Gold has traded between $1,206 and $1,222 so far today…as of 11:00 am Pacific, bullion is up $2 an ounce at $1,217…Silver is off slightly at $17.38…Copper has slipped a few pennies to $2.61…Nickel, which has enjoyed a strong week, has retreated modestly to $4.64…Crude Oil is is up 12 cents at $53.66 a barrel while the U.S. Dollar Index is flat at 99.85…

Holdings of the world’s largest Gold-backed exchange-traded fund, SPDR Gold Shares, rose for a second straight day yesterday, up 1.5 tonnes to 811.22 tonnes…however, MKS noted that interest in Gold in major consumer Asia was muted overnight despite the return of Chinese buyers to the market after the Lunar New Year holiday…

Holdings of the world’s largest Gold-backed exchange-traded fund, SPDR Gold Shares, rose for a second straight day yesterday, up 1.5 tonnes to 811.22 tonnes…however, MKS noted that interest in Gold in major consumer Asia was muted overnight despite the return of Chinese buyers to the market after the Lunar New Year holiday…

Despite a lackluster finish to 2016, the World Gold Council saw the past year as a good example of Gold’s role as an important diversifier in a global marketplace…in its year-end review, the WGC noted that Gold demand grew 2% in 2016 to 4,308 tonnes, its highest level in 3 years…the increased Gold consumption was completely driven by investor demand as Gold-backed exchange-traded products saw their second strongest year on record, only behind inflows recorded in 2009…sets the stage for a very interesting 2017!…

U.S. Dollar Index Update

John noticed some potential near-term trouble for the U.S. Dollar Index in December given the RSI(14) negative divergence with price, a classic “topping signal”, though mainstream commentators continued to push the narrative that the greenback was headed much higher in 2017 while Gold would come under further pressure…

As it turned out, John’s chart was bang-on and the greenback experienced its worst January in 3 decades while Gold bounced back up over $1,200 an ounce…

President Trump, concerned about how an overly strong dollar could negatively impact trade balances, has done his bit to help push down the currency…his efforts are appreciated because a dollar breakout above 104 would have been problematic for the resource sector…maybe he was reading John’s charts!…

The behavior of the Venture so far this year suggests the dollar should head lower this quarter, perhaps testing its rising 200-day moving average (SMA) around 97…in any event, the Dollar Index is clearly now constrained below major resistance at 104 and that’s very bullish for the Venture (expect the current Venture trend to intensify)…

When the Dollar Index 50-day SMA begins to turn lower, as it has just done, that’s a green light for the Venture and commodities to push higher…

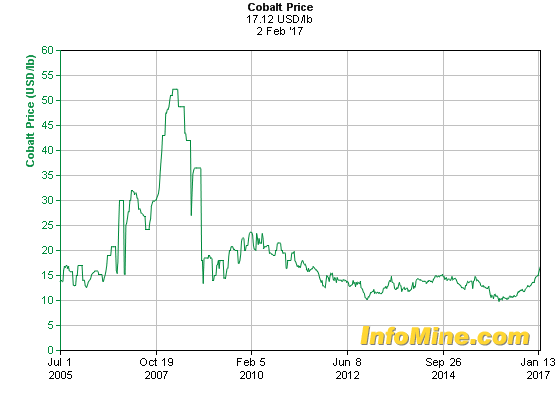

Cobalt Update

At BMR, we’ve been bullish on Cobalt since early last year and now the metal’s uptrend is accelerating with more investors beginning to get positioned in the sector…

Note on the multi-year chart how Cobalt is now trading around $17 a pound (U.S.), breaking out above the $15 resistance from late 2011…next stop should be $20 and that’s going to wake up a lot of investors…

Check out Daniels’s article on Cobalt from the other day…

Cobalt stocks on the move today include eCobalt Solutions (ESC, TSX-V), up 3 cents at 88 cents, CobaltTech Mining (CSK, TSX-V), up a penny at 25.5 cents, Castle Silver Mines (CSR, TSX-V) and Cruz Capital (CUZ, TSX-V)…more this weekend on Cobalt stocks in our Sunday Sizzler for Pro subscribers…

In Today’s Morning Musings…

1. Checking up on our favorite Gold producers/emerging producer…

2. ESK…essential (E) stock (S) to keep (K)…

3. Golden Valley Mines (GZZ, TSX-V) accelerates…

4. Daniel’s Den – Friday Footnotes, 3 stocks (including GGI) and 1 astute observation…

SAVE 25% on a BMR subscription with our Winter Special, extended for a few more days to accommodate reader requests…subscribe risk-free to a BMR Basic, Gold or Pro Subscription TODAY – and we’ll show you our proprietary strategies that have delivered unbeatable documented triple-digit returns…

