Geochemical sampling is one important way to effectively assess the potential of a property and target new discoveries.

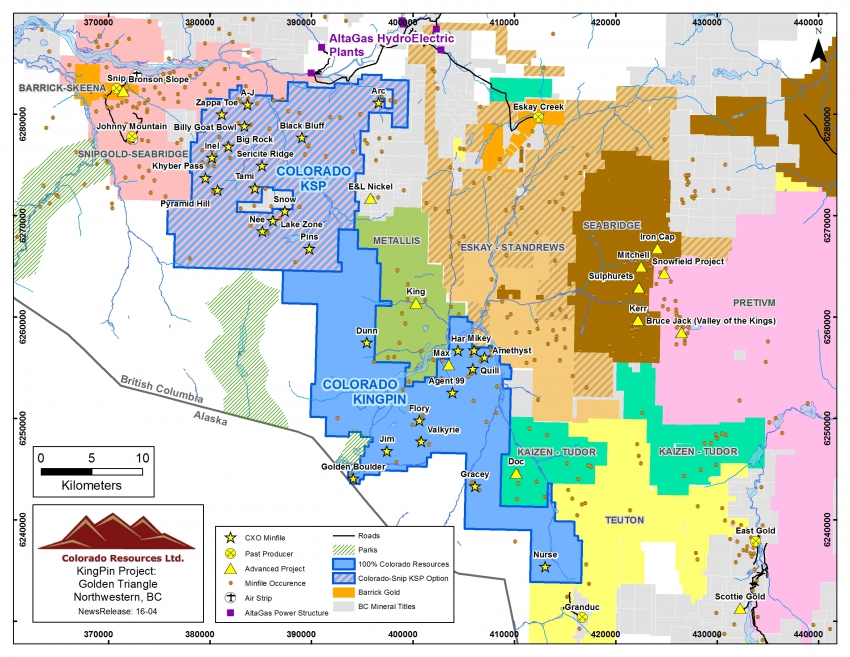

And the soils are unusually rich over parts of Colorado Resources‘ (CXO, TSX-V) KSP Property in the Iskut River Gold Camp in the heart of world class current deposits (Valley of the Kings, KSM) and high-grade past producers (Eskay Creek, Snip).

At Inel, a compilation of 1,215 soil samples (492 taken by CXO) in an 8.5 sq. km area averaged 800 parts per billion Gold (0.80 g/t) and also highlighted a 1,000 m x 1,500 section with 628 soil samples averaging a remarkable 1,270 parts per billion Gold (1.27 g/t ) with a maximum value of 31.2 g/t Au.

This 1.5 sq. km anomalous Gold-in-soil area is considerably larger than the areas tested by historical drill holes, and those results included numbers such as 424 g/t Au over 3.5 m (IS130) and 41 g/t Au over 7.4 m (IU171).

Keep in mind, of the hundreds of Gold deposits in the world with demonstrated reserves and resources, the average Gold grade is only just above 1 g/t. The soils at Inel are equivalent – imagine what could be in all the rocks below.

Click on the arrow to listen to a short excerpt (2 minutes) from our interview with Colorado President & CEO Adam Travis as he discusses the significance of the geochemical results from Inel ahead of the company’s 5,000-m drill program at that high-grade target.

Later today or tomorrow, as part of BMR Morning Musings, Jon has a fascinating discussion with Adam concerning the ramifications of last week’s announcement that Seabridge Gold (SEA, TSX) is proposing to acquire SnipGold (SGG, TSX-V) – another indication of how this prolific Gold camp is rapidly heating up.

Adam Travis on the geochemical anomaly at Inel – click on the arrow

Special Report, April 24, 2016

Something with dramatic possibilities has started to unfold on the exploration front in northwest British Columbia, concurrent with a new bull market in both Gold and the Venture Exchange that we correctly called back in February.

Last Tuesday, April 19, Seabridge Gold (SEA, TSX) – a company with a nearly $1 billion market cap and 38 million ounces of proven and probable Gold reserves at its KSM Project in the heart of B.C.’s prolific “Golden Triangle” – announced a friendly takeover of small junior SnipGold (SGG, TSX-V) in an all-stock transaction valued at around $10 million. If you were a BMR subscriber, you would have had a heads-up on the attractiveness of SnipGold which more than doubled in price to 30 cents on the morning of April 19.

Last Tuesday, April 19, Seabridge Gold (SEA, TSX) – a company with a nearly $1 billion market cap and 38 million ounces of proven and probable Gold reserves at its KSM Project in the heart of B.C.’s prolific “Golden Triangle” – announced a friendly takeover of small junior SnipGold (SGG, TSX-V) in an all-stock transaction valued at around $10 million. If you were a BMR subscriber, you would have had a heads-up on the attractiveness of SnipGold which more than doubled in price to 30 cents on the morning of April 19.

Why would Seabridge, cruising along at KSM with one of the world’s largest resources of Gold, Copper and Silver, plus critical provincial and federal approvals in hand, find it necessary to step in at this particular time and bother itself with the acquisition of SnipGold, a company that also has reclamation obligations with respect to the past-producing Johnny Mountain mine? There are two reasons in our view, and they both suggest Seabridge may have cut the deal of the year.

