Putin has certainly managed to deflect the world’s attention from Ukraine and whatever else the Russians might be up to…

Mixed U.S. Economic Data

A deluge of U.S. economic data this morning…on the bright side, a gauge of business investment plans surged in October, the latest suggestion that the worst of the drag from a strong dollar and deep spending cuts by energy firms could be over…the Commerce Department said today that non-defense capital goods orders excluding aircraft, a closely watched proxy for business spending plans, increased 1.3% last month after an upwardly revised 0.4% rise in September…the report came on the heels of data this month showing a solid increase in manufacturing output in October…

Meanwhile, U.S. consumer spending rose slowly in October for the 2nd straight month as Americans boosted savings and spent less on new cars and trucks…meanwhile, inflation as gauged by the PCE price index remains muted…this index has risen just 0.2% in the past 12 months…the core PCE index, excluding food and energy, is up just 1.3% over the past year – still well below the Fed’s target…

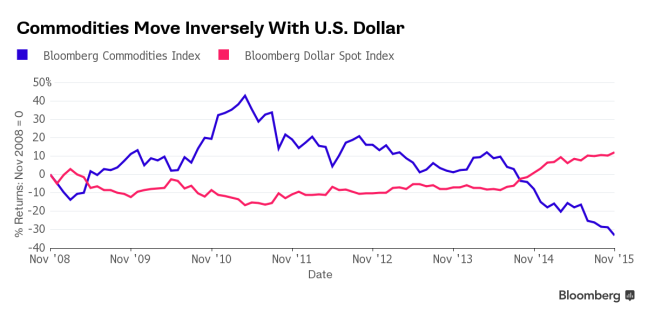

Bloomberg Commodities Index

The Bloomberg Commodities Index, which tracks the performance of 22 natural resources, has plunged two-thirds from its 2010 peak to the lowest level since 1999, creating very oversold technical conditions that are certainly due for a bounce…the drop to 1999 levels, however, shows that it’s back to square one for the so-called commodity super cycle, a hunger for metals, Oil and coal from Chinese manufacturers that powered a bull market for about a decade until 2011…

The biggest decliners in the mining index, which is down 31% this year, are Copper producers First Quantum Minerals, Glencore Plc and Freeport-McMoRan…

Note how the Bloomberg Index really started falling off the cliff last year relative to the U.S. Dollar…

In today’s Morning Musings…

1. The Golden opportunity in the HGU…

2. Ben Bernanke weighs in on what China needs to do to bolster its economy…

3. A non-resource play under a nickel that’s perking up after closing a $2 million sale…

4. Two high-quality juniors that should respond well during upcoming Venture seasonal strength…

5. How the Sheslay district could give the junior exploration market a needed boost…

Plus more…to view the rest of today’s Morning Musings, login with your username and password, or click here to gain full access to this and other exclusive BMR content and features…

29 Comments

testing

I was going to wait until this weekend to post this. I was alerted to a company last Thursday. The symbol is RYU. Ironically, a SH writer did an article on it today. This is an interesting company. The warrants on sedar are incorrect. Some have expired and the others are in the money at .50. I received one of the phone calls on this. I’m waiting for another to report the structure on warrants and revenue. This company is in the fitness line which is a multi billion year business. They are opening their first store this Friday and plan to open next in California. Later locations will be announced when ready. trying not to expand too fast is the key. Just look at U.S. waffle house and Q.T.

This company looks interesting and is opening their first store Friday located at 1745 W. 4th Ave. in Vancouver. They are having a pre grand opening tonight for Brokers and fund managers. Jon, if you have nothing to do tonight, I was told you would be invited in, just ask for Ann.

To beat a dead horse , DBV is a dog it seems like kinda , depressing in a way as of now expectations have not met even half the predictions . Besides GGI what else is looking good out there boys , most bang for your buck short term ?

RYU own this high end brand (akin to Holts) in Van for years. hmmm. guess that’s why they can afford to take down the debs + PP’s. http://leone.ca/

Short term, hard to say. Many I have been putting out there have gone up.

As I posted, the .30 wall got blown out on RYU at 3:11 – Yikes. they have their pre-grand opening with the brokers and fund managers tonight, kinda saw that coming.

Copper output to be cut by 2 million tonnes or more next year, says Antofagasta Minerals’ ceo.

KEK – wasn’t interested in breaking that .50 resistance today.

