CDNX and Gold

It was a volatile and critically important week for the CDNX which held support at 2200 and gained 34 points Friday to close the week up 2 points at 2268. The fact this market was able to hold its ground in the face of weakness in Gold throughout most of the week was impressive to say the least and strongly suggests we have indeed seen the bottom in Gold. The out-performance of the CDNX vs. Gold and the TSX Gold Index since early December has been incredible. The CDNX is actually up 7% since Gold’s Dec. 7 high of $1,425 while Gold is off 6% and the TSX Gold Index has declined 15%. This has been one of the key factors in us being able to predict (correctly it appears) Gold was not about to fall off a cliff, $1,300 is the “line in the sand” and the next major move in the yellow metal would be to the upside. We have seen no better indicator of the future direction of Gold prices than the CDNX.

After a successful test of 2200, is the CDNX now ready to finally bust through resistance (there were a few failed attempts this month) at the 2300 level? We believe so. Friday’s move was accompanied by “cautious” volume, however, and buying pressure as demonstrated by the CMF was weak – an indication that the 34-point gain had more to do with an absence of sellers than a stampede of buyers. That could change of course Monday. RSI and Stochastics indicators are bullish and the CDNX has managed to completely unwind its overbought condition that emerged after December’s 10% move to the upside. If there was ever a time the CDNX could start a new up-leg, now is it, especially given how the Index held up so well given the pounding that Gold took last week until Friday’s important reversal in the yellow metal.

Last week in this space we predicted: The reversal in Gold will come, in our view, when the TSX Gold Index actually touches its rising 300-day moving average (SMA) or actually drops below it (the bottom being in the range of 345-367 and this could be very brief) as has been the case repeatedly over the last two years. This will be a classic and major buying opportunity, confirmed also by the CDNX which is giving us Gold’s primary direction. If Gold was on the verge of a major collapse, the CDNX would simply not be performing as it is now – it would in fact be leading Gold to the downside, the opposite of which is occurring now.”

On Tuesday the TSX Gold Index actually did drop slightly below its 300-day SMA to 365. It’s important to note it did not make a new low Thursday when Gold dived and hit its low for the week just under $1,310. Below is the updated TSX Gold Index chart showing the 200 (light blue) and 300-day (dark blue) moving averages:

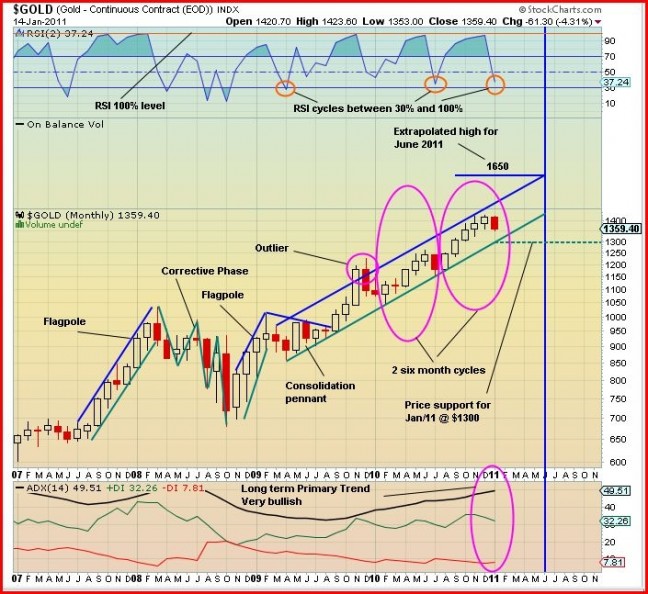

A chart worth looking at again is from John’s very astute article January 16 when he laid out the case for a $1,300 bottom in Gold this month:

So not only do the technicals show that Gold has likely found a bottom, but the main fundamental drivers for Gold remain solidly intact – currency instability, an extended period of negative real interest rates (inflation is greater than the nominal interest rate, even in China and India despite increasing rates there), massive government debt from the United States to Europe, central bank buying, flat mine supply, physical demand, investment demand, emerging market growth, geopolitcal conflicts, and the list goes on.

Yes, Gold is now reacting to the uprisings in Egypt and the uncertainty this potentially creates elsewhere in the Arab world. This was a driving factor in Gold’s $40 intra-day reversal Friday.

In the U.S., some positive economic data came out last week but the Fed reaffirmed that its stimulative policies will remain in place. The Congressional Budget Office (CBO) predicted the U.S. deficit will hit a staggering $1.5 trillion this year. Many state and local governments across the U.S. are also crippled with debt. These problems pose a significant threat to U.S. economic and employment growth. As a result, we expect the Fed will be forced to remain as accommodating as possible in its monetary policy for even longer than most people think. This is bullish for Gold.

The World Gold Council reported Wednesday that the surge in Gold prices during 2010 was driven not only by strong investment but a recovery in jewelry consumption and even industrial demand. “The Gold story in 2010 was about growth in all sectors in demand and not just due to economic concerns,” said Juan Carlos Artigas, investment research manager with the World Gold Council.

Despite all of its volatility this past week, Gold finished Friday essentially unchanged from the previous Friday with a drop of just $4 for the week ($1,342 to $1,338).

An interesting bit of news we picked up: The Wall St. Journal reported that a small hedge fund overleveraged itself to Gold futures last week (a small $10 million fund controlled the amount of Gold equal to South Africa’s annual production) and blew out its position, causing the biggest-ever one-day reduction in futures contracts for the Comex.

3 Comments

Hi guys.You stated that your last trip to Quebec was foe research and you were going back to do interviews with Frank and others.Have your plans changed and if so why.Thanks Bin parsons

Yes, exactly, the first trip was for research and I am returning. And yes, there will be an interview with Frank. Nothing has changed. What people have to remember is that to a significant extent the timing of our coverage on any company is determined by company news. With regard to GBB, the interview with Frank will come when there is major news.

Jon,

This is two days old now, but I think you may have helped me have a moment of clarity here. A question I e-mailed to a newsletter writer I subscribe to: What does the increase in capital reserve requirments established by the COMEX on Silver and Gold futures contracts, have on the price of gold and silver? In this case a hedge fund long in gold futures, had to dump the contracts. Their capital requirement probably effected this action. (It sounds similar to a margin call on a brokerage account.) Except this hedge fund decided to settle its account by selling out to those shorts eager to replace their short futures contracts at the recent lower gold price. They lose and the shorts win. Probably the only real effect in gold prices comes when futures contracts are recovered as physical precious metal, which would seemingly cause an increase in precious metals prices due to scarcity. The account settlements by the COMEX in terms of precious metals, is so small compared to the trillions of dollars worth of contracts traded for settlement in dollars, that the dollar price in gold is barely effected. Hence, supply in gold goes uneffected, and the supply in dollars trades hands.