TSX Venture Exchange and Gold

Based on historical data going back 15 years, and the way the Venture has traded since October in relation to the commodity sector, there’s a high probability in our view that last Thursday marked the December low at 510 in a healthy re-test of the August 24 all-time low (intra-day) of 509. That means there is no time to waste in terms of pouncing on the best opportunities in the market right now as the Venture is clearly signaling that it’s going to rally significantly through December, January and February in a fashion that’s at least consistent with historical averages.

Check the bottom of this report for 50 companies (top 50 opportunities) to consider (Venture and TSX) at a highly favorable point in the market.

As expected, Gold has started to recover out of unusually oversold conditions in November, brought on by the growing belief that the Fed will act on December 16 to raise interest rates for the first time in nearly a decade. Given the “window” that she now has, and the risk of losing all credibility in the markets, Fed Chair Janet Yellen must pull the trigger at the upcoming FOMC meeting. This should actually be positive for Gold and the commodity complex because it will remove a key dynamic – speculation of a pending rate hike – behind the record run in the U.S. dollar over the last year-and-a-half. Everyone who has wanted to sell Gold and commodities simply because the Fed is finally going to start raising interest rates (very modestly and gradually) has already done so. Friday’s $25 jump in Gold was an indication of that after the metal hit a 5.5-year low of just under $1,045.

“There is a good chance that the dollar has at least temporarily topped,” commented Adrian Day, president of Adrian Day Asset Management. “The modest rate hike expected from the Federal Reserve is not meaningful for Gold and has been more than discounted in any event,” he added.

Bill Gross, former leader at PIMCO’s $270 billion Total Return Fund, made this call back on November 6: “100 percent that they go in December and then try to tamp it down with mild, gradual language that will keep the dollar from strengthening even further.”

In what may have been an example of central bank coordination with regard to currencies and policy announcements, Mario Draghi dealt the dollar bulls a blow Thursday, and prevented the greenback from breaking out, when he announced an ECB decision that fell short of expectations on the stimulus side. There’s still a monetary policy divergence between the ECB and the Fed, but it’s not as wide now as many traders had expected. The euro enjoyed its biggest one-day percentage gain Thursday in nearly 7 years, giving Yellen some extra room to make her move.

Given obvious weakness in the U.S. manufacturing sector, plus stubbornly low inflation, the Fed can’t be keen on the possibility of seeing the greenback explode further to the upside. So Yellen will finally get a rate hike out of the way but will likely use language that will attempt to keep the dollar in check.

Venture 4-Month “Awareness Chart”

Repeatedly, the Venture has successfully tested RSI(14) support at 30% since the end of September, even in the face of major selling pressure in commodities from mid-October through the end of November. All the more reason to believe that support at the August low will hold. What’s also encouraging is that the Venture strongly out-performed commodities during the last 2 months, a divergence that typically indicates a near-term pattern change.

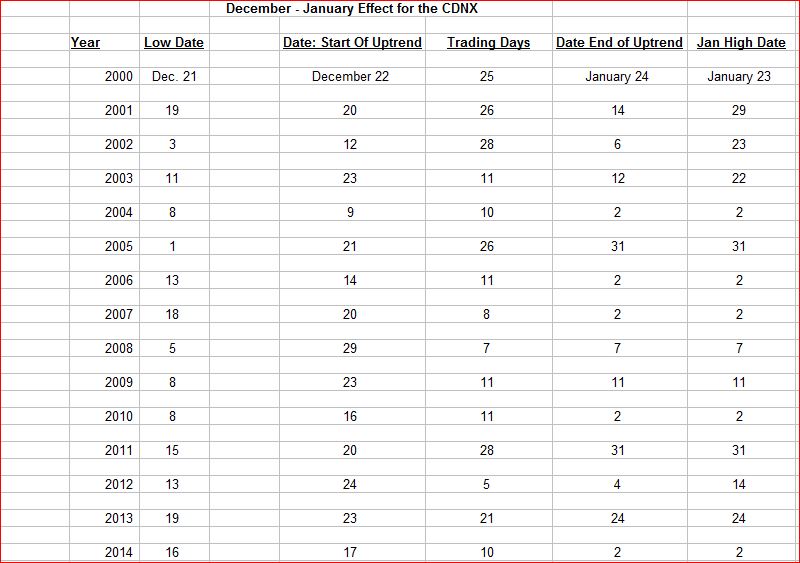

The Venture “December-January” Effect

This table below is important as it shows that 40% of the time since 2000 (6 years out of 15), the Venture’s December low has occurred during the first 8 days of the month. On average in those 6 years, the high the following month came January 13.