New subscribers receive an industry-leading 100% money back satisfaction guarantee, so try us out and super-charge your portfolio with the best speculative picks and commodity analysis you’ll find anywhere!…

Sign up NOW or login as a current subscriber with your username and password…

28 Comments

Jon/John

can we get a chart on CSR, I don’t remember you doing one, if so please guide me to it.

thanks

In our last update on CSR, when it was known as Takara, measured Fib. was 12 cents on John’s 2-year weekly, Gregh. I’ve been on that Castle Property, plus they also have the Beaver Property…I bought some more this morning so I consider these levels very attractive despite the recent gain…breakout above .12…6 minutes to the close, take a swing…

Daniel

sure kicking myself for not buying CCR when it plunged to 5 bucks.. darn

Thanks Jon

Another cobalt play Jon, forgot I even had some in a lira account I have, May want to have a look. About to acquire kittson property in NE ont. Already mines there…vvn.v. Cheap.

Well, what a close for GGI. Question is will it continue next week? E&L is the flagship at this time but one has to wonder what else may be happening. 3D modelling, VTEM planning, possible NLW (even though you guys at BMR are giving your readers very valuable information). Or, dare I even say a hit at Tora Tora?

What ever is happening, it should be a very exciting next few months for GGI and it’s shareholders.

Oh, believe me, it’ll continue next week, Dan !!…chart and everything else speaks to that…when one considers that just the Mexican high-grade Gold-Silver properties, including the 2 existing deposits, can easily justify the current market cap, that gives you very good perspective on where GGI is headed…of course they’re long overdue for an update from down south, but there’s no question that the value of those holdings in Mexico is going to be unlocked in a big way soon IMHO…the E&L is unique in all of B.C. and has the best address possible given such an amazing camp and so close to Eskay Creek…the E&L is going to power this GGI jet to amazing heights as it has an endless supply of fuel…most prospective property of its type in the country and that comes from Dr. Raymond Goldie who’s not one to exaggerate as a respected mining analyst…Red Lion is superb and I suspect there is going to be a deal on that with a major…other things happening in B.C…..$15 million market cap…peanuts IMHO. Lots of new eyes on this and hopefully Regoci will stir the pot a little more next week with another NR!.

Dan1

Re :GGI I think there are a lot of people like Dennis who feel like we’ve seen this movie before and are afraid to jump in. I’m sure all the buying today was BMR followers as it should be since BMR has the most knowledge of what is going on and is doing an excellent job of bringing it to their subsribers …still alot of nay sayers out there and I think once the 3D model comes out those nay sayers will be chasing it in the 20’s to 30’s …I hope….. Good move today up 3.5 cents on less than 500k shares… This is where Regoci needs to put out some good news next week and keep the momentum that BMR has created this week going…

A great day and a great week. Decided to jump into CPO, hard to ignore the volume on a Friday. And I had to sell a little GGI, rule No. 1 – protect your capital.

I don’t think much of the buying today was BMR subscribers. We have all had tons of time and recommendations to buy from BMR. I think others are starting to see the picture also…not the general public investors but ones in the know.

I would agree, weatheritout…GGI has grown some legs recently and the nice thing is that a whole lot of new eyes, well beyond our readership, are getting onto the E&L, people who really understand the significance and potential of this deposit including Ni-Cu massive sulphide experts…at some point, other newsletter writers will jump on the bandwagon and that’ll be fantastic, too…this is just in its infancy…some of the top geologists and geophysicists in the country who specialize in this type of rare system are big-time fired up on the E&L, and you’ve got a gentleman like Raymond Goldie putting his name to it and calling it the best Nickel-Copper massive sulphide prospect in Canada…this is a new chapter in GGI history, unfortunately the ghosts of the past are haunting some investors and will prevent them from reaping the full benefits of the blessing that’s going to come from the E&L…many of them may succumb to emotion and reverse capitulation and buy back in at much higher prices later on, when the share price strengthens their belief levels, but that’s the market…as long as you have peace with your decisions on buying and selling you’re ok…when I first stumbled on GGI 3 and a half years ago, I knew there was something special about this company and its properties, and even then it had carved out a position in this camp…there have been starts and stops since then, moments of excitement and frustration, but at the worst of times I never stopped believing….that patience has and will pay off massively…I predict it’ll be the biggest payday in a lot of people’s lives…there will be a time to ‘protect your capital” but now is not it…thinking big on this one makes all the sense in the world given the facts at hand…

weatheritout…totally agree with your comments, subscribers here should be in already, I think word is starting to get out.

DBV – Trump securities got the finders fee.

And Jon what about the grizzly project in the Shesley district…especially if dbv has some excellent results don’t u think ggi will benefit from that also?

