Gold has traded between $1,209 and $1,218 so far today…as of 8:15 am Pacific, bullion is down $3 an ounce at $1,210…Silver is flat at $15.93…Copper is off 2 pennies at $2.09…Crude Oil has retreated 36 cents to $48.65 while the U.S. Dollar Index is up one-tenth of a point to 95.50…

Holdings in SPDR Gold Trust, the world’s largest Gold-backed exchange-traded fund, rose 0.24% to 870.74 tonnes yesterday – the highest since November 2013…

Holdings in SPDR Gold Trust, the world’s largest Gold-backed exchange-traded fund, rose 0.24% to 870.74 tonnes yesterday – the highest since November 2013…

Sales data compiled by the U.S. Mint shows Gold sales in May were up more than 206% from the same month a year ago…looking at the Mint’s historical data, May is typically the start of slow season for the market…however, 2016 bucked the trend as this was the strongest May since 2011…

Short-term speculative investors, spooked by the unreliable Fed, were responsible in May for Gold’s worst month since last November, but many longer-term physical buyers have taken advantage of the recent weakness to add to existing positions…this underscores the strength in Gold around the $1,200 level and why the downside is limited…

“Wacky Ozone Regs” Stifling U.S. Economy

Jack Welch, former chairman and CEO of General Electric, said today that the Obama administration’s heavy focus on combating climate change is “radical behavior” that’s holding back the economy (the same can be said of course regarding the situation in Canada with the Trudeau-Wynne-Notley axis of climate change fanaticism)…a longtime GOP supporter, Welch told CNBC that the priority on preventing climate change spills over into “all kinds of policies throughout the different agencies…you get an economy that won’t move…you get ozone regs that are wacky.”

U.S. Jobs Growth Continues To Rely On Services Sector

U.S. job growth gains in the private sector in May came entirely from the service side which added 175,000 positions, according to this morning’s ADP report which was in line with expectations…goods-producing companies actually lost 1,000 jobs while manufacturing subtracted 3,000 jobs…the ADP report is not widely seen as a reliable indicator for the government’s jobs report with May’s non-farm payrolls to be released tomorrow, but last month ADP reported just 156,000 jobs…2 days later, April non-farm payrolls came in at just 160,000, 40,000 shy of expectations…the consensus estimate for tomorrow’s important jobs report has been 162,000…

The Organization for Economic Cooperation and Development (OECD) has once again downgraded its outlook for the U.S. economy which they now expect to expand by only 1.8% in 2016, down from its February forecast of 2.0%…the latest projections are well below growth of 2.4% that was seen in 2014 and 2015, respectively…the OECD acknowledges the strong U.S. dollar has hurt manufacturing and exports, but it views those affects as “transitory” and likely to diminish later in the year…

Oil Update

Mounting tensions among the 13 members of OPEC, and the differing economic needs of each country, have stymied any deal on output at meetings today in Vienna…not surprisingly, OPEC has refrained from changing its Oil output policy while also naming Nigeria’s Mohammed Barkindo its new secretary-general…

Reuters also reported that Saudi Arabia’s energy minister said he wouldn’t rule out increasing his country’s Crude capacity…as long as Iran, the Saudis’ arch-rival, continues to pump Oil faster than rabbits can make bunnies (thanks to an accommodating Obama), it’s safe to assume that the Saudis will do whatever they have to in order to maintain market share especially when supply disruptions in some parts of the world have kept Crude prices firm…

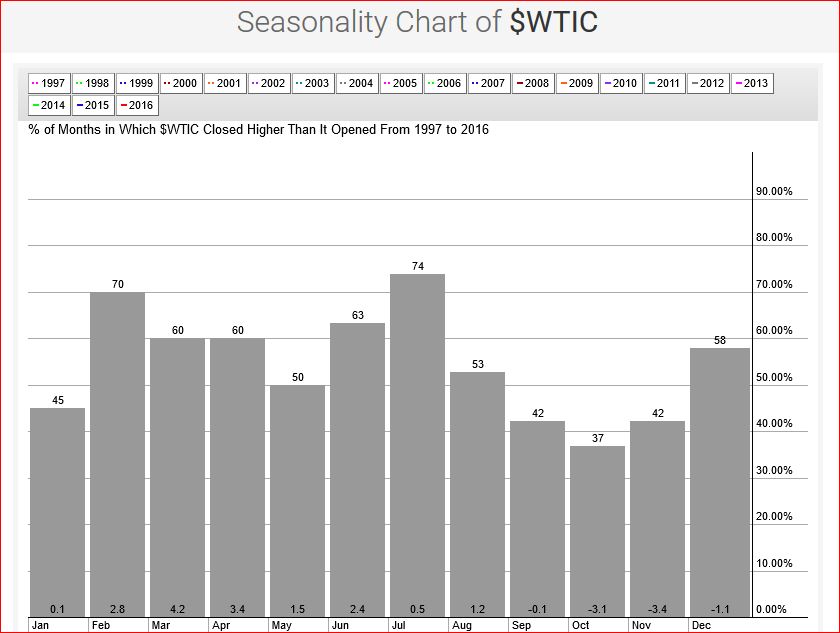

Crude Seasonality Chart

Historically, going back 2 decades, June is Crude’s 4th-best month of the year (2.4% average gain) which is strongest between February and August…prices increase in June and July 63% and 70% of the time, respectively, so any modest pullbacks over the near-term are likely going to be viewed by savvy traders as a buying opportunity…