Keep in mind, the Venture has posted average monthly gains for December, January and February of 4.5%, 4.3% and 4.4%, respectively, going back 15 years. There’s no better 3-month period for this Index, so now is the time to be positioned to take advantage of that seasonal strength.

Dollar Index 9-Month Daily Chart

Dollar bulls suffered a setback last week, but they may not give up without a fight. What’s important to watch for is whether the Dollar Index can hold support at 98. The key range at the moment is from 98 to chart resistance at 100.

The long trade in the dollar has proven to be very profitable since the summer of last year, thanks to speculation on the timing of the first rate hike in nearly a decade, but what happens when the news is out? Many traders/investors may decide to cash in their chips and go to a different table, especially if Yellen delivers a rate hike but couches it with dovish language.

The Dollar Index faces very strong RSI(14) resistance at 70% as shown on the chart below. During its latest move, the Index wasn’t able to overcome that resistance, perhaps a sign of weakening momentum.

Gold

Gold enjoyed its first weekly advance since October, climbing $29 an ounce. Most of that gain came Friday when bullion shot up $25 to close at $1,086.

All signs (technical, sentiment, short positions, etc.) have been pointing toward a turnaround in Gold and Gold stocks, which is why we recently encouraged subscribers to take a contrarian view and go long on the double-leveraged HGU around the $3 level ($15 post-consolidation). The smart-money commercial traders gave a screaming buy signal on Gold by dramatically reducing their net short positions, while the metal last week also hit the bottom of a downsloping channel on this 2.5-year weekly chart – consistently a major buy signal since late 2013.

It’s certainly possible we haven’t yet seen the final low for Gold in this cycle. However, for now at least, short-term momentum is in bullion’s favor, and a test of chart resistance at $1,150 appears likely over the next month or two. Some backfilling could occur in the days ahead, after Friday’s sharp advance, but a bullish trend has started.

Gold 6-Month Daily Chart

This 6-month daily chart demonstrates very well the extent of oversold conditions that emerged in November, and how sell pressure is rapidly declining. Important Fib. levels range from $1,080 to $1,160.

Last week’s $1,045 low should definitely hold going into 2016, given bullion’s current technical posture, so the risk-reward ratio at the moment is deemed to be highly favorable.

Silver jumped 35 cents last week to close at $14.55. Copper added 2 pennies to $2.10. Crude Oil slipped nearly $2 a barrel to $40.14 on supply concerns, while the U.S. Dollar Index fell nearly 2 points to finish at 98.25.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, the long-term bull market in Gold has been driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, has had a huge impact on bullion and will continue to support prices. Despite Gold’s largest annual drop in 3 decades in 2013, and current weakness, the fundamental long-term case for the metal remains solidly intact based on the following factors (not necessarily in order of importance):

- Growing geopolitical tensions, fueled in part by the ISIS and al Qaeda, and a highly dangerous and expansionist Russia under Vladimir Putin, have put world security in the most precarious state since World War II;

- Weak leadership in the United States and Europe is emboldening enemies of the West;

- Currency instability and an overall lack of confidence in fiat currencies;

- Historically low interest rates/highly accommodating central banks around the world;

- Continued solid accumulation of Gold by China which intends to back up its currency with bullion;

- Massive government debt from the United States to Europe – a “day of reckoning” will come;

- Continued net buying of Gold by central banks around the world;

- Mine closings, a sharp reduction in exploration and a lack of major new discoveries – these factors should contribute to a noticeable tightening of supply over the next couple of years.

Nearly 50 Companies To Consider

Alphabetical order – more details on each of these in Morning Musings over the next 2 weeks, and probably an expanded list as the month progresses. Email us at [email protected] or contribute to our comments section with your favorite pick that’s not on this list.

