Gold has backed off modestly after yesterday’s jump when equity markets went into another tailspin…bullion has traded between $1,092 and $1,106 so far today…as of 10:00 am Pacific, bullion is down $6 an ounce at $1,095…Silver has retreated 8 cents to $14.07…Copper is up 3 pennies at $2.01…Crude Oil has rallied more than $1 a barrel to $29.78 while the U.S. Dollar Index is up one-tenth of a point to 99.30…

Citi Research has revised its 2016 average forecast for Gold up by 7.5% to $1,070 an ounce, commenting that safe-haven buying is supportive at the start of the year although a stronger U.S. dollar will still take a toll on the precious metal. “Gold’s safe-haven rationale is back in vogue for the time being on fears of further China macro contagion, whipsaw equity markets and geopolitical issues in the form of rising Arabian Gulf tensions,” Citi said in a revised commodity outlook…

Citi Research has revised its 2016 average forecast for Gold up by 7.5% to $1,070 an ounce, commenting that safe-haven buying is supportive at the start of the year although a stronger U.S. dollar will still take a toll on the precious metal. “Gold’s safe-haven rationale is back in vogue for the time being on fears of further China macro contagion, whipsaw equity markets and geopolitical issues in the form of rising Arabian Gulf tensions,” Citi said in a revised commodity outlook…

ECB President Mario Draghi signaled this morning that the governing council may provide more stimulus at its next meeting in March, noting that the outlook for inflation had weakened “significantly“…earlier today, the central bank left its key interest rates unchanged, even as low energy prices and concerns about China’s impact on the global economy threaten to derail the ECB’s efforts to bring inflation back to its target…

Speaking at a news conference, aiming to give the market a boost, Draghi said the stimulus measures undertaken by the central bank since June 2014 – and topped up most recently in December – had “strengthened the euro area’s resilience to recent, global economic shocks“…but he added that fresh declines in Oil prices suggest that the annual rate of inflation in 2016 is likely to be “significantly” below forecasts released just 1 month ago…

Hedge Funds Bullish On Stocks

Hedge funds have been “buying the dip” in the equity markets to start 2016, which isn’t a comforting sign given their track record…according to data from one major Wall Street firm, they’re accumulating shares at a very brisk clip…Bank of America Merrill Lynch’s clients were net buyers of $2.3 billion worth of equities last week, according to its client trading desk data. “Net buying was chiefly due to hedge funds, who bought stocks for the 4th week in a row. Buying by this group was the largest since September 2010,” BofAML stated in a note to clients Tuesday…

About Resources & The Rise And Decline Of Nations

It has been just over 34 years since Mancur Olson, the late American economist, wrote The Rise and Decline of Nations…the premise of his widely acclaimed book is the longer a society enjoys political stability, the more likely it is to develop powerful special interest groups that erode economic prosperity…

Which brings us to today and the powerful special interest groups who have mushroomed over the last number of years in the United States, Canada, and elsewhere around the world, targeting Oil and other resource industries in the name of “saving the planet”…these groups, with a twisted ideology, are like a cancer, and that cancer has spread like wildfire…it’s also gradually killing economic prosperity…if it takes a politically incorrect Donald Trump to help stop this insanity, so be it…

One of many high-profile spokesmen for these special interest groups is actor Leonardo DiCaprio, a known Oilsands hater, who yesterday launched a ferocious attack on the world’s energy industry at the World Economic Forum in Davos…

“We simply cannot afford to allow the corporate greed of the Coal, Oil and gas industries to determine the future of humanity. Those entities with a financial interest in preserving this destructive system have denied, and even covered up the evidence of our changing climate.

“Enough is enough. You know better. The world knows better. History will place the blame for this devastation squarely at their feet (how, we wonder, will history, and more importantly God, judge many of those in Hollywood who have contributed to the devastation of the moral fabric of North American society – saving souls, rather than trying to “save the planet”, should be our most urgent priority)…

“Our planet cannot be saved unless we leave fossil fuels in the ground where they belong,” DiCaprio continued. “Twenty years ago, we described this problem as an addiction. Today, we possess the means to end this reliance.”