First, the macro picture. SnipGold, an easier immediate target for Seabridge than another company we’re about to mention, holds a large land position in a key part of the Golden Triangle north of Stewart and adjacent to prolific emerging mines and past producers. Overall, this core block (1,000 sq km) within the massive Golden Triangle is rapidly attracting intense new interest due to the advancement of two large mining projects, major infrastructure improvements including power, roads and bridges, very significant glacial retreat that has exposed rocks and soils never seen before, and bullish new geological interpretations aided by extensive reviews of historical data going back to the 1980’s boom driven by the Eskay Creek and Snip discoveries.

Second, and this is where the critical sense of urgency comes in, Seabridge made this move now, the evidence suggests, in order to strategically position itself ahead of a potential major new drilling discovery by Colorado Resources (CXO, TSX-V) at the high-grade Inel target, on strike to the southeast of Snip and part of some key ground Colorado optioned from SnipGold in December 2013. Upon the appropriate approvals of Seabridge’s acquisition of SnipGold, Colorado’s KSP option will be with the big fish, not the little one.

Given historical (1988) high-grade near-surface drill intercepts such as 424 g/t Au over 3.5 m (IS130), 41 g/t Au over 7.4 m (IU171), 38 g/t Au over 5.3 m (IS148) and 30.3 g/t Au over 4 m (IU040), and a remarkable geochemical anomaly averaging 1.27 g/t Au over an area 1,000 m x 1,500 m as reported by Colorado February 29, Inel is a significant new deposit-in-the-making and could generate Eskay Creek hole 109-type excitement this summer. CXO is making final preparations for the start of a 5,000-m drill program at Inel after two successful seasons of field work at KSP (Inel is part of KSP under the SnipGold option – most of KSP was staked by CXO).

“We’re off to the races here and it’s going to be an incredible drill season,” stated Adam Travis, Colorado President and CEO in a wide-ranging interview with BMR which we’ll be sharing more of in the days ahead. “I’ve never seen such low-hanging shallow targets in my career that are just waiting to be drilled…what an incredible opportunity we have.”

Travis was a young geologist who had just arrived on the scene when the Iskut River Gold Camp lit up like a thousand Christmas trees in the mid-1980’s, thanks to the likes of Murray Pezim and Ron Netolitzky. The discoveries sent some stocks through the stratosphere from pennies to many dollars per share, creating instant millionaires.

Eskay Creek, one of the richest ore bodies ever found, and Snip became world class high-grade producers but the election of an NDP government in British Columbia in 1991 quickly destroyed the exploration momentum in the district and ushered in a “lost decade” for B.C. exploration. Two subsequent revival periods got interrupted by external events, first by the 2008 global financial crisis and then the unprecedented industry and commodities bear market from 2011 through 2015.

A couple of heavyweights, though, kept punching aggressively the last several years while most juniors, with Colorado being one of the exceptions, were fighting just to stay alive.

Pretium Resources’ (PVG, TSX) recent success with Brucejack, one of the world’s highest-grade Gold deposits set to commence commercial production next year, Seabridge’s continued development of KSM, and important field work completed by Colorado during 2014 and 2015, are key factors that have created the foundation for the birth of another rip-roaring area play within this core block of the Golden Triangle. God has richly blessed this part of B.C. with incredible ore deposits of different styles, super high-grade and bulk tonnage. More large discoveries seem inevitable.

You heard it here first, so prepare. The Seabridge takeover announcement of SnipGold, and the recent death of the Venture and Gold bear markets, means THE GAME IS NOW ON in the Iskut River Gold Camp. If this heats up like the late 80’s, watch out.

Colorado leads the pack among juniors in this district, and has a chance to enjoy a spectacular summer, but there also other companies active in this area (and more to come) who investors need to be familiar with.

For the most insightful and dynamic coverage of this area, plus the exciting new Venture bull market, make sure to visit BMR regularly and as a subscriber in order to get critical investor information and the latest company charts on a daily basis you won’t find anywhere else.

Subscribe NOW and take advantage of our Spring Sizzler subscription special and our unmatched 100% money-back guarantee. You’ll gain immediate access to our Iskut River Gold Camp coverage and unparalleled fundamental and technical analysis that has delivered spectacular returns from our Top 50 Opportunities List.

Note: John and Jon both hold share positions in CXO. Jon also holds a share position in SGG.

7 Comments

My trading strategy has been to sell half when a stock doubles and let the profits run. Comments, concerns?

DavidW – If that strategy works for you and you are making a profit with no regrets, then there is nothing wrong with it. The problem I found with it is it leaves to much money on the table, especially in a bull market. Look at the recent run up in many of the gold and silver stocks as an example. I prefer to use fib levels and rsi to unload shares (and other factors including my instincts) most often half of the shares and sometimes small percentages on the way up. Just how I do it.

That is always the wisest strategy.

We have witnesses many stocks that have doubled and tripled in April. There are always a few that have lagged behind but have the ability to do shortly what many have done. One to keep an eye on is SEK. They have an attractive share structure and they start drilling in May. They also announced and closed a PP in 5 days. This is hard to do. The chart is attractive for a potential breakout. Maybe keep an eye on it. .07 is the last resistance mark.

waiting…waiting…waiting… for someone else to take a run at Snipp. .29 cents is to cheap and just begging for another buyer.

morning bmr boys check out latest press release for heron resources HER TEXCH regards walter emond

viv.v