BullMarketRun.com Special Feature

This article should help you with your near-term and longer-term trading/investment strategies as it takes you through 15 fascinating years of Venture history, and includes an amazing long-term chart from John, for clues as to how this month, and the balance of 2016 and the next year or two beyond that, are likely to unfold.

It was no surprise the Venture jumped 25 points or 3% to begin September last Thursday and Friday.

September has proven to be a POWERFUL month during Venture bull market years, and there’s no question we’re in a new bull market in 2016.

The evidence is overwhelming, which we’ll get into shortly.

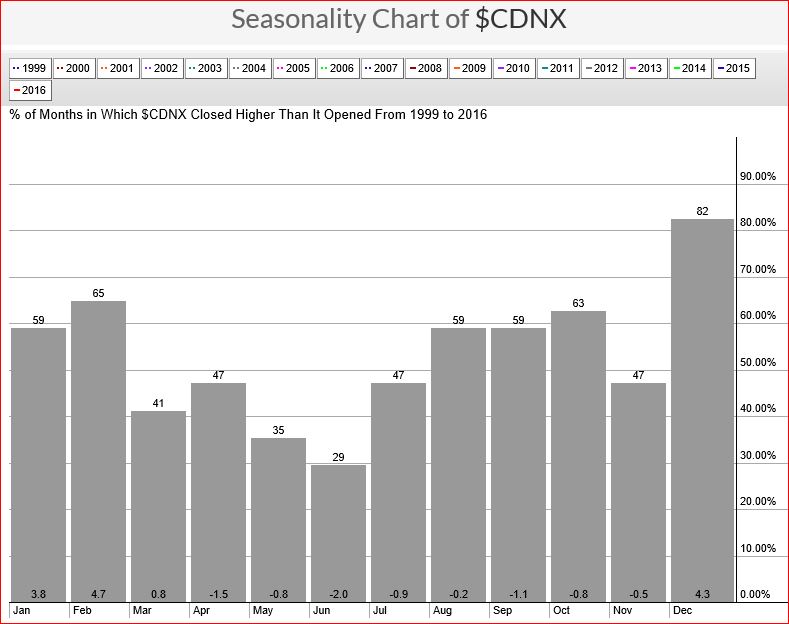

Seasonality Chart

First, let’s take a look at the Venture “Seasonality Chart” going back 15 years. It’s rather deceptive, actually, as it shows September as the third worst month of the year in terms of its average return (-1.1%).

You’ll notice, however, that only February, October and December have produced more winning months than September!

Breaking It Down – September During Bull Market & Bear Market Years

The “Seasonality Chart” doesn’t really help us unless we separate the bull market years from the bear market years. That’s when it gets really interesting and guides us in terms of trading strategies, with at least one fact that’s sure to astonish you!

During BULL market years (2003, 2004, 2005, 2006, 2009 and 2010) the Index has gained an average of 6.2% in September. If you don’t include 2006, the average advance is 9.3%. In 2006, September was a disappointment (9.2% loss) but the market more than made up for that with a spectacular 21% surge during October, November and December.

Meanwhile, September during BEAR markets (2007, 2008, 2012, 2013, 2014 and 2015) has typically been very negative with an average decline of 5%, highlighted by the 11.2% drop in 2014 and the 29% thumping in 2008 as the global financial crisis took hold. 2007 (sort of a “hybrid” year, and 2012 were exceptions (September 2007, an 8.9% gain, featured the Noront Ni-Cu-PGE discovery while September 2012, an 11.2% advance, proved to be just a bear market rally out of oversold conditions).

Defining Venture Bull Market & Bear Market Years

John has divided Venture history into 6 distinct trading periods. We’re now in “Period 6” – a confirmed bull cycle that should last for at least a couple of years.

Period 1 (2001 into early 2003) is best described as “neutral” – mostly range trading as the Venture gauged developments including 9/11 and the war and recession that followed.

Period 2 (early 2003 to early 2007, a bull cycle) delivered a stellar return of 280%.

Period 3 (early 2007 to the end of 2008) was nasty – an 80% wipe-out thanks to the Great Crash.

The gain during Period 4 (2009 to early 2011, another bull cycle) was staggering, similar to Period 2 but over a shorter time frame, at 264%.

Period 5 (early 2011 to early 2016) was an ugly bear market as we all know, and the Venture declined a whopping 81% (same percentage decline but worse in many ways than Period 3 because it dragged on for 5 years).

If Period 6 is similar to Periods 2 and 4, we can expect the Venture to make its way to at least 1700 during this cycle.

Buy pressure is increasing rapidly. The 300-day SMA – not shown on the chart below – has reversed to the upside, while a bullish +DI/-DI cross has also just occurred. RSI(14) is surging, just like it did at the beginning of Periods 2 and 4. Note the critical breakout, as well, above the downtrend line.

All those signals confirm a new bull market.

This Is Even More Amazing!

Not only has September been strong 83% of the time during Venture bull market years, but keep these 2 important facts in mind:

- In bull market years, the year-end close has always been higher than the August close;

- The average advance in bull market years between the end of August and the end of December has been a staggering 26.7%!

The Venture’s August 31 close was 786. If this is just an average bull market year, we can expect the Venture to reach at least 996 in December which almost matches John’s next measured Fib. resistance for the Index (978)!

The trend is your friend.

STAY LONG!

Venture 16-Year Monthly Chart & Periods 1 Thru 6

Click here for the BMR Top Opportunities List – up 200% on an annualized basis in 2016, and more big winners on the way!

4 Comments

Stay long and thirsty my friends..:)

http://www.gannglobal.com/webinar/2016/August/16-08-Video10-2ndChance.php

More asset history lessons here…

He talks of historical proportions in rally’s going back 60 years.. so with Golds current rally and correction, in price AND time – 50% of the time it was a bear market rally – counter trend… and 50% there was a continuation.

to me where we are now smells like a continuation duck!!

maybe the storey book,the fed who cryed wolf, is on it’s last chapter..venture 20 pt gain?

SIR.V- kaiser is recommending sir.getting interesting.

John Kaiser, investment newsletter publisher, Kaiser Research Online

John Kaiser is a well-known figure in the Canadian resource investing world. For more than 20 years he has run an investment service highlighting attractive junior mining stocks.

He sees a turnaround ahead for the sector, and he considers the more speculative nature of the investments he covers to be well-suited for a person investing funds that are not essential to their retirement planning.

Mr. Kaiser recommends a portfolio of what he calls “optionality plays.” That is, companies with an existing resource that may need a higher commodity price to be developed, but which also have untested exploration potential. He expects the better of these firms to be acquired by larger companies as metal prices creep higher.

Mr. Kaiser advocates an equally weighted portfolio of six companies. Three of them are gold-related: Midas Gold Corp. (MAX-TSX), Serengeti Resources Inc. (SIR-Venture Exchange) and Nevada Exploration Inc. (NGE-Venture).

His other picks are a zinc play by the name of InZinc Mining Ltd. (IZN-Venture), a uranium company called Uravan Minerals Inc. (UVN-Venture), and Scandium International Mining Corp. (SCY-TSX). Scandium is a rare mineral used in aluminum production. Scandium International owns the rights to a large deposit of the mineral in Australia.

scandium – same word used in a GGI NR a while back. good to see that neither SCY or GGI’s shareprice has moved on the mineral of the future yet.