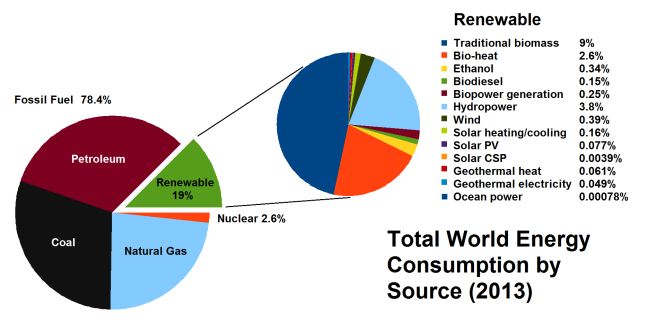

Wow…fossil fuels need to be left “in the ground where they belong?”…our Creator knew we needed them – they currently account for about 80% of world energy consumption, and it’s a cheap and plentiful source of energy (the climate change fanatics might be starting to panic now that they see Oil under $30 a barrel – the “addiction”, as DiCaprio describes it, may only increase at these prices even in a slower global growth scenario)…

Trudeau Derides Canadian Resource Industry

Canadian Prime Minister Justin Trudeau wasn’t as direct as DiCaprio, but nonetheless gave a “coded” message regarding fossil fuels yesterday in Davos…ironically, it took an ultra-liberal, one who we’ve occasionally taken jabs at, to deliver the most effective rebuke to Trudeau’s rather stunning keynote speech yesterday at the World Economic Forum where he actually derided the Canadian resource industry, not to mention an ex-PM from Calgary who was a champion of it…

“My predecessor,” Trudeau arrogantly bellowed, “wanted you to know Canada for its resources. I want you to know Canadians for our resourcefulness.”

Calgary Mayor Naheed Nenshi, who was there for Trudeau’s speech, commented to reporters afterward, “I might not have used the same language that the Prime Minister used today. We are still a resource-based economy. Our biggest export is still energy. And I do not see a path where that does not continue to be the case, so clearly we need to do what we can on market access…we also need to see action (on market access) from this federal government.”

Trudeau made an amateurish sales pitch aimed at trying to rebrand the country away from resources to more of a “tech hub”, which also showed a lack of understanding that our huge resource industry itself has become much more technology-focused…resources and tech aren’t mutually exclusive as the Prime Minister suggested yesterday – they are, in fact, becoming increasingly interwoven…he could have made an extremely powerful argument along those lines yesterday but unfortunately missed the opportunity…

God has blessed Canada with entrepreneurs, innovators, hard working people, and an abundance of resources from Oil to Natural Gas to vast amounts of water, from Gold, Copper, Nickel and Uranium to huge reserves of timber, and much more…

The cornerstone that distinguishes Canada’s prosperity, even in the current commodity slump, is our incredible resource endowment – it gives this great nation a distinct advantage in the global marketplace…it’s estimated that approximately 2 million jobs, half of all merchandise exports and more than one-quarter of all capital investment are attributed to Canada’s resource industry…

Yesterday, of course, did not mark the first attack on a global scale on the Canadian resource industry by a Prime Minister named Trudeau…we should all remember who introduced the disastrous National Energy Program in 1980 that contributed to a Canadian recession, cost Alberta tens of billions of dollars and alienated almost all of Western Canada…like father, like son…

The current Trudeau didn’t have to downplay Canada’s resource rich economy yesterday to emphasize tremendous opportunities this country offers in other sectors, but he chose to nonetheless, while also telling everyone that his New Canada will be one in which the government sets the pace and “invests” in a different sort of a not-so-well-defined future (that approach hasn’t worked out so well in Ontario under the McGuinty-Wynne regimes, nor did Trudeau’s father succeed with Big Government in the 1970’s when enormous deficits and debt accumulated that we’re still paying interest on today)…

Now is actually the ideal time to look at ways to maximize Canada’s competitive advantage in the resource area…the extent of the downturn the last 5 years in commodities only means that the next upswing is going to be more dramatic than ever…history tells us that…yes, despite all the doom and gloom at the moment, another commodities boom is just around the corner…it will be driven by a tightening of supplies (even a scarcity of supplies in some cases) due to a prolonged period of decreasing exploration, and current pullbacks in development – thanks in part to special interest groups, climate change fanatics, and weak politicians…

In today’s Morning Musings…

1. How much lower for Crude Oil?…

2. Gold at $1,600 CDN – updated chart…

3. Walker River Resources (WRR, TSX-V) firms on speculation…

Plus more…to view the rest of today’s Morning Musings, login with your username and password, or click here to gain full access to this and other exclusive BMR content and features…

45 Comments

Watch out , try and catch that us buck and you’ll lose your hand!

Has anyone heard anything recently from the DBV camp? It’s been pretty quiet since the CD mess was straightened out…

KTN Traded 355,000 shares today on the Aequitas exchange. That’s the most in a long time for KTN. It appears to be an RBC cross at .18. Interesting. Silver is woefully undervalued but the market is what the market is. When it does finally catch a bid I’m betting KTN will respond nicely.

