In the stunning Heart of Gold Camp in northwest British Columbia’s infamous Golden Triangle, much gets supersized – from tonnages and grades as detailed in historic production statistics and the most recent NI-43–101 reports, to a hydroelectric facility, land packages and market capitalizations.

There is something very, very special about the geological features and processes God has masterfully created in this particular part of the world. And the key to finding incredible mineral deposits in the Heart of Gold Camp, and generating enormous wealth, is to think BIG and persevere – just as Murray Pezim did, and others since. They followed their hearts, their passions and their instincts, and they made amazing discoveries in this uniquely rich district.

The Golden Triangle’s “Heart of Gold” Camp

Eskay Creek churned out more than 3 million ounces of Gold and 161 million ounces of Silver at mind-boggling average grades of 1.3 oz/ton Au and 65 oz/ton Ag, respectively.

Seabridge Gold (SEA, TSX) hosts the world’s largest concentration of Gold and Copper in Reserves at its KSM deposits, and is looking for more with 2 drill rigs in action at KSM while another drill program searches for potential high-grade Gold deposits at its Iskut Project.

Pretium Resources (PVG, TSX) is constructing one of the world’s highest-grade Gold mines at Brucejack, slated to commence commercial production in the 2nd half of next year at an annual clip of 500,000 ounces, while it also carries out exploratory drilling to the east.

Pretium’s market cap is now almost $3 billion.

Colorado Resources (CXO, TSX-V) consolidated supersized geological belts (KSP and KingPin) totaling 600 sq. km, and the stock has zoomed from 6 cents in February to 60 cents – a 10-bagger already – with a drill program in progress at KSP.

Walter Storm, who made fortunes in the last bull market on Osisko (Canadian Malartic), has supersized ideas for Tudor Gold (TUD, TSX-V) which has more than tripled in value since it first started trading in mid-May.

Several other companies are stirring, including Skeena Resources (SKE, TSX-V), Eskay Mining (ESK, TSX-V), Garibaldi Resources (GGI, TSX-V), American Creek (AMK, TSX-V), Teuton Resources (TUO, TSX-V), Metallis Resources (MTS, TSX-V) and Romios Gold (RG, TSX-V) – they could all have a “sizzling summer”, especially the ones who think BIG and overcome the challenges of the terrain.

Like The Little Engine That Could.

Tiny-sized Aben Resources (ABN, TSX-V), which closed today at 17.5 cents for a market cap of only about $3 million, is set to quickly power forward in the Heart of Gold Camp thanks to a supersized vision that has allowed this company to come from nowhere less than 3 months ago. President and CEO Jim Pettit thinks BIG, and so does Chairman Ron Netolitzky who of course was a driving force in the 1980’s boom when Snip and Eskay Creek were discovered.

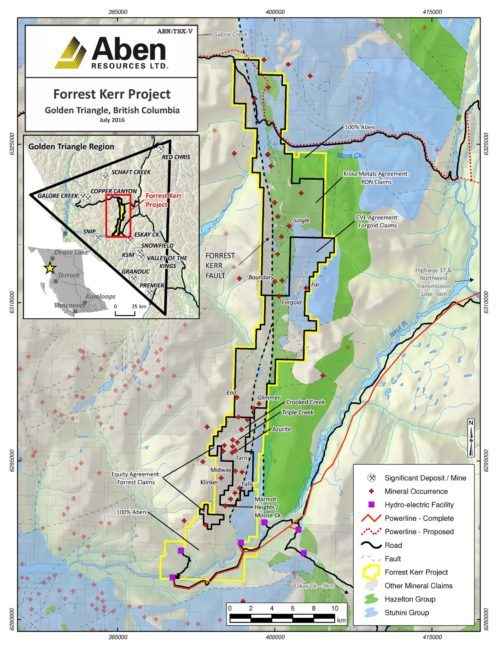

Aben has taken a page out of the Colorado playbook and has just received Exchange approval for a multi-party agreement announced last week that consolidates 230 sq. km beginning on the northern border of the KSP and the western border of Garibaldi’s PSP, and continues to the north for 40 km along the Forrest Kerr fault toward Galore Creek.

“When you can consolidate a whole belt that’s unique as this one, it’s a great opportunity. And it has turned some heads,” stated Pettit in an exclusive interview the BMR (full audio version as part of this feature piece).

Click here to read the rest of this article, and all BMR exclusive content, by taking advantage of our July Special, or login with your username and password.

And click here for a free BMR eAlert on a 9-cent junior ($2.3 million market cap) that’s set to SOAR on higher Silver prices.

12 Comments

Jon/John – every time you guys post Neil Young’s Heart of Gold – I have to listen to the entire song – it gets me pumped for news in the Golden Triangle to come! May it be an anthem you keep posting frequently!

The Rockman likes to rock! I know what you mean, the same feeling comes over me.

Have you heard Marty Falle’s country song, “Colorado”?…..”Oh Colorado, my sweet Colorado…it won’t be long…..oh Colorado, shower me with your sunshine…”

I stumbled on that one tonight, purely by accident. Was there a message in that? Maybe we’ll have 2 anthems for the Heart of Gold Camp…

Ok Jon

now you went and done it, I’ll be singing this song in my sleep all night…

youtube.com/watch?v=eOB4VdlkzO4

John Denver Rocky Mountain High Colorado…..

I wonder at what point does gold and the us $ quit hanging around with each other, and talk about 2 more rate hikes ramping up again, boy, getting pretty volatile out there.just can’t see that happening.

While Gold may seem volatile, Laddy, it’s behaving well within its clearly defined uptrend…the behavior of the Venture these last several months implies significantly higher Gold prices during this 2nd half, and a dollar that ultimately is going to come under a lot of pressure…

thx jon,i’ll stay away from the songs,the us $ is like saying,sooner or later the snow has to melt at the peak of the mountain and start running down.

then the avalanche ($U.S.)…

As the saying goes, buy the dip…Venture now positive on the day despite weakness in Gold…impressive new TSX chart in today’s Morning Musings…up, up she goes…

Well now that was a cute six figure bid on CXO earlier at .59 that was just removed. Gotta hand to these market makers, they try hard to shake the tree. They saw no one was biting to sell down so they removed it.

National Bank buying GGI – interesting

Gold USD – why buy bonds when most of the world is at 0% or negative. So is some of the money buying Gold since it may make a 1/4% vs 0 or negative for bonds? Is the USD a ‘safe’ haven for money that EU money that is perplexed as to what to do while UK figures out Brexit and Italy throws 5BB Euro at a bank that has 300BB euro in bad debts. Its messy out there

GGI-With a director selling 100,000 shares on June 30th you have to wonder about assays pending since august 2015.

More likely a starving geologist, Robert. Even Lawrence Nagy sold some CXO (109,000) at 43 cents in mid-to-late June. Also tells me some of these guys don’t seem to believe we’re in a rip-roaring bull market, which is a good sign.