Producers

What these 8 companies have in common is the fact they’ve significantly outperformed their peers since late 2013, a trend that will likely continue. Our two favorites are Richmont Mines (RIC, TSX) and Claude Resources (CRJ, TSX) who are also both currently drilling aggressively to expand high-grade resources.

Agnico Eagle Mines Ltd. (AEM, TSX)

Centerra Gold Inc. (CG, TSX)

Claude Resources Inc. (CRJ, TSX)

Detour Gold Corp. (DGC, TSX)

Klondex Mines (KDX, TSX)

Kirkland Lake Gold (KGI, TSX)

OceanaGold Corp. (OGC, TSX)

Richmont Mines Inc. (RIC, TSX)

Near-Producers/Advanced Resources

The “Saudi Arabia of Lithium” exists in central Sonora State (BCN, TSX-V), yet few investors have caught on to this yet.

Bacanora Minerals Ltd. (BCN, TSX-V)

Brazil Resources (BRI, TSX-V)

Fission Uranium Corp. (FCU, TSX)

Gold Standard Ventures Corp. (GSV, TSX-V)

GoldQuest Mining Corp. (GQC, TSX-V)

Integra Gold Corp. (ICG, TSX-V)

Kaminak Gold Corp. (KAM, TSX-V)

Lion One Metals Ltd. (LIO, TSX-V)

Nemaska Lithium Inc. (NMX, TSX-V)

True Gold Mining Inc. (TGM, TSX-V)

Pretium Resources Inc. (PVG, TSX)

Explorers

NexGen Energy (NXE, TSX-V) is on the right track with a world class high-grade Uranium discovery in Saskatchewan, while Garibaldi Resources (GGI, TSX-V) has a unique opportunity to deliver a dramatic and powerful 1–2 high-grade punch with the Grizzly Central discovery in the Sheslay district, plus developments in Mexico…

Adventure Gold Inc. (AGE, TSX-V)

Cordoba Minerals Corp. (CDB, TSX-V)

Dajin Resources Corp. (DJI, TSX-V)

Discovery Ventures Inc. (DVN, TSX-V)

Doubleview Capital Corp. (DBV, TSX-V)

Electra Stone Ltd. (ELT, TSX-V)

Equitas Resources Corp. (EQT, TSX-V)

Garibaldi Resources Corp. (GGI, TSX-V)

Kootenay Silver Inc. (KTN, TSX-V)

Lithium X Energy Corp. (LIX, TSX-V)

Nevada Sunrise Gold Corp. (NEV, TSX-V)

NexGen Energy Ltd. (NXE, TSX-V)

Precipitate Gold Corp. (PRG, TSX-V)

Probe Metals Inc. (PRB, TSX-V)

Pure Energy Minerals Ltd. (PE, TSX-V)

Pure Gold Mining Inc. (PGM, TSX)

Rogue Resources Inc. (RRS, TSX-V)

Plus…3 speculative plays under a nickel that could deliver big surprises from drilling:

Ashburton Ventures Inc. (ABR, TSX-V)

Kiska Metals Corp. (KSK, TSX-V)

Walker River Resources Corp. (WRR, TSX-V)

Non-Resource Plays

All of these companies have good-looking charts and business models that are working.

Aphria Inc. (APH, TSX-V)

Biorem Inc. (BRM, TSX-V)

Cannabix Techologies Inc. (BLO, CSE)

Canopy Growth Corp. (CGC, TSX-V)

Cematrix Corp. (CVX, TSX-V)

CO2 Solutions Inc. (CST, TSX-V)

Deveron Resources Ltd. (DVR, TSX-V) – currently halted, investors can gain exposure to this through majority shareholder VGN.

Eurocontrol Technics Group Inc. (EUO, TSX-V)

Greencastle Resources Ltd. (VGN, TSX-V)

Sernova Corp. (SVA, TSX-V)

Sirona Biochem Corp. (SBM, TSX-V)

click here to learn more and gain full access to exclusive BMR content and features.

Please read our disclaimer by clicking here.

32 Comments

Wondering why BLO didnt make any lists????

We’re still adding to it, Patricia – it’s there or will be.

Jeff – It was posted on SH.

Cmon Jeff, now really.

first – I don’t have the same handle on SH

second – I rarely post on SH

third – nobody knows my position on any stock buying/ or selling.