In today’s Morning Musings…

1. Chad’s Bad Day in court is Doubleview Capital’s (DBV, TSX-V) gain…

2. “Just stay tuned”, says Eskay Mining (ESK, TSX-V) CEO as Golden Triangle’s Heart of Gold Camp heats up on multiple fronts…

3. Umbral Energy (UMB, CSE) hits highest levels since late 2014 on Clayton Valley look-a-like in Utah…

Plus more…click here to take advantage of our Spring Sizzler Subscription Special in effect for a limited time only, or login with your username and password to view the rest of today’s Morning Musings…

SAVE 25% with a risk-free subscription (as little as $1 per day) as you gain full access to this and other exclusive BMR content…

25 Comments

oh boy,here we go again,calls for trudeau and his pansys to step in and cool off the so called overheating of the housing market.they are best to keep their noses out of it,also they need to be told that this has nothing to do with GLOBAL WARMING!!

Look like the Golden Triangle is going to be on Fire this summer

Good scoop on ESK BMR

CXO drilling starts next week

Glta

An incredible summer coming up, Skipper.

Smart ones are buying the Golden Triangle stocks today those waiting are going to be chasing the stocks later

Buy low sell high

Thanks BMR

Jon

I know I keep asking, but I just don’t see any interest at least in the stock so far in MTS, hopefully they are in talks too with someone? and I guess if CXO has good early results that could cause all the companies in the Golden Triangle to take off?

Hi Greg, MTS is looking good – very tightly held which accounts for low volume so far. I have no doubt they’re in talks. Keep in mind, in terms of all that’s happening in the district, the masses haven’t shown up at the ball park yet. First inning hasn’t even started. And when they do pile in, the stadium’s going to fill up for one amazing show. CXO pulls a hole right off the bat – and why won’t they given that they know precisely where to drill into some high-grade given historical data and their work the last 2 years – everything in the area will light up big-time. This has the potential to be 1989 all over again this summer. Fortunes will be made IMHO.

DEC came to life today! Cant find any news?? Anyone? TIA.

Pretty good volume on dec today, just didn’t see any news on them, last year is all I see, the whole area looking good, just need to get jobs data over with, and I can’t see it, but the fed kicks the can down the road some more, it’s getting a little old already!!

DEC & MTB had news today sampling results high grade gold that extends there gold zone up to 4kms

Decade, Mtn Boy sample up to 263.81 g/t Au at Red Cliff

Dec & Mtb have a planned summer drilling program

GBR just rolled there stock back doing .15 cent pp plans to drill BA zone 50/50 with MTB as there right beside IDM super high grade silver and zinc

JDN & MTB around 1 million oz gold on there property no idea if they plan drilling there or not free ride for MTB

JON: is GGI part of the Golden tRiangle??? thanks…

Of course, Steven1, and importantly they’re very much in this core area we’re referring to as the Heart of Gold Camp…with the King and Palm Springs properties. 150 sq. km approx. The King is the more advanced and some limited shallow drilling in 1989 created some major excitement on this property as a 150-m long vein grading 1 opt was intersected, open in all directions…there are multiple zones with different mineralization styles at the King. Looking fwd to it getting drilled this summer (GGI has the drill permits in hand).

All the golden triangle stocks you mention are rated ‘ Overvalued ‘ by Morningstar. What are they missing?

That’s funny, DavidW. I have no idea how they rate stocks, but I doubt they understand the Golden Triangle or the Heart of Gold Camp specifically (which is probably why they should have a BMR Pro membership). All of these plays are grossly undervalued given the dynamics that have unfolded and will unfold – but that’s what makes a market. Some are blind and won’t see it until it’s evident to them in the actual market, when some of these situations literally explode over the summer. That’s when many – the masses – will jump on the bandwagon big-time.

One of the best corporate investment moves of 2016 has been Seabridge’s acquisition of SnipGold. Kinross just acquired more Colorado. More of this kind of stuff is on the way in this Camp, and for important reasons. Follow the money.

38,000 jobs in May. MAYDAY, MAYDAY! Wow, the Obama economy is really rolling (downhill). Hillary is going to get creamed, along with the U.S. dollar. Gold up sharply. Definitely no rate hike in June, nor July in all likelihood, or just when, exactly?…..Fed has a serious credibility problem, and that’s highly favorable for Gold…

Nice, realality sets in, not till after the election I would say.

Indeed, Laddy, and when you combine that with Hillary’s horrendous speech in San Diego yesterday on foreign policy…it was like the arsonist warning everyone about the dangers of playing with fire…this political environment we’re in, the incredible upheaval we’re about to see, is dollar bearish and commodity bullish…that’s why Gold and the Venture have acted as they have these last few months…(Horrendous Hillary, Trump may want to use that line)…

CME rate hike odds for June just plunged to 6%. Can anyone find the July odds please?

About as high as August, John (there’s no meeting in August)…what a tangled web the Fed has weaved, but they’ve had plenty of help from incompetent fiscal/regulatory management in Washington…

Ha Ha. Good one John!

Both March and April numbers were also revised down. And I don’t think anyone believes that bogus 4.7% unemployment.

WHOA.. gold shoots up, US $ down big time. I think the venture is going to feel some love today.

The Venture always feels love when the dollar doesn’t, Tonyt…lots and lots more love to come for the Venture the rest of the year when the dollar index tanks into the 80’s…

UMB looking strong on the bid pre-market…really interesting chart in this morning’s report…

Hoping we hear from GGI next week in regards to Rambo.

How many are making easy money each month buying gold and selling $US, just prior to the jobs #. The Fed. is your friend.