There could be a minor positive effect on GGI in that scenario, Sameer, but the problem is they’re not working up there at the moment—–if DBV were to hit big at the Hat now or in the coming months, I’m sure Regoci would entertain some possibilities…all options on the table….however, the core focus in B.C. for GGI is obviously the E&L, with next priorities being PSP (next to Eskay Creek and SIB, don’t forget), King, Red Lion, Tora Tora and Grizzly…E&L and Mexico are the top 2 priorities….

Great volume on CPO Cobalt today! Looks ready for a move ‘up’!

Doubleview Capital $572,040 debenture private placement with Trump Securities LLC

Anthony Scaramucci, the hedge-fund rainmaker in Donald Trump’s inner circle of advisers, gets some of the money he steers to hedge funds from an outfit called Trump Securities.

Things are heating up for Doubleview,Farshad buying 1 million shares in Private Placement,Insider buying in open market.

3 important surprises are in store for shareholders.

GLTA

Well Jon , shortly after you mentioned GGI way back then I got in, I thought with all of the properties they have,they have to hit somewhere, as you said it’s been ups and downs but I never gave up and always grabbed more on the lows, so I must say I’m glad you stumbled upon GGI, now, it appears that the little engine that could, WILL,,As frustrating as its been with Steve all this time,he’s not only tried to build a company but maybe an empire.. Thanks again, up up and away!!

Jon- re: GGI -just to clarify- the 3D model will show what they think is at E&L (Q anomaly) based on past work while the VTEM would possibly outline/delineate an ore body within that region and thus gain specific targets to drill? Does a nickel ore body have a particular conductance- ie would the VTEM readings narrow down what ore body is inside (and confirm the nickel)? Or would an ovoid shape be the telltale sign that they are looking for? THanks

STEVEN1…CPO is looking good, I think you were the one that first mentioned it on this board, looks like a rising tide when it comes to Cobalt stocks, should be interesting for CPO next week, will try to grab a few more below .10

This is what we posted in late November for subscribers re: CPO, Danny…

Cobalt Power Group (CPO, TSX-V)

A stock we suggest subscribers accumulate – preferably between 5.5 and 7.5 cents – is Cobalt Power Group (CPO, TSX-V) which is yet another Venture company that has transitioned into the emerging Cobalt space…good chance of a minimum 50% gain in this play by year-end if you’re positioned at no more than 8 cents…the company has only 33 million shares outstanding and completed an $800,000 financing early last month which isn’t free-trading until the beginning of February…

CPO has assembled a land package near the historic mining community of Cobalt, Ontario, which we visited in early 2015…a technical team is currently on the Smith Cobalt Property collecting additional ground samples, clearing access to underground workings and meeting with a mining engineer to review options for reopening historical mine shafts as announced this morning…

CPO is up half a penny at 7.5 cents as of 10:30 am Pacific…

GGI Website- haven’t been on there in a while, but there is a link to Rodadero core pics with a ‘New- click here to view’ tag’. How recently were these uploaded?

Jon, I stand corrected, thanks for the re-post. The volume on Friday suggests that it is starting to get noticed.

Jon, one more point, looks like the shares from the PP for CPO become free trading Feb 7th so there may be some selling pressure, may provide an opportunity.

Yes, Danny, given the current dynamics, I don’t think it’s a major issue, and most of that PP was in hard dollars as opposed to flow-through.

For the first time in approx 5 years I can really sense the excitement for the junior miners, as I go from board to board and visit different stocks everyone finally seems to be excited and talking about buying whatever their favorite flavor is ! This could really be crazy and a lot of fun! And it’s not just gold miners either

That’s what makes this so interesting!

Finally have a moment to catch up on posts.

kudo’s to Jon for excellent coverage on GGI. just my two cents worth. I doubt the buying has been from the majority of bmr subscribers. I sold on the last run up and bought more at .135 recently. (yes, I trade). I only wish that I bought more. I don’t have the liberty of capital to simply hold like I’m guessing many of you do. I can tell you that some of the buying did come from the U.S. I think Jon is right on with the market cap at the time of drilling in May. His track record speaks for itself as well as john’s. Maybe GGI gets newsletter writers attention down the road, that would be great. I truly hope it is another voisey bay. How sweet that would become.

I have been so busy, I am late to the cobalt space. I am sitting here on a Saturday wondering which one to chance and buy, which one will continue to move up before a correction. I know that I get some slack for being a trader, but its how I subsidize my living.

A core position in GGI makes so much sense right now, I just might hold what I have.

This is a wonderful board run by a wonderful crew. Look forward to the future with GGI.

Csr: perfect Silver and Cobalt fit, low float, low market cap

And super high grade. Mine already in place. Nobrainer imho.