Zippy – followed your link on lithium from a couple days ago, started surfing and found Protean Electric. Anyone interested in electric car technology should check it out. They put the motor in the wheel(as in behind the tire) and claim to be able to retrofit any vehicle. Revolutionary and huge potential.

BMR – “saving souls, rather than trying to “save the planet”, should be our most urgent priority” – most important thing you have ever said and kudos to you for speaking the truth.

DBV , Looks like the same drill program as last years , it’s not happening .

Well…let’s see what’s in those cores ggi…I’m sure they are imminent

WRR must be seeing visible gold and the drillers have let the cat out of the bag,because this much volume over the last couple of days says something good is happening.

GGI doesn’t see this much volume in a month.WRR is gonna blow sometime.Too much pressure not to.

GGI – You would think with the Cambridge Conference Monday they would want results out (If Stellar) prior to the show to cause some excitement and exposure even if there is no booth. The one positive since the SP erosion the past couple of weeks is it as been on fairly low volume.

I have been watching WRR lift off today on huge volume. I am holding 100,000 shares from last February at .045. Does anyone have any insight on this or what price it may reach? I believe a few years back it reached .18 on speculation.

GGI web page update.

GGI investor presentation update! just receive an email!

So if we read between the line they have the result in hand now!

It looks close, Martin…just had a quick look…they’re now referring to the “black unit” as a “significant” and “unique” district discovery. Assays pending, following confirmation now that additional procedures had to be carried out (good sign, I would say). Also, I see where they’re now referring to mineralization over the entire width of the drilled area – 1.2 km…as opposed to calling it a “broad area”….reading between the lines, yes, they must be very confident they have something.

Hopefully…they’re still saying drill results as soon as possible. I really hope they have them for the Cambridge show

Wow. WRR is on a roll now. Great call on this one Jon.

If anyone is looking to speculate on the outcome of an upcoming court decision, V.SUP (Northern Superior Resources) may be worth a punt. Market cap. of $2.9M with $1.5M in cash. Gold properties as well being their primary focus.

Link garibaldiresources.com/i/pdf/GGI_FactSheet.pdf

GGI Also noticed the comment on Rodadero – Rodadero project in Sonora State offers further substantial high grade discovery potential (Beyond Silver Eagle) with multiple GOLD-SILVER targets. I emphasized gold-silver because Silver Eagle was a silver discovery. I am thinking they are into a gold discovery as well at Rodadero. Imagine a significant “Black Unit” discovery at Grizzly (Extremely high grade gold?) And possibly another high grade gold-silver system at Rodadero. Bring on the news!

We’ll find out the secrets inside the “black box” soon enough, Dan1 – one thing we can rule out is low-grade Copper/gold porphyry. They have something different, we’ve made note of that here just based on the core photos/descriptions. It’ll be fascinating to see what Kaketsa has cooked up in this particular part of Grizzly Central and the district. Metal value per tonne, potential tonnage – those will be key metrics. If they have discovered a deposit here, that would be absolutely remarkable in the sense that these were the first 5 holes ever drilled on a 300 sq. km property. And what they’ve drilled so far covers an area of just 1 sq. km—–huge upside. If you hit a deposit on the first 1 sq. km, what does that say about the other 299 sq. km? Kaketsa could be one mother of a heat engine.

WRR is the most active on CDNX today !

Very encouraging, well,maybe Steve will have more Friday or Monday, what better place to showcase a new discovery than rite here in bc./Vancouver show.

No booth, I know, but the interest would spread quickly..

Guy,the thing that convinced me to buy WRR today was the continued buying by Anonymous.It went on all day.Lots of bids and only 856,000 to .085,which isn’t much if this volume continues into next week.

Definitely they have hit something big and the word is out to somebody.None of this is happening with any other miner,including GGI,so come to your own conclusions.

Just had a quick nap after work and i had a dream GGI was listed on the NYSE, i was there at the bell! lol just a joke!

You mention Jon many time that a starter or many would be essential for the distric. When you review news from hole 4, isn’t it exactly what you where referring to?

The recently completed fourth hole, collared 600 meters west-southwest of GC-15-03 and 800 meters southwest of GC-15-01, was drilled adjacent to outcrop displaying intense potassic alteration and quartz veining containing chalcopyrite with traces of malachite and bornite. Notably, beginning at a depth of 139.8 meters and continuing to the end of the hole, GC-15-04 intersected a dark, strongly magnetic mafic unit with fine-grained pyrite along shear surfaces similar to that observed in GC-15-03 and GC-15-01.