Its time to let this die and move on.

Thank you! Sure appreciate all the excellent info and very glad that I decided to get a subscription. Well worth it!

What happened to gbb. Not on the list anymore after months of pumping?

We were actually going to add GBB as a potential 2016 “turnaround”, Matt, because that’s certainly what it could be. The key of course is the receipt of the CA…..so we’re watching it closely…another potential turnaround situation is North Arrow (NAR, TSX-V) which has been hammered hard, and could still drop a little more, but has the ingredients to bounce back strongly at some point in 2016…

Just wanted to let everyone know that I will be absent the next couple weeks. Packing my house and moving to new location. Hectic time right before Xmas here. Good luck to everybody and with GGI and EQT.

thanks for all the info dave good luck on your move hoping all goes well

Nice list-Jon.. Thanks. Dave- ” check- in” every so often!!Enjoy your posts!!

great report and site. favorite pick CMC metels CMB.V;high grade gold in California 21/g/t highgrade silver in mexico waiting on smelter deal and operating permit the company’s bishop mill. ceo is also ceo of Cardiff energy get report http/rockstone-research.com/php/en/9-reseach-spotlight-english/324-new–high-grade-assays target#1 .27 target#2 .83

Jon – did you edit the list to add BLO?? and the fact that it trades on the CSE:) but I was sure I didnt see it… and I look now and it is..!!!! am I going bonkers????

You probably briefly saw not the final version, Patricia, as someone hit the button a little early on this end. So, no worries, you’re not going bonkers!

Jon, will there be a Sunday Sizzler this week?

Of course, Dan, but later than usual, sorry…it has been a busy day.

Thanks Jon. It will be a Monday Sizzler for me, but busy for a good reason I am sure. Have a good night all

Have a good night, Dan1, you have something to look fwd to when u wake up in the am.

Newcastle Gold – NCA – gets my vote. High grade system with over 4,000,000 ounces in the measured and indicated categories and a recently updated NI 43-101 that looks good.

good morning bmrboys great lists but where is heron resources (HERTEXCH)? regards walter emond

DBV mobilized field crew to prepare the camp for an anticipated winter drill program and cut drill cores from H-23,H-24 and part of H-25 to send to labs in Vancouver.

DBV news out…..

Doubleview Resumes Exploration Program at its Hat Project

December 7, 2015

DBV news.

doubleview.ca/doubleview-resumes-exploration-program-hat-project/

DBV.. finally… guess Chad Day is no longer an issue… wonder how it got resolved??? disappointed that he wasnt made an example of… not revengeful, but legal

Patricia- court hearing for damages was re-scheduled in the new year……January I heard.

DBV received a letter from CD’s lawyer saying no more an issue and he wouldn’t interfere.

clivemaund.com/gmu.php?art_id=68&date=2015-12-06

GGI – I am quite disappointed in the recent trading. I hope this starts to pick up steam otherwise is wish I sold at 0.17.

It’s actually pretty healthy trading, 02charoc, from a techncial perspective with GGI merely touching its rising 50-day moving average (and on low volume)…CGC, for example, did the exact same thing recently after it ran to $3.69 and then retraced, before going back up…same pattern occurred in GGI at the beginning of 2014 when it retraced to 10 cents (the 50-day at the time) and then blasted higher…understanding those “entry points” and the primary trend is important…

The CEO of GBB noted on his website’s forum that the one remaining piece of information requested by the Ministry will be submitted before the end of the year. I expect the stock to fly when the CA announcement is made.

Thx DDD4:) very much appreciated:) just glad that it didnt get swept under the FN rug!!!

Keynote that 07 house is doing all the selling, tax loss? Patience….

And it’s Monday, markets are down…this is creating even better opportunities across a broad spectrum of stocks…the week will finish very differently…

Interesting list but I note there are very few silver companies listed.Silver has much more upside potential than gold and you are also missing many excellent gold plays as well. I own most of your list but totally have small stakes in about 200 junior stocks covering a broad range from lithium, rare earths, uranium, agricultural,Oil & Gas, copper, zinc, and other base metals, diamonds and more.

Myron … starting a mutual fund:) !!:)