Answering post 3. You have a point regarding DBV. They have dropped the warrant price from 28 cents to 20 cents recently and now have had to postpone the option agreement with the issuing vendor. This sure smacks of a immediate fund requirement. They have said they are about to restart the drill program, my question would be, do they have the money in the short term to commence this venture? And if not, will they be forced to do a small IPO at these 13 cent low levels, heaven forbid.

“We are already on a lot of radar screens “!

Dave – wishing you a most happy Thanksgiving holiday tomorrow and any other U.S. posters on here. Thanks for all your posts. It’s been said before but I’ll say it again a real class act group here. We all should be thankful for the blessings in our lives because of what so many have given. Best wishes, Reese.

Quiet here!

We’re waiting!

We all have so much to be thankful for, thanks everyone.

LTE.C went on sale today. I bot more.

Thank you DBReese – you and many others are a class act. It is enjoyable to be a member of this board. Here is wishing a green trading day today up in Canada. God bless everyone.

HGU – excellent jump today, if only it wasn’t a result of a 5:1 consolidation !

Yes, a $12 jump would be nice, David. The consolidation (1:5) puts the HGU at $3.09 this morning, pre-consolidation. Watch for a nice a nice gain in this over the next month.

Hopefully assay results from GGI next week. Some core photos of hole 5 would be nice to keep us going.

Did Regoci give any indication as to how they will fund the winter drill program? My understanding when I spoke with the PR company was that they had enough cash to drill 7 holes which probably means up to the 1st week in December.

Tom, Regoci’s cash cow is going to be hole #3. Keep in mind, there are also warrants at 30 cents that would bring in $1 million. He just needs to focus on the great work they’re doing at Grizzly Central, and I’m sure we’ll hear more next week since today is U.S. thanksgiving and markets will be quiet tomorrow as well.

Hi Jon, Do you know what happened to HGU.TO This morning? I tried to find an explanation in the Horizon prospectus but couldn’t find. I didn’t see any news related to that neither. As David stated in the comment no.17 it seems to be a 5:1 consolidation but why now ? I just try to figure how it works…..! Thank you and have a nice day !

See comments below, Sylvain. It was consolidated beginning today (1 for 5)…….so the current trading level is about $3.09.

HGU HNU HOU HIX HXD and HQD were all consolidated. Horizon funds does this every couple of years in to stop these from trading in the pennies. Look at long term charts. these are not long term stocks(other than to short long term). way to many underlying things going on in them to be anything other than a brief holder. be very careful playing these ETFs

Ok gang, getting ready to leave to gooble up that Turkey. Hey Jon, I noticed a NR out by AVU when I signed on to check mail. Would this depth and grade not be a discovery. I’m thinking this is more than GGI will have. Am I missing something here?

Jon

Was curious when you do the interviews with Regoci do you have to sign an NDA? are there other things he says to you that you cannot say here? It just seems to me if I was interviewing someone I would also be talking to them off the record and get a really good idea of what they really think but cannot say in a public forum… just wondering if that is the case here?

thanks

Happy Thanksgiving to all of you Americans and Canadians too! we all have a lot to be thankful for

Hi Greg, we’ve never done an NDA on an interview with anyone. On a site visit, yes. As a wise CEO, Regoci is always careful about what he says in any situation, especially in the midst of a drill program, but it’s often not hard to read between the lines when it comes to news or quotes. Also, if you’re experienced enough with interviews, body language can tell you a lot. That reinforces our bullish view on GGI. More from that interview tomorrow.

Jon

Thanks for the reply, I’m in sales so I’m constantly trying to read people and after 36 years I’ve gotten pretty good at it

Every once in a while though I do get fooled, I guess what I was trying to ask is if You had picked up any additional info that has not been posted here or that you could not share here because of the relationship you have with Regoci and not wanting to hurt that relationship where he would no longer agree to be interviewed,? Yes or no answer would suffice

Thanks again

Thank you David for your comment no.23

Sometimes the best things are taking place when it’s quiet.

Doubleview website is down and scheduled return tomorrow 2:30

I’m watching for a new look to coincide for Farshad to roll out the final leg of his plans.

Sometimes you’re better to watch the idle right hand of the magician while the left hand is waving?

You BMR guys have any thoughts on T.PWR news yesterday

Cormark put a target on it of $1.25

I bought at .45 as soon as I saw the news.

Plus I asked much earlier if you guys ever took a look at V.CST

CO2 Solutions Inc.

Lots of news lately and the best is coming soon I think.

Thanks