After 14.5 meters of overburden, GC-15-04 immediately entered an intense silica chlorite-sericite breccia for 22 meters. This was followed by a 103-meter interval with sections of finely disseminated chalcopyrite and pyrite stringers in andesitic volcanoclastic rocks consistently chlorite-sericite altered, featuring approximately 5-15% quartz veins.

WRR!

starter pit should read

Significant “black unit” discovery, unique for the district, over a broad area (206 meters thick in GC-15-03) at Grizzly Central, 2 km east of Kaketsa “heat engine”

Note the 2 km from heat engige, that is where they think the black unit is trending!

Martin, I’m looking at the Grizzly Central magnetics map (project maps on Grizzly page, GGI web site) and I believe there are multiple things going on here. The “black unit” is definitely defined by strong geophysical signatures (IP and mag), fault-bounded, starting from the north and trending (getting wider) to the south and southwest, certainly for more than 2 km. This would be deposit #1, if the assays confirm, and what type obviously remains to be determined. The faults are probably quite significant. About 500 m to the west of this northern half of the geophysical anomaly there is another smaller mag feature with some similar characteristics to the one just drilled (I believe this mag survey was done at 200 m spacing, so tighter spacing would be helpful to get a better read in terms of what might be in between).

Interestingly, you’ll notice a NW-trending feature to the southeast that then turns north-south across from the narrow mag low in blue (on the other side of the “island”, so to speak, just drilled). So if the first geophysical feature is confirmed by assays, then this second one to the southeast and the east (more moderate) becomes very important. Hole #5 was drilled toward the east on a big step-out from hole #3.

Third point is this: Vectoring to the west toward Kaketsa should reveal something different yet again – the geophysics profile changes, and we know there is very intense alteration at Kaketsa (seen it from the air) and in every direction immediately around it. Geochem also probably kicks up in a ring around Kaketsa. The Grizzly West porphyry is an indication possibly that a ring of porphyry systems forms immediately around Kaketsa (a model seen elsewhere in the world around fertile plutons), then something else is going on further out to the east and southeast at Grizzly Central.

Bottom line – there is growing evidence there are multiple deposits on the Grizzly, and more than one deposit type. That’s critically important. It’s going to take multiple deposits and a high-grade starter area somewhere to turn this entire district into a mining camp, plus the room (away from any sensitive areas) to put a very large processing center and other infrastructure.

You know something about DBV that we don’t Les?

Nice move in WRR. Congrats to all those that had the patience to sit tight on this one. Nice move in PE, LIX, and a good rebound in GLH. Just need GGI to jump on the bandwagon.

Robin – you been buying GEM.V yet?

No , Steve I don’t, but it has been almost three months since the CD incident has cleared and you would think DBV would have resumed drilling . It is like watching pain dry.

No,and I see it’s starting to move,George.

DBV,GGI- We know that DBV arrive with result of holes 23,24 and a part of hole 25,and if both company decide to announce result in the same time for a better impact !

During the DBV conference call last week Farshad said that drilling will start once weather permits. He is working on many things which he says will be revealed next month. I think drilling will start in February. Overall, DBV is getting positioned for a very exciting year. Yes, its been a long wait but I think what’s to come will more than make up for the delays imo.

Guy, are you saying Dbv has the results already? DDD4, can you confirm this?

DBV- I think within two weeks !

Unless they had them rushed I doubt they have received the assays from the lab.

Weren’t they sent to the lab before Christmas?

DDD4 , didn’t you say you didn’t talk to CEO’s to obtain your information ?

I debated about listening to it and decided to participate at the last minute since we have been in the dark for so long…..I didn’t speak to him….was in listening mode. I took it all with a grain of salt. Although information was very good I haven’t bought any shares as I don’t buy due to upbeat words from a company.

Thanks DDD4 . Let’s hope they get those cores analysed and get mobile with the winter drill program sooner than last year.

DDD4 – Isnt listening to him and believing what he has to say the same thing as speaking to him and believing what he has to say? Isn’t that just semantics…

No need to pick apart others comments on here George…DDD4 is just adding his own value to the discussion, some here appreciate his input.

Listening to someone is a one sided conversation….speaking to him is two sided.

I was going to post the info passed during the DBV 46 minute conference call but not worth my time as some will find a way to criticize me on it.

Ddd4, please post it, most of us appreciate the info

DDDDDDD4…Post it pal as we all appreciate your DBV posts but not sure why you constantly bash GGI??